Facial Injectables Market Size, Share, Trends and Forecast by Product Type, Application Type, Application, End User, and Region, 2025-2033

Facial Injectables Market Size and Share:

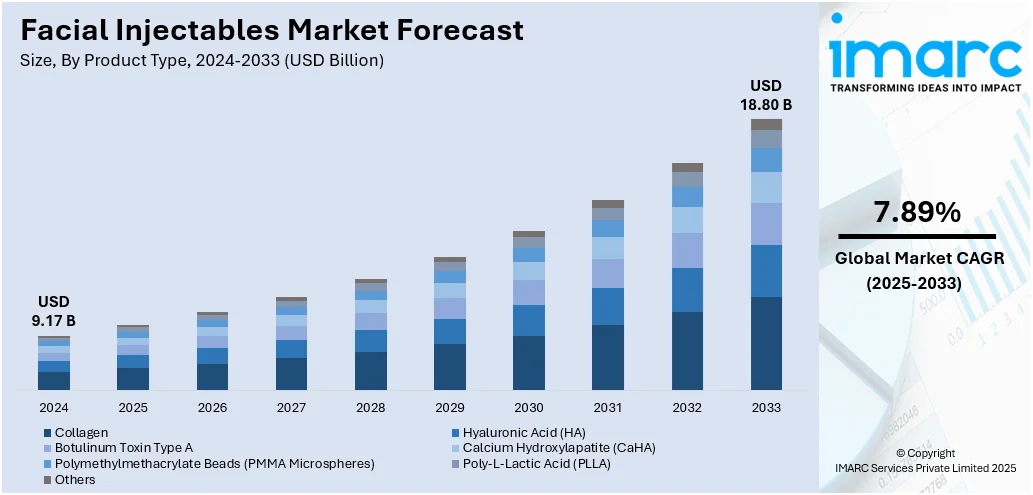

The global facial injectables market size was valued at USD 9.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.80 Billion by 2033, exhibiting a CAGR of 7.89% from 2025-2033. North America currently dominates the market, holding a market share of 39.0% in 2024. The market is driven by a growing aging population seeking effective anti-aging solutions to maintain youthful appearances. Rising demand for non-invasive procedures like Botox and dermal fillers attracts individuals preferring quick, low-risk treatments with minimal downtime. Additionally, celebrity endorsements and social media influence have significantly normalized aesthetic enhancements, encouraging more people to opt for these procedures. Combined, these factors are fueling facial injectables market share, making them a preferred choice for both corrective and preventive cosmetic treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.17 Billion |

|

Market Forecast in 2033

|

USD 18.80 Billion |

| Market Growth Rate 2025-2033 | 7.89% |

The key growth driver of the facial injectables market is increasing demand for non-surgical aesthetic treatments. Customers are opting for non-surgical aesthetics such as Botox, dermal fillers, and other injectable treatments because of their fast effects, less downtime, and lower complications than conventional cosmetic surgery. The trend is also driven by rising awareness regarding aesthetic improvements, social media culture, and seeking young looks among all generations. Also, improvements in injectable products and availability of safer, longer-acting products are drawing a wider customer base towards it, thus converting minimally invasive treatments into a leading facial injectables market trend.

To get more information on this market, Request Sample

The U.S. plays a dominant role in the facial injectables market, supported by high consumer awareness, advanced healthcare infrastructure, and strong demand for aesthetic enhancements with a market share of 88.20%. With a large base of skilled dermatologists and cosmetic surgeons, the country is a leading hub for minimally invasive procedures like Botox and dermal fillers. In 2023 alone, approximately 9.48 million neuromodulator injections and 5.29 million hyaluronic acid filler procedures were performed, reflecting year-over-year growth of 9% and 8%, respectively. Social media influence, celebrity trends, and a growing focus on youthful appearances further drive demand. Supportive FDA regulations, rising disposable incomes, and an aging population seeking anti-aging solutions strengthen the U.S. market’s leading position.

Facial Injectables Market Trends:

Increasing Aging Population:

As the global population is aging the demand for facial injectables is rising. While they are essential, aging comes with various visible signs like wrinkles, fine lines, and sagging skin. Thus, individuals always opt for aesthetic treatments to keep a youthful appearance. Due to the zero downtime and non-surgical procedure, facial injectables encourage a wide audience inquiring about self-rejuvenation without undergoing invasive treatments. Furthermore, the age sector in developed countries is expanding, and people now care more about their appearance. Hence, they are willing to seek aesthetic treatments to look and feel their best, influencing the facial injectables market outlook. In 2020, the global population aged 60 years and above exceeded the under-five children, according to the World Health Organization. The aging population is expected to double globally from 12% in 2015 to 22% in 2050.

Rising Demand for Non-Invasive Procedures

Individuals are opting for non-invasive facial plastic procedures owing to their convenience, minimal downtime decreased risk, and fewer side effects. For example, dermal fillers and botulinum toxin injections, are injectables that provide quick and efficient solutions to numerous common aesthetic problems like wrinkles, volume depletion, and facial asymmetry. Moreover, busy lives, and technological advances that make many procedures efficient and less dangerous, influence the new generation of non-invasive face treatments, which is increasing the facial injectables market value. Data from the American Society of Plastic Surgeons (ASPS) reveals that a total of 26.2 million surgical and minimally invasive cosmetic and reconstructive treatments were performed in the United States in 2022. It also reveals that 19% of cosmetic surgeries surged since 2019, increasing the facial injectables market demand.

Celebrity Endorsements and Social Media Influence

Beauty standards and consumer preferences are influenced by celebrity endorsements and social media personalities which is driving the facial injectables market growth. When celebrities openly discuss their facial plastic surgeries or post about them on various social media sites, their followers are more likely to consider using facial injectables. For instance, according to the survey by the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), facial plastic surgeons have reported a 90% rise in facelifts since 2019. Last year, facelifts were the leading surgical procedure for females, with 86% of surgeons performing them. Noses jobs or rhinoplasty come second, with surgeons performing them on 79%, while blepharoplasty or eye lift stood at 73%. For both genders, the top three surgical procedures are rhinoplasty accounting for 83%, blepharoplasties at 49%, and facelifts and partial facelifting at 48%.

Facial Injectables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global facial injectables market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application type, application, and end user.

Analysis by Product Type:

- Collagen

- Hyaluronic Acid (HA)

- Botulinum Toxin Type A

- Calcium Hydroxylapatite (CaHA)

- Polymethylmethacrylate Beads (PMMA Microspheres)

- Poly-L-Lactic Acid (PLLA)

- Others

Based on the facial injectables market forecast, the botulinum toxin type A dominates the facial injectables market with a market share of 54.8% due to its proven effectiveness, quick results, and wide range of cosmetic and therapeutic applications. It is highly preferred for reducing fine lines, wrinkles, and other signs of aging, making it a go-to choice for minimally invasive facial rejuvenation. Its non-surgical nature, minimal downtime, and relatively low risk profile attract a broad demographic of patients seeking aesthetic enhancements. Additionally, its temporary but noticeable results encourage repeat procedures, driving sustained demand. Growing awareness, expanding indications, and the increasing acceptance of preventive cosmetic treatments among younger populations further strengthen its market dominance. Continuous advancements in formulation and delivery methods also enhance its appeal, supporting its leading position in the segment.

Analysis by Application Type:

- Aesthetics

- Therapeutics

Aesthetics account for the majority of shares of 35.0% driven by the rising demand for minimally invasive cosmetic enhancements aimed at improving appearance and boosting confidence. Increasing awareness of aesthetic procedures, fueled by social media influence, celebrity trends, and changing beauty standards, has significantly expanded the customer base. Patients prefer injectables for their quick results, minimal downtime, and reduced risks compared to surgical interventions. Additionally, the growing popularity of preventive treatments among younger individuals and anti-aging solutions among older populations further drives demand. Continuous innovations in product formulations, offering longer-lasting and more natural results, also contribute to the dominance of the aesthetics segment, making it the largest and most rapidly growing application area in this market.

Analysis by Application:

- Facial Line Correction

- Lip Augmentation

- Face Lift

- Acne Scar Treatment

- Others

According to the facial injectables market analysis, the facial line correction is a leading application of injectables, primarily targeting wrinkles, fine lines, and folds caused by aging or facial expressions. Botulinum toxin and dermal fillers are commonly used to smoothen skin, restore youthful contours, and enhance facial aesthetics with minimally invasive, quick, and effective treatments.

Additionally, the lip augmentation uses dermal fillers to enhance lip volume, shape, and definition. It is popular among younger patients seeking fuller lips and older individuals addressing age-related thinning. Minimally invasive techniques and customizable results make it a sought-after procedure, boosting demand for injectables in aesthetic treatments.

Moreover, the non-surgical facelifts with injectables help restore facial volume, reduce sagging, and enhance contours without invasive surgery. Dermal fillers and neuromodulators are combined to achieve natural-looking rejuvenation. The quick recovery and lower risk compared to surgical facelifts make this approach increasingly attractive to patients.

Besides this, the injectables play a vital role in improving acne scars by filling depressions and stimulating collagen production. Dermal fillers provide immediate volume restoration, while some injectables promote long-term skin healing. This minimally invasive option appeals to patients seeking smoother skin without downtime, driving growth in aesthetic dermatology.

Besides this, the other applications include chin augmentation, tear trough correction, and non-surgical nose reshaping. These procedures address specific facial concerns, improving symmetry and enhancing overall facial aesthetics. The versatility of injectables, combined with personalized treatment plans, expands their use across varied cosmetic and reconstructive applications, contributing to overall market growth.

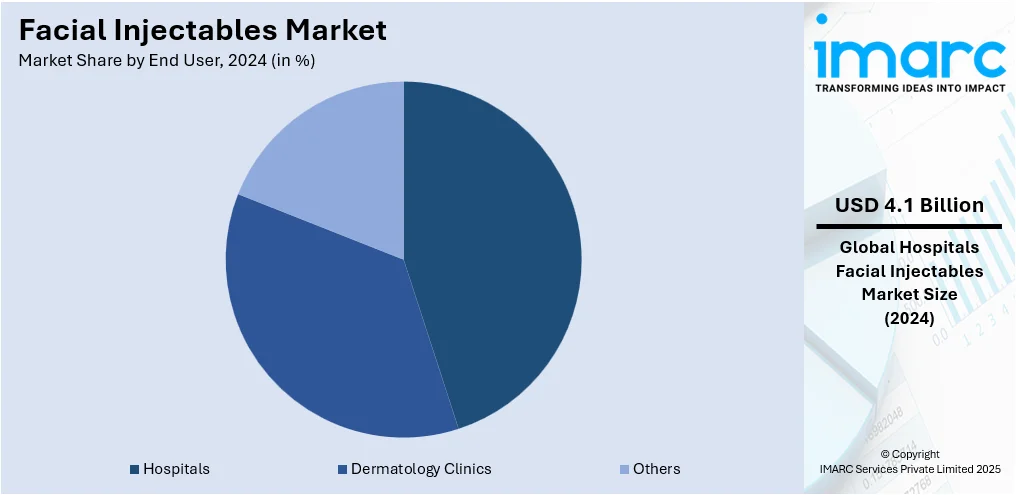

Analysis by End User:

- Hospitals

- Dermatology Clinics

- Others

Hospitals represent significant growth with a market share of 45% due to their ability to offer comprehensive care, advanced facilities, and high safety standards. Patients often prefer hospitals for injectable treatments due to the availability of experienced specialists, access to emergency care, and adherence to stringent regulatory protocols. Hospitals also cater to both cosmetic and therapeutic applications of injectables, attracting a diverse patient base. The growing number of hospital-based aesthetic clinics, combined with the rising demand for minimally invasive procedures, boosts their role in market expansion. Additionally, hospitals often serve as training and research centers, fostering innovation and ensuring the availability of the latest injectable products and techniques, further driving their contribution to market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the facial injectables market with a market share of 39.0% driven by high consumer awareness, strong demand for aesthetic enhancements, and advanced healthcare infrastructure. The region benefits from a well-established network of skilled dermatologists and cosmetic practitioners who offer a wide range of minimally invasive procedures. Increasing social media influence, changing beauty standards, and the growing acceptance of cosmetic treatments across various age groups fuel market growth. Additionally, the presence of innovative, regulatory-approved injectable products ensures access to safe and effective solutions. Rising disposable incomes, a large aging population seeking anti-aging treatments, and the popularity of preventive aesthetics among younger consumers further support North America's dominance in this market. Continuous technological advancements and frequent product innovations also play a key role.

Key Regional Takeaways:

United States Facial Injectables Market Analysis

The United States facial injectables market is primarily driven by increasing consumer demand for non-invasive aesthetic treatments. In line with this, individuals increasingly seeking quicker and safer methods to enhance their appearance are impelling the market. The continual advancements in injectable formulations, which provide longer-lasting results, are further propelling the market growth. Similarly, heightened awareness about facial aging and available treatments is encouraging more patients to opt for injectables. The expanding aging population in the U.S. is creating a larger customer base, fueling market development. According to Census.gov, in 2024, the U.S. had 61.2 million individuals aged 65 and older, marking a 13% rise from 54.2 million in 2020, while the number of children (ages 0 to 17) decreased, reflecting the national aging trend. Furthermore, the growing influence of social media and celebrity endorsements is significantly increasing interest in aesthetic procedures, strengthening market demand. Furthermore, favorable reimbursement policies in certain states are also contributing to the enhanced market's appeal. Moreover, ongoing technological innovations in injectables, along with improved safety profiles, continue to enhance consumer confidence, accelerating higher adoption rates.

Europe Facial Injectables Market Analysis

The market in Europe is witnessing growth propelled by the increasing consumer preference for minimally invasive aesthetic procedures, offering quick recovery and natural results. In accordance with this, the growing focus on anti-aging treatments, fueled by the rising elderly population, is propelling market expansion. As such, Cambridge-based biotech Clock.bio raised USD 5.3 Million in a seed round led by LocalGlobe, focusing on reversing cellular aging using human pluripotent stem cells and CRISPR, aiming to develop anti-aging treatments. Similarly, the heightened influence of social media and celebrity endorsements is further augmenting awareness and demand for these treatments across the region. Additionally, the emerging trend of personalized skincare, with customized injectables tailored to individual skin types, is attracting more consumers to the market. An industry report highlights that in Europe, especially the UK, 60% of consumers prioritize skincare products that are vegan, organic, and ethically sourced, underscoring the rising demand for personalized products that blend effectiveness with ethical principles. The increased affordability of treatments, driven by competitive pricing and innovative financing options, is also contributing to the market's growth. Apart from this, rising healthcare awareness and the expanding focus on self-care are encouraging individuals to invest in facial injectables, further strengthening market momentum.

Asia Pacific Facial Injectables Market Analysis

The Asia Pacific injectables market for the face is mostly fueled by rising disposable incomes and shifting beauty ideals, resulting in greater utilization of aesthetic treatments. Likewise, the expansion of medical tourism in countries such as Thailand and South Korea is further boosting market demand. Based on the Ministry of Health and Welfare's data, South Korea's medical tourism sector saw high growth in 2024, as the number of overseas patients almost doubled to 1.17 million from 605,768 in 2023. Growth in dermatology clinics and medical spas is popularizing injectables in the marketplace. In addition, increased social media and celebrity culture influence is also increasing awareness and expanding market size. Also, the increasing demand for non-surgical over conventional surgeries is favoring market demand since patients are opting for quicker results and less time spent in recovery. Further, the regional competitive environment is favoring the establishment of innovative injectable products, hence opening up profitable market opportunities.

Latin America Facial Injectables Market Analysis

In Latin America, the market for facial injectables is increasing because of the expanding middle class who are looking for aesthetic procedures. The International Society of Aesthetic Plastic Surgery (ISAPS) 2021 survey listed Brazil, Mexico, Argentina, and Colombia in the top 10 nations for aesthetic procedure, with Brazil being ranked second globally for combined surgical and nonsurgical procedures. Apart from this, the growth of influencer culture is broadening awareness and defining beauty trends, and it is urging more people to seek cosmetic procedures. The constant development of product formulas, providing longer-lasting effects with minimal side effects, are also helping boost consumer confidence in the market. In addition to this, the rising popularity of non-invasive beauty treatments among both men and women is backing the region's rising market for facial injectables.

Middle East and Africa Facial Injectables Market Analysis

The Middle East and Africa market is significantly expanding due to increasing disposable incomes, enabling consumers to prioritize aesthetic procedures. Furthermore, the growing influence of social media driving demand for cosmetic enhancements is impelling the market. The rise in medical tourism within the region is attracting international patients, further stimulating the market appeal. Industry analysis highlighted that Dubai is emerging as a prominent medical tourism hub. In 2023, the city welcomed over 691,000 health tourists, 58% of whom were women, primarily seeking gynecology and cosmetic surgery. These visitors collectively spent over AED 1 Billion (USD 280 Million) on treatments. Besides this, continual advancements in healthcare infrastructure are expanding access to modern injectable technologies, improving treatment options, and market accessibility.

Competitive Landscape:

The competitive environment is extremely dynamic and driven by innovation, with many players competing on enlarging the product portfolio and enhancing treatment effectiveness. Competitors compete on product safety, effectiveness, long-term results, and ease of use, leading to relentless investment in research and development. Strategic partnerships, mergers, and product introductions are prevalent to consolidate market positions and enhance offerings. In addition, the growth of minimally invasive treatments has contributed to more competition among manufacturers in creating more sophisticated injectables with longer durations and fewer side effects. The market also experiences heightened focus on patient education, customized treatment methods, and practitioner education, which further increases competition. In general, the market is influenced by technological advancements, regulatory clearances, and the increasing global demand for aesthetic treatments.

The report provides a comprehensive analysis of the competitive landscape in the facial injectables market with detailed profiles of all major companies, including:

- Allergan Plc

- Anika Therapeutics Inc.

- Bloomage BioTechnology

- Johnson & Johnson

- Galderma Pharma S.A.

- Integra LifeSciences

- Ipsen (Mayroy SA)

- Medytox Inc.

- Merz Holding GmbH & Co. KG

- Prollenium Medical Technologies Inc.

- Sanofi

- SciVision Biotech Inc.

- Sinclair Pharma (Huadong Medicine Co. Ltd.)

- Suneva Medical Inc.

- Bausch Health Companies Inc.

Latest News and Developments:

- February 2025: Evolus, Inc. announced FDA approval for two new injectable hyaluronic acid dermal fillers, Evolysse Form and Evolysse Smooth. The products, designed for nasolabial fold treatment, demonstrated safety, efficacy, and versatility in clinical trials, outperforming Restylane-L. The fillers are set for release in Q2 2025.

- September 2024: Allergan Aesthetics announced FDA approval for BOTOX Cosmetic (onabotulinumtoxinA) to treat masseter muscle prominence (MMP) in China. This approval introduces a non-invasive solution for facial slimming and addresses a key aesthetic concern, marking Allergan’s entry into the MMP treatment market.

- August 2024: Crown Laboratories announced a USD 924 Million merger with Revance, a medical aesthetics firm known for injectables like Daxxify. The deal aims to expand Crown's portfolio in global aesthetics and skincare, positioning the company for further growth in the industry.

- July 2024: Skinvive, a hyaluronic acid injectable approved by the FDA in May 2023, launched in the U.S. to improve skin texture, hydration, and fine lines. Unlike traditional fillers, it hydrates and smooths skin. Results last up to six months, with side effects like mild swelling and bruising.

Facial Injectables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Collagen, Hyaluronic Acid (HA), Botulinum Toxin Type A, Calcium Hydroxylapatite (CaHa), Polymethylmethacrylate Beads (PMMA Microspheres), Poly-L-Lactic Acid (PLLA), Others |

| Application Types Covered | Aesthetics, Therapeutics |

| Applications Covered | Facial Line Correction, Lip Augmentation, Face Lift, Acne Scar Treatment, Others |

| End Users Covered | Hospitals, Dermatology Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allergan Plc, Anika Therapeutics Inc., Bloomage BioTechnology, Johnson & Johnson, Galderma Pharma S.A., Integra LifeSciences, Ipsen (Mayroy SA), Medytox Inc., Merz Holding GmbH & Co. KG, Prollenium Medical Technologies Inc., Sanofi, SciVision Biotech Inc., Sinclair Pharma (Huadong Medicine Co. Ltd.), Suneva Medical Inc., Bausch Health Companies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the facial injectables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global facial injectables market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the facial injectables industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The facial injectables market was valued at USD 9.17 Billion in 2024.

The facial injectables market is projected to exhibit a CAGR of 7.89% during 2025-2033, reaching a value of USD 18.80 Billion by 2033.

The facial injectables market is driven by rising demand for minimally invasive aesthetic procedures, growing awareness of cosmetic enhancements, and increasing influence of social media and celebrity trends. Additionally, an aging population seeking anti-aging solutions, technological advancements in injectables, and availability of safer, FDA-approved products further boost market growth.

Botulinum toxin type A currently dominate the market with a market share of 54.8% due to its proven effectiveness in reducing wrinkles, delivering quick, visible results, and its broad use in both cosmetic and therapeutic applications. Its non-invasive nature, minimal side effects, and high patient satisfaction continue to drive strong market demand.

Aesthetics account for the majority of shares of 35.0% in the facial injectables market due to growing demand for minimally invasive procedures that enhance appearance and boost self-confidence. Popular treatments like wrinkle reduction, lip augmentation, and facial contouring attract a wide demographic. Quick results, minimal downtime, and natural-looking outcomes make aesthetic injectables highly preferred across all age groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)