Europe Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Country, 2026-2034

Europe Used Car Market Size and Share:

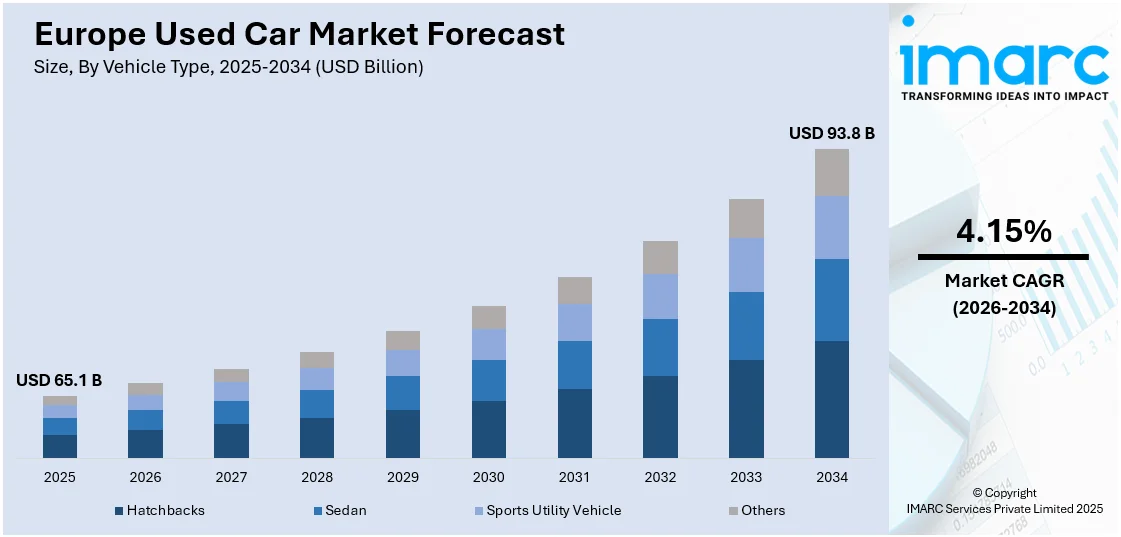

The Europe used car market size was valued at USD 65.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 93.8 Billion by 2034, exhibiting a CAGR of 4.15% from 2026-2034. The market is witnessing steady growth driven by rising demand for affordable vehicle ownership, increased adoption of online sales platforms, and greater availability of certified pre-owned options. Supply chain disturbances in new car production and a growing focus on sustainability further contribute to the market’s expansion across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 65.1 Billion |

| Market Forecast in 2034 | USD 93.8 Billion |

| Market Growth Rate (2026-2034) | 4.15% |

The Europe used car market is expanding due to growing consumer demand for affordable mobility solutions. Economic challenges, such as inflation and rising living costs, are pushing buyers to opt for pre-owned vehicles as a cost-effective alternative to new cars. For instance, according to industry reports, the European Union's index of consumer prices increased to 2.3% in October from 2.1% in September, reflecting the financial pressures on households. The availability of certified pre-owned programs, which offer warranties and thorough vehicle inspections, has increased consumer trust and boosted market activity. Additionally, the decline in new car production due to supply chain disruptions has shifted demand towards the used car segment, further driving its growth.

To get more information on this market Request Sample

Technological advancements in online car retail platforms are transforming the used car market, making transactions more accessible and transparent. These platforms allow consumers to compare prices, view detailed vehicle histories, and explore financing options conveniently. The increasing adoption of digital tools is streamlining the buying process and enhancing customer satisfaction. For instance, in November 2024, AUTO1 Group SE, a prominent digital platform specializing in used car transactions across Europe, inaugurated its 500th drop-off branch in Jena, Germany, under its C2B Buying brand. Operating in nine countries such as Germany, France, and Spain, the company provides private sellers with a convenient car-selling solution, solidifying its position as a market leader. Furthermore, the growing emphasis on sustainability is encouraging consumers to consider used cars, recognizing the environmental benefits of extending vehicle lifespans. These combined factors are positioning the used car market as a critical driver of mobility across Europe.

Europe Used Car Market Trends:

Growth of Online Platforms

The Europe used car market is witnessing a significant shift toward digitalization, with online platforms emerging as a key sales channel. These platforms offer buyers access to a vast range of vehicles with transparent pricing, vehicle history reports, and virtual inspection tools. The convenience of browsing, comparing, and purchasing cars online has gained traction among tech-savvy consumers. For instance, in August 2024, AutoScout24, a prominent European online automotive marketplace, announced its acquisition of TRADER Canada. This strategic move extends AutoScout24’s reach beyond Europe, incorporates dealer software and financing solutions, and bolsters its status as a leading global player in online automotive marketplaces, driving further innovation and expansion. Additionally, features such as financing options, home delivery, and AI-driven recommendations enhance the customer experience. This trend is further fueled by the integration of mobile apps and digital payment solutions, enabling seamless transactions. The growing reliance on online platforms is reshaping the traditional dynamics of the used car market across Europe.

Increasing Demand for Low-Emission Vehicles

The rising focus on sustainability is driving demand for low-emission vehicles in the Europe used car market. Government regulations and incentives, including tax benefits and subsidies for environmentally friendly vehicles, are encouraging consumers to choose hybrid and electric pre-owned cars. This trend supports Europe's dedication to lowering carbon emissions and achieving its environmental goals. For instance, in April 2024, the European Parliament passed legislation aimed at cutting CO2 emissions from heavy-duty vehicles. The regulation introduces phased targets for reducing emissions from trucks and buses, supporting Europe's climate objectives and accelerating the shift towards zero-emission vehicles by 2040 to promote sustainability. The availability of certified pre-owned low-emission vehicles with warranties further boosts consumer confidence. Advancements in battery technology and the expanding infrastructure for electric vehicles also support this growing segment, making low-emission cars a pivotal trend in shaping the future of the used car market.

Preference for Compact and Fuel-Efficient Cars

Consumers in Europe maintain a clear inclination toward smaller, fuel-efficient vehicles within the used car segment. Hatchbacks and small SUVs dominate due to their practicality, lower maintenance costs, and suitability for urban driving. Economic considerations, including rising fuel prices, further reinforce this trend. For instance, in 2024, natural gas prices in Europe surged to their peak following Ukraine's acquisition of the final transit hub for Russian gas entering Europe. This led to a three-day price increase, surpassing €40 (USD 43.71) per megawatt-hour for the first time since December 4, 2023. Manufacturers and dealerships are responding by offering certified pre-owned vehicles with improved fuel efficiency and modern safety features. Additionally, compact vehicles are gaining traction among first-time buyers and younger demographics. The focus on affordability and functionality makes compact and fuel-efficient cars a key trend driving demand in Europe’s used car market.

Europe Used Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe used car market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on vehicle type, vendor type, fuel type, and sales channel.

Analysis by Vehicle Type:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Hatchbacks are a prominent segment in the Europe used car market, valued for their compact design, fuel efficiency, and versatility. These vehicles are particularly popular among urban buyers and small families due to their easy maneuverability and affordability. Hatchbacks typically offer spacious interiors and foldable rear seats, making them ideal for both daily commutes and light cargo transportation. The increasing availability of certified pre-owned hatchbacks with enhanced safety features and modern technology further drives their demand. Their widespread appeal across various demographics ensures hatchbacks remain a leading segment in the European market for used cars.

Sedans represent a significant segment in the Europe used car market, preferred for their comfort, style, and superior driving experience. Known for their aerodynamic design and spacious interiors, sedans cater to individuals and families seeking premium features at affordable prices in the used car segment. Their strong presence in urban and suburban areas is driven by a balanced mix of performance and fuel efficiency. Sedans also appeal to business professionals due to their sleek design and advanced features. The availability of high-quality pre-owned sedans with warranties further enhances their demand in the European market.

SUVs are a fast-growing segment in the Europe used car market, favored for their robust build, spacious interiors, and off-road capabilities. These vehicles appeal to families and adventure enthusiasts alike, offering versatility and performance. SUVs with fuel-efficient engines and modern safety features are particularly popular among pre-owned buyers. The rise in demand for compact and crossover SUVs further boosts this segment’s growth. Additionally, certified used SUVs with advanced technology and warranties make them an attractive option for value-conscious consumers, solidifying their strong position in the European used car market.

Analysis by Vendor Type:

- Organized

- Unorganized

The organized sector of the European used car market includes certified pre-owned programs and dealership networks, and online platforms that operate with structured processes and professional management. These vendors ensure transparency by providing verified vehicle histories, warranties, and quality assurance. Organized players are gaining market share due to their focus on customer satisfaction, offering financing options, and streamlined purchasing experiences. The growing adoption of digital tools for vehicle valuation and inventory management further enhances their appeal. This segment’s professionalism and reliability attract consumers seeking trusted solutions, driving growth in the European used car market.

The unorganized segment of the Europe used car market includes private sellers, small-scale dealers, and informal networks that operate without standardized processes. These vendors typically offer lower-priced vehicles but lack the guarantees and verified histories provided by organized counterparts. While this segment attracts cost-conscious buyers, challenges such as limited transparency and potential quality issues pose risks. However, the unorganized market continues to serve as a significant channel for transactions, especially in rural areas and for older vehicles. Its accessibility and lower overhead costs ensure its ongoing relevance in the European used car market.

Analysis by Fuel Type:

- Gasoline

- Diesel

- Others

The gasoline segment dominates the Europe used car market due to its widespread availability, lower initial cost, and suitability for urban driving. Gasoline-powered vehicles are favored for their smoother performance, reduced noise levels, and lower emissions compared to diesel. They appeal to individuals seeking reliable cars for short distances and city commutes. With increasing restrictions on diesel vehicles in some European regions, demand for gasoline cars in the used market continues to rise. Certified pre-owned gasoline vehicles with improved fuel efficiency and modern features further enhance their appeal, driving growth in this segment.

The diesel segment remains a significant part of the Europe used car market, valued for its fuel efficiency and durability, particularly for long-distance travel and heavy usage. Diesel vehicles are preferred by buyers seeking lower running costs and higher torque for robust performance. However, stricter emission regulations and the rising popularity of alternative fuel vehicles are impacting their market share. Despite these challenges, demand persists in rural and suburban areas where infrastructure supports diesel usage. Certified used diesel cars with upgraded emission-compliant engines remain attractive options for cost-conscious buyers in specific regions of Europe.

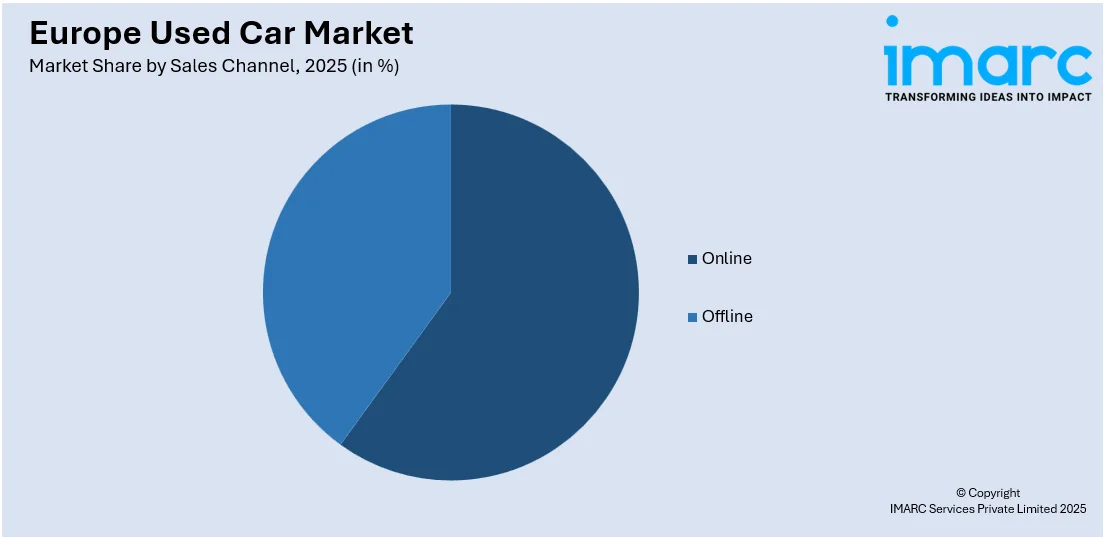

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The online segment in the Europe used car market is rapidly growing; driven by the convenience and transparency it offers. Digital platforms provide buyers with access to a wide range of vehicles, detailed specifications, and verified histories, enabling informed decision-making. Features such as virtual showrooms, financing options, and home delivery enhance the customer experience. The use of AI and analytics for price comparisons and personalized recommendations further boosts the appeal of online channels. The organized sector in the European used car market includes dealership networks and certified pre-owned initiatives.

The offline segment remains a crucial part of the Europe used car market, encompassing traditional dealerships, auctions, and private sellers. These platforms allow buyers to personally evaluate vehicles, take them for test drives, and engage in face-to-face price negotiations. Offline sales are particularly preferred by consumers seeking immediate transactions or personalized assistance. Established dealerships provide additional services such as warranties and trade-ins, enhancing buyer confidence. Despite the growth of online platforms, the offline segment retains its relevance, especially among traditional buyers and in regions where digital penetration is limited, maintaining its importance in the European used car market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a dominant region in the Europe used car market, driven by its robust automotive industry and high vehicle turnover rates. German consumers prefer high-quality pre-owned vehicles, with a focus on fuel efficiency and advanced features. The presence of certified dealerships and online platforms enhances market transparency and accessibility. Popular brands like BMW, Mercedes-Benz, and Volkswagen bolster demand in the used car segment. Additionally, Germany's strong export market for used cars contributes to its leadership in the region. Growing digital adoption further streamlines transactions, solidifying Germany's position as a key market for used vehicles.

The used car market in France is rising due to increasing demand for affordable mobility in the country. The total market is helped out by incentives provided by the government toward the purchase of ecological friendly vehicles, therefore encouraging the importation of the latest models and subsequently creating demand for newer and more efficient used cars. It became possible due to digital platforms that have been growing in popularity and offer more transparency to consumers in terms of access to information about vehicles. Moreover, fuel is a critical consideration for French buyers, giving prominence to small and subcompact vehicles, such as hatchbacks. The dealership and private sellers’ network guarantee adequate stock of pre-owned vehicles. From the case of France, integration of sustainability aspect and appropriate pricing really helped in the growth of used car market.

The United Kingdom plays a big role in used car market in Europe due to the high demand for affordable mobility and accreditation of pre-owned vehicles. With the help of online platforms, information transparency, convenience, and a choice of a vast number of companies for buyers are the new market specifics. That is why the demand for hatchback vehicles, especially compact SUVs, is high. There is also increased demand for hybrid and electric used car due to the UK’s motive of adopting sustainable products. Existence of a strong used car dealership stock and favorable policies to encourage the upgrade of vehicles add into the UK’s strong position in the used car market.

Italy's used car market is growing steadily, fueled by consumer preference for affordable alternatives to new vehicles. Compact and fuel-efficient cars dominate the market, appealing to urban buyers. A strong network of dealerships and informal sellers ensures a consistent supply of pre-owned vehicles. Additionally, online platforms are becoming more prominent, offering greater transparency and ease of purchase. Economic factors, such as high taxes on new cars, further drive demand for used cars. Italy’s focus on promoting low-emission vehicles is increasing interest in newer, environmentally friendly pre-owned cars, making it a dynamic segment of the European used car market.

Spain is a key region in the Europe used car market, driven by affordability and a high demand for versatile, fuel-efficient vehicles. The market is supported by a strong mix of traditional dealerships and digital platforms, which improve accessibility and transparency for buyers. Compact vehicles and small SUVs are particularly popular due to their practicality and suitability for urban environments. Economic considerations and rising interest in sustainable mobility are boosting demand for low-emission pre-owned vehicles. Spain's growing emphasis on digitalization and the availability of financing options further enhance its position in the European used car market.

Competitive Landscape:

The Europe used car market is highly competitive, driven by a mix of organized dealerships, certified pre-owned programs, and emerging online platforms. Key players focus on enhancing transparency, offering warranties, and integrating digital solutions for seamless transactions. The rise of online marketplaces has intensified competition by providing broader access to vehicle inventories and advanced pricing tools. Traditional dealerships maintain a strong presence by emphasizing customer relationships and personalized services. Additionally, partnerships between automakers and certified dealers are reshaping the market landscape. For instance, in October 2024, AUTO1 Group SE, a prominent digital automotive platform in Europe, introduced its AUTO1 financing solution to Belgium and the Netherlands. This initiative enables partner dealers to acquire vehicles from AUTO1.com without upfront equity, providing rapid financing approval and integrated features. The solution enhances vehicle accessibility, ensures prompt delivery, simplifies paperwork, and offers a clear, fully digital experience, making the purchasing process more efficient and dealer-friendly. Furthermore, increasing demand for low-emission and fuel-efficient vehicles further drives innovation and differentiation among competitors in this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the Europe used car market with detailed profiles of all major companies, including:

- Lookers Plc

- Emil Frey AG

- Autorola Group Holding

- Pendragon Plc

- AUTO1.com

- AMAG Automobil und Motoren AG

- Bernard

- Chopard Lallier

- Cosmobilis/BymyCar

- Eden Auto

- Gueudet

- Van Mossel

- Yutong

Latest News and Developments:

- In April 2024, Monaco-Occasions, a Monaco based secondhand car website, unveiled their first Special Days event, at the Grimaldi Forum. Featuring high-end pre-owned cars from brands like Ferrari, Bentley, and Rolls-Royce were displayed, this provided customers an opportunity to explore premium vehicles, access tailored deals, and experience exceptional service in a prestigious setting.

Europe Used Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Lookers Plc, Emil Frey AG, Autorola Group Holding, Pendragon Plc, AUTO1.com, AMAG Automobil und Motoren AG, Bernard, Chopard Lallier, Cosmobilis/BymyCar, Eden Auto, Gueudet, Van Mossel, Yutong, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe used car market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe used car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The used car market in Europe was valued at USD 65.1 Billion in 2025.

The market in Europe is majorly driven by increasing demand for affordable mobility solutions, rising fuel costs, growing digitalization through online platforms, economic uncertainties and supply chain challenges in new car production, and consumer interest in low-emission and fuel-efficient vehicles.

The used car market in Europe is projected to exhibit a CAGR of 4.15% during 2026-2034, reaching a value of USD 93.8 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)