Europe Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Motor Type, Engine Capacity, Transmission, and Country, 2025-2033

Europe Two-Wheeler Market Size and Share:

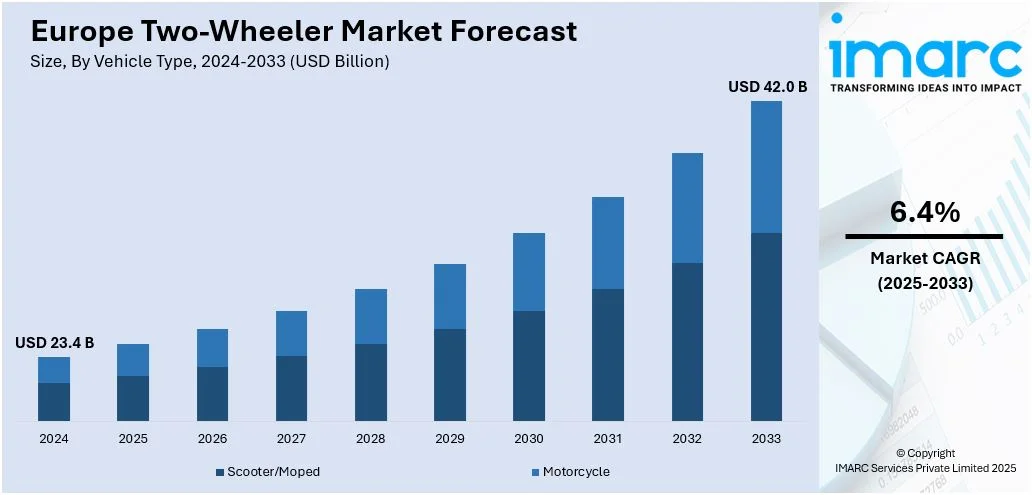

The Europe two-wheeler market size is estimated at USD 23.4 Billion in 2024, and is estimated to reach USD 42.0 Billion by 2033, exhibiting a CAGR of 6.4% during the forecast period 2025-2033. France dominates the market due to its extensive cycling infrastructure, iconic biking routes like the Tour de France trails, and strong government initiatives promoting eco-friendly transportation and tourism.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.4 Billion |

| Market Forecast in 2033 | USD 42.0 Billion |

| Market Growth Rate (2025-2033) | 6.4% |

The European two-wheeler market share is growing due to the fast-paced urbanization and growing sensitivity toward ecological sustainability. Electric versions of two-wheelers are more viable options against rising traffic conditions in cities as they reduce strain on vehicles during daily travel. Governments provide further incentives, in the form of subsidies or tax benefits on electric two-wheelers, thereby urging consumers to adopted latest technology. The push toward net-zero emissions by 2050 have boosted the adoption of e-mobility. The UK ranks 3rd globally in environmental sustainability, according to the Sustainable Governance Indicators, and is crucial to the trend of greener transport solutions. Development in lightweight, compact transportation options is part of a wider thrust toward efficiency and sustainability in urban geography.

Another significant promoter for the two-wheeler market is technological advancements in the two-wheeler sector. The emphasis on improvements such as better battery technology, extended range, and smart connectivity features is making electric two-wheelers more attractive. Investments in charging infrastructure by European cities add further fuel to market expansion. The growing number of shared mobility services, such as e-scooter and e-bike sharing, also helps to grow the market. Environmentally friendly policies such as sustainable governance leadership in the UK, low-emission zones, and rising fuel prices are other reasons responsible for the rising demand of two-wheelers. These vehicles are the best solutions for practical, environmentally friendly, and affordable mobility. Thus, they have become an important element in the way Europe will go green for its urban transport.

Europe Two-Wheeler Market Trends:

Rise in electric scooter demand

Electric scooters are increasingly being adopted across Europe, driven by the need for sustainable urban mobility and government policies to combat pollution. These small, eco-friendly vehicles provide an efficient alternative to city commuting and help alleviate traffic congestion and the increasing cost of fuel. Governments in Europe are encouraging the shift to electric scooters through subsidies, tax breaks, and investments in charging infrastructure, which influences the market. Low-emission zones and electric scooters have emerged a rapid pace, as cities favor these vehicles during short distances for traveling. On account of this, the European Commission has adopted numerous proposals, so as to minimize the new greenhouse gas net emissions level by at least 55% by 2030. This regulatory nudge further reiterates the EU's commitment to sustainable mobility and fosters an environment conducive to the growth of electric scooters. Technological developments, such as better batteries and faster charging, along with shared e-scooter services, are transforming urban mobility, making electric scooters a key component of Europe's sustainable transport revolution.

Growing demand for shared mobility solutions

Shared mobility is changing the urban transportation landscape in Europe, with two-wheeler rental services such as e-scooters and e-bikes gaining immense popularity. Cities are encouraging these services to reduce congestion and pollution while improving last-mile connectivity. Companies such as Lime, Tier, and Voi have capitalized on this trend, offering convenient app-based rental platforms that appeal to environmentally conscious urbanites. Shared mobility is a preferred mode of transportation for short trips, especially in densely populated areas, as it is affordable and flexible. Governments are also partnering with service providers to establish regulations and infrastructure, ensuring safety and seamless integration into urban transit systems. This trend aligns with the broader goals of sustainability and smart city development, enabling people to access transport without ownership burdens. As more European cities adopt low-emission zones and congestion charges, shared two-wheeler solutions are expected to grow significantly, fostering a culture of sustainable and collaborative mobility.

Growth of two-wheeler tourism

The popularity of two-wheeler tourism is growing across Europe, with its beautiful scenery and the increasing interest in outdoor adventures, thereby contributing to Europe two-wheeler market growth. These statistics show the increase in the preference for two-wheeler travel by adventure enthusiasts and eco-conscious tourists. Two-wheeler tourism in Europe benefits from well-developed cycling infrastructure, including dedicated trails, bike-friendly accommodations, and rental services. Countries like France, Italy, and the Netherlands actively promote cycling tourism through national campaigns and events, such as "EuroVelo" routes. The trend aligns with growing environmental awareness, as two-wheelers offer a low-carbon footprint alternative to traditional transport modes. Moreover, the rise of e-bikes has made long-distance and hilly terrain travel more accessible, appealing to a wider demographic. These factors collectively contribute to the sustained demand for two-wheelers in the European tourism sector.

Europe Two-Wheeler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe two-wheeler market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, fuel type, engine capacity, and transmission.

Analysis by Vehicle Type:

- Scooter/Moped

- Motorcycle

- Sport/Supersport

- Enduro

- Chopper

- Classic

- Commuter

- Others

Motorcycles lead the European two-wheeler market due to their flexibility, performance, and adaptability to the profiles of riders from a wide spectrum. They are faster than scooters or mopeds and show more endurance when going over various surfaces, so they are appropriate for both commuting and sporting activities. According to the ACEM, for the first six months of 2024, new motorcycle registrations in five of the largest European markets, namely France, Germany, Italy, Spain, and the UK, touched 610,757 units, up 1.7 percent from 2023. Thus, the sustained growth across most of the European markets illustrates about the robustness of demand within the segment. Additionally, long-distance tourers and adventure bikes have picked up the niche of high-performing motorcycles, such as better suspension setups, navigation gadgets, and significantly better fuel efficiencies. The Eurocentric premium demand for motorcycles and the culture of pure performance and super brands should act as a bottom line for retaining the segment into the core competence of two-wheelers.

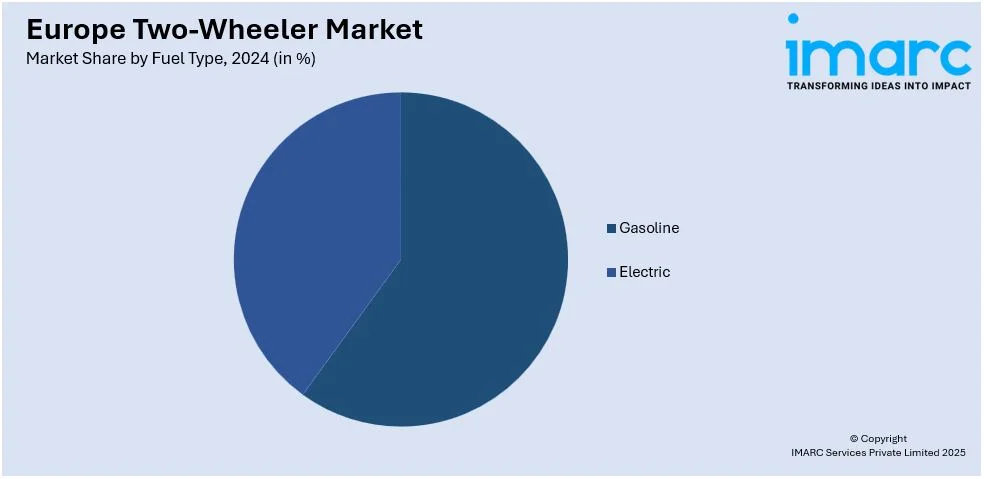

Analysis by Fuel Type:

- Gasoline

- Electric

Gasoline-powered two-wheelers continue to dominate the European market due to their low price, high availability, and high performance. In addition, their long-term attractiveness is further enhanced by the fact that 75.6% of the population, or 563,417,440 people in 2024, as per the Worldometer live in urban areas, as these vehicles can be used effectively in congested city streets as a convenient means of transportation for urban commuters. The established refueling infrastructure allows for accessibility by riders in urban and rural settings. Gasoline vehicles are also highly favored for their versatility, as they have a very good power output and reliability, which is well-suited to performance-focused segments like sport and touring motorcycles. Advances in engine technology have improved fuel efficiency and reduced emissions, helping manufacturers comply with strict European environmental standards like Euro 5. The segment also benefits from a strong resale market, which enhances value for consumers. Cultural preferences for gasoline-powered motorcycles, supported by a heritage of premium brands and high-performance models, continue to drive demand. Though the momentum toward electrification is on, issues like a weak charging network and a costlier electric alternative have let gasoline two-wheelers continue at the top. In terms of engine capacity, the European two-wheeler market can be divided into four distinct categories.

Analysis by Engine Capacity:

- Up to 125 cc

- 126-250 cc

- 251-500 cc

- Above 500 cc

Two-wheelers with engines of up to 125 cc form the urban commuter segment as they are lightweight, fuel-efficient, and cost-effective. These vehicles are particularly popular among first-time riders, eco-conscious consumers, and those navigating congested city streets. This segment has become even more prominent in cities such as London, which topped the Traffic Scorecard in Europe and ranked fifth globally, with drivers losing 101 hours sitting in congestion in 2024, a 2% increase in delays compared to 2023, as per Inrix. In such high-traffic urban environments, compact and agile two-wheelers offer a practical solution to avoid prolonged delays.

Models in the 126-250 cc range appeal to riders seeking a balance of performance and affordability, making them ideal for suburban commutes and occasional longer rides. They provide greater power and stability while remaining cost-effective.

The 251-500 cc segment caters to experienced riders who need versatile two-wheelers for both city travel and recreational touring, offering a balance of power and maneuverability.

Above 500 cc hold a significant position, which are more or less high-performance bikes with higher standards of suspension, high-end safety systems, and luxury finishes. These models provide comfort and long-distance capability performance and are opted for by enthusiasts focused on speed and comfort, hence sports and touring applications, with each ridership targeted to a unique clientele in the very diverse preferences of the European market. Based on transmission type, the European two-wheeler market is divided into manual and automatic models, each catering to different consumer needs.

Analysis by Transmission:

- Manual Transmission

- Automatic Transmission

Manual transmission Two-wheelers are the preferred choice for riders who require more control, engagement, and performance. The models dominate the sports and touring categories, where precise gear control is critical in tackling diverse terrains and achieving optimal performance. Traditionalists enjoy the old-fashioned feel of riding and the feeling of control that comes with manual transmission. Automatic two-wheelers, especially scooters, have become increasingly popular in recent years due to their ease of operation and simplicity. These vehicles are popular among city commuters and recreational riders as they are easy to use in stop-and-go traffic, require little maintenance, and are easy to operate. Automatic models are attractive to new customers and riders seeking a solution for daily practical mobility in denser cities. With urbanization and sustainability driving demand for two-wheelers on electric powertrains, automatic transmission is likely to grow further to serve a wider cross-section of people with ease of riding and accessibility.

Country Analysis:

- France

- Italy

- Spain

- Germany

- United Kingdom

- Russia

- Netherlands

- Others

France leads the European two-wheeler market, driven by the combination of consumer demand, favorable government policies, and a culture of motorcycles. As per the Central Intelligence Agency, France consists of population of over 68,374,591 in 2024 and the growing urban demographic is fueling demand for two-wheelers as practical and efficient transportation solutions in congested cityscapes. Urban cities such as Paris, Marseille, and Lyon prefer scooters and commuter motorcycles due to their compact design, affordability, and easy navigation through congested roads. The increasing population also serves to expand the consumer base from commuters looking for an affordable means of mobility to enthusiasts who like sports and touring bikes. France has a glorious history of motorcycling supported by iconic European brands and an established dealer network. Government incentives toward sustainable mobility have encouraged the adoption of electric two-wheelers, although gasoline-powered variants continue to be in greater demand due to their performance and affordability. Increasing population and urbanization trends ensure France remains at the heart of the European two-wheeler market.

Competitive Landscape:

Innovation, strategic partnerships, and sustainability initiatives by leading market players in the European two-wheeler industry are actively shaping the market. The most notable trend is the explosive growth of e-bikes as demand for green urban mobility solutions increases. As per the IMARC Group, the Europe e-bike market size was estimated to be at USD 6,056 Million in 2024 and it is expected to reach USD 10,441.2 Million by 2033. This growth can be seen due to increasing demand for sustainable and versatile transport from consumers. Companies are investing in light materials, enhanced battery technology, and extended ranges to cater to diversified consumer needs. Collaboration in developing electric charging infrastructure with Governments and aligning in Europe with carbon reduction goals further accelerates the development of this segment. Premium motorcycle brands focus on high-end safety features, connectivity, and performance models for sporty enthusiasts. Further, digitalizing the retail segment through online sales platforms and virtual showrooms enhances customer accessibility and experience to shape the segment's commitment to innovation and adaptability.

The report provides a comprehensive analysis of the competitive landscape in the Europe two-wheeler market with detailed profiles of all major companies, including:

- BMW AG

- Energica Motor Company S.p.A.

- Harley-Davidson, Inc.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- KWANG YANG MOTOR CO., LTD. (KYMCO)

- Piaggio & C. SpA

- PIERER Mobility AG (KTM, Husqvarna, GasGas)

- Sanyang Motor Co., Ltd. (SYM)

- Triumph Motorcycles Ltd.

- Yamaha Motor Co., Ltd.

- Zero Motorcycles, Inc.

Latest News and Developments:

- On November 2024, At EICMA 2024, Honda introduced its 25YM European lineup, comprising two electric concepts: the EV Fun and EV Urban. It continued its pursuit of electrification with its V3 engine concept that houses ground-breaking torque-boosting technology. In addition, there were new refreshed models like the NC750X, along with updates for its best-selling scooters and motorcycles, all being EURO5+ compliant.

- On June 2024, Kawasaki unveiled the retro-styled W230, initially shown at the Japan Mobility Show, for the German market and indicated Euro emissions approval. This bike comes with a 250cc air-cooled engine, LED lights, ABS, and classic 1960s styling, blending modern features with nostalgic design, showcasing Kawasaki's attention to performance and aesthetics.

- On November 2024, the Piaggio Group presented new and updated motorbikes and scooters from Aprilia, Moto Guzzi, Vespa, and Piaggio at EICMA 2024 in Milan. The group highlighted innovative designs and performance, reasserting its position as Europe's top two-wheeler manufacturer after a record-breaking 2023 with 559,500 vehicles sold and nearly €2 billion in turnover.

- On May 2024, Energica Motor Company, headquartered in Italy, collaborated with Electra Vehicles to improve electric two-wheeler performance by implementing AI-powered battery management systems. The partnership looked to optimize range, charging, and lifespan, addressing the problems of range anxiety and enhancing reliability. This R&D initiative solidified Energica's commitment to innovation and safety in high-performance electric motorcycles.

Europe Two-Wheeler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Scooter/Moped and Motorcycle (Sport/Supersport, Enduro, Chopper, Classic, Commuter, Others) |

| Fuel Types Covered | Gasoline, Electric |

| Engine Capacities Covered | Up to 125 cc, 126-250 cc, 251-500 cc, Above 500 cc |

| Transmissions Covered | Manual Transmission and Automatic Transmission |

| Countries Covered | France, Italy, Spain, Germany, United Kingdom, Russia, Netherlands, Others |

| Companies Covered | BMW AG, Energica Motor Company S.p.A., Harley-Davidson, Inc, Honda Motor Co., Ltd, Kawasaki Heavy Industries, Ltd., KWANG YANG MOTOR CO., LTD., Piaggio & C. SpA, PIERER Mobility AG, Sanyang Motor Co., Ltd., Triumph Motorcycles Ltd, Yamaha Motor Co., Ltd., Zero Motorocycles, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe two-wheeler market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe two-wheeler market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A two-wheeler is a vehicle with two wheels that is operated either through a motor or manual effort, designed to help one move for personal benefits. Instances of such vehicles include bicycles, motorcycles, and scooters. Most individuals use two-wheelers for commuting, as they are affordable and efficient in terms of fuel to navigate the traffic.

The Europe two-wheeler market was valued at USD 23.4 Billion in 2024.

IMARC estimates the Europe two-wheeler market to exhibit a CAGR of 6.4% during 2025-2033.

The market is driven by urbanization, eco-friendly demand, government incentives, fuel costs, traffic congestion, shared mobility, and technological advancements like connected features and improved battery performance.

In 2024, motorcycles represented the largest segment by vehicle type due to their flexibility, performance, and adaptability to the profiles of riders from a wide spectrum.

Gasoline leads the market by motor type owing to due to their low price, high availability, and high performance.

Gasoline leads the market by motor type owing to due to their low price, high availability, and high performance.

On a regional level, the market has been classified into France, Italy, Spain, Germany, United Kingdom, Russia, Netherlands, and others wherein France currently dominates the market.

The motorcycles segment holds the largest share in the Europe two-wheeler market due to their affordability, and suitability for urban commuting.

Some of the major players in the Europe two-wheeler market include BMW AG, Energica Motor Company S.p.A., Harley-Davidson, Inc, Honda Motor Co., Ltd, Kawasaki Heavy Industries, Ltd., KWANG YANG MOTOR CO., LTD., Piaggio & C. SpA, PIERER Mobility AG, Sanyang Motor Co., Ltd., Triumph Motorcycles Ltd, Yamaha Motor Co., Ltd., and Zero Motorocycles, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)