Ferromanganese Market Size, Share, Trends and Forecast by Grade, Application, and Region, 2026-2034

Ferromanganese Market Size and Share:

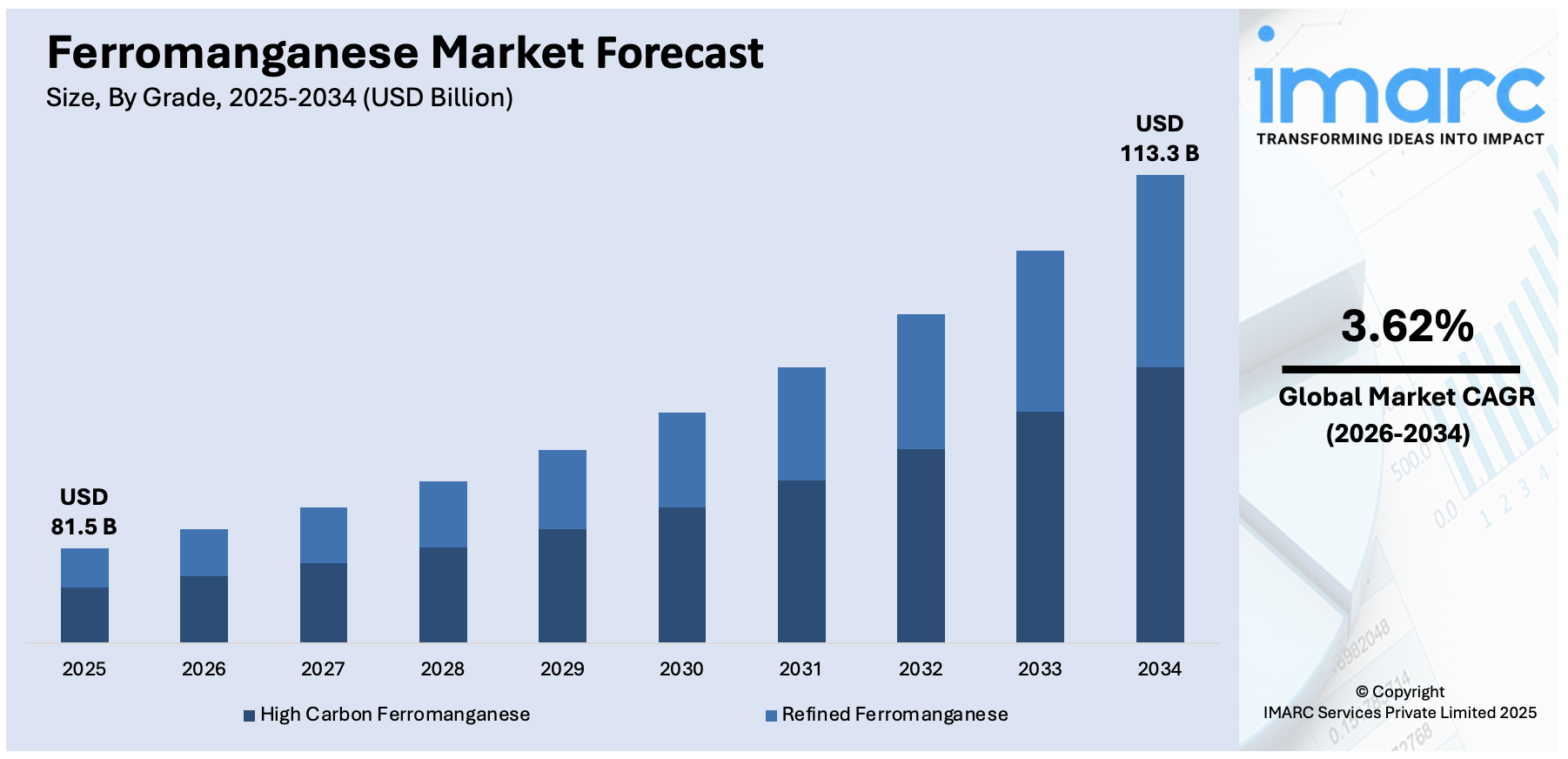

The global ferromanganese market size was valued at USD 81.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 113.3 Billion by 2034, exhibiting a CAGR of 3.62% from 2026-2034. Asia-Pacific currently dominates the market, holding a market share of 38.7% in 2025. Increasing industrialization activities are fueling the market growth. Besides this, the rising vehicle production, which is encouraging the usage of high-strength steel for manufacturing car bodies, engines, and various components, is contributing to the expansion of the ferromanganese market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 81.5 Billion |

|

Market Forecast in 2034

|

USD 113.3 Billion |

| Market Growth Rate 2026-2034 | 3.62% |

Presently, the market is growing steadily due to the essential role of ferromanganese in steel manufacturing. It acts as a deoxidizing and desulfurizing agent, making it vital for producing strong and high-quality steel. Besides this, as construction and infrastructure projects are expanding, the demand for steel is rising, which is creating the need for ferromanganese. The automotive industry is also supporting this market growth by requiring durable steel components. Rapid industrialization in developing countries is further boosting alloy utilization. Additionally, technological improvements in steelmaking are enhancing the effectiveness of ferromanganese, making it more valuable.

To get more information on this market Request Sample

The United States has emerged as a major region in the ferromanganese market owing to many factors. The rising demand from the domestic steel industry is fueling the ferromanganese market growth. Based on CRU's data, US steel output reached 6.7 Million Metric Tons in December 2024, reflecting a 4.8% increase from 6.4 Million Metric Tons in November 2024. The country’s construction, automotive, and manufacturing sectors rely heavily on high-quality steel, creating the need for ferromanganese as a key alloying element. Public infrastructure projects, including bridges, highways, and transportation systems, are further increasing steel usage. Technological advancements in steelmaking are encouraging the employment of specialized ferromanganese grades for enhanced performance. Additionally, the defense and energy sectors are contributing to consistent demand for durable and corrosion-resistant steel alloys.

Ferromanganese Market Trends:

Rapid industrialization activities

Rising industrialization activities are impelling the market growth. As per the United Nations Industrial Development Organization, in 2023, worldwide industrial sectors experienced a 2.3% increase, underscoring the strong industrialization taking place across the globe. As industries are expanding, the need for durable and high-strength steel is increasing, especially in construction, machinery, and transportation. Ferromanganese is a vital additive in steel production because it improves strength, hardness, and resistance to wear. Industrial growth in developing nations is leading to large-scale infrastructure projects, which are further boosting steel usage and, in turn, the demand for ferromanganese. Manufacturing plants, industrial facilities, and power generation projects also require robust steel components, adding to the market growth. Additionally, industrialization supports the development of railways, ports, and roads, which rely heavily on steel-based structures. The increasing focus on modernization and urban expansion is supporting the steady rise in industrial activity, reinforcing the need for steel and strengthening the ferromanganese market.

Need for stainless steel

The escalating demand for stainless steel is offering a favorable ferromanganese market outlook. Ferromanganese is used to add manganese, which helps improve the strength, toughness, and corrosion resistance of stainless steel. As stainless steel finds rising applications in industries, such as construction, food processing, and medical devices, the need for ferromanganese is increasing. Stainless steel’s popularity, driven by its durability, versatility, and resistance to rust, is driving its demand in both developed and developing regions. The rapid expansion of infrastructure and manufacturing activities is further creating the need for stainless steel, strengthening the market. As industries are focusing on producing high-performance materials for long-lasting products, the role of ferromanganese is becoming critical in meeting the requirements of stainless steel production. As per a report published by the IMARC Group, the global stainless steel market is set to grow at a CAGR of 5.08% during 2025-2033.

Growing vehicle production

Rising vehicle production is bolstering the market growth. Ferromanganese is essential in steelmaking because it improves the strength, durability, and corrosion resistance of the steel used in vehicles. As the demand for vehicles is increasing, the need for high-quality steel is rising, thereby driving the demand for ferromanganese. Automakers are focusing on producing lighter, stronger, and more fuel-efficient vehicles, which requires advanced steel alloys, further increasing the reliance on ferromanganese. Additionally, the shift towards electric vehicles (EVs), which also require durable steel for battery enclosures and structural components, is adding to the demand for ferromanganese. Besides this, the expansion of automotive retail channels is positively influencing the market. According to the Federation of Automobile Dealers Associations (FADA), automobile sales at retail rose by 9% in 2024.

Ferromanganese Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ferromanganese market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on grade and application.

Analysis by Grade:

- High Carbon Ferromanganese

- Refined Ferromanganese

High carbon ferromanganese held 77.5% of the market share in 2025. It is widely used in the steel industry for its strong deoxidizing and desulfurizing properties. It contains a high percentage of manganese and carbon, making it highly effective in improving the strength, hardness, and durability of steel. Steel manufacturers prefer high carbon ferromanganese because it is cost-effective and suitable for the mass production of carbon and structural steels. It is commonly used in the production of construction steel, rails, shipbuilding materials, and automotive components. Its widespread utilization in both primary and secondary steelmaking is further supporting its dominant market share. The availability of raw materials and established manufacturing processes are also making the production of high carbon ferromanganese more efficient. Moreover, high carbon ferromanganese easily integrates into various stages of steel production without requiring extensive processing. Its ability to meet the consistent quality and performance requirements of large-scale industries keeps demand high.

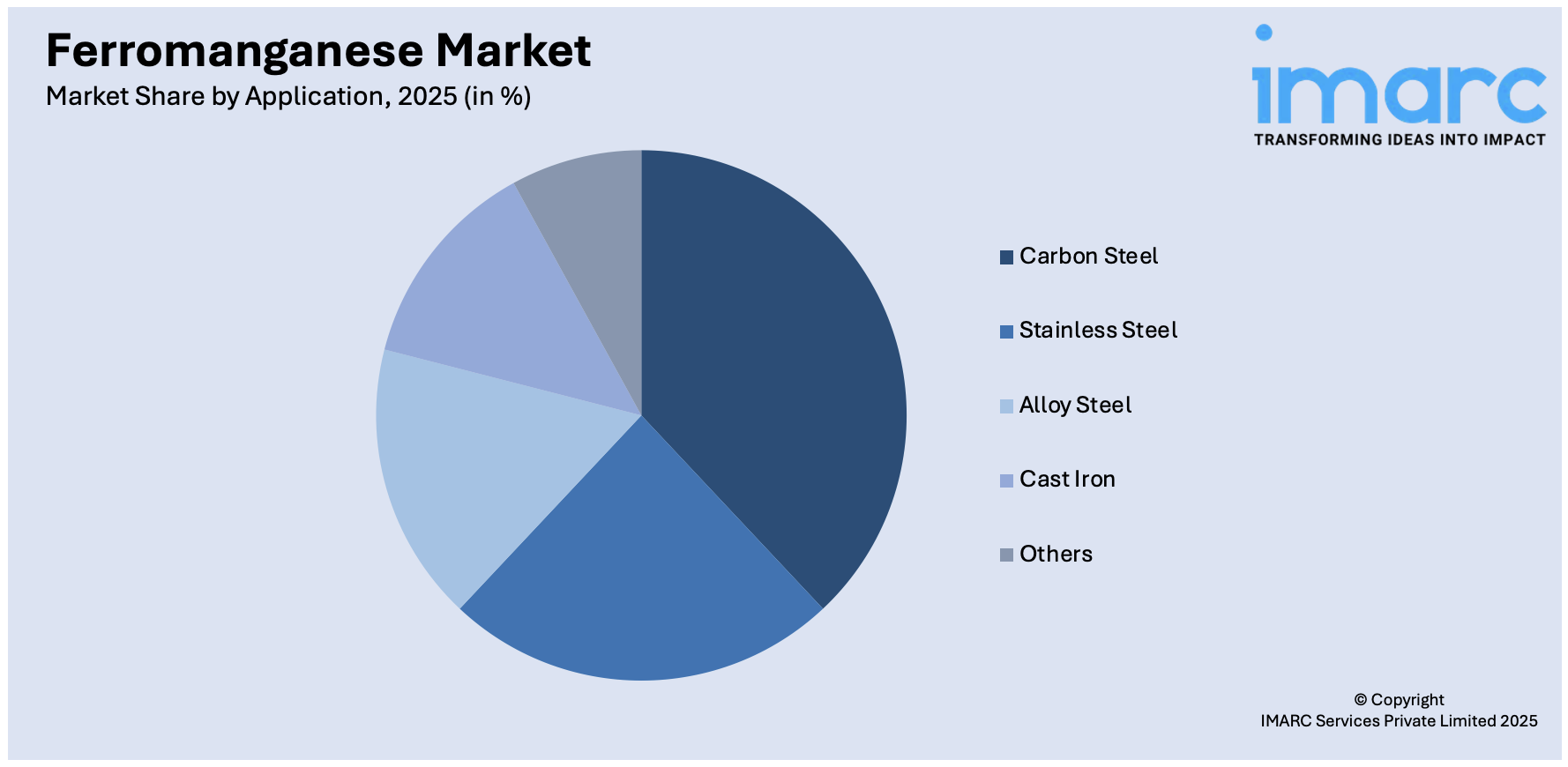

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

Carbon steel is the most widely produced and used type of steel across various industries. Ferromanganese plays an important role in carbon steel production by removing oxygen and sulfur impurities and improving the mechanical strength, hardness, and wear resistance of the final product. Industries, such as construction, automotive, infrastructure, shipbuilding, and heavy machinery, depend heavily on carbon steel for its strength, cost-effectiveness, and versatility. Ferromanganese enhances these properties, making it an essential additive in carbon steel manufacturing. According to the ferromanganese market forecast, the high demand for carbon steel in residential and commercial construction, along with public infrastructure development, will aid in strengthening the market. Carbon steel is also used in pipelines, bridges, tools, and appliances, which depend on consistent material performance. This widespread and essential utilization ensures that carbon steel remains the leading application segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 38.7%, enjoys the leading position in the market. The region is noted for its high steel production and rapid industrial activities. Nations like Japan, China, India, and South Korea have well-established manufacturing and construction bases that rely heavily on steel, driving the demand for ferromanganese. As per the IMARC Group, Japan construction market size reached USD 625.4 Billion in 2024. The region hosts some of the world’s largest steel producers, which employ ferromanganese in large volumes for deoxidizing and alloying processes. Rapid urbanization activities, infrastructure development, and a thriving automotive industry are further boosting steel employment. In addition, the area is benefiting from the abundant availability of manganese ore and lower production costs, which are supporting domestic ferromanganese manufacturing. Governments in the region are investing heavily in industrial expansion and public infrastructure, creating a sustained need for steel and related materials. The presence of integrated supply chains is also strengthening the region’s dominance.

Key Regional Takeaways:

United States Ferromanganese Market Analysis

The United States holds 80.10% of the market share in North America. The United States market is primarily driven by the steel and foundry industries, where the alloy plays a significant role in deoxidizing and desulfurizing molten steel and improving the strength, hardness, and durability of finished products. As per industry reports, during the week ending April 26, 2025, raw steel production in the United States hit 1,706,000 net Tons, while the capacity utilization rate rose to 76.0%, showing a 1.4% increase from the week ending April 19, 2025, and a 0.6% rise compared to the corresponding week in 2024. As the demand for high-quality steel is growing in construction, automotive, shipbuilding, and energy infrastructure projects, the employment of ferromanganese is increasing. The rising emphasis on stronger and more lightweight vehicle components in the automotive sector is also creating the need for specific steel grades requiring manganese-based alloys. Additionally, the ongoing development of pipelines, bridges, and transportation networks is contributing substantially to industry expansion. The thriving foundry industry is further driving the demand, as ferromanganese is essential in casting applications where precision and material performance are critical. Technological advancements in steelmaking and alloy customization are also influencing the market landscape, allowing manufacturers to fine-tune compositions based on end-user requirements.

Europe Ferromanganese Market Analysis

In Europe, the market is experiencing robust growth, fueled by emerging trends in advanced manufacturing and material innovations. The emphasis on enhanced durability and performance in industrial machinery, construction equipment, and tools has led to a rising demand for specialty steels, which often require higher concentrations of manganese alloys. The emphasis on circular economy practices in the region has also increased the use of scrap-based steelmaking, which necessitates precise alloy additions, including ferromanganese, to maintain material consistency. Moreover, the region's shift towards digitalization and automation in heavy industries is creating the need for specialized steel components that are wear-resistant and structurally stable, further stimulating ferromanganese utilization. Additionally, the increasing adoption of EVs and sustainable energy systems is driving the demand for specialized steel alloys, increasing the relevance of ferromanganese. According to industry reports, in 2022, EVs represented 80% of total passenger car sales in Norway. In Sweden, EVs held 32%, whereas in the Netherlands, they constituted 24% of total passenger vehicle sales during that year. Other than this, economic stability across key European countries is also providing a conducive environment for industrial production, sustaining a consistent market for ferromanganese in Europe.

Asia-Pacific Ferromanganese Market Analysis

In the Asia-Pacific region, the market is expanding due to increasing demand for high-performance steel in emerging sectors like renewable energy, shipbuilding, and railway development. The diversification of infrastructure projects into more complex and large-scale engineering, such as high-speed rail networks and offshore energy installations, is creating the need for specialized steel grades, boosting the use of ferromanganese for its strengthening and anti-corrosive properties. Additionally, the region’s strong manufacturing base, particularly in automotive and machinery production, is contributing substantially to consistent ferromanganese utilization owing to its role in enhancing the strength and wear resistance of steel components. Besides this, the rise in domestic steel production capacities, combined with growing exports, is also driving the demand for ferromanganese in the Asia-Pacific region. According to the IBEF, in FY24, India's finished steel exports and imports were 7.49 MT and 8.32 MT, respectively. The government implemented several measures to enhance the sector, such as launching the National Steel Policy 2017 and permitting 100% foreign direct investment (FDI) in the steel industry through the automatic route.

Latin America Ferromanganese Market Analysis

The Latin America market is significantly influenced by the region’s abundant mineral resources and increasing demand for steel in infrastructure and construction activities. As countries are expanding transportation networks, residential projects, and industrial facilities, the need for steel, particularly alloyed with ferromanganese to enhance strength and durability, is steadily rising. Brazil has become the largest steel manufacturer in Latin America and the ninth highest in the world, operating 21 steel plants with a steel capacity of 44 MT, as per industry reports. The region’s increasing participation in the international steel trade is supporting consistent alloy demand. The mining and heavy equipment sectors are also contributing substantially to industry expansion, as they require high-strength and wear-resistant steel components that depend on ferromanganese in their production.

Middle East and Africa Ferromanganese Market Analysis

In the Middle East and Africa region, the market is witnessing expansion due to the growing demand for alloyed steel in mining, cement, and mineral processing industries, which are key economic sectors in the region. These industries require machinery and structural components with high strength and wear resistance, encouraging the use of ferromanganese in steel manufacturing. Additionally, expanding urbanization activities and investments in energy and utility infrastructure are also contributing to the need for high-performance steel, reinforcing ferromanganese’s role in the region’s industrial growth. According to estimates, 45% of the population in Africa resided in urban areas in 2023, equating to 698,148,943 individuals. Besides this, the region’s expanding trade networks and export activities in semi-finished and finished steel products are catalyzing demand for ferromanganese as it is a critical input in maintaining quality standards.

Competitive Landscape:

Key players are working to develop innovative products to meet the high demand. They are investing in modern manufacturing processes that improve product quality, efficiency, and environmental compliance. These companies ensure a steady supply of ferromanganese by securing access to manganese ore and maintaining integrated supply chains. They also focus on meeting the evolving needs of the steel industry by developing customized alloy solutions. Through partnerships with steel manufacturers and infrastructure developers, key players are expanding their market presence and influence. Their research and development (R&D) efforts are supporting the creation of advanced grades of ferromanganese for high-performance applications. Additionally, they play a vital role in stabilizing prices and ensuring product availability in both domestic and international markets. For instance, in October 2024, Menar, the South African mining firm, revealed intentions to invest around R 1.8 Billion for the creation of a ferromanganese production plant within the mineral-rich Bushveld Complex in South Africa. This followed Khwelamet, a branch of Khwela Capital, which was owned by Menar Capital and Ntiso Investment Holdings, signing a binding agreement to purchase Samancor's Metalloys manganese alloy smelting plant in Gauteng Province.

The report provides a comprehensive analysis of the competitive landscape in the ferromanganese market with detailed profiles of all major companies, including:

- China Minmetals Group Co. Ltd.

- Eramet Group

- Eurasian Resources Group

- Ferroglobe (Grupo Villar Mir, S.A.U.)

- Gulf Manganese Corporation Limited

- Jiaocheng Yiwang Ferroalloy Co Ltd.

- OM Holdings Ltd.

- Sakura Ferroalloys Sdn. Bhd. (Assmang Proprietary Limited)

- South32

- Tata Steel Ltd.

- Vale S.A.

Latest News and Developments:

- March 2025: Jindal Stainless Steel revealed intentions to spend INR 40,000 Crore to set up a stainless steel manufacturing facility in Maharashtra to support the company's growth initiatives in India. The company submitted an investment proposal to the Maharashtra government, which was approved during a meeting of a state cabinet subcommittee. The suggested project is set to be developed over the next decade and is expected to create more than 15,000 jobs in the area.

- March 2025: Yongjin Corporation, the Chinese steel producer, revealed the establishment of a joint venture (JV) with Hainan Fuxinhui Investment from China and Lahne Holdings from Singapore in Yalova, Turkey. The partnership, provisionally named CANDAR, was set to build a cold-rolled stainless steel plant in Turkey with a capacity of 400,000 Metric Tons annually. The production facility is anticipated to start manufacturing in two years.

- November 2024: Angola's manganese-to-silica processing plant, currently being built, announced that it was set to start operations in 2025. The construction of the facility was being undertaken by Angolan firm MN Kitota alongside the Chinese company ST New Materials Lda and the fuel supplier Kwanza-Norte Fuel Facilities. The factory aimed to produce silica manganese in its initial phase, then transition to ferromanganese, fertilizers, ferrosilicon, and pig iron in the subsequent stages. The facility is anticipated to create 1000 new jobs in the area by the middle of 2025.

Ferromanganese Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | High Carbon Ferromanganese, Refined Ferromanganese |

| Applications Covered | Carbon Steel, Stainless Steel, Alloy Steel, Cast Iron, Others |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | China Minmetals Group Co. Ltd., Eramet Group, Eurasian Resources Group, Ferroglobe (Grupo Villar Mir, S.A.U.), Gulf Manganese Corporation Limited, Jiaocheng Yiwang Ferroalloy Co Ltd., OM Holdings Ltd., Sakura Ferroalloys Sdn. Bhd. (Assmang Proprietary Limited), South32, Tata Steel Ltd. and Vale S.A |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ferromanganese market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ferromanganese market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ferromanganese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ferromanganese market was valued at USD 81.5 Billion in 2025.

The ferromanganese market is projected to exhibit a CAGR of 3.62% during 2026-2034, reaching a value of USD 113.3 Billion by 2034.

Rapid urbanization activities and the expansion of infrastructure projects worldwide are leading to higher steel usage, creating the need for ferromanganese. The automotive and construction sectors are further contributing to the market growth due to their reliance on strong and durable steel. Moreover, technological advancements in steelmaking processes enhance the importance of high-quality ferromanganese in achieving specific material properties.

Asia-Pacific currently dominates the ferromanganese market, accounting for a share of 38.7% in 2025, driven by high steel production, rapid industrial growth, and strong demand from the construction and automotive sectors. The region is benefiting from abundant raw materials, low manufacturing costs, and the presence of major steel-producing countries like China and India.

Some of the major players in the ferromanganese market include China Minmetals Group Co. Ltd., Eramet Group, Eurasian Resources Group, Ferroglobe (Grupo Villar Mir, S.A.U.), Gulf Manganese Corporation Limited, Jiaocheng Yiwang Ferroalloy Co Ltd., OM Holdings Ltd., Sakura Ferroalloys Sdn. Bhd. (Assmang Proprietary Limited), South32, Tata Steel Ltd., Vale S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)