Fiberglass Market Size, Share, Trends and Forecast by Glass Product Type, Glass Fiber Type, Resin Type, Application, End User, and Region, 2025-2033

Fiberglass Market Size and Share:

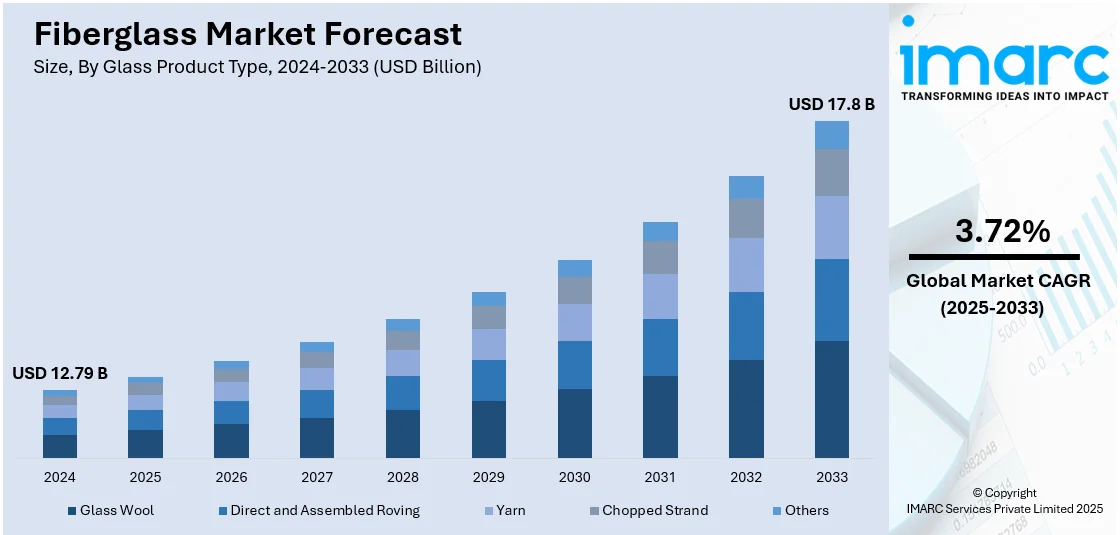

The global fiberglass market size was valued at USD 12.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.8 Billion by 2033, exhibiting a CAGR of 3.72% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 48.6% in 2024. The expanding building sector, the automobile and aerospace industries’ growing need for lightweight materials, several renewable energy projects, and the rising focus on environmentally friendly production methods are some of the major factors expanding the fiberglass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.79 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Market Growth Rate (2025-2033) | 3.72% |

The market is significantly influenced by the rapid urbanization and the push for smart city initiatives, which are increasing the use of fiberglass in advanced construction materials. With the United Nations estimating that 55% of the global population currently lives in cities and projecting this figure to reach 68% by 2050, the demand for durable, lightweight, and energy-efficient materials like fiberglass is expected to rise, particularly in infrastructure, insulation, and reinforced composites. The rising adoption of fiberglass in electric vehicles (EVs) for lightweight structural components and battery enclosures is driving fiberglass market growth. Augmenting demand for fiberglass-reinforced pipelines in desalination plants also supports its application in water infrastructure. Additionally, rising investments in offshore wind energy projects contribute to higher consumption of wind turbine blades. In addition to this, the integration of fiberglass composites in hydrogen storage tanks aligns with the energy transition, which is also a significant growth-inducing factor for the market.

The US market is witnessing considerable growth on account of upgrading the existing railway infrastructure and expansion of high-speed rail networks. In addition to this, rising investments in green buildings and sustainable construction are driving the use of energy-efficient fiberglass insulation. An industry report shows that 34% of American companies currently focus on green buildings, with 46% set to implement them in the future. Such increased emphasis on sustainability will fuel demand for fiberglass-based insulation and composite materials, considering their high thermal performance, durability, and recyclability, further cementing the strength of the market growth. The U.S. Increasing Department of Defense procurement of advanced composite materials for aerospace and naval use is leading to fiberglass market demand. In addition, increased interest in corrosion-resistant fiberglass in chemical processing facilities is expanding its industrial uses. The expansion of fiber-optic networks in telecommunications is also accelerating fiberglass usage.

Fiberglass Market Trends:

Renewable Energy Sector's Demand for Wind Turbine Blades

Fiberglass is extensively used in the production of wind turbine blades due to its high strength, durability, and resistance to corrosion. The global shift towards clean and sustainable energy sources leads to a rapid increase in wind energy installations. As a result, the demand for fiberglass in the manufacturing of wind turbine blades is witnessing significant growth. The demand for wind energy is on the rise, with global wind power capacity reaching 1,021 GW in 2023, a 13% increase from the previous year, according to the Global Wind Energy Council (GWEC). Increased length, reduced weight, and enhanced aerodynamics are a few benefits of fiberglass blades, which raise the efficiency of energy production. The increasing need for fiberglass in the renewable energy industry is a result of continued investments in wind power projects, government assistance, and advantageous laws meant to lower carbon emissions.

Growing Construction Industry

The expanding construction industry, particularly in emerging economies, is positively influencing the fiberglass market outlook. Fiberglass is widely used in construction for various applications, including insulation, roofing, and reinforcement. The material's excellent strength-to-weight ratio and insulation properties make it an ideal choice for construction projects. Emerging economies are also contributing to this surge. India's construction industry, for example, is the third-largest employer in the country, contributing 8% to its Gross Domestic Product (GDP), as per an industry report. Similarly, China's construction market is the largest globally, accounting for over 20% of global construction output. In addition, fiberglass offers durability, resistance to corrosion, and versatility in design, enabling architects and engineers to create innovative structures. With the increasing urbanization and infrastructure development in countries like China, India, and Brazil, the demand for fiberglass in the construction industry is on the rise.

Automotive Industry Shift towards Lightweight Materials

The automotive industry's emphasis on fuel efficiency and reducing emissions results in a growing demand for lightweight materials, including fiberglass, which is increasing the fiberglass market demand. Fiberglass is being increasingly used in the manufacturing of automotive components such as body panels, interiors, and structural reinforcements. Its high strength, coupled with its lightweight nature, helps to reduce the overall weight of vehicles without compromising on safety and performance. This results in improved fuel efficiency and lower carbon emissions. As electric vehicle (EV) production rises, the need for lightweight materials is intensifying, with EV sales reaching 14 million units in 2023, a 35% increase over 2022 sales, as per reports. Additionally, fiberglass offers design flexibility, enabling automakers to create complex shapes and aerodynamic designs. As the automotive industry continues to focus on sustainability and efficiency, the demand for fiberglass is expected to witness substantial growth.

Fiberglass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fiberglass market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on glass product type, glass fiber type, resin type, application, and end user.

Analysis by Glass Product Type:

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

Direct and assembled roving leads the market in 2024. Both of these product types serve different applications in their construction and processing types. Direct roving is continuous glass filaments coated with a sizing agent. It allows superior tensile strength, uniformity, and good compatibility with many resin systems. It is used widely in pultrusion, filament winding, and weaving processes. It is crucial in applications in the wind energy, automotive, and aerospace sectors. Assembled roving, on the other hand, consists of filament strands pooled together, provides added bulk and flexibility in process capabilities, suitable for spray-up, compression molding, and sheet molding compound (SMC) applications. It is preferred when manufacturing large, complex structures such as boats, storage tanks, and construction panels. Both product types are now experiencing increased demand resulting from the increased use of lightweight, high-performance composite materials in infrastructure, transportation, and renewable energy sectors.

Analysis by Glass Fiber Type:

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

E-glass leads the market with around 67.6% of market share in 2024 due to its excellent balance of mechanical, electrical, and chemical properties. E-glass consists primarily of silica but contains alumina, calcium oxide, and boron oxide. Hence it has a good tensile strength, lightweight, moisture and chemical resistance, making it the preferred reinforcement in applications in a myriad of industries such as automotive, aerospace, wind energy, and construction. Its dielectric characteristics are also suitable for use as electrical insulation. For the marine and infrastructure sectors, E-glass is integral to corrosion-resistant composites for pipes, tanks, and structural reinforcements. It is cost-effective, compared with high-performance materials like S-glass or carbon fiber, and has already collected much acceptance for the composite. With development now shifting more towards light weight and extremely long-lasting materials, E-glass is playing a very important part in the fiberglass market.

Analysis by Resin Type:

- Thermoset Resin

- Thermoplastic Resin

Thermoset resins are widely used in the fiberglass market. These resins undergo a chemical reaction when cured, resulting in a rigid and durable material. The most common thermoset resins used in fiberglass applications are polyester and epoxy. Polyester resins offer good corrosion resistance and are commonly used in industries such as construction, marine, and automotive. Epoxy resins provide high mechanical strength, excellent adhesion, and chemical resistance, making them suitable for applications in aerospace, electrical, and composite manufacturing.

Thermoplastic resins are another category of glass resins used in fiberglass. Unlike thermoset resins, thermoplastics can be melted and re-molded multiple times without undergoing significant chemical changes. This property allows for easy processing and recycling. Examples of thermoplastic resins used in fiberglass applications include polypropylene (PP), polyethylene terephthalate (PET), and polyamide (PA). Thermoplastic resins find applications in industries such as automotive, consumer goods, and packaging.

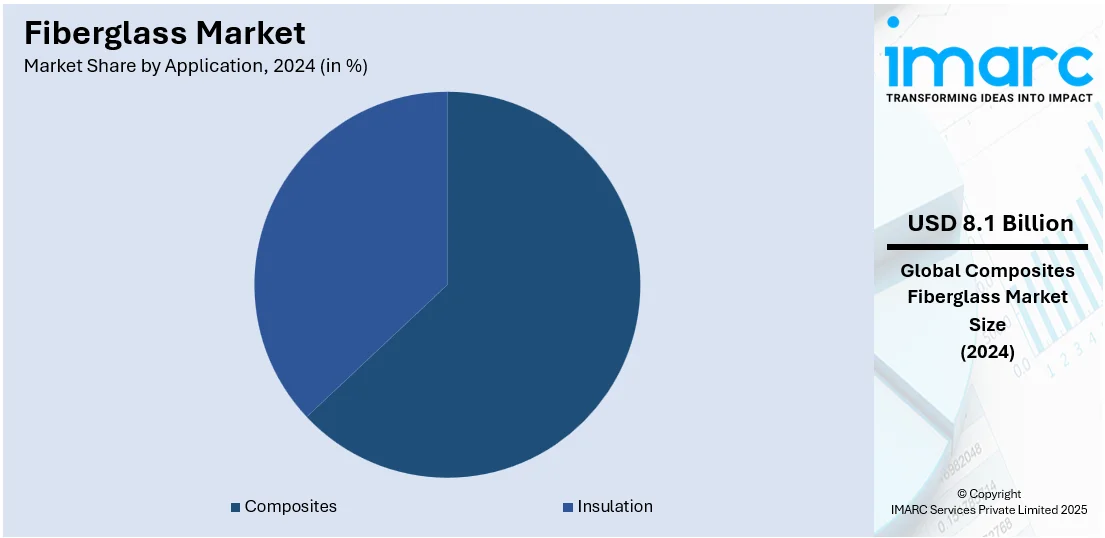

Analysis by Application:

- Composites

- Insulation

Composite leads the market with around 63.2% of market share in 2024, leveraging fiberglass’s strength, durability, and lightweight properties to enhance material performance across multiple industries. Fiberglass-reinforced composites excel in mechanical strength, corrosion resistance, and thermal stability, thus playing an important part in the aerospace, automotive, wind energy, marine, and construction sectors. In transport, composites solve the problem of weight in vehicles, resulting in greater fuel economy and lower emissions. Fiberglass blades are used in wind energy for very robust turbine blades. Fiberglass is used in reinforced concrete, panels, and insulation for structural integrity in construction. All of these applications use fiberglass composites for their ability to withstand wet and extreme environmental conditions. With the increased demand for high-performance and sustainable materials, fiberglass composites are becoming even more established as substitutes for conventional metals and plastics while providing manufacturers with a cost-effective solution to flexible and long-term durable designs.

Analysis by End User:

- Construction

- Automotive

- Wind Energy

- Aerospace and Defense

- Electronics

- Others

Automotive leads the market in 2024. The sector utilizes fiberglass's lightweight, high-strength, and corrosion-resistant properties to enhance vehicle performance, fuel efficiency, and safety. Fiberglass-reinforced composites replace traditional metals in various components, including body panels, hoods, bumpers, and structural reinforcements, helping manufacturers meet stringent emission regulations by reducing overall vehicle weight. In electric vehicles (EVs), fiberglass plays an important role in battery enclosures, insulation materials, and other areas, all aimed at better thermal management and safety. The ability of the material to be molded into complex shapes makes it suitable for innovative automotive design with durability at a low cost. Even as the industry heads towards the path of sustainability, fiberglass composites show potential merit in producing recyclable and energy-efficient vehicle components that will deepen their value for next-generation automotive manufacturing.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

In 2024, Asia Pacific accounted for the largest market share of over 48.6% due to its booming industrial growth, rapid urbanization, and increased infrastructure development. As home to some of the world's fastest-growing economies like China and India, the region has seen an amplified demand for fiberglass in various sectors, including automotive, construction, and electronics. The automotive sector, particularly, is experiencing swift expansion due to increased vehicle production and a push for lightweight, fuel-efficient materials. The construction industry, on the other hand, is propelled by urbanization and the demand for durable, lightweight, and corrosion-resistant materials. Additionally, favorable government policies and low manufacturing costs in the region foster local production and attract international companies. Besides this, the high population in the region, combined with growing disposable incomes, is driving consumer demand, thereby fueling the market further.

Key Regional Takeaways:

United States Fiberglass Market Analysis

The United States holds a substantial share of the North American fiberglass market at 85.80% in 2024. The US fiberglass industry is growing as a result of mounting demand from construction, automotive, and renewable energy industries. Industrial reports state that the U.S. manufactured around 1.2 million metric tons of fiberglass in recent years, with local producers aiding infrastructure development and lightweight vehicle parts. Lightweight materials are enhancing fuel efficiency in the automotive sector, thereby increasing the demand for fiberglass-reinforced plastics. The wind energy profession has become one of the major consumers of fiberglass, especially in Texas and California, due to the material's very high strength-to-weight ratio. The demand in the wind energy industry is increasing, as fiberglass is critical for blade uses in turbines. In addition, environmental regulations promote the use of fiberglass over competing materials since it is popular for its ability to be recycled and durability. Government programs encouraging energy efficiency also contribute to market expansion, especially in applications involving insulation. Top local players are emphasizing technology development to increase product longevity and sustainability.

Europe Fiberglass Market Analysis

The strict environmental regulations and high industrial demand foster the growth of the fiberglass market in Europe, especially in Germany, France, and the United Kingdom. The construction sector is the major consumer as it uses fiberglass mainly in energy-efficient building scenarios to comply with the EU sustainability goals. Automotive manufacturers like Germany and Italy are increasing their composites' use of fiberglass in new applications to cut vehicle weight and emissions. According to an industrial report, Germany is central to the production of the region with a yearly fiberglass production capacity of about 700,000 metric tons. Its robust industrial foundation and emphasis on advanced composite materials fuel growth and innovation in the market. Moreover, the renewables sector, wind energy in particular, is most influenced by countries such as Denmark and Spain, in that fiberglass is used as one of the main constituents in turbine blade manufacture. Top producers are targeting high-performance composites for fulfilling increasing needs for strong, lightweight materials. With increased infrastructure developments and efforts towards cleaner alternatives, Europe is still a leading force in the international fiberglass market.

Asia Pacific Fiberglass Market Analysis

The Asia Pacific market dominates the international fiberglass market led by China, the largest global producer of fiberglass. China dominates global fiberglass production, supported by low manufacturing costs and large-scale industrial applications. According to an industrial report, China provides almost 60% of global fiberglass production capacity with an approximate 5.4 million metric tons annually as of 2021. Strong demand from principal industries such as construction, the automotive sector, and wind energy drives this supremacy. Sustained demand comes from the nation's mass infrastructure developments as well as an increase in demand for renewable energy. India also emerges as an important contributor with increasing investments to fiberglass production supporting its burgeoning construction and manufacturing bases. Rapid industrialization, urbanization, as well as state drives favoring indigenous manufacturing and export are bolstering the region. There are also continuing R&D initiatives supporting breakthroughs in high-performance fiberglass composites. With high domestic demand and increasing global exports, Asia Pacific is still the focal point for fiberglass manufacturing, guaranteeing sustained market growth in the next few years.

Latin America Fiberglass Market Analysis

Latin America's fiberglass market is expanding due to rising demand from the construction, automotive, and wind power industries. Brazil leads the region, with a solid manufacturing industry and growing exports. In 2022, as per the Observatory of Economic Complexity (OEC), Brazil shipped glass fibers worth USD 59.1 Million, primarily to Argentina and the United States. Domestic infrastructure development and an increasing industrial base underpin the nation's fiberglass manufacturing. Mexico is also proving to be a large market, with increasing investment in the use of fiberglass composites in light automobile parts. The region's growing use of renewable energy, especially wind power, also fuels demand for fiberglass materials. Government policies encouraging local manufacturing and green building materials also add to market growth. With a mix of domestic consumption and export-led growth, Latin America is consolidating its position in the international fiberglass market.

Middle East and Africa Fiberglass Market Analysis

Middle East and Africa fiberglass market is growing with increasing construction, infrastructure, and industrial uses. As per SASAC, as of 2023, Africa is experiencing increased presence in fiberglass manufacturing, with Egypt becoming a prominent manufacturing base. The inauguration of "Africa's largest fiberglass base" in Egypt, constructed by a Chinese firm, is a big boost to the sector. This plant has an annual output capacity of as much as 340,000 metric tons, with an emphasis on fiberglass tanks and wire drawing production lines. The Middle East region, especially the UAE and Saudi Arabia, is also committing to manufacturing fiberglass to finance the region's infrastructure boom as well as industrial development. Government policies supporting energy efficiency as well as sustainable building products are also spurring demand. Moreover, growing uses in desalination plants, oil and gas, and renewable energy industries drive market growth. With growing domestic production and strategic investments, the region is consolidating its position in the international fiberglass market.

Competitive Landscape:

The key players in the market are continuously investing in research and development activities to innovate and introduce new fiberglass products. They focus on developing advanced fiberglass materials with improved strength, durability, and performance characteristics to cater to the evolving needs of various industries. This includes the development of specialized fiberglass composites, high-performance insulation materials, and lightweight components for applications in automotive, aerospace, and construction sectors. Additionally, companies in the market are engaging in mergers, acquisitions, and collaborations to strengthen their product portfolios, expand their customer base, and enhance their manufacturing capabilities. These strategic moves allow companies to gain access to new technologies, markets, and distribution networks. By acquiring or partnering with complementary businesses, key players can offer comprehensive solutions and expand their global reach. Besides this, key players are forming partnerships and collaborations with other companies, research institutes, and industry associations to foster innovation, exchange expertise, and develop novel fiberglass solutions. These collaborations help in leveraging combined strengths and resources to address market demands more effectively.

The report provides a comprehensive analysis of the competitive landscape in the fiberglass market with detailed profiles of all major companies, including:

- Asahi Fiber Glass Co. Ltd. (Yoshino Gypsum Co. Ltd.)

- Braj Binani Group

- China Jushi Co. Ltd.

- Chongqing Polycomp International Corp. (Yuntianhua Group Co. Ltd.)

- Compagnie De Saint-Gobain S.A.

- Johns Manville (Berkshire Hathaway Inc.)

- Knauf Insulation

- Nippon Electric Glass Co. Ltd.

- Owens Corning

- PFG Fiber Glass Corporation (Nan Ya Plastics Corporation)

- Taishan Fiberglass Inc (Sinoma Science & Technology Co. Ltd.)

- Taiwan Glass Industry Corporation

Recent Developments:

- September 2024: Owens Corning is evaluating strategic alternatives for its global glass fiber reinforcements business, including a potential sale or spin-off. The unit, generating USD 1.3 Billion annually, operates in 11 countries with 18 facilities, supplying wind energy, infrastructure, industrial, transportation, and consumer markets.

- September 2024: Johns Manville emphasizes its ongoing commitment to fiberglass recycling, focusing on reducing glass fiber waste and promoting sustainable practices across its composites operations, regardless of location.

- September 2024: Knauf Insulation launched its Performance+™ fiberglass insulation portfolio at the 2024 ICAA Convention. The CERTIFIED asthma & allergy friendly® and Verified Healthier Air™ product line enhances thermal and acoustic performance, reinforcing Knauf’s commitment to indoor air quality and energy efficiency in residential construction.

- February 2023: Saint-Gobain announced the acquisition of India-based UP Twiga Fiberglass, a glass wool insulation firm with two manufacturing sites. UP Twiga has been a Saint-Gobain licensee since 2005. The deal, expected to close in Q1 2023, strengthens Saint-Gobain’s position in India’s insulation and facade solutions market.

Fiberglass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Product Types Covered | Glass Wool, Direct and Assembled Roving, Yarn, Chopped Strand, Others |

| Glass Fiber Types Covered | E-Glass, A-Glass, S-Glass, AR-Glass, C-Glass, R-Glass, Others |

| Resin Types Covered | Thermoset Resin, Thermoplastic Resin |

| Applications Covered | Composites, Insulation |

| End Users Covered | Construction, Automotive, Wind Energy, Aerospace and Defense, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico, Saudi Arabia, UAE |

| Companies Covered | Asahi Fiber Glass Co. Ltd. (Yoshino Gypsum Co. Ltd.), Braj Binani Group, China Jushi Co. Ltd., Chongqing Polycomp International Corp. (Yuntianhua Group Co. Ltd.), Compaigne De Saint-Gobain S.A., Johns Manville (Berkshire Hathaway Inc.), Knauf Insulation, Nippon Electric Glass Co. Ltd., Owen Corning, PFG Fiber Glass Corporation (Nan Ya Plastics Corporation), Taishan Fiberglass Inc. (Sinoma Science & Technology Co. Ltd.), Taiwan Glass Industry Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fiberglass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global fiberglass market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the fiberglass industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fiberglass market was valued at USD 12.79 Billion in 2024.

The fiberglass market is projected to exhibit a CAGR of 3.72% during 2025-2033, reaching a value of USD 17.8 Billion by 2033.

The market is driven by increasing demand from construction and automotive industries, rising infrastructure development, growing preference for lightweight and durable materials, expanding wind energy sector, advancements in manufacturing technologies, and stringent regulations promoting energy-efficient and sustainable materials in various end-use applications.

Asia Pacific currently dominates the fiberglass market, accounting for a share of 48.6% in 2024. The dominance is fueled by rapid industrialization, increasing construction activities, rising automotive production, expanding renewable energy projects, and strong government support for infrastructure and manufacturing growth across key economies like China and India.

Some of the major players in the fiberglass market include Asahi Fiber Glass Co. Ltd. (Yoshino Gypsum Co. Ltd.), Braj Binani Group, China Jushi Co. Ltd., Chongqing Polycomp International Corp. (Yuntianhua Group Co. Ltd.), Compaigne De Saint-Gobain S.A., Johns Manville (Berkshire Hathaway Inc.), Knauf Insulation, Nippon Electric Glass Co. Ltd., Owen Corning, PFG Fiber Glass Corporation (Nan Ya Plastics Corporation), Taishan Fiberglass Inc. (Sinoma Science & Technology Co. Ltd.), and Taiwan Glass Industry Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)