Europe Recycled Plastics Market Size, Share, Trends and Forecast by Source, Application, Plastic Type, and Country, 2026-2034

Europe Recycled Plastics Market Summary:

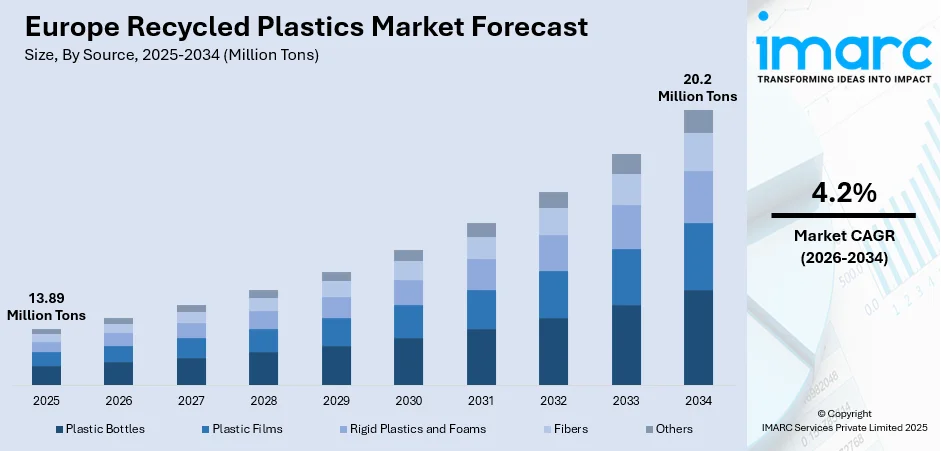

The Europe recycled plastics market size reached 13.89 Million Tons in 2025 and is projected to reach 20.2 Million Tons by 2034, growing at a compound annual growth rate of 4.2% from 2026-2034.

The European recycled plastics market is driven by the growing emphasis on sustainable packaging, stringent environmental regulations, and rising adoption of extended producer responsibility programs. Governments across Europe are implementing policies to reduce plastic consumption and promote recycling infrastructure, supporting the integration of recycled materials across various industries including packaging, automotive, and construction. The increasing corporate sustainability commitments and consumer preference for eco-friendly products are accelerating the demand for recycled plastics, thereby contributing to the Europe recycled plastics market share.

Key Takeaways and Insights:

-

By Source: Plastic bottles dominate the market with a share of 38% in 2025, owing to the widespread collection infrastructure through deposit return schemes and established recycling technologies. Increasing regulations targeting single-use plastics have boosted bottle collection rates, supporting market expansion.

-

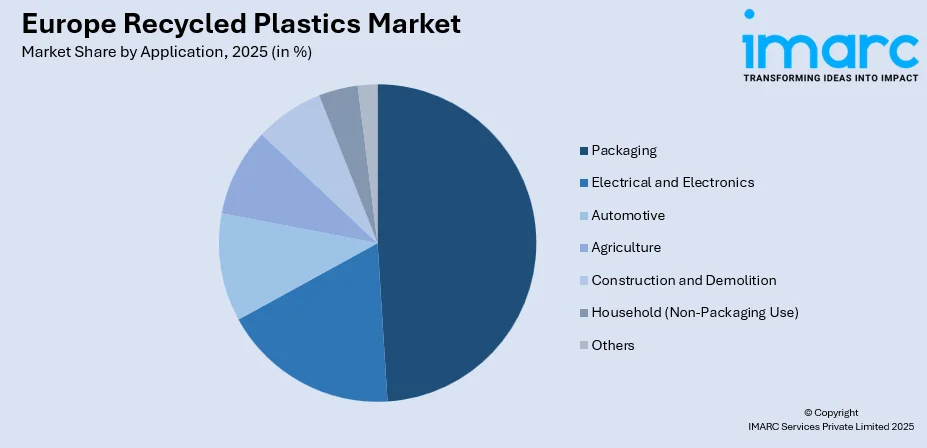

By Application: Packaging leads the market with a share of 49% in 2025. This dominance is driven by the rising demand for sustainable packaging solutions from food and beverage, personal care, and consumer goods industries seeking to meet recycled content mandates.

-

By Plastic Type: Polyethylene terephthalate (PET) exhibits a clear dominance in the market with 42% share in 2025, reflecting strong collection systems, high recyclability, and widespread use in beverage bottles that align with bottle-to-bottle recycling initiatives.

-

By Country: Germany is the largest country with 24% share in 2025, driven by its advanced waste management infrastructure, comprehensive deposit return scheme, and strong manufacturing sector demanding recycled materials.

-

Key Players: Key players drive the Europe recycled plastics market by investing in advanced recycling technologies, expanding processing capacity, and strengthening supply chain partnerships. Their focus on innovation, sustainability certifications, and strategic collaborations enhances product quality and market penetration. Some of the key players operating in the market include Veolia Environnement S.A., SUEZ S.A., Berry Global Inc, LyondellBasell Industries Holdings B.V., TotalEnergies SE, Borealis AG, Paprec Group, Morssinkhof Rymoplast B.V., MBA Polymers, Inc and Jayplas Ltd.

To get more information on this market Request Sample

The European recycled plastics market represents a pivotal component of the region's circular economy transformation, supported by ambitious regulatory frameworks and robust infrastructure investments. Legislative directives mandating recycled content in beverage bottles and packaging materials are creating substantial demand for recycled materials across multiple end-use industries. The structural shift toward incorporating post-consumer recycled plastics into converted products reflects the growing commitment of converters and brand owners to integrate recyclate into their packaging applications. This transition demonstrates the industry's alignment with sustainability objectives and environmental responsibility goals. The market benefits from expanding deposit return systems across member states, which improve collection rates and feedstock quality for recyclers. Technological advancements in sorting and processing capabilities continue enhancing material recovery efficiency, while growing consumer awareness regarding environmental sustainability increasingly drives purchasing decisions toward products containing recycled content throughout the region.

Europe Recycled Plastics Market Trends:

Expansion of Chemical Recycling Technologies

Chemical recycling is emerging as a transformative technology complementing traditional mechanical recycling processes across Europe. This technology enables the processing of mixed and contaminated plastic waste streams that mechanical methods cannot effectively handle, converting them into feedstock for new virgin-quality polymers. Plastics Europe has announced planned investments reaching eight Billion Euros by 2030 for chemical recycling capacity expansion. These technologies including pyrolysis, depolymerization, and gasification are gaining traction particularly for food-contact packaging applications requiring stringent quality standards.

Acceleration of Bottle-to-Bottle Recycling

The transition toward closed-loop recycling systems for PET bottles is gaining significant momentum across European markets. The volume of recycled PET utilized for bottle production has increased substantially in recent years, with some producers now commercializing bottles containing entirely recycled content. Packaging has emerged as the dominant end-use for recycled PET, with bottle applications representing the largest share of consumption. This circular approach reduces reliance on virgin materials while supporting mandatory recycled content targets established under European directives.

Proliferation of Deposit Return Schemes

Deposit return schemes are expanding rapidly across European member states as effective mechanisms for improving collection rates and material quality. These systems have been implemented in numerous European Union countries, covering a substantial portion of the regional population. Germany operates the highest-performing system globally, achieving exceptional collection rates for PET plastic bottles through comprehensive retailer participation and consumer incentives. Additional countries have announced plans to implement similar systems in the coming years, promising further improvements in feedstock availability and material quality for recyclers across the region.

Market Outlook 2026-2034:

The European recycled plastics market outlook remains positive, supported by regulatory momentum and growing end-user demand for sustainable materials. Mandatory recycled content targets, expanding collection infrastructure, and technological innovations in processing are expected to drive sustained growth throughout the forecast period. The market size was estimated at 13.89 Million Tons in 2025 and is expected to reach 20.2 Million Tons by 2034, reflecting a compound annual growth rate of 4.2% over the forecast period 2026-2034. Investments in both mechanical and chemical recycling capacity combined with harmonized policy implementation across member states will underpin market expansion.

Europe Recycled Plastics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Plastic Bottles |

38% |

|

Application |

Packaging |

49% |

|

Plastic Type |

Polyethylene Terephthalate (PET) |

42% |

|

Country |

Germany |

24% |

Source Insights:

- Plastic Bottles

- Plastic Films

- Rigid Plastics and Foams

- Fibers

- Others

Plastic bottles dominate with a market share of 38% of the total Europe recycled plastics market in 2025.

Plastic bottles constitute the largest source segment in the European recycled plastics market, driven by well-established collection infrastructure and regulatory frameworks targeting single-use beverage containers. Deposit return schemes operating across numerous European Union countries have achieved exceptional collection rates, demonstrating the effectiveness of structured collection mechanisms in capturing post-consumer materials. The sorted for recycling rate for PET beverage bottles has improved significantly in recent years, reflecting the success of enhanced collection programs and expanding infrastructure across the region.

The segment benefits from mature recycling technologies capable of producing high-quality recyclate suitable for food-contact applications. Growing investment in bottle-to-bottle recycling infrastructure has enhanced processing capacity, enabling manufacturers to meet mandatory recycled content targets. Consumer awareness campaigns and convenient return mechanisms continue to strengthen collection volumes, while technological advancements in sorting and processing have improved material quality. The circular economy emphasis on maintaining material value within closed-loop systems further supports the prominence of plastic bottles as a recycling feedstock.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Electrical and Electronics

- Automotive

- Agriculture

- Construction and Demolition

- Household (Non-Packaging Use)

- Others

Packaging leads with a share of 49% of the total Europe recycled plastics market in 2025.

Packaging represents the dominant application segment in the European recycled plastics market, supported by stringent recycled content mandates and growing consumer demand for sustainable solutions. The Packaging and Packaging Waste Regulation establishes aggressive recycled content targets for plastic packaging starting 2030, requiring producers to source substantial volumes of recycled polyethylene, polypropylene, and PET annually. Major fast-moving consumer goods companies have committed to incorporating recycled materials in their packaging portfolios to meet regulatory requirements and sustainability objectives.

Brand owners are increasingly integrating recycled content into bottles, trays, films, and flexible packaging formats to reduce environmental footprints and demonstrate commitment to circular economy principles. Technological improvements in recycling processes have enabled production of food-grade recyclate meeting stringent safety standards required for consumer-facing applications. The segment continues to benefit from ongoing innovations in design for recycling practices and advanced material recovery technologies that enhance packaging circularity and recyclability. These developments collectively strengthen the packaging sector's position as the primary consumption channel for recycled plastics throughout Europe.

Plastic Type Insights:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

Polyethylene terephthalate (PET) exhibits a clear dominance with a 42% share of the total Europe recycled plastics market in 2025.

Polyethylene terephthalate dominates the plastic type segment owing to its excellent recyclability, established collection systems, and widespread application in beverage packaging. The average recycled content rate for PET beverage bottles across Europe has improved substantially in recent years, with several regions already exceeding mandatory recycled content thresholds through advanced collection infrastructure and processing capabilities. PET products placed on the European market are predominantly utilized in packaging applications, reflecting the material's suitability for consumer-facing containers and food-contact uses.

The PET recycling value chain has invested significantly in capacity expansion to meet mandatory recycled content targets established under European directives. Total installed recycling capacity for PET has grown considerably, with a substantial portion destined for food contact applications requiring stringent quality standards. Mechanical recycling remains the predominant processing method due to its cost-effectiveness and established infrastructure, while chemical recycling technologies including depolymerization are gaining adoption for handling contaminated streams and producing virgin-quality output. The shift toward bottle-to-bottle recycling continues strengthening as brand owners prioritize closed-loop systems that maintain material value within packaging applications.

Country Insights:

- Germany

- United Kingdom

- Italy

- France

- Spain

- Others

Germany represents the leading country with a 24% share of the total Europe recycled plastics market in 2025.

Germany dominates the European recycled plastics market through its comprehensive waste management infrastructure, world-leading deposit return scheme, and strong manufacturing demand for recycled materials. The country's deposit system achieves a collection rate exceeding ninety-eight percent for single-use containers, making it the highest-performing system globally. In 2024, deposit requirements expanded to include milk and dairy products in single-use plastic bottles, further strengthening collection volumes.

The German government has implemented stringent waste sorting regulations and effective deposit refund mechanisms that have increased recycling rates significantly over time. Enhanced domestic processing capabilities have substantially reduced reliance on plastic waste exports, keeping valuable materials within the national recycling ecosystem. Major recycling infrastructure investments continue supporting capacity expansion across mechanical and chemical recycling technologies, while the packaging industry's strong demand for recycled content drives sustained market growth. The country's emphasis on circular economy principles, advanced recycling technologies, and comprehensive extended producer responsibility frameworks positions Germany as a leader in sustainable plastics management across Europe.

Market Dynamics:

Growth Drivers:

Why is the Europe Recycled Plastics Market Growing?

Stringent Regulatory Frameworks and Recycled Content Mandates

The European regulatory environment represents a primary catalyst for recycled plastics market expansion, establishing mandatory requirements that create guaranteed demand for recycled materials. The Single-Use Plastics Directive requires PET beverage bottles to contain specified proportions of recycled content, with targets increasing progressively over the coming years. Member states must achieve ambitious separate collection rates for plastic bottles within defined timelines to ensure adequate feedstock availability for recyclers. The Packaging and Packaging Waste Regulation further extends recycled content obligations across all plastic packaging categories, broadening the scope of mandatory requirements throughout the value chain. These legally binding requirements compel converters, preform producers, and beverage brands to secure long-term recycled material supplies, creating stable market demand that incentivizes infrastructure investment.

Growing Corporate Sustainability Commitments and ESG Integration

Major corporations across consumer goods, packaging, and retail sectors are driving recycled plastics demand through ambitious sustainability targets that often exceed regulatory minimums. Brand owners have committed to incorporating specified proportions of recycled content in their packaging portfolios as part of comprehensive environmental, social, and governance strategies. These voluntary commitments create additional market demand beyond mandatory requirements, providing incentives for recyclers to expand capacity and improve material quality. Companies increasingly recognize that sustainable packaging enhances brand reputation and consumer loyalty while addressing stakeholder expectations regarding environmental responsibility. The integration of circularity metrics into corporate reporting frameworks further reinforces commitment to recycled material utilization across value chains.

Expansion of Collection Infrastructure and Deposit Return Systems

The proliferation of deposit return schemes and separate collection systems across European member states is substantially improving feedstock availability for recyclers. Countries with operational deposit return systems achieve significantly higher collection rates compared to those relying solely on kerbside collection. Germany's deposit system demonstrates that well-designed programs can capture nearly all target materials, providing recyclers with consistent, high-quality feedstock. Several additional countries have announced plans to implement deposit return schemes, promising further improvements in collection volumes over the forecast period. Enhanced sorting infrastructure utilizing advanced technologies including optical and near-infrared systems improves material separation efficiency, increasing the proportion of collected waste suitable for recycling while reducing contamination levels.

Market Restraints:

What Challenges the Europe Recycled Plastics Market is Facing?

Competition from Low-Priced Imports

European recyclers face intensifying competition from low-priced recycled plastic imports originating from regions with less stringent environmental and quality standards. These imports benefit from lower labor costs, reduced energy expenses, and minimal regulatory compliance requirements. The influx of cheaper materials undermines the price competitiveness of domestically produced recyclates, threatening the viability of European recycling operations and discouraging further infrastructure investment.

High Operational and Energy Costs

European recyclers operate under elevated cost structures driven by high energy prices, increasing labor expenses, and rising waste collection costs. These operational burdens compress margins and reduce profitability compared to virgin plastic alternatives and imported recyclates. Energy-intensive sorting and processing operations are particularly affected by fluctuating utility prices, creating uncertainty in production economics and challenging business planning for capacity expansion investments.

Quality and Price Challenges Versus Virgin Materials

Recycled plastics often face quality perception challenges compared to virgin materials, particularly in applications requiring consistent color, clarity, and mechanical properties. Price volatility in recycled material markets creates uncertainty for buyers, while periods of low virgin plastic prices reduce the economic incentive for recyclate adoption. Contamination in waste streams and limited design-for-recycling practices further complicate efforts to produce consistent, high-quality recyclates.

Competitive Landscape:

The European recycled plastics market exhibits a moderately concentrated competitive landscape characterized by the presence of established waste management conglomerates alongside specialized recycling operators. Leading players invest substantially in capacity expansion, technology upgrades, and strategic partnerships to strengthen market positions. Companies differentiate through processing capabilities, material quality certifications, and integrated supply chain solutions spanning collection through processing. Strategic acquisitions enable market consolidation while providing access to complementary technologies and customer relationships. Investment in chemical recycling technologies represents a key competitive focus as companies seek to address challenging waste streams and produce virgin-quality output for demanding applications.

Some of the key players include:

- Veolia Environnement S.A.

- SUEZ S.A.

- Berry Global Inc

- LyondellBasell Industries Holdings B.V.

- TotalEnergies SE

- Borealis AG

- Paprec Group

- Morssinkhof Rymoplast B.V.

- MBA Polymers, Inc

- Jayplas Ltd.

Europe Recycled Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook. Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Plastic Bottles, Plastic Films, Rigid Plastics and Foams, Fibres, Others |

| Applications Covered | Packaging, Electrical and Electronic, Automotive, Agriculture, Construction and Demolition, Household (Non-Packaging Use), Others |

| Plastic Types Covered | Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others |

| Countries Covered | Germany, UK, Italy, France, Spain, Others |

| Companies Covered | Müller-Guttenbrunn Group, MBA Polymers, Inc., Paprec Group, Morssinkhof Rymoplast, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe recycled plastics market reached a volume of 13.89 Million Tons in 2025.

The Europe recycled plastics market is expected to grow at a compound annual growth rate of 4.2% from 2026-2034 to reach 20.2 Million Tons by 2034.

Plastic bottles dominated the market with a share of 38%, driven by well-established deposit return schemes, mature collection infrastructure, and strong demand from bottle-to-bottle recycling applications across the region.

Key factors driving the Europe recycled plastics market include stringent regulatory frameworks mandating recycled content, expanding deposit return systems improving collection rates, growing corporate sustainability commitments, and increasing consumer preference for eco-friendly packaging solutions.

Major challenges include competition from low-priced recycled plastic imports, high operational and energy costs for European recyclers, price volatility affecting recyclate competitiveness versus virgin materials, and quality consistency requirements for demanding applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)