Europe Toys Market Size, Share, Trends and Forecasts by Product Type, Age group, Sales Channel, and Country, 2025-2033

Europe Toys Market Size and Share:

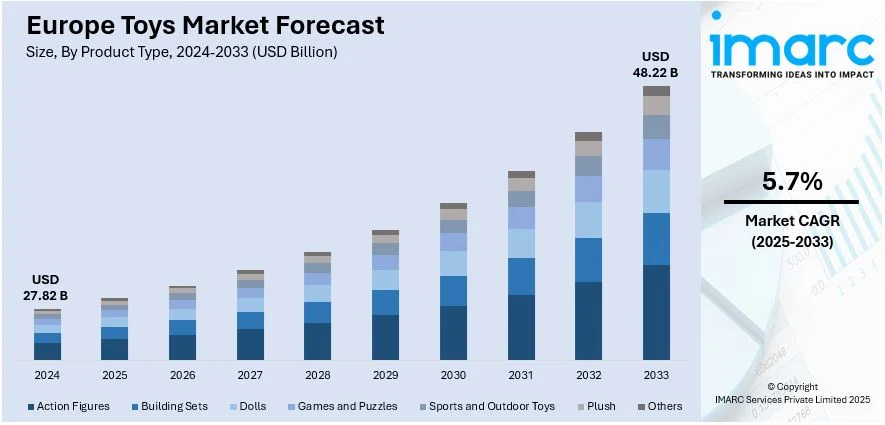

The Europe toys market reached a value of approximately USD 27.82 Billion in 2024. The market is projected to grow at a CAGR of 5.7% between 2025-2033, reaching a value of nearly USD 48.22 Billion by 2033. The market is driven by the growing adoption of green packaging solutions that are eco-friendly and cost-effective, along with rising demand for specialized toys to cater to the requirements of children with special needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.82 Billion |

|

Market Forecast in 2033

|

USD 48.22 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

E-commerce platforms provide access to an extensive variety of toys that may not be available in physical stores across the European region. People can choose from different categories like educational, collectible and interactive toys of various brands. People can compare prices across multiple retailers as well as read reviews and ratings from other buyers to make better purchasing decisions. Besides this, online shopping platforms give parents ease to buy toys during late hours or while traveling. Individuals can receive curated toys for their children on a monthly or quarterly basis, based on the subscription box model they opt for. This model is a convenient way to ensure that children receive a continuous flow of new and age-appropriate toys. Furthermore, easy return and exchange policies are offered through e-commerce platforms to alleviate concerns about purchasing toys online. As per the IMARC Group’s report, the Europe e-commerce market is expected to reach USD 7.2 billion by 2032.

Augmented reality (AR) games create a more immersive gaming experience by merging the virtual world with the real world. In AR games, the level of engagement is high, as players interact with both physical environments and virtual objects. AR games can be played on smartphones and tablets, which are easily accessible to a wide audience. This makes AR gaming more convenient for users who may not have access to gaming consoles or expensive virtual reality (VR) equipment. AR games have social or multiplayer components, where players can converse with friends, family, or other users. This encourages players to participate in teamwork and friendly competition. One of the most important aspects of AR games is that they can encourage children to develop science, technology, engineering, and math (STEM) skills by offering challenges that require problem-solving, critical thinking, and creativity.

Europe Toys Market Trends:

Rising Demand for Smart Toys

The increasing demand for smart toys is impelling the Europe toys market growth. With the help of artificial intelligence (AI), sensors, and connectivity, smart toys offer a dynamic and personalized play experience. Smart toys are equipped with sensors that detect touch, movement, and gestures. They can learn from a child’s actions, preferences, and progress as well as understand and respond to voice commands. They can also reciprocate physical actions like pressing buttons, tapping, or waving hands. In line with this, they can be integrated with apps to provide additional content, games, or educational activities associated with toys. Many smart toys also feature wireless charging stations that make it easier for parents to keep the toy powered without needing to constantly replace batteries. In October 2024, Clementoni, a leading toy company, launched AIRO, an artificial intelligence (AI)-enabled robot to enhance learning experience of children aged above 9 years.

Increasing Adoption of Green Packaging

Europeans are becoming more aware of the environmental impact of the products they buy and thus seek sustainable and eco-friendly products, including toys. Toy manufacturers in the region are shifting to biodegradable, recyclable, and reusable packaging alternatives, such as cardboard, paper, and plant-based materials. Due to the evolving Europe toys market trends, the usage of plastic in toys has been significantly reduced, resulting in decreased waste accumulation in landfills and oceans. Brands that incorporate green packaging solutions attract buyers who are more likely to remain loyal. By adopting green packaging, toy brands can build stronger relationships with customers and foster brand trust. Green packaging involves using fewer materials and lighter alternatives, which can lower the cost of packaging production. Furthermore, the European Union is implementing strict regulations and directives aimed at reducing environmental impacts, because of which, toy manufacturers are adopting greener packaging solutions. The IMARC Group’s report predicted that the Europe green packaging market will exhibit a growth rate (CAGR) of 6.4% during 2025-2033.

Rising Prevalence of Autism Spectrum Disorder (ASD)

The increasing occurrence of autism spectrum disorder (ASD) among children is supporting the market growth, thereby increasing the Europe toys market share. According to an article published by Yellow Bus ABA in 2024, the prevalence of ASD among 5- to 18-year-olds living in Europe is estimated to be around 0.8% dependent on register-based studies and 1.4% based on population examinations. Toys that require verbal or non-verbal communication can aid children with autism spectrum disorder (ASD) to practice their language skills. Dolls, action figures, and pretend play sets like kitchens or doctor’s offices encourage children to practice social roles, interactions, and basic conversation. Many children with ASD have sensory sensitivities, meaning they may be overly sensitive or under-sensitive to light, sound, touch, or movement. Sensory toys, such as fidget spinners, sensory balls, textured toys, and weighted blankets help children self-regulate and manage sensory overload and provide soothing tactile stimulation. Children with ASD can learn to be self-sufficient and confident with the help of independent games. Simple and self-directed toys that require little adult supervision can help children develop focus and concentration while also allowing for relaxation. Visual timers and schedules are often used alongside toys to help children with ASD understand the concept of time and sequence.

Europe Toys Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe toys market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, age group, and sales channel.

Analysis by Product Type:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

Action figures are very popular in Europe due to famous movie franchises, comic characters, and video game-inspired toys. They feature intricate detailing and advanced articulation that is liked by children and adult collectors. Toy companies collaborate with entertainment brands to manufacture limited editions of action figures.

Building sets carry the ability to promote creativity, problem-solving, and cognitive development. Popular brands invest in building sets to create innovative designs and themed sets based on movies, and architecture. Parents choose building sets for their educational value, while adult enthusiasts appreciate difficult sets.

Dolls are preferred by European people, as they are highly customizable and can interact, when integrated with modern technologies. Popular doll brands offer products inspired by pop culture and societal trends to attract buyers across the region. Dolls can represent diverse body types, ethnicities, and abilities, which is why they are in high demand.

Games and puzzles can foster family bonding, social interaction, and mental stimulation. Board games, card games, and challenging puzzles appeal to consumers of all ages. People are more interested in stay-at-home entertainment and seek engaging indoor activities, where games and puzzles come into play.

European adults and children who prefer physical activity and outdoor play, choose sports and outdoor toys. Products, such as balls, bicycles, and trampolines encourage active lifestyles and are popular among parents, who promote health and fitness. Seasonal trends like increased outdoor play during summer, and advancements in toy safety contribute to the growth of this segment across Europe.

Plush toys maintain strong appeal due to their emotional connection and comfort factor. They resemble popular characters, animals, or personalized themes, which makes them a popular gift option. Additionally, being soft and safe, plush toys are favored for younger children. European brands incorporate sustainable materials to entice eco-conscious buyers.

Analysis by Age Group:

- Up to 5 years

- 5 to 10 years

- Above 10 years

For children up to 5 years of age, parents focus on toys designed to aid in early childhood development, including sensory, motor, and cognitive skills. Products, such as plush toys, building blocks, and educational toys are highly popular. Parents need safe and durable toys with growth benefits when choosing toys for this age group.

In the 5 to 10 years age group, toys are very important to enhance creativity, social interaction, and problem-solving skills. Building sets, action figures, games, puzzles, and outdoor toys are preferred for this segment. Children actively engage in imaginative play, educational toys and themed products based on popular franchises.

The above 10 years age group includes toys that cater to advanced cognitive abilities, hobbies, and collectibles. Popular products in this category range from complex building sets to action figures, board games, and tech-based toys like drones and coding kits. Adult collectors and enthusiasts enjoy assembling limited-edition toys.

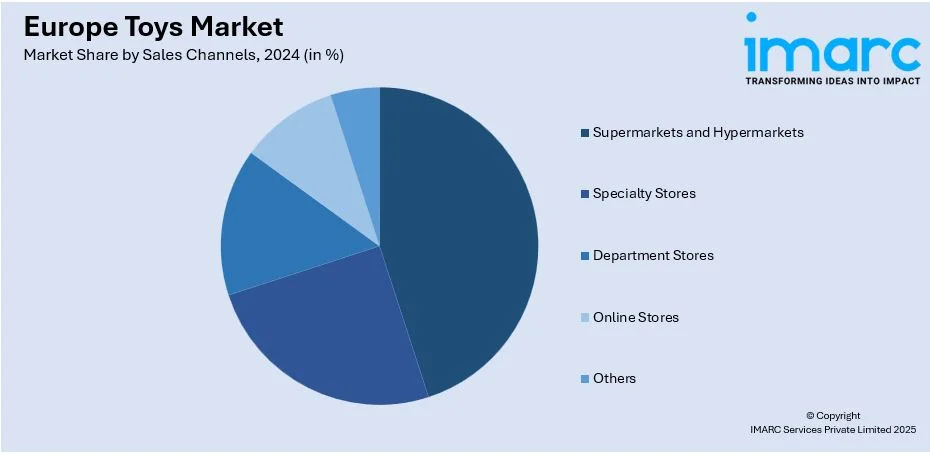

Analysis by Sales Channels:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

Supermarkets and hypermarkets make toys more convenient and accessible. They offer a wide range of toys, from which buyers can select and buy. They feature seasonal promotions, bulk discounts, and readily available stock to attract busy parents and gift shoppers.

Specialty stores cater to European buyers, who seek expert guidance, premium products, and exclusive toys. They offer curated collections with unique items that appeal to collectors and parents looking for educational and high-quality toys. They create personalized shopping experiences and provide hands-on demonstrations, which makes them a preferred choice.

Department stores offer a blend of variety and convenience, with specific sections of different types of toys. They attract a diverse customer base and combine accessibility with premium brand offerings. Seasonal displays and promotional events during holidays make department stores more popular.

European people opt online stores for shopping, as they can browse and choose products from their homes. Buyers can also compare prices from different brands and make informed decisions. Features like customer reviews, detailed product descriptions, and flexible delivery options enhance their appeal.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is known for its robust economy and high buyer spending on educational and science, technology, engineering, and math (STEM)-based toys. Germans prioritize good-quality and safe toys, which is driving the demand for eco-friendly and durable toys. They also have access to a wide range of toys through e-commerce platforms.

In France, people emphasize on creativity and cultural values. French buyers prefer educational toys, art and craft kits, and products inspired by local heritage. The market is experiencing a rise in demand for both traditional toys and innovative tech-based items. Specialty stores and department stores remain key sales channels, along with online platforms gaining traction across the region.

In the United Kingdom, toy manufacturers focus on innovation, digital integration, and the influence of popular entertainment franchises. People often favor licensed products, building sets, and board games. The thriving e-commerce sector, coupled with robust retail infrastructure, is creating widespread availability of toys.

In Italy, buyers prefer traditional and creative toys that align with family-oriented cultural values. Italian population seeks toys that promote social interaction, such as board games and outdoor toys. Specialty stores and local markets are popular sales channels, while e-commerce adoption is gradually increasing.

Outdoor toys, sports equipment, and games are encouraged highly in Spain to promote active play. Individuals choose affordable and high-quality toys, which makes supermarkets and hypermarkets key retail channels. To respond to popular preferences, manufacturers come-up with tech-integrated toys and educational products.

Competitive Landscape:

Key players in the European toys market are focusing on introducing diverse product ranges, including educational toys, tech-enabled gadgets, and sustainable options, which cater to various age groups and preferences. Major players are investing in robust retail and e-commerce networks, to make toys more accessible. They are capitalizing on digital marketing strategies, influencer partnerships, and seasonal campaigns to enhance brand visibility and consumer engagement. The emphasis on sustainability creates the need for adoption of eco-friendly materials and packaging across the region. Toy companies are collaborating with entertainment franchises to ensure a steady demand for licensed merchandise and collectibles. They are also opening new stores in locations to increase their sales. For instance, in 2024, Ducklings Toy Shop unveiled its brand-new store at Five Valleys in Stroud to expand and offer a wider range of toys and games in its new location.

The report provides a comprehensive analysis of the competitive landscape in the Europe toys market with detailed profiles of all major companies.

Latest News and Developments:

- January 2024: Family founded UK-based toy company, Click Europe announced the launch of a new range of puzzles and games under its boppi brand at the Toy fair in London. The puzzles are made from recycled cards and contribute to the increasing range of products for eco-conscious families with children aged 18 months and older.

- January 2024: Merlin Entertainments, the LEGO Group, and toy board game producer Hasbro announced that the popular cartoon character Peppa Pig will be launched in the form of a new LEGO® DUPLO® building bricks.

- February 7, 2024: Millimages announced a partnership with PlaybyPlay, a Famosa brand within the Giochi Preziosi toy group, to produce and distribute a range of Molang plush toys across Europe and Latin America, targeting a Christmas 2024 market release. The initial items from this collection were unveiled at the Nuremberg Toy Fair, highlighting plush as the top-performing category for the Molang brand, which boasts over 950 consumer products from more than 80 licensees worldwide.

- September 30, 2024: HTI Group, a Fleetwood-based global supplier of children's toys and games, acquired Bury-based Sambro International, establishing HTI as the UK's largest privately-owned toy company. This strategic acquisition combines annual sales exceeding EUR 120 million and extends HTI's presence to over 70 international markets. In order to guarantee smooth service and uninterrupted operations for partners and clients, both businesses will keep running out of their current UK sites.

- December 4, 2024: Sky Castle Toys and Jazwares announced a multi-year partnership to expand the distribution and brand development of Sticki Rolls™ across North America and Europe. Under this agreement, Jazwares will manage sales and distribution to various retailers in the U.S., Canada, and major European markets, enhancing the brand's availability and consumer engagement.

Europe Toys Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports, and Outdoor Toys, Plush, Others |

| Age Groups Covered | 5 Years, 5 To 10 Years, Above 10 years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe toys market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe toys market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The toys market was valued at USD 27.82 Billion in 2024.

The market in Europe is primarily driven by increasing disposable income levels, which encourage parents to spend on high-quality, educational, and innovative toys. More brands are focusing on creating toys that are inclusive of all children and the escalating demand for craft kits, including painting, modeling clay, and sewing sets.

The toys market is projected to exhibit a CAGR of 5.7% during 2025-2033, reaching a value of USD 48.22 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)