Europe Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Country, 2026-2034

European Real Estate Market Overview:

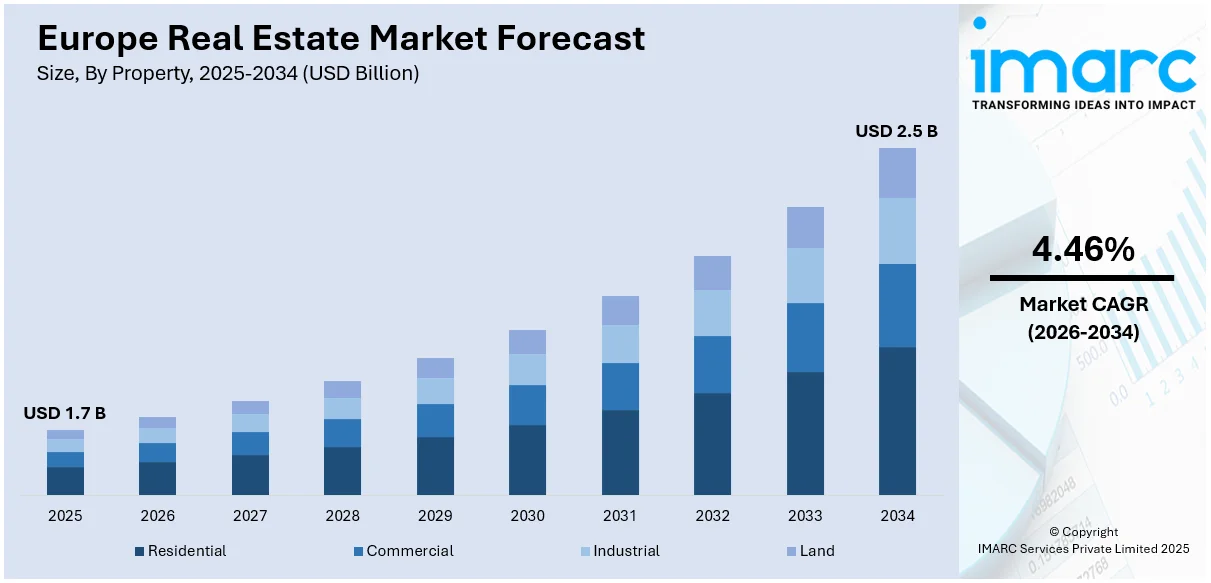

The Europe real estate market size was valued at USD 1.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.5 Billion by 2034, exhibiting a CAGR of 4.46% during 2026-2034. Germany currently dominates the market, holding a market share of 32.0% in 2025. The market is driven by rapid urbanization, demographic shifts toward an aging population shaping the property demands, and the bolstering growth of the e-commerce industry. Additionally, the expanding development of sustainable and green buildings, significant advancements in PropTech, and a prevailing low-interest-rate environment represent some of the key factors expanding the Europe real estate market share.

Key Insights:

- The Europe real estate market is projected to grow from USD 1.7 Billion in 2025 to USD 2.5 Billion by 2034, with an estimated CAGR of 4.46% between 2026-2034.

- Germany held the dominant position in the Europe market, accounting for 32.0% of the total market share in 2025.

- Residential was the leading segment based on property, comprising approximately 45.8% of the market, driven by rapid urbanization, economic stability, and rising homeownership demand.

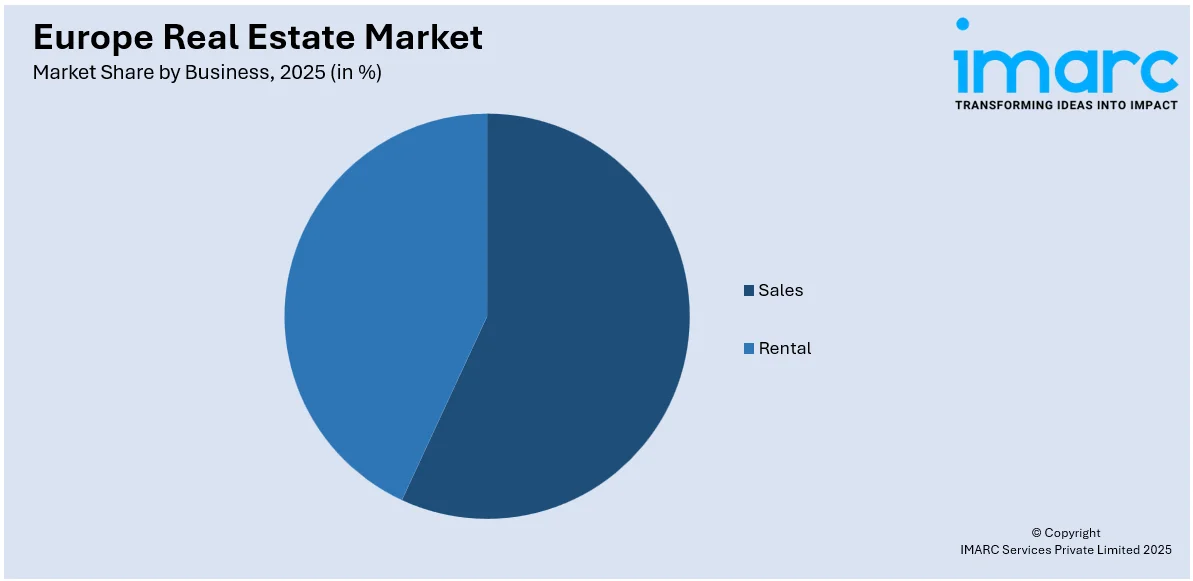

- Sales transactions made up 56.8% of the market, supported by affordable financing, investor interest in second homes, and post-pandemic lifestyle shifts.

- Among modes, the offline segment led with a market share of 64.5% in 2025, as buyers favor face-to-face interaction, personalized service, and local expertise in complex transactions.

The market is primarily driven by rapid urbanization and population growth, particularly in major cities such as London, Paris, and Berlin. The demand for residential and commercial properties remains strong as individuals migrate to urban centers for employment and better amenities. As of 2023, 69% of individuals living in the European Union are owners of dwellings, with 19.7% of their disposable incomes going towards house payments, and only 2.9% of the EU land area is made up of residential land. Between 2010 and 2023, property prices have grown by 48% and rental costs by 22%, in particular in places such as Estonia and Hungary, where there has been the greatest amount of growth. In spite of affordability concerns, housing sector investment touched 5.8% of GDP, further emphasizing the indispensable role played by real estate Europe in the European economy. According to the Europe real estate market report, low interest rates in many European countries have made mortgages more affordable, encouraging homebuyers and investors. The rise of remote work has also influenced housing preferences, with increased demand for larger homes and suburban properties. Government incentives, such as tax breaks for first-time buyers, further stimulate market activity, ensuring steady growth despite economic uncertainties.

To get more information on this market Request Sample

The market is primarily driven by rapid urbanization and population growth, particularly in major cities such as London, Paris, and Berlin. The demand for residential and commercial properties remains strong as individuals migrate to urban centers for employment and better amenities. As of 2023, 69% of individuals living in the European Union are owners of dwellings, with 19.7% of their disposable incomes going towards house payments, and only 2.9% of the EU land area is made up of residential land. Between 2010 and 2023, property prices have grown by 48% and rental costs by 22%, in particular in places such as Estonia and Hungary, where there has been the greatest amount of growth. In spite of affordability concerns, housing sector investment touched 5.8% of GDP, further emphasizing the indispensable role played by real estate Europe in the European economy. According to the European real estate market report, low interest rates in many European countries have made mortgages more affordable, encouraging homebuyers and investors. The rise of remote work has also influenced housing preferences, with increased demand for larger homes and suburban properties. Government incentives, such as tax breaks for first-time buyers, further stimulate market activity, ensuring steady growth despite economic uncertainties.

In addition, foreign investments, particularly in prime locations including London, Paris, and Southern European holiday destinations, are also positively influencing the market. Investors are attracted by stable property values, high rental yields, and favorable exchange rates. The commercial real estate market in Europe benefits from the growth of tech hubs and co-working spaces, driven by the expanding startup ecosystem. Sustainability trends are also shaping the market, with green buildings and energy-efficient properties gaining preference among buyers and tenants. Infrastructure developments, such as transportation upgrades, enhance property values in connected areas. Between 2012 and 2022, Spain led motorway development across the EU by adding up to 271 km in Andalucia. Germany and the Netherlands registered the highest motorway densities, over 160 km per 1,000 km² in important regions. Luxembourg had 97% electrification of its railways, and the Netherlands' areas excelled at inland waterway density, promoting connectivity critical for European real estate market and logistics hub growth. Despite geopolitical challenges, Europe’s property sector remains resilient due to its diversity and long-term investment appeal, as echoed in the recent European real estate market update.

Europe Real Estate Market Trends:

Rising Economic Growth and Stability

The Europe real estate market outlook 2024 witnessed strong growth, driven by consistent economic expansion and investor confidence. According to Eurostat, the euro area GDP grew by 0.9% in 2024, reflecting a steady recovery. Unemployment rates across key economies, including Germany and France remain low, averaging 6.5%, which is bolstering consumer spending. Foreign direct investment (FDI) inflows into European commercial real estate market surpassed EUR 320 Billion (USD 362.82 Billion) in 2024, with commercial property alone accounting for over EUR 160 Billion (USD 181.28 Billion). This inflow is significantly improving demand in the commercial, residential, and industrial segments. Property prices rose by 6.2% year-over-year, while rental yields in urban hubs such as Paris, Berlin, and Amsterdam continue to outperform expectations, reinforcing the sector's resilience and attracting long-term investments. Therefore, this is further creating a positive real estate market outlook Europe.

Rapid Urbanization

The rising trend of urbanization is leading to a higher demand for housing, retail facilities, and office spaces in major cities, which is contributing to the growth of the market across the region. The demand for new infrastructure and real estate development is increasing as more individuals are moving toward urban areas, which is further facilitating the market demand. According to data from the European Commission, Europe's level of organization is expected to increase to approximately 83.7% in 2050. Trends in the total population of EU27 and the UK from 1961 to 2018 show a decline in the share of the population living in rural areas over the total population, while towns and cities experienced a smooth and constant increase. Built-up areas are likely to expand by more than 3% between 2015 and 2030, reaching 7% of the EU territory by 2030. This is expected to enhance Europe property market over the coming years, with significant spillover anticipated in the Europe residential real estate market as development expands into suburban zones and peri-urban corridors.

Increasing Foreign Investment

The increasing foreign capital, particularly from Asia and North America, is driving the market growth and stimulating development projects across various real estate sectors. Europe remains a prime destination for international investors seeking stable returns. According to Business France, the French government’s business promotion agency, foreign investment in France increased by 7% in 2022 in comparison with the previous year. The United States was the leading foreign investor in France with investment in 280 new projects creating 17,107 jobs in 2022. This momentum is further supported by data from UN Trade & Development, which shows that the United Kingdom witnessed a 32% increase in greenfield investments, reaching USD 85 Billion, while Italy posted a remarkable 71% rise to USD 43 Billion as of January 2025. These indicators also support the projections in the Europe real estate market 2025, where capital flows and development strategies will increasingly align with broader sustainability goals and smart infrastructure initiatives. Analysts expect that the EU real estate market will benefit particularly from these cross-border commitments. The ongoing diversification and capital deployment strategies across asset classes are influencing not only the urban centers but also secondary cities and regional clusters, feeding into the European real estate market outlook 2025, which anticipates strong returns across segments for institutional investors and funds.

Europe Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe real estate market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on property, business, and mode.

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

Residential stand as the largest component in 2025, holding around 45.8% of the market. The residential property sector in Europe is driven by rapid urbanization which is increasing the demand for housing in major cities, along with economic stability and rising incomes which is further enhancing homebuying capacity. In addition to this, demographic trends such as an aging population and the influx of young professionals create varied housing needs. Low interest rates make mortgages more affordable, encouraging home purchases. Foreign investment also plays a role, as international buyers seek properties in stable European markets. Additionally, governments across Europe are expanding housing policies to boost affordability and reduce the gap between supply and demand.

Analysis by Business:

Access the comprehensive market breakdown Request Sample

- Sales

- Rental

Sales leads the market with around 56.8% of market share in 2025. The demand for sales in the Europe real estate market is driven by economic stability which enhanced purchasing power and consumer confidence. Rapid urbanization increases the need for residential and commercial properties in cities. Low interest rates make mortgages more affordable, encouraging home purchases. Foreign investment seeks stable returns in European markets. Technological advancements in property management and online sales platforms enhance the buying process, further stimulating demand. Demographic changes, such as aging populations and young professionals, also drive varied property needs. Rising interest in second-home ownership, particularly in scenic and tourist-friendly regions, is also contributing to the surge in property sales. Moreover, flexible work arrangements post-pandemic have prompted many buyers to relocate or invest in properties outside traditional city centers.

Analysis by Mode:

- Online

- Offline

Offline leads the market with around 64.5% of market share in 2025. The demand for offline mode in the market across Europe is driven by personalized service, trust, and the complexity of transactions. Several buyers and renters prefer face-to-face interactions with agents for personalized advice and guidance. Physical site visits and in-person negotiations also build trust and confidence in property transactions. Complex legal and financial processes often require hands-on assistance. Older generations and high-net-worth individuals often favor traditional methods, valuing the expertise and assurance provided by experienced real estate professionals. In many European cities, long-standing relationships between clients and local real estate firms also reinforce the dominance of offline channels. Additionally, regulatory differences across countries make local, in-person guidance essential for navigating region-specific legal frameworks.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2025, Germany accounted for the largest market share of over 32.0%. In Germany, the Europe real estate market growth is driven by strong economic performance, rapid urbanization, and foreign investment. Germany’s robust economy enhances consumer confidence and the property demand period of rapid urbanization increases the need for commercial and residential development in cities including Munich, Frankfurt, and Berlin. Low interest rates make financing more accessible, encouraging property purchases. Germany's stable political environment and attractive returns draw significant foreign investment. In addition, the country's well-developed infrastructure supports seamless logistics and connectivity, further boosting the appeal of real estate investments. Sustainability initiatives and smart building technologies are also becoming key factors that shape investment decisions in Germany’s property sector.

Top Real Estate Companies in Europe:

The competitive landscape of the European real estate market is characterized by intense rivalry among developers, investors, and property management firms, all vying for prime assets and high returns. Large institutional investors and private equity firms dominate high-value transactions, particularly in commercial and residential segments, while smaller regional players focus on niche markets. Competition is further fueled by rising demand for sustainable and tech-integrated properties, pushing firms to innovate in construction and energy efficiency. Cross-border investments add another layer of competition, with international buyers targeting stable markets with strong rental yields. Additionally, digital platforms and proptech solutions are reshaping the industry, enabling faster transactions and data-driven decision-making. Firms that adapt to regulatory changes, tenant preferences, and economic shifts gain a competitive edge, while those slow to change risk losing market share in this dynamic environment.

The report provides a comprehensive analysis of the competitive landscape in the Europe real estate market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Telescope, a Norwegian prop-tech startup, secured EUR 3.7 million seed funding to help European real estate owners transform climate compliance into strategic advantage. Its SaaS platform assesses physical risks (floods, fires) and biodiversity impacts (protected species, habitats) using granular data, enabling actionable insights for development and sustainability transitions.

- March 2025: Manova Partners launched its Manova European Logistics Real Estate Fund II (MELREF II), targeting EUR 300–500 million for institutional investors. The fund aimed for a 5% yield, focused on prime logistics assets across Europe, and followed a core/core+ strategy.

- March 2025: Apollo Global Management launched its first European real estate credit fund targeting wealthy investors, aiming to grow its USD 150 billion private wealth portfolio. The fund, seeded with USD 170 million from an Apollo insurance affiliate, focused on senior loans to low-risk properties and was structured as a semi-liquid perpetual vehicle.

- December 2024: Lionel Messi's real estate investment trust, Edificio Rostower Socimi, debuted on Spain's Portfolio Stock Exchange with a market cap of EUR 223 million. The company owns properties across Spain, Andorra, London, and Paris.

- June 2024: Four former executives from Cromwell Property Group and Valad Europe launched MC Property, a pan-European real estate investment firm focused on industrial.

Europe Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Countries Covered | Germany, France, the United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe real estate market from 2020-2034.

- The Europe real estate market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market was valued at USD 1.7 Billion in 2025.

The Europe real estate market is projected to exhibit a CAGR of 4.46% during 2026-2034, reaching a value of USD 2.5 Billion by 2034.

Urbanization, cross-border investments, and low interest rates have supported growth. Rising demand for logistics and residential assets, ESG compliance, tech adoption, and housing shortages also contribute. Geopolitical risks and monetary tightening now shape investor behavior and asset repricing. Southern and Eastern Europe are gaining attention for better yields.

The residential property segment accounted for the largest market share in 2025, holding approximately 45.8% of the Europe real estate market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)