Europe Tire Market Report by Radial Vs Bias (Radial, Bias), End-Use (OEM, Replacement), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two-Wheeler, Off-The-Road (OTR), Three-Wheelers), Distribution Channel (Offline, Online), and Country 2025-2033

Market Overview:

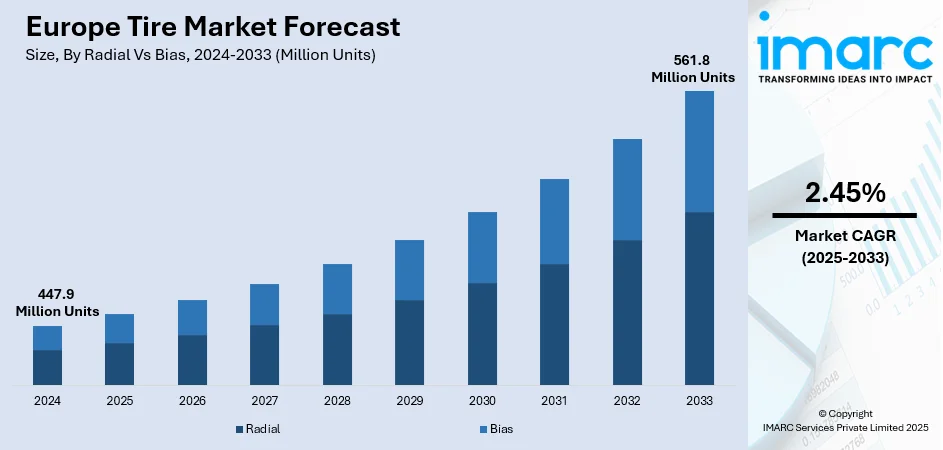

- The Europe tire market size was valued at 447.9 Million Units in 2024 and is projected to reach 561.8 Million Units by 2033.

- The market is estimated to grow at a CAGR of 2.45% from 2025-2033.

- The tire market in Europe is driven by rising vehicle ownership, demand for fuel-efficient and eco-friendly tires, strict safety standards, winter tire regulations, and growth in electric vehicles.

- In terms of radial vs bias, the radial segment dominate the market in Europe.

- Region wise, Germany is dominating the tire market in Europe.

- Some of the leading companies in the Europe tire market include MICHELIN, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli Tyre S.p.A., Yokohama Tire Corporation, Hankook Tire Co., Ltd., Toyo Tire Corporation, and KUMHO TIRE CO., INC.

A tire is a fundamental component of a vehicle that provides a crucial interface between the vehicle and the road surface. It is a resilient, cylindrical structure typically manufactured of reinforced rubber and filled with compressed air or other suitable materials. The primary function of a tire is to support the weight of the vehicle, absorb shocks, and provide traction, ensuring safe and efficient transportation. Tires consist of several layers, including the tread, sidewall, and bead, which work together to deliver optimal performance. Tires come in various types, catering to different vehicle types, terrains, and weather conditions. From everyday sets to European winter tires, drivers have many options for changing conditions and driving styles.

To get more information on this market, Request Sample

Rising demand for ultra-high-performance models with long life spans supports the European tyre market. Furthermore, the growing demand for tires that offer better fuel efficiency, noise reduction, and all-terrain capabilities is contributing to the growth of the market. Additionally, the rising popularity of electric vehicles and autonomous vehicles is impelling the market. Moreover, ongoing advancements in tire manufacturing technologies, such as the development of new materials, tire designs, and manufacturing processes, are impacting the demand favorably. Besides, the increasing concerns about environmental sustainability and reducing carbon emissions have led to the implementation of stricter regulations in the automotive industry, further creating a positive market outlook. Apart from this, continual improvements in infrastructure, such as the expansion of road networks or transport links also lift sales across tyres Europe.

Europe Tire Market Trends/Drivers:

Significant Growth in the Automotive Industry

Significant growth in the automotive industry is exerting a strong influence on the Europe tire market. Expanding car production, including hybrids and EVs, strengthens demand for Europe tyres. This can be attributed to the growth in vehicle production, including passenger cars, commercial vehicles, and electric vehicles, which increases the demand for tires. Moreover, the rising adoption of EVs requires specialized tires designed for electric vehicles’ unique requirements, such as low rolling resistance and extended range. This shift fuels the demand for electric vehicle tires in the Europe market and these factors push EU tyres makers to adapt quickly. Furthermore, the escalating concerns about environmental sustainability and reducing carbon emissions have led to the implementation of stricter regulations in the automotive industry. This includes regulations related to tire labeling, fuel efficiency standards, and tire recycling.

Continual Technological Advancements in Manufacturing Processes

Ongoing technological advancements are playing a crucial role in shaping the Europe tire market. New tech keeps shaping the European tires brands scene and the advancements have led to the development of tires with reduced rolling resistance that minimizes energy loss during rolling, resulting in improved fuel efficiency and reduced carbon emissions. Additionally, continual innovations in tire tread design, such as improved grip, handling, and braking capabilities, contribute to enhanced safety on Europe roads. Moreover, innovative approaches, including using renewable or recycled materials in tire production, reduce the environmental impact associated with tire manufacturing and disposal. Using recycled and bio-based materials cuts waste from tires Eu production and disposal. Furthermore, ongoing technological advancements have led to the development of run-flat and self-sealing tire technologies as run-flat tires allow vehicles to continue driving safely even after a puncture or loss of air pressure, eliminating the need for an immediate tire change.

Shift Toward Smarter Tires

Across Europe, tire makers face new demands as driving trends and technology evolve. Tighter emissions rules and a push for fuel savings lead to designs that cut rolling resistance and trim weight. More drivers switching to electric cars means tires must handle extra battery weight and deliver a quiet ride despite stronger torque. Seasonal laws for winter tires in colder countries drive steady demand every year, while many still prefer all-season versions for flexibility. Older vehicles staying on the road ensure replacement sales remain steady. Buyers notice brands cutting waste with greener methods. Fleets and delivery vans want sturdy tyres Eu that go the distance without costing too much. Commercial fleets and delivery services want longer-lasting, fuel-efficient options to manage costs. Digital buying and mobile fitting teams make tire swaps quicker than before. Safety, grip, low noise, and durability top buyer checklists. Online shops and mobile teams help drivers swap sets fast. Grip, safety, and quiet performance stay at the top of must-have lists for European tires.

EV Growth and Smart Features

More electric vehicles on Europe’s roads bring fresh needs for tire design. Heavier battery packs and instant torque put extra stress on treads, so manufacturers build reinforced structures to handle the load. Rolling resistance needs to stay low to squeeze out more range per charge. Some brands focus on cutting road noise to keep cabins quiet. Smart technology is moving in fast too — sensors inside tires can monitor pressure, heat, and wear, sending updates straight to drivers or fleet managers. This tech helps avoid unexpected flats and improves safety. Commercial transport companies see value in data that helps extend tire life and plan maintenance better. Run-flat features, noise-reducing foam layers, and better puncture resistance are also getting more common. Many companies invest in research to meet the mix of performance, energy savings, and safety. As cleaner transport expands, tyres Europe makers roll out products ready for the next generation of electric travel.

Europe Tire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe tire market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on radial vs bias, end-use, vehicle type, and distribution channel.

Breakup by Radial Vs Bias:

- Radial

- Bias

Radial represents the most widely used in the market

The report has provided a detailed breakup and analysis of the market based on the radial vs bias. This includes radial and bias. According to the report, radial represented the largest segment.

Radial tires dominate the Europe tire market due to several key factors. Radial tire technology revolutionized the tire industry when it was introduced and continues to be the preferred choice for vehicles in Europe. Radial tires offer significant performance advantages over their bias-ply counterparts. The radial construction allows the tire to have a flexible sidewall, which provides improved grip, traction, and stability, resulting in enhanced handling and cornering capabilities. Radial tires also have a larger contact area with the road surface, contributing to better braking performance and overall ride comfort. They offer a smoother and more comfortable ride due to their flexible sidewalls. The design absorbs road shocks and vibrations, providing a quieter and more pleasant driving experience. The advanced construction and materials used in radial tires contribute to improved durability and resistance to wear.

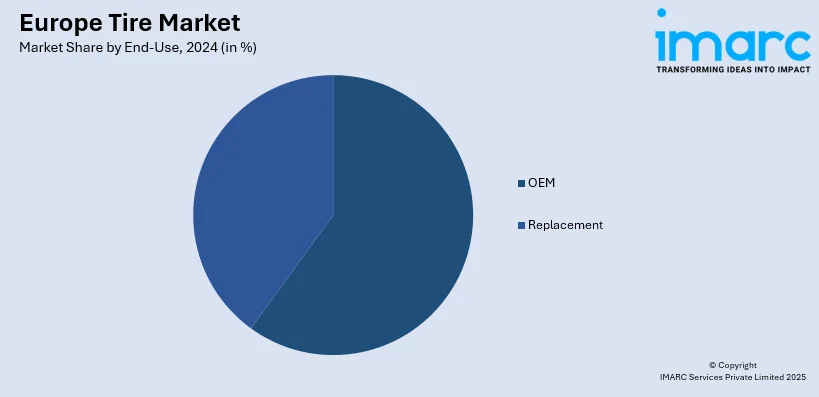

Breakup by End-Use:

- OEM

- Replacement

Replacement account for the majority of the market share

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes OEM and replacement. According to the report, replacement segment accounted for the largest European tire market share.

The replacement segment dominates the Europe tire market. Tires have a limited lifespan and wear out over time due to regular usage and exposure to various road conditions. As a result, vehicle owners need to replace their tires periodically to maintain optimal performance and safety. Europe experiences distinct seasons, including winter, summer, and transitional periods. This necessitates seasonal tire changes to ensure optimal performance and safety. Consumers often prefer to customize their vehicles and tailor them to their specific needs and preferences. This includes selecting tires that align with their driving style, performance requirements, and weather conditions. The replacement segment caters to these diverse consumer preferences, offering a wide range of tire options to choose from. The replacement tire market benefits from the presence of independent tire retailers and service centers. These establishments specialize in tire sales, installation, and maintenance.

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two-Wheeler

- Off-The-Road (OTR)

- Three-Wheelers

Passenger cars hold the largest share in the market

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two-wheeler, three-wheelers and off-the-road (OTR). According to the report, passenger cars accounted for the largest market share.

Europe has a significant number of passenger cars on the roads, representing a majority portion of the overall vehicle population. Passenger cars are the primary mode of transportation for individuals and families, contributing to a consistently high demand for tires in this segment. Passenger cars are widely used for daily commuting, personal transportation, and recreational purposes in Europe. The reliance on passenger cars for various activities, such as commuting to work, running errands, and leisure travel, results in frequent tire usage and replacement needs. Passenger car owners prioritize safety and performance when selecting tires. They look for tires that offer excellent grip, handling, braking, and overall safety features to ensure a comfortable and secure. Original equipment manufacturers (OEMs) work closely with tire manufacturers to provide passenger cars with specific tire fitments that complement their performance and design.

Breakup by Distribution Channel:

- Offline

- Online

Offline channel represents the most widely used distribution channel

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online. According to the report, offline represented the largest segment.

Europe has a well-developed retail infrastructure, with a vast network of brick-and-mortar tire dealerships, automotive service centers, and tire specialty stores. These physical retail outlets provide a wide range of tire brands, models, and sizes, allowing consumers to browse and make informed choices. Offline tire retailers offer a personalized customer experience, where consumers can interact with knowledgeable staff who can provide expert advice on tire selection, fitment, and maintenance. Offline retailers often provide tire installation services, including mounting, balancing, and alignment, as well as additional maintenance and repair services. These services offer convenience to consumers, as they can have their tires professionally installed and receive ongoing support from the retailer. Additionally, they build trust and credibility over time through their established presence and reputation in the market.

Breakup by Country:

- Germany

- United Kingdom

- Spain

- France

- Italy

- Russia

- Turkey

- Netherlands

- Belgium

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, United Kingdom, Spain, France, Italy, Russia, Turkey, Netherlands, Belgium and other.

Germany is a major manufacturing hub for tires in Europe. It is home to several leading tire manufacturers, including Continental, Michelin, Pirelli, and Bridgestone, among others. These companies have established production facilities in Germany, which contributes to the overall tire production capacity in Europe. The country's manufacturing prowess and technological expertise in the automotive sector have a substantial impact on the tire market. Germany is known for its strong focus on research and development (R&D) in the automotive industry, including tire technology. German tire manufacturers invest heavily in R&D to develop innovative tire solutions, improve performance, and meet the evolving demands of customers.

On the contrary, the United Kingdom is home to several prominent tire retail chains and distribution centers. These establishments play a vital role in the distribution and availability of tires across Europe. Many tire manufacturers, both domestic and international, rely on the UK's retail and distribution network to reach customers in various countries.

Competitive Landscape:

The key players in the market have made several innovations and advancements to meet the evolving demands of consumers and businesses. They launched the michelin sustainable mobility plan, focusing on reducing CO2 emissions, using sustainable materials, and developing eco-friendly tires. The companies are introducing technologies, such as the RunOnFlat system, allowing drivers to continue driving on a flat tire for a certain distance. They have also introduced innovative tire models, such as the P Zero range, which offers high-performance capabilities for various vehicles. They have also been involved in motorsports, using it as a platform to test and improve their tire technology. Additionally, the leading players are developing eco-friendly tires, such as the Ecopia range, designed to reduce fuel consumption and CO2 emissions. Bridgestone has also been involved in tire recycling programs to minimize waste.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- MICHELIN

- Bridgestone Corporation

- Continental AG,

- Goodyear Tire & Rubber Company

- Sumitomo Corporation,

- Pirelli Tyre S.p.A.

- Yokohama Tire Corporation

- Hankook Tire Co., Ltd

- Toyo Tire Corporation

- KUMHO TIRE CO., INC.

Europe Tire Market Recent News:

- May 2025: Goodyear confirmed its truck racing tires for the FIA European Truck Racing Championship would contain 55% sustainable materials. This move strengthened green innovation in motorsport and commercial fleets, encouraging eco-friendly tire production and boosting demand for advanced, resource-efficient tire solutions.

- April 2025: Europe-based ENSO released its Premium ultra-high performance tires for Tesla and other EVs. These A/A EU-labeled tires improved energy efficiency, extended range, and reduced wear. This launch supported Europe’s shift to cleaner transport and encouraged more sustainable tire options for electric vehicles.

- March 2025: Michelin launched its Air X Sky Light radial aircraft tire, cutting weight by 10–20% and saving over 550 pounds on an Airbus A350. This advance reduced fuel burn, boosted efficiency, and set a new benchmark for lightweight, durable aviation tires in Europe.

- January 2025: Hankook launched its Optimo sub-brand in Europe, expanding its car and SUV tire lineup with summer, all-season, and winter options. This move boosted Hankook’s market share, met rising demand, and strengthened its position as a trusted supplier for European drivers.

Europe Tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Radial vs Bias Covered | Radial, Bias |

| End-Uses Covered | OEM, Replacement |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two-Wheeler, Three-Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Countries Covered | Germany, United Kingdom, Spain, France, Italy, Russia, Turkey, Netherlands, Belgium, Others |

| Companies Covered | MICHELIN, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli Tyre S.p.A., Yokohama Tire Corporation, Hankook Tire Co., Ltd., Toyo Tire Corporation, KUMHO TIRE CO., INC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe tire market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe tire market is expected to grow at a CAGR of 2.45%during 2025-2033.

Tires on electric cars often wear out quicker than those on petrol or diesel vehicles, mainly due to heavier batteries and strong acceleration. Many last between 25,000 and 40,000 miles. Regular checks, careful driving, and proper pressure help extend how long they last.

More cars on the road, energy-saving demands, and seasonal tire rules keep sales strong across Europe. Electric vehicles, smarter tire features, and eco-friendly materials attract buyers. Fleets and logistics companies want durable options to cut costs, which pushes brands to upgrade designs regularly.

During COVID-19 pandemic, people drove less, delaying tire changes and new purchases. Manufacturers faced shipment slowdowns and factory interruptions. As travel picked up again, tire orders jumped to meet postponed needs. Many buyers now shop online for tires, boosting digital sales and delivery services.

Based on the radial vs bias, the Europe tire market has been segmented into radial and bias.

Based on the end-use, the Europe tire market has been segmented into includes OEM and replacement.

Based on the vehicle type, the Europe tire market has been segmented into passenger cars, light commercial vehicles, medium and heavy commercial vehicles, three-wheelers and off-the-road (OTR), and two-wheeler.

Based on the size, the Europe tire market has been segmented into passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, off- the- road (OTR) and three-wheelers.

Based on the distribution channel, the Europe tire market has been segmented into offline and online.

On a regional level, the Europe tire market has been segmented into Germany, United Kingdom, Spain, France, Italy, Russia, Turkey, Netherlands, Belgium and other.

Some of the major players in the Europe tire market include MICHELIN, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli Tyre S.p.A., Yokohama Tire Corporation, Hankook Tire Co., Ltd., Toyo Tire Corporation, and KUMHO TIRE CO., INC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)