Europe Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034

Europe Wine Market Size and Share:

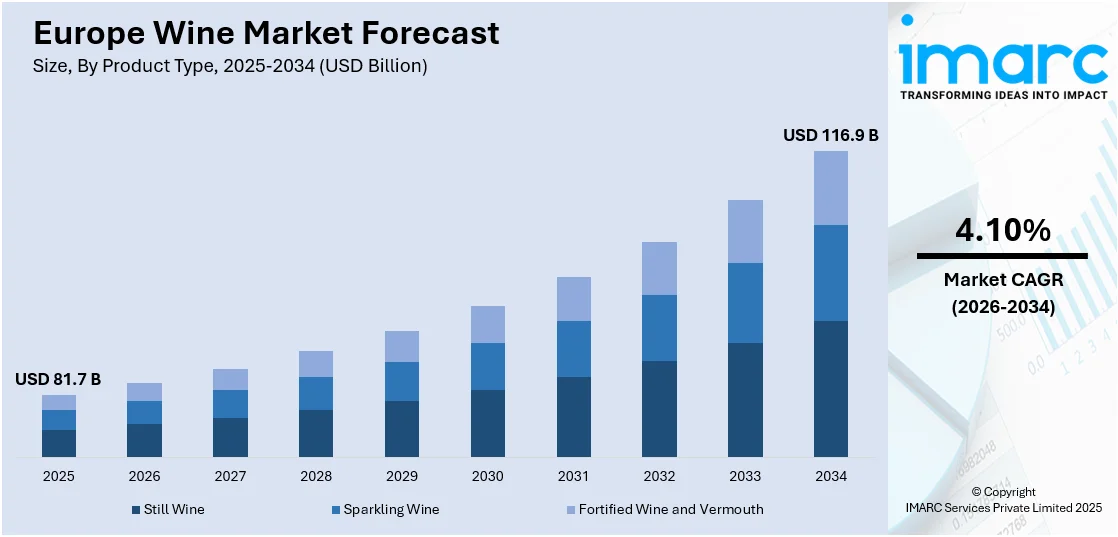

The Europe wine market size was valued at USD 81.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 116.9 Billion by 2034, exhibiting a CAGR of 4.10% from 2026-2034. The market is driven by the rising demand for premium, organic, and sustainable wines because of health-conscious and younger consumers. Climate change influences production regions and grape varieties, while technological advances like e-commerce and precision viticulture enhance accessibility and quality. Additionally, evolving consumer preferences, wine tourism, and regulatory standards are bolstering the market growth in Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 81.7 Billion |

|

Market Forecast in 2034

|

USD 116.9 Billion |

| Market Growth Rate (2026-2034) | 4.10% |

Sustainability is a cornerstone for the European wine industry, as producers align their practices with environmentally conscious approaches. Efforts to reduce carbon footprints, promote biodiversity, and adopt organic and biodynamic farming methods reflect the commitment to sustainable production. These initiatives enhance the influence of European wines on ecologically aware customers, facilitating trust and loyalty in international markets. Furthermore, the rising demand for premium and high-quality wines is driving the industry forward. European wineries are focusing on craftsmanship, heritage, and innovation to cater to sophisticated palates. This focus elevates the perception of value and exclusivity, enabling producers to achieve strong market positioning and maintain healthy profit margins.

To get more information on this market Request Sample

Besides this, the incorporation digital tools and platforms is transforming how wines are marketed and sold. Online retail channels, virtual tastings, and engaging digital content are broadening the reach of wineries, making it easier for consumers to explore and purchase wines. This digital evolution is opening new pathways for engaging with wider audiences while fostering personalized experiences. Moreover, the adoption of cutting-edge technologies in viticulture and winemaking is enhancing productivity and quality. Innovations in vineyard management, fermentation techniques, and precision agriculture contribute to consistency and efficiency. These advancements ensure that European wineries remain competitive and responsive to the evolving demands of international markets.

Europe Wine Market Trends:

Rising Emphasis on Sustainability and Eco-Friendly Packaging

Sustainability is a rising as well as chief priority in the European wine industry, affecting production, packaging, and general business operations. Numerous wineries are embracing sustainable practices, including water-saving methods, the use of renewable energy, and the protection of biodiversity to lessen their environmental impact. Moreover, lightweight containers, recyclable resources, refillable options, and biodegradable packaging are becoming popular, contributing to waste reduction. Many producers are investigating carbon-neutral or carbon-positive practices by compensating for emissions and strategically planting vineyards to enhance soil health. These initiatives not only lessen environmental harm but also appeal greatly to eco-aware consumers, enhancing brand loyalty and increasing market share for sustainable winemakers. In 2024, Ardagh Glass Packaging-Europe launched a new collection of lightweight wine bottles in Germany, reaching a 12% decrease in carbon emissions by reducing weight and employing up to 80% recycled glass cullet. Available in different colors and finishes, the 750ml Bordeaux and Schlegel bottles offer sustainable options for the European market.

Innovations in Distribution Channels and E-Commerce

The rise of online wine retailers and direct-to-consumer (DTC) sales channels is reshaping how wines are marketed and sold, offering consumers diverse selections at competitive prices with the convenience of home delivery. European wineries are adopting digital platforms, enabling them to expand their reach to international markets and establish direct relationships with consumers. Subscription models and virtual wine tastings are gaining popularity, providing interactive and engaging purchasing experiences. In addition to this, online platforms are actively opting for advanced algorithms and data analytics to offer personalized recommendations, enhancing buyer satisfaction. These innovations are making wines more accessible, appealing to younger, tech-savvy consumers. In 2024, the premium wine gifting service Di-vine has officially debuted in the UK, providing same-day delivery in London and next-day service throughout the UK mainland. Di-vine allows customers to curate personalized wine gift boxes with handwritten cards, and plans to expand to European and US markets by Christmas.

Impact of Climate Change on Vineyard Practices

Climate change is reshaping wine production in Europe, prompting vineyards to adapt to changing weather patterns and evolving environmental conditions. Warmer temperatures are allowing grape cultivation in regions that were previously unsuitable for winemaking, leading to new opportunities for expansion. Traditional wine-growing areas are focusing on planting drought-resistant grape varieties and employing innovative irrigation and canopy management techniques to preserve yield and maintain quality. Winemakers are also altering harvesting schedules and experimenting with blends to suit the shifting climate. Governments are actively supporting these adaptations through funding for research, subsidies for sustainable practices, and policies encouraging climate-resilient farming. These tactics guarantee both sustainability and robustness in the wine industry. In 2024, the European Commission established the High-level Group for the EU Wine Sector to tackle issues like erratic harvests and fluctuating exports stemming from climate change and increasing expenses. The team intends to complete proposals for the post-2027 Common Agricultural Policy by the start of 2025.

Europe Wine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe wine market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, color, and distribution channel.

Analysis by Product Type:

- Still Wine

- Sparkling Wine

- Fortified Wine and Vermouth

Still wine is crucial segment in the market, enveloping white, red, and rosé varieties. Known for its deep-rooted traditions, still wine benefits from a strong focus on regional appellations and terroir-driven production. Consumers value the diversity of flavors and styles, with increased interest in organic and natural wine options reflecting a growing preference for minimally processed beverages.

Sparkling wine, including champagne, prosecco, and cava, maintain a significant share of the market, celebrated for its association with celebrations and luxury. Producers are innovating with sweeter and lower-alcohol variants to cater to broader tastes. The rise in casual sparkling wine consumption beyond special occasions further bolsters demand across different demographic groups.

Fortified wine and vermouth are key segments as per the Europe wine market forecast, valued for their rich flavors and versatility. Traditional favorites like Port and Sherry maintain strong regional demand, while vermouth's resurgence in modern mixology and cocktails drives growth, appealing to younger and adventurous consumers.

Analysis by Color:

- Red Wine

- Rose Wine

- White Wine

Red wine holds a prominent place in the market, prized for its complex flavor profiles and pairing versatility. It often appeals to consumers seeking full-bodied and robust options, with production emphasizing aging potential and regional identity. The growing interest in natural and organic red wines further strengthens its demand among health-conscious and environmentally aware consumers.

Rose wine continues to grow in popularity, appreciated for its light, refreshing characteristics and visual appeal. Its versatility across seasons and suitability for casual or formal occasions contribute to its broad consumer base. Producers are expanding their offerings with diverse flavor profiles to cater to evolving preferences, ensuring continued growth in this segment.

White wine remains a key segment in the market, celebrated for its crisp, aromatic qualities and suitability with a variety of cuisines. High wine consumption in Europe highlights the demand for white wines, with their versatility appealing to a broad range of palates. Consumers value its diversity in sweetness levels and styles, which range from light and fresh to rich and oaked. Interest in lower-alcohol and sustainably produced white wines further drives innovation and market growth.

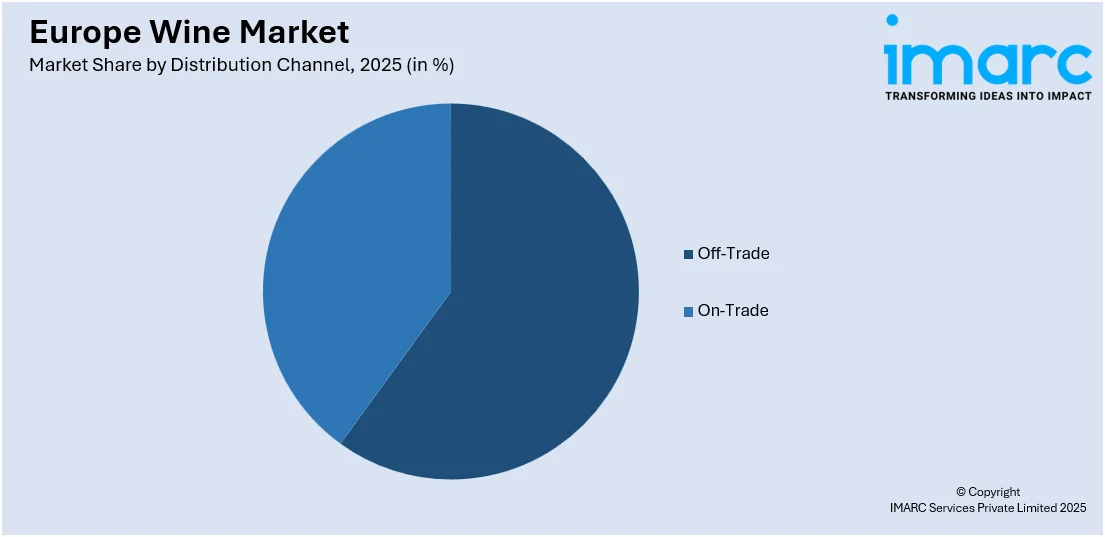

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Off-Trade

- On-Trade

The off-trade segment, which encompasses retail locations like supermarkets, wine stores, and online websites, constitutes a major portion of wine sales. Consumer preference for this channel is influenced by competitive prices, convenience, and varied options. E-commerce is growing substantially, providing curated assortments, tailored suggestions, and subscription options that serve a diverse array of consumer tastes and events.

The on-trade segment, encompassing restaurants, bars, hotels, and tasting rooms, thrives on experiential consumption and the appeal of wine paired with culinary experiences. This channel benefits from the expertise of sommeliers and curated wine lists, encouraging consumers to explore premium and unique options. Seasonal and event-driven demand further enhances sales through this avenue.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany’s wine market is characterized by a preference for both domestic and imported wines, with a strong tradition of white wine production. Consumer interest in high-quality, sustainable wines has driven growth, along with a focus on local varietals and modern wine styles.

France remains a key market in wine production and consumption, renowned for its diverse wine regions and appellations. As a leader in European wine production, the country showcases a perfect blend of tradition and modernity, leveraging its heritage to maintain global recognition. The market emphasizes tradition and quality, with strong domestic and export demand, supporting innovation while preserving heritage.

The United Kingdom market is largely import-driven, reflecting a diverse palate and openness to international wines. Sparkling wines and innovative formats are gaining traction, alongside a growing interest in locally produced options.

Italy’s wine market is deeply rooted in tradition, with a strong emphasis on regional varietals and styles. Both domestic consumption and exports benefit from Italy’s focus on quality, innovation, and sustainability in production.

Spain’s market thrives on its reputation for affordable, high-quality wines. There is increase in interest in organic and minimally processed options, which align with evolving consumer preferences.

Others, including smaller producers and emerging regions, contribute to the diversity of the wine market. These regions often capitalize on unique terroirs and niche offerings, appealing to adventurous consumers and expanding the appeal of wines.

Competitive Landscape:

Major participants in the market aim to improve their product ranges by leveraging innovation and strategic branding efforts. They are focusing on sustainability by implementing environmentally friendly production techniques, including organic agriculture and lowered carbon emissions, to meet consumer expectations. Direct-to-consumer avenues and investments in digital platforms are broadening their scope and delivering tailored experiences. Numerous companies are enhancing relationships with distributors and seeking new markets to improve their global competitiveness. Furthermore, they highlight the variety of wine styles to meet changing preferences, such as low-alcohol and natural selections. In 2024, Australian Vintage announced the launch of its Tempus One canned wine spritzers to the UK market, debuting in Asda at a suggested retail price of £2. Targeted towards younger consumers, the spritzers featuring 4% ABV come in watermelon, passionfruit, and berry varieties, combining Sauvignon Blanc, soda, and fruity flavors.

The report provides a comprehensive analysis of the competitive landscape in the Europe wine market with detailed profiles of all major companies, including:

- Accolade Wines

- Pernod Ricard SA

- Treasury Wine Estates Ltd

- Rotkäppchen-Mumm Sektkellereien GmbH

- GCF Group

- Constellation Brands, Inc.,

- E. & J. Gallo Winery

- Castel Group (Baron de Lestac)

- Louis Roederer

- Financière Pinault SCA (Groupe Artemis SA)

Europe Wine Market News and Developments:

- October 2024: It was announced that Merenda, a Southern European bistro and wine bar, will open in Oceanside, offering Mediterranean-inspired dishes and sustainable wines. The chic restaurant features a curated menu, unique design elements, and a wine retail section.

- September 2024: Europe initiated the VITÆVINO campaign, bringing together the wine industry to honor and safeguard wine culture via the VITÆVINO Declaration. The initiative highlights wine’s cultural, economic, and social importance, advocating for responsible consumption and sustainability.

- June 2024: Accolade Wines launched its premium European wine series, Remastered, in travel retail, featuring Italian Sangiovese and Fiano wines at £10 each, supported by summer tasting events. Aimed at younger consumers, the wines offer a modern twist on tradition.

Europe Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution Channels Covered | Off-Trade, On-Trade |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe wine market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe wine market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe wine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Wine is an alcoholic beverage created from the grapes' fermented juice, with its flavor and characteristics shaped by factors like grape variety, region, and production methods. It comes in several types, such as sparkling, white, red, rosé, sparkling, and fortified, offering diverse taste profiles. It is entrenched in culture and tradition, symbolizing celebration, artistry, and shared experiences.

The Europe wine market was valued at USD 81.7 Billion in 2025.

IMARC estimates the Europe wine market to exhibit a CAGR of 4.10% during 2026-2034.

The Europe wine market is driven by the growing demand for premium, organic, and sustainably produced wines, reflecting evolving consumer preferences. Climate change is reshaping production regions, prompting innovation in grape cultivation and winemaking. Advances in e-commerce and digital marketing expand accessibility, while a focus on regional authenticity and diverse styles supports both domestic consumption and exports.

Some of the major players in the Europe wine market include Accolade Wines, Pernod Ricard SA, Treasury Wine Estates Ltd, Rotkäppchen-Mumm Sektkellereien GmbH, GCF Group, Constellation Brands, Inc., E. & J. Gallo Winery, Castel Group (Baron de Lestac), Louis Roederer, Financière Pinault SCA (Groupe Artemis SA), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)