Feed Mycotoxin Detoxifiers Market Size, Share, Trends and Forecast by Type, Animal Type, End User, and Region, 2026-2034

Feed Mycotoxin Detoxifiers Market Size and Share:

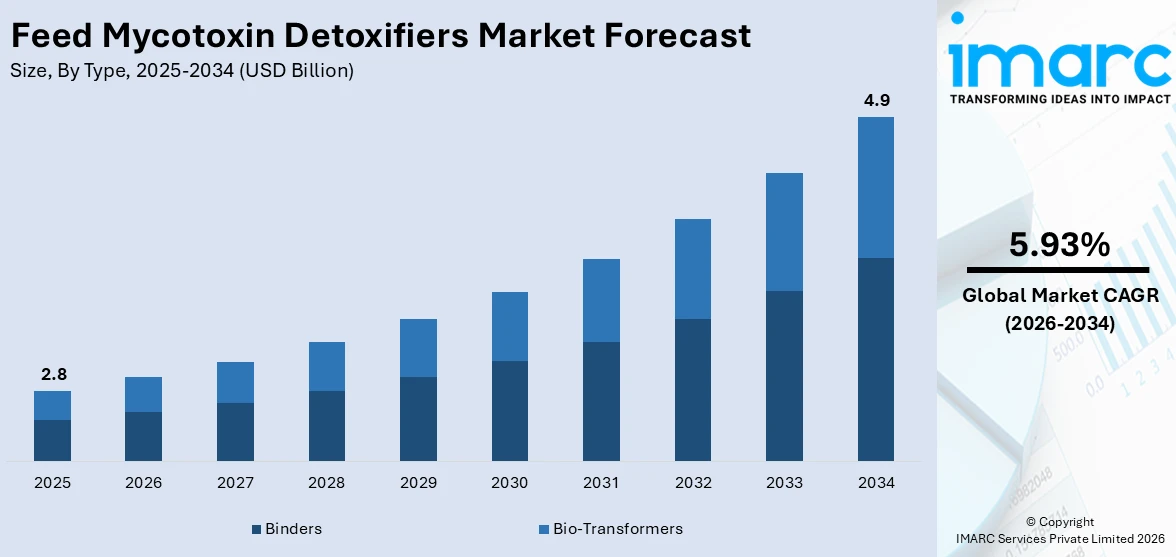

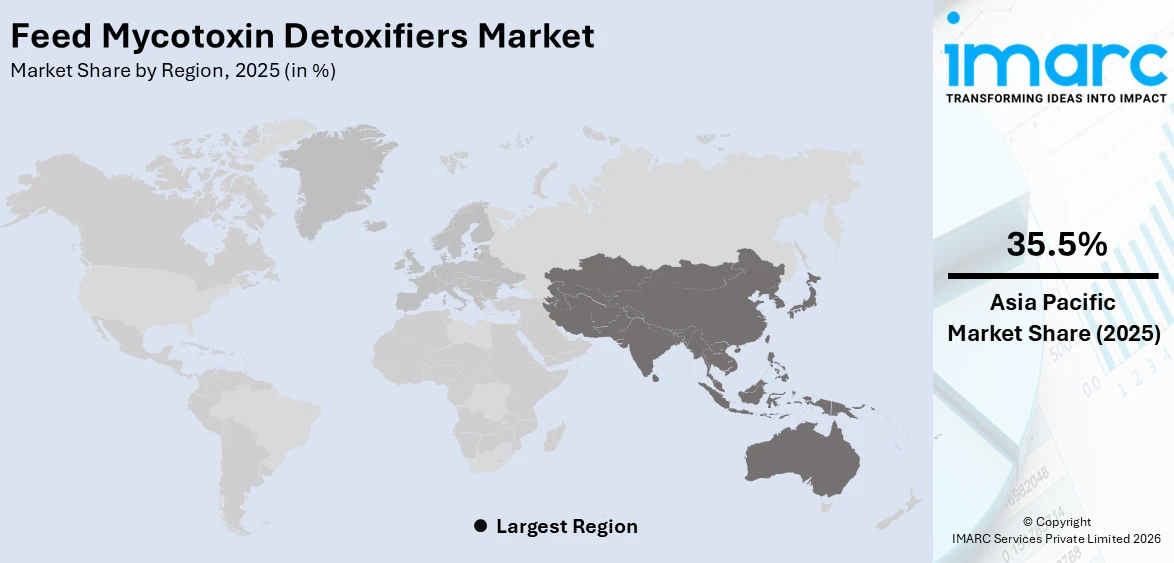

The global feed mycotoxin detoxifiers market size was valued at USD 2.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.9 Billion by 2034, exhibiting a CAGR of 5.93% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of 35.5% in 2025. The market is driven by growing awareness of animal health and safety concerns. The rising demand for quality animal feed and increased focus on livestock productivity are contributing to the growing importance of detoxifiers, ultimately boosting the feed mycotoxin detoxifiers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 4.9 Billion |

| Market Growth Rate (2026-2034) | 5.93% |

Technological advancements in feed mycotoxin detoxification products are among the major drivers of the market growth. New-generation detoxifiers contain active ingredients that are more effective in lowering mycotoxin concentration in livestock feed. Consequently, businesses are finding it necessary to embrace cutting-edge solutions to guarantee feed quality and safety for animals. This growth is especially critical in areas where mycotoxins pose severe health threats to animals, which in turn affect productivity. The increasing requirement for more effective solutions is likely to drive the global feed mycotoxin detoxifiers market growth. Major companies are emphasizing the product development of enzymatic and microbiological-based detoxifiers that not only detoxify mycotoxins but also improve the uptake of nutrients by animals.

To get more information on this market Request Sample

In the United States, the market for feed mycotoxin detoxifier is highly determined by strict government regulations and safety standards. The U.S. Food and Drug Administration (FDA) has established clear standards for the allowable levels of mycotoxins in animal feed, prompting manufacturers to ensure their products are safe and compliant. These standards are crucial for preventing any potential health threats to livestock and, consequently, the human food supply. Since mycotoxins are associated with a variety of negative health impacts in animals, such as slowed growth, productivity, and immunity, the need for mycotoxin detoxifiers has been on the rise. Due to these issues, feed manufacturers are now more using efficient detoxification technologies to make their products adhere to the desired safety levels. This phenomenon is especially pronounced in industries such as poultry, pig, and cattle farming, where the nutritional quality of the feed has a direct influence on both the health of the animals and the quality of the end product for the consumer.

Feed Mycotoxin Detoxifiers Market Trends:

Advancements in Mycotoxin Management Solutions

The global feed mycotoxin detoxifiers market is driven by the increasing demand for more effective and safer animal feed options, fueled by growing awareness of the risks associated with mycotoxins. These toxic compounds in animal food can have drastic effects on the health, productivity, and overall safety of livestock, thus leading to the demand for sophisticated detoxifying agents. Producers are looking to adopt more effective mycotoxin management solutions to safeguard animal health and produce high-quality food. Increasing consumer demand for healthier animal products, combined with increasingly stringent food safety legislation, is further driving the trend. For example, in December 2024, Tectron hosted a seminar in Karnal, with an emphasis on managing mycotoxin in poultry feed and highlighting innovative technologies such as Protec, a multi-toxin binder. Protec efficiently eliminates several forms of mycotoxins, offering a safer and more effective solution than conventional detoxifiers. The seminar strongly emphasized the importance of conducting proper mycotoxin testing in feed mills and implementing timely detoxification processes. These training programs and field solutions are increasing international awareness of mycotoxin hazards and the benefits of utilizing state-of-the-art detoxifiers, such as Protec. As awareness levels increase, market uptake of the products is likely to rise, leading to enhanced growth in the global feed mycotoxin detoxifiers market.

Regulatory Approvals and Product Innovation

The increasing regulatory focus on food safety and animal health is driving the growth of the feed mycotoxin detoxifiers market. As governments and industry standards tighten, producers are under pressure to ensure their feed products meet regulatory requirements for safety and quality. Consequently, there is a growing demand for scientifically validated and regulatory-approved mycotoxin detoxifiers that are proven to effectively eliminate or reduce the risks posed by these harmful substances. Innovations in detoxifier formulations and new product launches are enhancing the performance and versatility of detoxifiers, making them integral to modern feed production. For instance, in December 2024, DSM-Firmenich launched FUMzyme Silage, an EU-approved additive designed to detoxify fumonisins in maize silage. This product quickly and effectively reduces fumonisin contamination without altering fermentation parameters or nutritional value, offering a practical solution for silage producers. By addressing the regulatory and technical challenges associated with fumonisins, FUMzyme Silage provides a crucial addition to the growing portfolio of feed mycotoxin detoxifiers. Its approval and subsequent market introduction reflect the importance of regulatory compliance and product innovation in driving market growth. As more producers seek solutions that align with international standards, the feed mycotoxin detoxifiers market growth is expected to expand, supported by the continued introduction of innovative and approved products, such as FUMzyme Silage.

Growth in Animal Farming and Feed Industry

The rapid expansion of the compound feed industry, alongside the increasing demand for animal-based products such as dairy, eggs, and meat, are key factors fueling the market's growth. Global meat consumption has grown over the past decades, with the average per capita consumption rising from 41.4 kilograms in 2012 to 44.5 kilograms by 2022. Concurrently, there has been a significant rise in mycotoxin contamination in animal feed crops, such as maize, primarily due to unfavorable weather conditions. A recent survey found that 60–80% of global food and feed crops are contaminated with major mycotoxins, with 20–25% exceeding EU and Codex Alimentarius limits. This has led to heightened awareness among farmers about the importance of feed mycotoxin detoxifiers, boosting product demand. The increasing consumer preference for high-quality food and a greater focus on animal health are also driving the adoption of mycotoxin detoxifiers in animal feed. Furthermore, the implementation of modern animal husbandry practices and the rising livestock population are propelling market growth. Between 2002 and 2022, global animal farming expanded significantly, with chicken numbers increasing by 68%, cattle numbers by 16%, and goat numbers by 46%, reflecting the overall growth across these species. Additionally, leading manufacturers are investing heavily in research and development to introduce innovative feed additives, further supporting market expansion.

Feed Mycotoxin Detoxifiers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global feed mycotoxin detoxifiers market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, animal type, and end user.

Analysis by Type:

- Binders

- Bentonite

- Clay

- Others

- Bio-Transformers

- Enzymes

- Yeasts

- Others

As per the feed mycotoxin detoxifiers market outlook, in 2025, the binders segment led the market, accounting for 68.7% of the total market share, driven by their critical role in effectively binding mycotoxins in animal feed. Binders are essential for ensuring the safe consumption of animal feed, especially in regions where mycotoxin contamination is prevalent due to poor storage conditions. These products help neutralize harmful toxins, improving livestock health and preventing toxicological effects, which is a significant concern in animal husbandry. The increasing demand for high-quality animal products, coupled with the rising awareness of the health risks associated with mycotoxin contamination, has accelerated the adoption of binders. Additionally, growing regulatory standards and the need for safe feed additives are boosting the use of binders, solidifying their position as the leading segment in the market.

Analysis by Animal Type:

- Ruminant

- Poultry

- Swine

- Others

In 2025, the poultry segment led the feed mycotoxin detoxifiers market, accounting for 32.7% of the total market share, driven by the growing demand for poultry products worldwide. Poultry is particularly susceptible to mycotoxin contamination, as its feed often consists of grains and other raw materials that are vulnerable to fungal growth. The increasing concerns about the health of poultry livestock and the negative impact of mycotoxins on productivity, including reduced egg production, weight gain, and immune function, have led to a greater emphasis on mycotoxin management solutions. Additionally, the growing awareness among poultry farmers about the benefits of feed mycotoxin detoxifiers in enhancing animal health and improving product quality is driving the demand for these products in the poultry industry. The poultry sector's continuous growth, both in developed and emerging markets, further drives this market segment.

Analysis by End User:

.webp)

Access the comprehensive market breakdown Request Sample

- Aquaculture

- Feed Manufacturers

- Farmers

- Home-Mixers

- Others

In 2025, feed manufacturers led the feed mycotoxin detoxifiers market, driven by the increasing demand for safe and high-quality animal feed. Feed manufacturers play a critical role in sourcing, processing, and distributing animal feed products, and they are under pressure to meet stringent quality standards, including the management of mycotoxins. With the rising awareness of mycotoxin contamination’s harmful effects on livestock and animal-derived food products, feed manufacturers are turning to mycotoxin detoxifiers to ensure the safety and nutritional value of their products. Regulatory pressures, such as the implementation of safety standards by authorities in major agricultural markets, are pushing manufacturers to adopt detoxifying agents. Furthermore, the growing demand for safer and healthier animal products among consumers is encouraging feed manufacturers to integrate advanced detoxification solutions into their production processes.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, the Asia-Pacific region led the feed mycotoxin detoxifiers market, accounting for 35.5% of the total market share, driven by the significant livestock industry and the increasing concerns over feed safety in the region. Countries like China, India, and Japan are key players in the agricultural sector, where mycotoxin contamination in feed is a growing concern due to high humidity, improper storage, and inadequate agricultural practices. The rising awareness of mycotoxin-related health risks to both livestock and consumers has spurred the demand for mycotoxin detoxifiers. Moreover, with the expansion of livestock production to meet the growing protein consumption in Asia-Pacific countries, the need for effective feed additives is on the rise. Regulatory frameworks aimed at improving food safety and livestock health further support the adoption of feed mycotoxin detoxifiers in the region, strengthening its market leadership.

Key Regional Takeaways:

United States Feed Mycotoxin Detoxifiers Market Analysis

The U.S. feed mycotoxin detoxifiers market is being driven by the increasing recognition among livestock producers of the detrimental effects mycotoxins can have on animal health. The rising occurrence of mycotoxin contamination in animal feed, exacerbated by climate change, is further accelerating the uptake of detoxification solutions. Advances in detection technologies are also enhancing the effectiveness of detoxifiers, making them more attractive to feed producers. Additionally, the growing demand for safe, high-quality animal products is driving producers to prioritize feed safety, thereby further boosting market growth. Regulatory pressures, particularly around mycotoxin levels in animal feed, continue to play a significant role. At the same time, the expanding livestock industry, especially in the poultry and swine sectors, contributes to this trend. As of June 2024, the U.S. Department of Agriculture's National Agricultural Statistics Service (NASS) reported an increase of 1% in the number of hogs and pigs, with 74.5 Million reported on U.S. farms, compared to the previous year. Additionally, there is an increasing focus on sustainable farming practices, with a preference for non-toxic feed additives, which is also fostering growth in the feed mycotoxin detoxifiers market. Efforts to enhance animal performance and prevent diseases are further creating growth opportunities in this market.

Europe Feed Mycotoxin Detoxifiers Market Analysis

The European feed mycotoxin detoxifiers market is growing due to rising consumer demand for safe and sustainable animal products. Increasing feed contamination, driven by weather fluctuations and farming practices, is fueling demand for detoxification solutions. Technological advancements in feed processing are enhancing the efficacy of detoxifiers, making them more effective at managing mycotoxins. The European Union's regulatory standards on permissible mycotoxin levels are becoming stricter, prompting greater adoption of detoxifiers. Furthermore, greater awareness of the adverse effects of mycotoxins on animal health and productivity is encouraging the use of detoxification products. The rise in organic farming, combined with the growing demand for toxin-free feed, is further pushing market development. According to Eurostat, organic agricultural land in the EU grew to 16.9 Million hectares in 2022, up from 15.9 Million hectares the previous year. As awareness grows about the links between zoonotic diseases and foodborne pathogens, the demand for safer animal feed is rising. Moreover, Eastern Europe's increasing livestock industry is contributing to the market's expansion, as there is a higher adoption of mycotoxin management solutions in these regions to ensure the safety of animal products and reduce production losses.

Asia Pacific Feed Mycotoxin Detoxifiers Market Analysis

The Asia Pacific feed mycotoxin detoxifiers market is primarily driven by the growing livestock population, particularly in countries such as China and India. According to recent data, the total livestock population in India was reported to be over 500 Million, with rural areas comprising the majority of this total. This growing population is increasing the need for safe and effective feed additives to combat the health risks posed by mycotoxins. Additionally, awareness regarding mycotoxin-related health risks is rising, driving the adoption of detoxification products across the region. Advancements in feed processing technologies are also enhancing the efficiency of detoxifiers, further promoting market growth. Government support for agriculture and livestock sectors is encouraging the use of advanced feed additives to ensure animal safety and productivity. The expanding middle class in the region, coupled with increased demand for high-quality animal-based products, is also driving market growth. Furthermore, the shift towards sustainable farming and organic agricultural practices is promoting the use of non-toxic feed additives, ensuring better quality and healthier livestock. As consumer awareness of food safety and animal health continues to rise, the demand for mycotoxin detoxifiers is expected to grow rapidly in the coming years.

Latin America Feed Mycotoxin Detoxifiers Market Analysis

The feed mycotoxin detoxifiers market in Latin America is expanding due to the growing demand for animal-based proteins, driven by rising consumption levels. The region is increasingly focused on improving animal welfare and productivity, which is promoting the adoption of mycotoxin management solutions. The prevalence of mycotoxins in feed is rising, influenced by regional climate conditions, which is accelerating the demand for detoxifiers. Additionally, the region's expanding agricultural infrastructure and modernization of livestock farming practices are supporting market growth. A USD 1.602 Billion program approved by the World Bank to enhance Brazil's agrifood system is set to benefit over 1 Million people and improve livestock production and food security. This initiative is also focused on ensuring climate resilience, further boosting the market for feed mycotoxin detoxifiers. The region's efforts to enhance feed safety and farm efficiency are further driving the demand for effective detoxification solutions, which are crucial in maintaining the safety and productivity of livestock, ensuring consumer health, and improving overall market conditions.

Middle East and Africa Feed Mycotoxin Detoxifiers Market Analysis

In the Middle East and Africa, the feed mycotoxin detoxifier market is growing due to the rising demand for premium meat and dairy products. With increased investments in livestock farming and veterinary care, there is a growing focus on the use of advanced feed additives. The rising awareness of the health risks associated with mycotoxins, particularly in food safety, is pushing for more widespread adoption of detoxification solutions. Furthermore, the adverse effects of climate change on crop production and the increase in mycotoxin contamination are driving the need for efficient detoxifiers in animal feed. According to an industry report, Sub-Saharan Africa's crop yields are expected to decline by 10%-20% by 2050 due to changing climate conditions, including increased droughts and heatwaves. This climate uncertainty is expected to exacerbate the mycotoxin contamination in crops, further fueling demand for detoxification solutions in the region. The demand for safer feed practices, coupled with ongoing investments in the region's agricultural sector, is contributing to the market's expansion as the focus on sustainability and food safety continues to rise.

Competitive Landscape:

Advancements in feed mycotoxin detoxifiers production, application technologies, and integration strategies are fueling the growth of the market. Companies are focused on improving the effectiveness, scalability, and efficiency of detoxifiers for use across various industries, including agriculture, animal health, and food safety. Market competition is intensifying as companies develop high-performance detoxifiers, which are increasingly being adopted in livestock feed to ensure safe and healthy animal products. Feed mycotoxin detoxifiers market forecast indicates rising demand as industries prioritize solutions for animal health, food safety, and sustainable agricultural practices, leading to greater investment in innovative detoxification technologies.

The report provides a comprehensive analysis of the competitive landscape in the feed mycotoxin detoxifiers market with detailed profiles of all major companies, including:

- Adisseo

- Adiveter, S.L. (Pintaluba group)

- Alltech

- Amin Impex Pvt Ltd.

- BASF SE

- Cargill, Incorporated

- dsm-firmenich

- EW Nutrition

- Impextraco NV

- Kemin Industries, Inc

- Nutrex

- Olmix

Latest News and Developments:

- January 2025: A field trial on a German dairy farm demonstrated the effectiveness of B.I.O.Tox Activ8, a feed mycotoxin detoxifier, in reducing DON levels in milk. The trial showed a significant reduction in mycotoxin contamination, improving milk quality and dairy cow performance.

- January 2025: SAM Nutrition launched Nexus, a new feed additive division aimed at enhancing livestock performance through innovative, research-backed solutions, including analyzing new feed detoxifiers. Nexus will focus on developing advanced feed additives that improve growth optimization, digestive health, immunity, and feed efficiency across various livestock species.

- October 2024: Clariant inaugurated a new feed additives production facility in Cileungsi, Indonesia. The facility will manufacture Toxisorb and Terrana products, which effectively bind both polar and non-polar mycotoxins. This initiative supports animal health and food safety and aligns with the United Nations Sustainable Development Goals.

- September 2024: Innovad introduced biomonitoring for mycotoxin exposure using FTA cards to analyze 36 biomarkers in blood. This method provides a more accurate assessment of mycotoxin risk, revealing exposure not detected in feed. Combining this with detoxifiers like Escent helps reduce mycotoxin levels and improve animal performance.

Feed Mycotoxin Detoxifiers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Animal Types Covered | Ruminant, Poultry, Swine, Others |

| End Users Covered | Aquaculture, Feed Manufacturers, Farmers, Home-Mixers, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adisseo, Adiveter, S.L. (Pintaluba group), Alltech, Amin Impex Pvt Ltd., BASF SE, Cargill, Incorporated, dsm-firmenich, EW Nutrition, Impextraco NV, Kemin Industries, Inc, Nutrex, Olmix, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the feed mycotoxin detoxifiers market from 2020-2034.

- The feed mycotoxin detoxifiers market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the feed mycotoxin detoxifiers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The feed mycotoxin detoxifiers market was valued at USD 2.8 Billion in 2025.

The feed mycotoxin detoxifiers market is projected to exhibit a CAGR of 5.93% during 2026-2034, reaching a value of USD 4.9 Billion by 2034.

The feed mycotoxin detoxifiers market is driven by increasing awareness of mycotoxin contamination in animal feed, growing demand for safe and healthy livestock products, regulatory requirements, and the need for improved animal health and productivity, all of which contribute to the market's expansion.

In 2025, Asia Pacific dominated the feed mycotoxin detoxifiers market accounting for 35.5% of the total market share, driven by the region's large livestock industry, increasing awareness of mycotoxin contamination, rising demand for safe animal products, and stringent regulations regarding animal health and feed quality in key countries like China and India.

Some of the major players in the global feed mycotoxin detoxifiers market include Adisseo, Adiveter, S.L. (Pintaluba group), Alltech, Amin Impex Pvt Ltd., BASF SE, Cargill, Incorporated, dsm-firmenich, EW Nutrition, Impextraco NV, Kemin Industries, Inc, Nutrex, Olmix, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)