Europe Premium Chocolate Market Size, Share, Trends and Forecast by Product Type, Packaging Type and Distribution Channel, and Country, 2025-2033

Europe Premium Chocolate Market Size and Share:

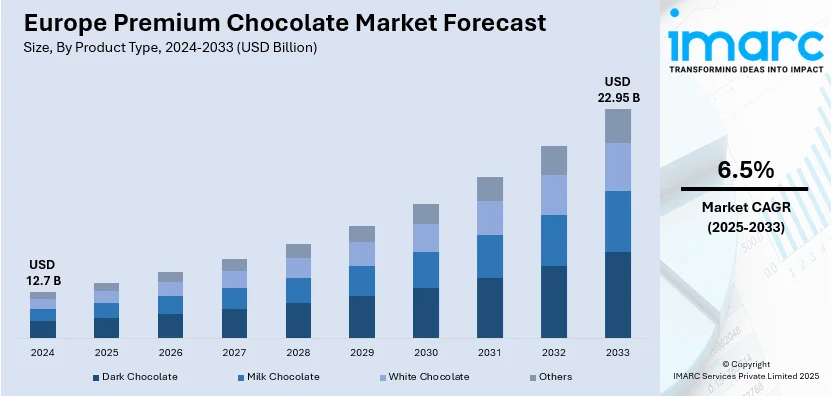

The Europe premium chocolate market size was valued at USD 12.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.95 Billion by 2033, exhibiting a CAGR of 6.5% from 2025-2033. The market is experiencing significant growth, with projected revenue driven by rising health-consciousness, demand for ethically sourced products, and luxury gifting trends, particularly in Germany, where the preference for high-quality, sustainable dark chocolate with health benefits and strong flavor is dominating consumer choices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.7 Billion |

|

Market Forecast in 2033

|

USD 22.95 Billion |

| Market Growth Rate (2025-2033) | 6.5% |

Europe premium chocolate market is growing rapidly due to rising consumer awareness of the health benefits associated with high-quality, dark, and organic chocolates. Consumers are increasingly shifting toward healthier snacking options, favoring chocolates with higher cocoa content, reduced sugar, and natural ingredients. The market is further bolstered by the popularity of functional chocolates enriched with superfoods, nuts, and seeds, appealing to health-conscious buyers. For instance, in November 2024, Lindt launched its "Dubai chocolate" in Europe, blending chocolate, pistachio cream, and knafeh, sparking massive queues and social media hype, with limited-edition bars priced at €14.99 each selling rapidly. Simultaneously, there is a growing demand for sustainably and ethically sourced products, driving manufacturers to adopt certifications such as Fair Trade and Rainforest Alliance. Transparency in ingredient sourcing and production processes has become a critical factor in earning consumer trust, positioning premium chocolate brands as leaders in quality and ethical practices, which is significantly boosting the market growth.

Cultural traditions and seasonal celebrations serve as a major driver for the Europe premium chocolate market growth. Holidays, such as Christmas and Easter have elevated the status of premium chocolates as luxurious gifts, often enhanced by elegant packaging and unique flavor offerings. For example, in February 2024, Belgian premium chocolate brand Neuhaus expanded its gifting range with the History Box, featuring 28 handcrafted pralines and regional souvenir packaging, targeting travelers across Europe’s airports amidst growing demand for luxury chocolate gifts. Moreover, evolving consumer preferences for exotic and artisanal flavor combinations, including fruits, spices, and gourmet infusions, further boost demand. Rising disposable incomes and urbanization have made premium chocolates an attainable luxury for a broader demographic. Furthermore, the expansion of e-commerce and direct-to-consumer (DTC) platforms has improved accessibility, enabling brands to reach diverse audiences. These factors collectively strengthen the market’s growth trajectory, positioning premium chocolates as a staple of indulgence and celebration.

Europe Premium Chocolate Market Trends:

Health-Focused Innovations

The rising trend of healthy wellbeing has highly impacted the super chocolate market in Europe. Most consumers prefer chocolates having more cocoa because of the health benefits, such as its antioxidant content and less amounts of sugar. Consumers seeking health-enhancing elements purchase functional chocolates that carry beneficial ingredients such as probiotics, vitamins, or even adaptogens. Brands are coming up with sugar-free and keto-friendly variants that target specific dietary needs are expanding the base of consumers. Natural, organic, and minimally processed ingredients also ensure quality, as it aligns with consumer demand for clean-label products. Packaging emphasizing health benefits further amplified appeal, making health-focused innovations the dominant trend bolstering the Europe premium chocolate market share.

Sustainable and Ethical Sourcing

The rising demand for sustainably sourced and ethically produced chocolates has reshaped the European premium chocolate landscape. Consumers are increasingly valuing brands that prioritize fair wages for farmers and use environmentally friendly practices. Certifications like Fair Trade, Rainforest Alliance, and Organic have become essential for manufacturers aiming to capture environmentally conscious consumers. For example, in July 2024, Nestlé launched its travel-exclusive Sustainably Sourced chocolate range, crafted with Rainforest Alliance-certified cocoa from the Nestlé Cocoa Plan, emphasizing responsible sourcing, personalized packaging, and sustainability in global airport retail markets. Additionally, transparent supply chains and traceable sourcing of cocoa beans are integral to building trust and loyalty among buyers. Companies are also adopting sustainable packaging solutions to minimize environmental impact, further resonating with consumer values. This trend highlights how social and environmental responsibility is influencing purchasing decisions and strengthening the growth of premium chocolate brands in Europe.

Unique Flavor and Artisanal Offerings

There is an amplifying demand for distinct flavor profiles and handmade products within the premium chocolate market in Europe. Consumers are demanding for novel combinations of exotic spices, herbs, and fruits within the chocolates or regional specialties. The demand among customers is high, as artisanal chocolates are made in small batches, with traditional techniques. Exclusive limited-edition collections and collaborations with popular chefs or local artisans increase the exclusivity of the products, hence making them more sought after. The focus on personalization in terms of customized flavors or luxury packaging enhances consumer engagement. Unique offerings that are not only a response to changing tastes but also premium chocolate as a luxury indulgence raises its appeal among diverse consumer segments.

Europe Premium Chocolate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe premium chocolate market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, packaging type and distribution channel.

Analysis by Product Type:

- Dark Chocolate

- Milk Chocolate

- White Chocolate

- Others

The health benefits and strong flavor of the dark chocolate appeal to health-conscious customers, which is dominating the market. High cocoa and antioxidant properties support wellness trends, boosting its popularity further. Demand is also stimulated by premium variants that bring unique infusions, exotic spices, nuts, or fruits with diverse taste profiles. The focus on sustainable sourcing and ethical production will fit the environmentally conscious consumer better and improve its market position. Artisanal processes and small-batch production provide exclusivity, which would attract discerning buyers searching for high-quality, luxurious experiences. This combination of health, flavor, and ethics makes dark chocolate a category to stand out.

Analysis by Packaging Type:

- Standard Packaging

- Gift Packaging

Standard packaging prioritizes practicality and maintaining chocolate quality, offering options like resealable pouches, bars, and boxes tailored for daily use. Designed for convenience, these packages are durable, user-friendly, and increasingly eco-friendly, appealing to health-conscious and environmentally aware consumers. The use of recyclable or biodegradable materials reflects growing sustainability trends, enhancing its appeal to ethically minded buyers. Standard packaging ensures freshness, making it ideal for personal consumption or casual snacking. Its versatility and focus on preserving product integrity cater to a broad consumer base, balancing functionality with responsible practices to meet modern expectations in the premium chocolate market.

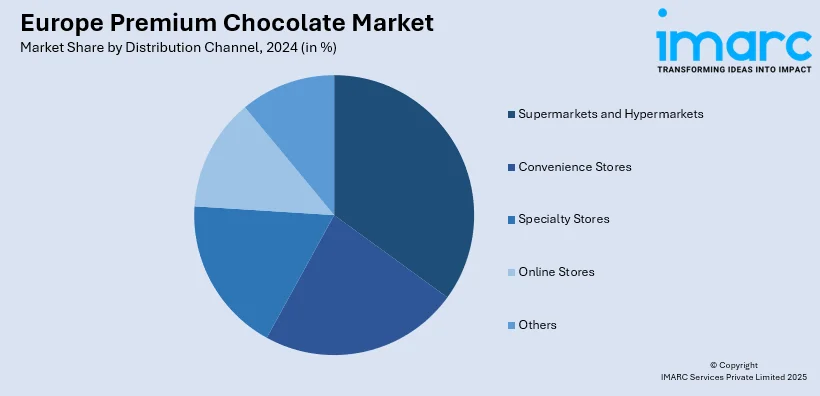

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Speciality stores cater to the tastes of customers looking for premium quality as they have an excellent supply of handmade and luxury premium chocolates. These stores emphasize unusual flavors, handcrafted pieces, and exclusive collections to appeal to refined tastes. Personalized packaging and limited editions make gifting special with every purchase. Focusing on developing an engaging experiential shopping environment, specialty stores build stronger relationships with customers and increase brand loyalty. Their focus on exclusivity, quality, and innovation aligns with the preferences of discerning buyers, positioning them as key players in the premium chocolate market and driving continued interest and demand.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Switzerland

- Belgium

- Netherlands

- Poland

- Russia

- Others

Premium chocolate is a key market for Germany in Europe as the country has a good chocolate culture and a growing need for high-quality, sustainable products. Consumers are preferring chocolates with organic ingredients and ethical sourcing certifications, hence a growing environmental and health awareness. The country boosts a strong retail infrastructure with a lot of specialty stores, gourmet outlets, and big supermarkets, which makes accessing premium brands easy. Germany is also known for its luxury packaging and innovative flavor offers to cater to the selective consumer base. Sales amplify significantly during holidays, such as Christmas and Easter. Powerful local and international brands make the competition intense, resulting in continuous product diversification and market expansion.

Competitive Landscape:

There is intense competition among established brands and up-and-coming firms in the European premium chocolate sector. Key players like Lindt & Sprüngli, Ferrero, and Mondelez International dominate the market by relying on brand recognition strongly and various distribution networks. Small artisanal chocolatiers focus on unique flavors, ethical sourcing, and sustainability to capture niche markets. Innovation in product formulations, such as sugar-free or vegan options, enhances competitiveness. Attraction to consumers is further through seasonal campaigns and luxury packaging. Market reach is extended through partnerships with retail chains and e-commerce platforms. Further, the competitive landscape is also shaped by consumer demand for transparency, as this creates pressure on companies to point out certifications such as Fair Trade and Rainforest Alliance.

The report provides a comprehensive analysis of the competitive landscape in the Europe premium chocolate market with detailed profiles of all major companies, including:

- Cemoi Group

- Chocoladefabriken Lindt & Sprüngli AG

- Hershey Company

- Ferrero International S.A

- Mars Incorporated

- Mondelez International Inc

- Nestlé S.A.

- Neuhaus (United Belgian Chocolate Makers)

- Pierre Marcolini Group

- Pladis Global (Yildiz Holding)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.

Latest News and Developments:

- In July 2024, French premium chocolatier Cemoi announced a cocoa supply digitization project to meet EUDR deforestation regulations. Using satellite mapping and FarmForce technology, the initiative ensures 100% traceability and sustainable sourcing across 70,000 West African producers, supporting agroforestry, education, and women's empowerment while enhancing compliance with environmental and ethical standards in cocoa farming.

- In March 2024, Nestlé International Travel Retail launched its sustainable KitKat bars across European travel outlets. The "Breaks for Good" bars use cocoa sourced via the Income Accelerator Programme, promoting traceability and supporting cocoa-farming families with improved livelihoods and sustainability practices. Packaging features a QR code linking to programme details.

Europe Premium Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dark chocolate, milk chocolate, white chocolate, others |

| Packaging Types Covered | Standard and gift packaging |

| Distribution Channels Covered | Supermarkets and hypermarkets, convenience stores, specialty stores, online stores, others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Switzerland, Belgium, Netherlands, Poland, Russia, Others |

| Companies Covered | Cemoi Group, Chocoladefabriken Lindt & Sprüngli AG, Hershey Company, Ferrero International S.A, Mars Incorporated, Mondelez International Inc, Nestlé S.A., Neuhaus (United Belgian Chocolate Makers), Pierre Marcolini Group and Pladis Global (Yildiz Holding) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe premium chocolate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe premium chocolate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe premium chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Premium chocolate refers to high-quality chocolate made from superior-grade cocoa beans, often with a higher cocoa content and minimal additives. It typically excludes artificial flavors and uses fine ingredients like natural vanilla and pure cocoa butter. Applications include gourmet confectionery, baking, and luxury gifting.

The Europe premium chocolate market was valued at USD 12.7 Billion in 2024.

IMARC estimates the Europe premium chocolate market to exhibit a CAGR of 6.5% during 2025-2033.

The Europe premium chocolate market is driven by growing consumer preference for healthier, high-quality ingredients, rising demand for sustainable and ethically sourced cocoa, and increasing popularity of luxury gifting. Innovation in flavors and packaging further enhances appeal, catering to evolving consumer tastes.

In 2024, dark chocolate represented the largest segment by type, driven by health benefits, antioxidant properties, and rich flavor. Its high cocoa content and growing consumer preference for healthier indulgence significantly contributed to its leading position.

Standard packaging leads the market by packaging type owing to practicality and cost-effectiveness. Its suitability for everyday use and ability to preserve product quality, coupled with eco-friendly material trends, made it the preferred choice among health-conscious and sustainability-focused consumers.

The specialty stores are the leading segment by distribution channel, driven by offering curated selections of premium, artisanal chocolates. Their focus on exclusive collections, unique flavors, and personalized packaging created an experiential shopping environment that attracted discerning consumers and built strong brand loyalty.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, Switzerland, Belgium, Netherlands, Poland, Russia, Others, wherein Germany currently dominates the market.

Some of the major players in the Europe premium chocolate market include Cemoi Group, Chocoladefabriken Lindt & Sprüngli AG, Hershey Company, Ferrero International S.A, Mars Incorporated, Mondelez International Inc, Nestlé S.A., Neuhaus (United Belgian Chocolate Makers), Pierre Marcolini Group and Pladis Global (Yildiz Holding), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)