Europe Safes and Vaults Market Size, Share, Trends and Forecast by Type, Function Type, Application, End User, and Country, 2025-2033

Europe Safes and Vaults Market Size and Share:

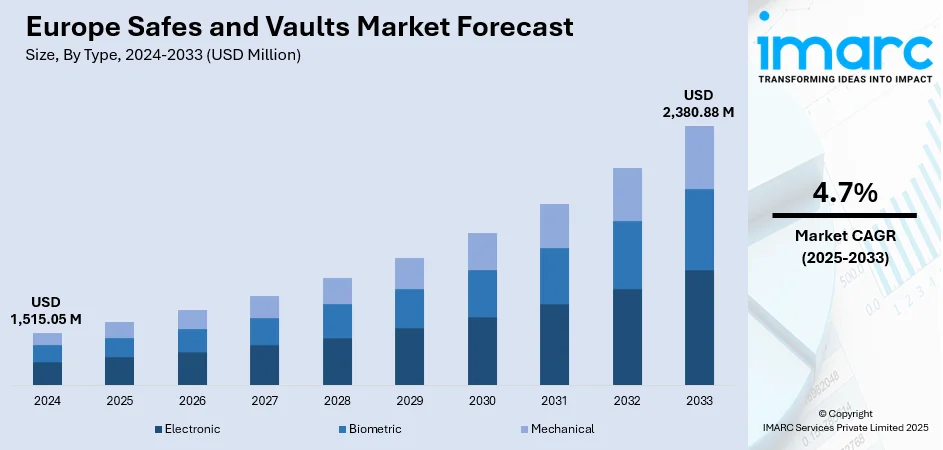

The Europe safes and vaults market size was valued at USD 1,515.05 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,380.88 Million by 2033, exhibiting a CAGR of 4.7% during 2025-2033. Germany dominated the market in 2024. The market in Europe is growing, spurred by factors that include high crime rates and growing fears about asset safety. They are widely used in homes and businesses, featuring modern access methods like passcodes, biometric scans, and PINs. Growing demand is driven by rising crime rates and the expanding banking sector, which requires secure storage for assets. Advanced safes also help businesses comply with strict security regulations and insurance requirements, collectively contributing to the growth of the Europe safes and vaults market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,515.05 Million |

| Market Forecast in 2033 | USD 2,380.88 Million |

| Market Growth Rate 2025-2033 | 4.7% |

The market is experiencing steady growth due to heightened security concerns across residential, commercial, and institutional sectors. Rising burglary rates and the need to protect valuables, sensitive documents, and cash are major contributors. Financial institutions, retail stores, and hospitality businesses are key adopters, driven by strict regulations for secure storage. Technological innovations, including biometric authentication, digital locking, and smart connectivity, are further boosting adoption by offering higher convenience and reliability. Growing demand from high-net-worth individuals for luxury safes to store jewelry, collectibles, and other personal assets also plays an important role. Additionally, the rising emphasis on fire-resistant and customized safes tailored to user needs supports market expansion, making security products a priority investment across Europe.

To get more information on this market, Request Sample

Rising gold demand, fueled by geopolitical uncertainty and financial instability, is driving rapid expansion of secure storage services in Europe. Providers are focusing on precious metal vaulting with immediate access, enhancing confidence for investors seeking protection. This surge in bullion trade and storage is shaping the Europe safes and vaults market outlook. For instance, in April 2025, IBV International Vaults London launched IBV Gold, a division focused on the secure storage and trade of gold and silver. The surge in gold demand, driven by geopolitical tensions and market instability, propelled the vault's growth, offering immediate, secure storage solutions, boosting the safes and vaults market.

Europe Safes and Vaults Market Trends:

Smart Safes Making Inroads in Retail

Europe safes and vaults market forecast is expected to highlight a rapid transition among retailers toward smart safes, driven by the need to automate cash handling and minimize losses. The safes feature digital interfaces, automated deposit recording, and remote monitoring. The technology reduces the need for manual counting and is used to combat internal theft, making it a worthwhile investment for large chain retailers, supermarkets, and gas stations. The British Retail Consortium (BRC) Retail Crime Survey 2025 highlights the urgency behind this trend, revealing that retailers spent a record USD 2.3 Billion on crime prevention measures in one year, up from USD 1.5 Billion the previous year. One of the primary drivers of growth is the need for real-time visibility into cash at multiple locations. Smart safes give secure, traceable deposits that can be tracked centrally and are best suited to high-cash-turnover businesses. In areas such as Germany and the UK, auditors and insurance companies are in increasing demand for smart safes due to their enhanced recording and protection against fraud capabilities. The ability to interface with POS systems and alert in the event of tampering also makes these safes a viable tool for enhancing operational efficiency. Suppliers are enhancing their products with mobile app management, touchscreens, and cloud reporting. With increasing labor costs and the requirement for greater accountability, adoption is likely to increase rapidly in the next couple of years. The emphasis on security and efficiency is turning intelligent safes into a central element is propelling the expansion of Europe security vaults market.

Biometric Vaults Drive Non-Banking Demand

Biometric vaults are expanding their role across non-banking sectors, becoming a key part of Europe safes and vaults market trends. According to IMARC Group, the Europe biometrics market was valued at USD 12.4 Billion in 2024, and is projected to reach USD 39.3 Billion by 2033, growing at a CAGR of 13.7% between 2025 and 2033. Healthcare providers, upscale hotels, and private homeowners are turning to fingerprint- and iris-based access systems to tighten control and reduce risks linked to traditional locks. In hospitals and pharmacies, these vaults are being adopted to secure medications and confidential files, aligning with strict EU rules around data protection and controlled substances. Luxury hotels are embedding biometric access into guest room safes to offer a higher level of security and discretion. At the residential level, interest is growing among affluent households. Vaults are being used to protect high-value items, from jewelry to firearms, driven in part by rising urban burglary rates. Legal practices and logistics firms are also investing in vault systems for secure document handling and shipment of sensitive goods. What’s emerging is a broader, cross-industry move toward smarter, more connected security infrastructure. This also ties into Europe sustainable vaults development, with manufacturers exploring materials and systems that reduce environmental impact without compromising security. Biometric vaults, by enabling remote management and reducing physical waste tied to key/card replacements, support these goals. These trends signal a shift toward more intelligent and responsible security solutions in the Europe banking safes market.

Europe Safes and Vaults Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe safes and vaults market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, function type, application, and end user.

Analysis by Type:

- Electronic

- Biometric

- Mechanical

Mechanical stood as the largest type in 2024 because of its strong adoption across residential, commercial, and banking applications. Mechanical safes are widely preferred in Europe for their reliability, durability, and cost-effectiveness compared to electronic models. Consumers and institutions value the fact that these safes do not depend on power supply or digital systems, making them resistant to hacking, malfunctions, and cyberattacks. In countries where small businesses, jewelry shops, and private households are significant users of safes, mechanical solutions remain the trusted choice. Demand is further supported by strict regulations in parts of Europe requiring secure physical storage for firearms, valuables, and sensitive documents. This steady reliance on mechanical systems sustains growth in the region’s safes and vaults market.

Analysis by Function Type:

- Cash Management Safes

- Depository Safes

- Gun Safes and Vaults

- Vaults and Vault Doors

- Media Safes

- Others

Cash management safes stood as the largest function type in 2024 as businesses across retail, hospitality, and banking increasingly adopt them to improve security and efficiency. These safes are designed to streamline cash handling by reducing manual errors, preventing theft, and ensuring accountability in daily transactions. In Europe, where high cash circulation persists in sectors like supermarkets, fuel stations, and convenience stores, the demand for such solutions is strong. Cash management safes also integrate features like deposit tracking and time-delay locks, which enhance protection against internal and external threats. With regulations in many European countries mandating strict cash handling and audit practices, businesses are turning to these safes to stay compliant. Their ability to combine security with operational efficiency makes them a key growth driver in the region.

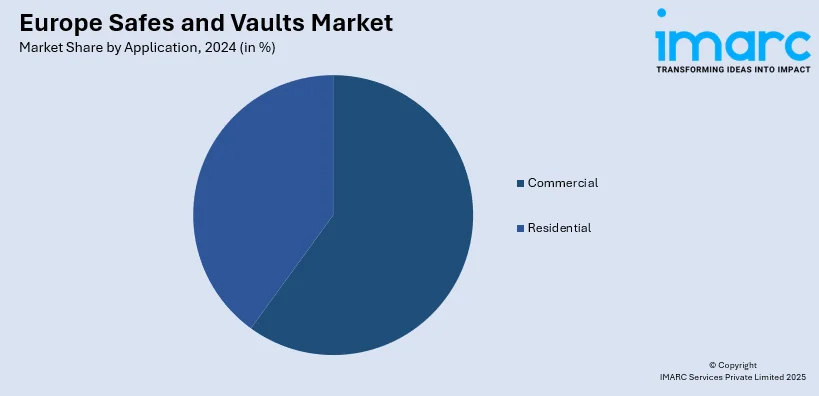

Analysis by Application:

- Residential

- Commercial

Commercial led the market in 2024, fueled by the need for secure storage across banks, financial institutions, retail chains, hotels, and corporate offices. These organizations handle large volumes of cash, confidential documents, and high-value assets daily, creating strong demand for advanced security solutions. In Europe, the banking sector, luxury retail, and hospitality industries are especially reliant on safes and vaults to protect against theft, burglary, and internal risks. Growing concerns about organized crime and stricter insurance requirements further push businesses to invest in high-grade security equipment. Additionally, the rise of luxury goods stores and multinational corporations across European cities is expanding the customer base. The commercial sector’s consistent requirement for reliable and durable safes ensures steady Europe safes and vaults market growth.

Analysis by End User:

- Banking Sector

- Non Banking Sector

The banking sector led the market in 2024, as financial institutions require highly secure storage systems to safeguard cash reserves, sensitive documents, gold, and other valuables. Banks face constant pressure to maintain customer trust and comply with stringent security regulations, making investment in advanced safes and vaults essential. In Europe, where cross-border trade, high-value transactions, and wealth management services are significant, the need for reliable physical security is strong. Modern banking vaults are designed to resist burglary, fire, and sophisticated attacks, ensuring maximum protection. With the growing presence of private banking and the rise of high-net-worth clients, demand for high-capacity, technologically advanced vaults has increased. This reliance on safes and vaults positions the banking sector as a key growth driver for the regional market.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share, supported by its strong financial sector and extensive network of banks, credit institutions, and private wealth management firms. The country’s strict security and insurance regulations create consistent demand for high-quality safes and vaults, particularly for commercial and institutional use. In addition, the presence of advanced manufacturing facilities and leading security technology companies gives Germany a competitive edge in producing innovative and durable products. Growing urbanization and rising concerns over burglary and theft also contribute to the adoption of modern residential safes. Moreover, Germany’s role as a major economic hub attracts significant investment in banking and corporate infrastructure, further boosting the need for reliable security solutions across both private and professional settings.

Competitive Landscape:

The safes and vaults market in Europe is seeing steady activity, with most developments centered on smart solutions that integrate biometric access, digital locks, and remote monitoring. Companies are putting effort into research and development to upgrade traditional designs into more secure, technology-enabled systems. Strategic partnerships between manufacturers and tech providers are becoming more visible, aimed at expanding product portfolios and meeting the demand for advanced security. Product launches with upgraded digital features remain the most common practice at present, reflecting a strong push toward innovation. Government initiatives and funding rounds are less frequent, though the sector is influenced by wider regulations on security standards. Overall, product launches and collaborations are driving current growth trends.

The report provides a comprehensive analysis of the competitive landscape in the Europe safes and vaults market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Lotus launched public beta rewards for its SUI, BTC, and Stable Farms, offering up to 1000 SUI weekly. Through smart vaults, the platform automated DeFi yield strategies without minimum deposits. These advancements positioned Lotus for a secure, high-efficiency vault infrastructure ahead of its mainnet deployment.

- April 2025: Cennox partnered with Link FX’s Retail365 to offer retailers same-day access to in-store cash via smart deposit safes. The integration of Lincsafe technology and Retail365’s fintech platform modernized cash handling, reduced cash flow delays, and introduced real-time banking solutions in the evolving retail vault ecosystem.

Europe Safes and Vaults Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electronic, Biometric, Mechanical |

| Function Types Covered | Cash Management Safes, Depository Safes, Gun Safes and Vaults, Vaults and Vault Doors, Media Safes, Others |

| Applications Covered | Residential, Commercial |

| End Users Covered | Banking Sector, Non Banking Sector |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe safes and vaults market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe safes and vaults market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe safes and vaults industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The safes and vaults market in Europe was valued at USD 1,515.05 Million in 2024.

The Europe safes and vaults market is projected to exhibit a CAGR of 4.7% during 2025-2033, reaching a value of USD 2,380.88 Million by 2033.

The Europe safes and vaults market is driven by rising concerns over burglary, growing adoption in commercial sectors like banks and retail, technological advancements in biometric and digital locking systems, regulatory compliance for secure storage, and increasing demand for luxury safes among high-net-worth individuals.

Germany accounted for the largest share in 2024 due to strong demand from banking, commercial, and residential sectors, driven by strict security regulations, advanced manufacturing capabilities, and a high concentration of financial institutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)