Extended Warranty Market Report by Coverage (Standard Protection Plan, Accidental Protection Plan), Application (Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, and Others), Distribution Channel (Manufacturers, Retailers, and Others), End User (Individuals, Business), and Region 2026-2034

Market Overview:

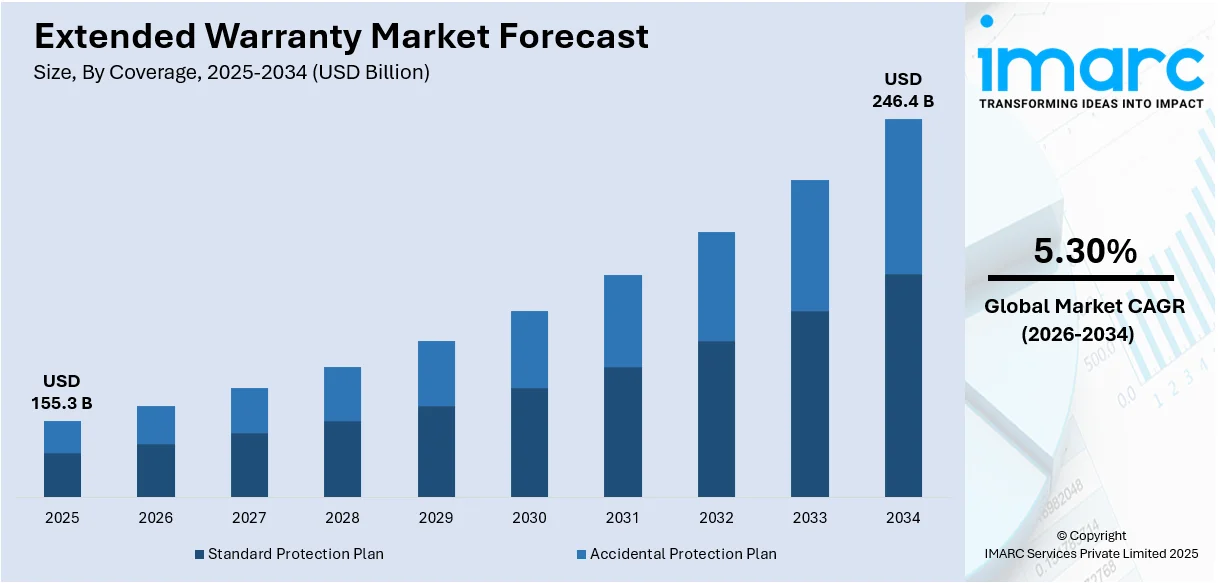

The global extended warranty market size reached USD 155.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 246.4 Billion by 2034, exhibiting a growth rate (CAGR) of 5.30% during 2026-2034. The growing demand for financial protection against unforeseen defects or malfunctions, rising sales of high-value items, and increasing complexities in consumer products, such as electronics, appliances, and automotive vehicles, are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 155.3 Billion |

|

Market Forecast in 2034

|

USD 246.4 Billion |

| Market Growth Rate 2026-2034 | 5.30% |

Extended Warranty Market Analysis:

- Major Market Drivers: The extended warranty market is mainly driven by the rising consumer demand for product protection apart from standard manufacturer’s warranty. This growth is further propelled by the increase in the sales of high value electronics and appliances where consumers seek to minimize their repair costs. The availability of customizable warranty options and convenience of managing the risks associated with expensive repairs also contribute significantly to the extended warranty market growth. Moreover, businesses leverage these warranties as competitive tools to enhance customer satisfaction and loyalty. The trend towards online shopping has further bolstered the market growth by providing easy purchase of extended warranties at the point of sale.

- Key Market Trends: Key trends in extended warranty market includes the growing emphasis on digital sales channels enhancing customer purchase convenience and accessibility. There is a notable shift towards personalized warranty offerings especially tailored to individual needs and their product usage patterns. In line with this, the integration of technology like artificial intelligence for claims processing and customer service is further improving efficiency and consumer satisfaction. The market is also witnessing a significant growth in sectors such as automobiles and household electronics because of rising consumer awareness about cost benefits of extended warranties thereby propelling the extended warranty market growth.

- Geographical Trends: Geographical trends in extended warranty market shows a significant growth in North America because of its high consumer electronics and automobile sales. Europe follows closely, mainly driven by stringent consumer protection laws that favors warranty services. In Asia Pacific the extended warranty market is growing rapidly with China and India at the forefront because of its rising middle-class affluence and increase in expenditure on durable goods. Latin America and Middle East are also emerging as a promising market stimulated by growing consumer awareness and rising availability of warranty services.

- Competitive Landscape: Some of the major market players in the extended warranty industry include Allianz Partners, Allstate Insurance Company, American International Group, Inc., AmTrust Financial, Assurant Inc., Asurion, Carchex, CarShield LLC, Domestic & General Group Limited, Edel Assurance, Endurance Warranty Services, LLC, Likewize, MAPFRE, among many others.

- Challenges and Opportunities: Extended warranty market experiences various challenges such as increase in regulatory scrutiny and consumer skepticism about the value and transparency of warranty terms. This necessitates clear communication and fair practices from warranty providers. Opportunities abound in the increase in consumer electronics and automobile sales which further encourages consumers to protect their investments through various extended warranties. There is also a potential for growth in emerging markets where awareness and demand are on the rise. Furthermore, the technological advancements in service delivery and claims processing can enhance consumer experience and operational efficiency creating a competitive edge for providers in this sector.

To get more information on this market Request Sample

Extended Warranty Market Trends/Drivers:

Rising product complexities

The rising complexities in consumer products, such as electronics, appliances, and automotive vehicles, are contributing to the growth of the market. Advanced software, intricate components, and integrated systems are becoming integral parts of these products, which makes them more prone to technical issues and failures. The intricate nature of these modern products also makes them costly to repair. In 2024, Allianz Partners launched a range of new roadside assistance products in the UK, expanding its breakdown offering to mobility providers, fleet owners, banks and insurers. The new products offer three levels of cover - 'breakdown', 'accident', and 'breakdown and accident' combined which can be further customized to suit the needs of business partners and their customers. Consequently, consumers are increasingly opting for extended warranties to mitigate the financial risks associated with potential repairs. Besides this, manufacturers and retailers reassure customers that they will receive comprehensive support and protection beyond the standard warranty period by offering extended warranty coverage to them.

Increasing demand for financial protection against unforeseen defects or malfunctions

Consumers are rapidly seeking reassurance and peace of mind when making significant purchases. Buying high-value products, such as expensive smartphones, premium laptops, or luxury automobiles, can be a substantial investment. The fear of unexpected breakdowns or repair costs can deter potential buyers from making such purchases. Extended warranties act as a safety net and provide consumers with confidence in their buying decisions. The BMW Extended Warranty and Service Package, known as BMW Repair Inclusive (BRI), offers the flexibility of extending the warranty of a BMW car with unlimited mileage for up to 6 years, ensuring comprehensive coverage and maintenance services for peace of mind and long-term value retention. These warranties offer financial protection against unforeseen defects or malfunctions while ensuring that customers will not be burdened with expensive repair bills. Extended warranties provide peace of mind to customers that assist in changing their purchasing behaviour and enhance their satisfaction.

Growing sales of high-value items

There is a rise in the demand for high-value items due to increasing disposable incomes and changing consumer preferences. Premium smartphones, high-end laptops, luxury vehicles, and other high-value items are becoming more popular among consumers across the globe. According to an article published by Business Insider, Apple dominated the global smartphone market in 2023, with seven out of the top ten best-selling smartphones being iPhones. The iPhone 14 was the best-selling smartphone of the year, followed by the iPhone 15 Pro Max and the iPhone 15. However, these luxury products often come with a hefty price tag, which makes customers wary of potential repair costs after the standard warranty expires. Consequently, consumers are opting for extended warranties that can bear the cost of defects and malfunctions in high-value products. Furthermore, the increasing adoption of extended warranty coverage for these costly purchases, as consumers are seeking financial protection and peace of mind, is positively influencing the market.

Extended Warranty Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global extended warranty market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on coverage, application, distribution channel and end user.

Breakup by Coverage:

- Standard Protection Plan

- Accidental Protection Plan

Standard protection plan represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes standard protection plan and accidental protection plan. According to the report, standard protection plan represented the largest segment.

The standard protection plan is the basic level of extended warranty coverage offered for most products. It typically extends the warranty period beyond the original warranty by manufacturers and provides protection against defects and malfunctions for an additional period. The coverage under the standard protection plan often includes parts and labor costs for repairs and ensures that consumers are safeguarded from unexpected repair expenses. In line with this, it offers basic coverage for a reasonable price and may not encompass all potential issues.

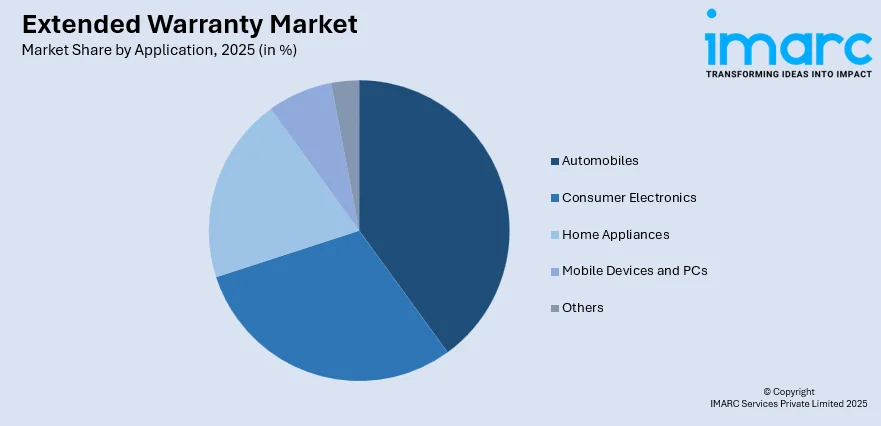

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

Automobiles account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes automobiles, consumer electronics, home appliances, mobile devices and PCs, and others. According to the report, automobiles represented the largest segment.

The automobile extended warranties are specifically tailored to provide coverage for vehicles and their components and ensure protection against potential mechanical and electrical failures. There are usually two primary categories of extended warranties for automobiles, such as new vehicle extended warranty and used vehicle extended warranty. In addition, the new vehicle extended warranty is offered for brand-new vehicles purchased from dealerships. On the other hand, the used vehicle extended warranty is designed for pre-owned vehicles and offers similar coverage to new vehicle extended warranties.

Breakup by Distribution Channel:

- Manufacturers

- Retailers

- Others

Manufacturers hold the biggest market share

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes manufacturers, retailers, and others. According to the report, manufacturers represented the largest segment.

Many product manufacturers offer extended warranty programs directly to consumers at the point of sale (POS). This distribution channel allows manufacturers to leverage their brand reputation and customer trust to promote this warranty coverage. By offering extended warranties, manufacturers can enhance customer loyalty and satisfaction, as customers perceive the manufacturer to gain insight about the product and its components. Additionally, these warranty programs are typically designed to complement the standard warranty by manufacturers and may include additional benefits, such as priority service, dedicated support, and coverage for specific components not covered under the standard warranty.

Breakup by End User:

- Individuals

- Business

Individuals dominate the extended warranty market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes individuals and business. According to the report, individuals represented the largest segment.

Individuals represent a substantial end-user segment in the market. These consumers are private individuals who purchase various products, such as electronics, appliances, automobiles, and other valuable items for personal use. When making such purchases, individuals often have the option to buy extended warranty coverage to safeguard their investments and protect themselves against unforeseen repair costs. In addition, extended warranties offer individuals peace of mind by providing financial coverage. The decision to opt for extended warranties is influenced by factors, such as the value of the product, the perceived reliability of the brand, and the willingness to secure long-term protection for their purchases.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest extended warranty market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America held the biggest market share due to the presence of major manufacturers and retailers. Additionally, the rising awareness among individuals about their rights is strengthening the growth of the market in the region. Besides this, the increasing demand for high-value products among the masses is offering a positive market outlook. In line with this, the rising adoption of technologically advanced consumer electronics is supporting the growth of the market in the North America region.

Competitive Landscape:

Key players are expanding their coverage options to include a broader range of products and industries. This includes offering extended warranties for not only electronics and appliances but also for emerging sectors like smart home devices, renewable energy systems, and electric vehicles (EVs). In addition, companies are offering customizable extended warranty plans to cater to individual customer requirements. Consumers can choose from different levels of coverage, durations, and add-on services based on their specific needs and budgets. Apart from this, major manufacturers are investing in user-friendly websites and digital platforms to streamline the purchasing process, which allows consumers to easily compare plans, access information, and make online purchases conveniently.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Allianz Partners

- Allstate Insurance Company

- American International Group, Inc.

- AmTrust Financial

- Assurant Inc.

- Asurion

- Carchex

- CarShield LLC

- Domestic & General Group Limited

- Edel Assurance

- Endurance Warranty Services, LLC

- Likewize

- MAPFRE

(Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.)

Extended Warranty Market Recent Developments:

- In 2023, Allianz S.p.A. announced the the acquisition of Tua Assicurazioni S.p.A. from Assicurazioni Generali S.p.A. for 280 million euros, enhancing its position in the Italian P/C market by approximately 1 percentage point. This acquisition strengthens Allianz's presence in Italy's Property and Casualty insurance sector, leveraging Tua Assicurazioni's profitable portfolio and distribution network to consolidate its market share.

- In 2023, CarShield announced the renewal of its sponsorship of NASCAR driver Ross Chastain, who has secured a spot in the NASCAR Gander Outdoors Truck Series playoffs after a strong season with multiple wins and top-five finishes. The partnership will see CarShield's logo prominently displayed on Chastain's #45 Silverado truck as he competes for the championship title.

Extended Warranty Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allianz Partners, Allstate Insurance Company, American International Group, Inc., AmTrust Financial, Assurant Inc., Asurion, Carchex, CarShield LLC, Domestic & General Group Limited, Edel Assurance, Endurance Warranty Services, LLC, Likewize, MAPFRE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the extended warranty market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global extended warranty market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the extended warranty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global extended warranty market was valued at USD 155.3 Billion in 2025.

We expect the global extended warranty market to exhibit a CAGR of 5.30% during 2026-2034.

The rising consumer concerns towards the safety of their electronic devices after the original warranty has expired are primarily driving the global extended warranty market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of extended warranty claims by individuals via online portals for a hassle-free post-sales experience.

Based on the coverage, the global extended warranty market has been divided into standard protection plan and accidental protection plan, where standard protection plan currently exhibits a clear dominance in the market.

Based on the application, the global extended warranty market can be categorized into automobiles, consumer electronics, home appliances, mobile devices and PCs, and others. Currently, automobiles account for the majority of the total market share.

Based on the distribution channel, the global extended warranty market has been segregated into manufacturers, retailers, and others. Among these, manufacturers exhibit a clear dominance in the market.

Based on the end user, the global extended warranty market can be bifurcated into individuals and business. Currently, individuals hold the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global extended warranty market include Allianz Partners, Allstate Insurance Company, American International Group, Inc., AmTrust Financial, Assurant Inc., Asurion, Carchex, CarShield LLC, Domestic & General Group Limited, Edel Assurance, Endurance Warranty Services, LLC, Likewize, and MAPFRE.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)