Filling Equipment Market Size, Share, Trends and Forecast by Sales Type, Process Type, Product Type, End Use Industry, and Region, 2025-2033

Filling Equipment Market Size and Share:

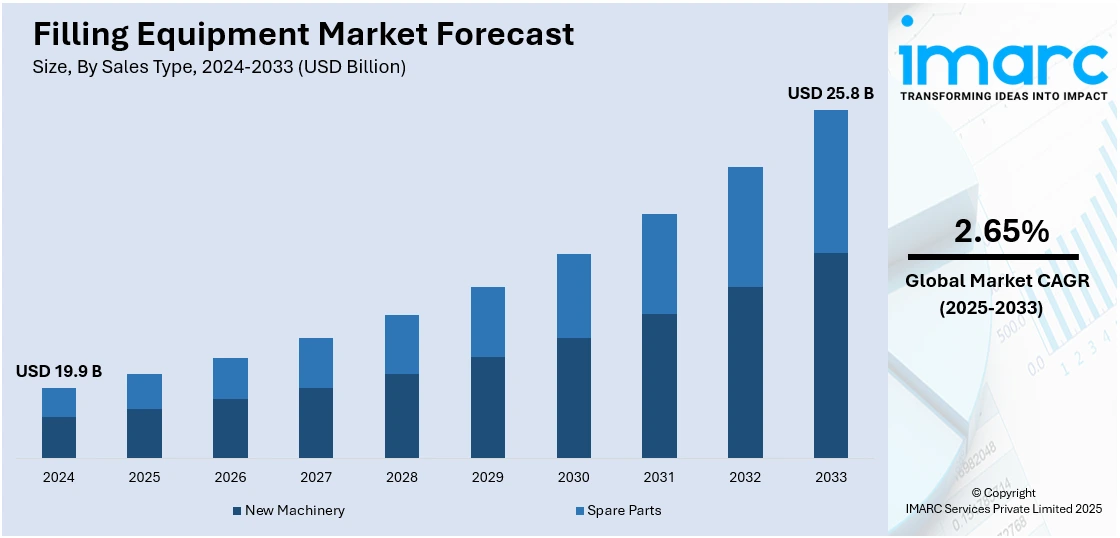

The global filling equipment market size was valued at USD 19.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.8 Billion by 2033, exhibiting a CAGR of 2.65% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.9% in 2024. The market growth in this region is primarily bolstered by notable increase in industrialization, proliferating manufacturing segments, and amplifying need for packaged products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.9 Billion |

|

Market Forecast in 2033

|

USD 25.8 Billion |

| Market Growth Rate (2025-2033) | 2.65% |

The global filling equipment market is chiefly driven by increasing demand for packaged products across food, beverage, pharmaceutical, and personal care industries. For instance, as per industry reports, bottled soft drink consumption in Indian households increased significantly, surpassing 50% annual penetration in FY24. Additionally, premium washing liquids launched by leading FMCG majors exceeded 100,000 tons in FY24, highlighting robust market growth. Moreover, advancements in automation technologies are enhancing operational efficiency and accuracy, fueling the adoption of automatic filling equipment. Rising consumer preference for convenience products and ready-to-consume goods further accelerates market growth. In addition, stringent regulatory standards for product quality and hygiene are boosting the demand for advanced filling systems. Furthermore, expansion in emerging markets, coupled with technological innovations like IoT-enabled equipment, is creating new growth opportunities for manufacturers, supporting the market's steady expansion globally.

The United States holds a significant position in the global filling equipment market, driven by advanced manufacturing capabilities and robust demand across industries such as food and beverages, pharmaceuticals, and cosmetics. The country’s emphasis on automation and precision engineering supports the widespread adoption of automatic filling equipment. Moreover, stringent regulatory standards encourage the use of high-quality, efficient machinery, fostering market growth. The rising demand for packaged goods, particularly in liquid products, further fuels innovation in filling technologies. In addition, the U.S. market benefits from strong research and development initiatives and the presence of key global players, ensuring sustained competitiveness. For instance, in October 2024, Ispire Technology Inc., a U.S.-based vaping technology and precision dosing company, unveiled its innovative "I-80" vapor device filling machine, offering unmatched efficiency for the cannabis industry. The machine fills and seals up to 4,000 vapor devices per hour, operating 10x faster than manual methods and 2x quicker than current automated systems. Its self-sealing feature eliminates capping, significantly enhancing production efficiency and cost-effectiveness.

Filling Equipment Market Trends:

Increase in Automation and Industry 4.0 integration

The elevating adoption of automation and incorporation with Industry 4.0 principles represents one of the chief factors propelling the global market growth. As per an industrial report, integration of Industry 4.0 facilitates real-time data collection and allows manufacturers to assess equipment performance, thus streamlining production lines. It also enables for 10-20 % efficiency gains and up to 30% reduction in downtime. Manufacturers can leverage this data to monitor equipment performance, detect issues early, and optimize production lines for better resource allocation. Additionally, major industry players are rapidly depending on automated filling equipment to lower costs of labor, upgrade their production processes, and enhance efficacy significantly. Apart from this, the magnifying deployment of automated filling equipment in the pharmaceutical sector for guaranteeing precise dosing of various chemicals and medications is fortifying the expansion of the market.

Rising Demand for Customization and Flexibility

The escalating demand for customization and flexibility is another significant factor contributing to the market growth. Filling equipment that can handle different product viscosities, sizes, and packaging materials allows manufacturers to produce a broader product portfolio without significant retooling. For instance, the global filling equipment market size reached USD 19.9 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 2.65%, reaching USD 25.8 billion by 2033. In addition, the development of filling equipment with quick-changeover features is enabling manufacturers to switch between product lines efficiently, reducing downtime and increasing overall productivity. Apart from this, various leading filling equipment manufacturers are focusing on innovating with modular designs, adaptive controls, and tool-less changeover systems. These advancements empower manufacturers to configure their filling equipment for specific production requirements and gain a competitive advantage in the market.

Stringent Quality and Hygiene Standards

The regulatory authorities across various industries, especially in pharmaceuticals, F&B, and cosmetics are following stringent quality and hygiene standards, which is influencing the market positively. In addition, the rising need for precision filling to ensure product consistency and consumer satisfaction in cosmetics and personal care product manufacturing is strengthening the growth of the market. Furthermore, various leading manufacturers are designing machines with enhanced hygienic features, such as easy-to-clean surfaces, sanitary fittings, and compliance with Current Good Manufacturing Practices (cGMP) guidelines. For instance, the U.S. Food and Drug Administration (FDA) requires Current Good Manufacturing Practices (cGMP) of the manufacturers that must maintain high hygiene and quality standards. Failure to comply could lead to a heavy fine; in 2023 alone, the FDA fined companies of different industries a total amount of more than USD 50 million for cGMP violations. Moreover, according to an FDA report published in the GMP Journal, in March 2024, Section 211.84 of the Code of Federal Regulations, historically a common citation in warning letters, accounted for 69% of citations in fiscal year 2023, marking a significant increase. Additionally, advanced quality control systems, including vision inspection and reject mechanisms, are integrated into filling equipment to ensure that only products meeting quality standards reach the market.

Filling Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global filling equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on sales type, process type, product type, and end use industry.

Analysis by Sales Type:

- New Machinery

- Spare Parts

According to the report, new machinery dominates the sales type segment. It incorporates the latest technological innovations, making them more efficient, precise, and adaptable. Additionally, manufacturers continuously invest in research and development (R&D) to stay at the forefront of technological advancements, enabling them to offer state-of-the-art filling equipment that outperforms older models. Besides this, new machinery is installed with advanced quality control systems, such as vision inspection and reject mechanisms. These features ensure that only products meeting stringent quality criteria are packaged, which aids in reducing waste and enhancing the overall product quality. Moreover, various new machines are equipped with the Internet of Things (IoT) connectivity, allowing for remote monitoring and predictive maintenance.

Analysis by Process Type:

- Manual

- Semi-Automatic

- Automatic

Automatic leads the market with around 78.1% of market share in 2024. Automatic filling machines offer optimal efficiency and speed and can handle high production volumes, significantly increasing output compared to manual or semi-automatic methods. Additionally, they enable businesses to reduce their reliance on manual labor and minimize the risk of human error, improving overall production efficiency. Apart from this, many automatic filling machines are versatile and can be adjusted to accommodate a wide range of products, container sizes, and packaging formats. This flexibility allows manufacturers to quickly respond to changing market demands and produce various products on the same machine. Furthermore, modern automatic filling machines are equipped with advanced quality control systems, including vision inspection and reject mechanisms.

Analysis by Product Type:

- Solid

- Semi-Solid

- Liquid

According to the report, liquid is a leading segment, which is ubiquitous across industries, including food and beverage, pharmaceuticals, cosmetics, chemicals, and automotive. These industries rely heavily on liquid filling equipment to package a wide array of products, such as beverages, sauces, pharmaceutical solutions, lotions, lubricants, and automotive fluids. Besides this, individuals find liquids more convenient for consumption or application, leading to a high demand for liquid-filled products, which, in turn, drives the need for efficient liquid-filling equipment. Furthermore, liquid pharmaceuticals, including oral medications, injectables, and syrups, require precise filling to ensure accurate dosing and patient safety. Moreover, liquid filling equipment offers customization and versatility. It can handle a wide range of viscosities and container sizes, making it suitable for large-scale production and niche, specialized applications.

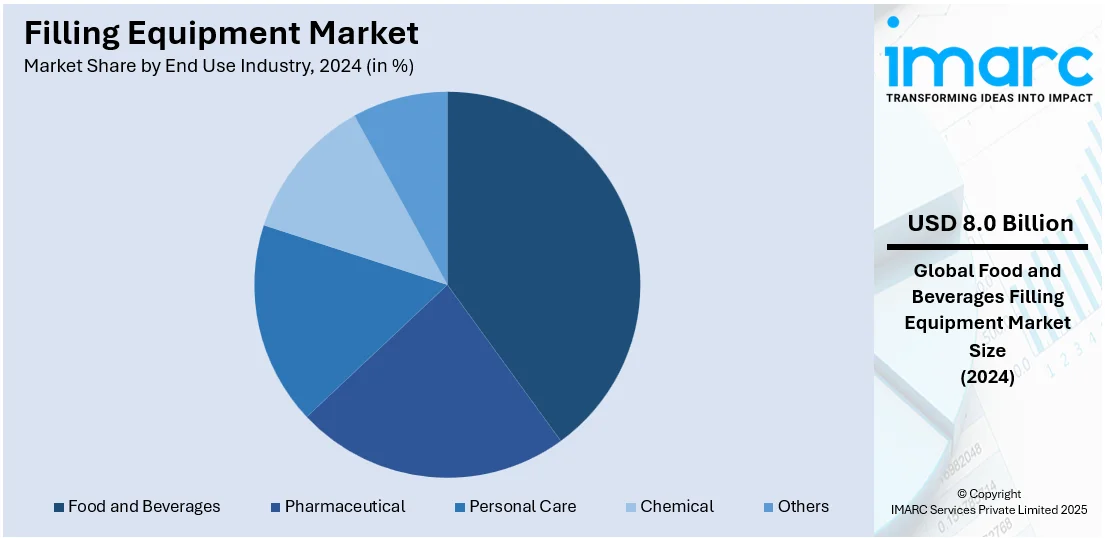

Analysis by End Use Industry:

- Food and Beverages

- Pharmaceutical

- Personal Care

- Chemical

- Others

Food and beverages lead the market with around 40.1% of market share in 2024. The food and beverage (F&B) industry encompasses an extensive range of products, from beverages like soft drinks and juices to sauces, dairy products, and condiments. This diversity creates a substantial demand for various types of filling equipment, including liquid fillers, volumetric fillers, and auger fillers, tailored to different product viscosities and packaging requirements. Apart from this, F&B production operates on a global scale to meet the demands of a growing population. This massive production volume necessitates high-speed and high-capacity filling equipment that can pack millions of units daily. As a result, the industry drives the development and adoption of advanced filling machinery.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 35.9%. This regional market is growing rapidly with increasing industrialization and the rising demand in the food, beverage, and pharmaceutical sectors. According to industrial report, Asia Pacific's packaging market is significantly boosting the adoption of filling machinery. Major contributors to this trend are China and India. China Chamber of Commerce for Import and Export of Machinery stated that its exports of packaging equipment grew significantly in 2023. Beverage consumption is another growth driver; for instance, the Japanese market for non-alcoholic beverages reached USD 28 billion in 2023, thus requiring extremely high-speed fillers with high precision. In the region, partnerships between local and global players such as Indian firms partnering with Krones for technology transfer also further bolster innovation and market growth in the region.

Key Regional Takeaways:

United States Filling Equipment Market Analysis

The U.S. filling equipment market benefits from strong manufacturing growth and technology development. The U.S. Census Bureau reported that manufacturing activity accounted for USD 2.3 trillion in 2023 GDP, which had a significant portion of contributions coming from automation and packaging sectors. The demand for more complex filling solutions is higher in beverages, pharmaceuticals, and consumer goods industries. This indicates a tremendous growth in demand for fast and accurate filling equipment in the beverage industry. Companies such as Krones and Bosch Packaging Technology lead in developing innovations in automation and sustainable solutions. Federal incentives, for example, the 2023 Clean Energy Manufacturing Initiative, encourage the adoption of energy-efficient filling equipment that helps in market growth. Additionally, rising exports of U.S.-made machinery strengthen the country’s global position, with filling equipment exports increasing by 12% in 2023, according to the U.S. Department of Commerce.

Europe Filling Equipment Market Analysis

Europe's filling equipment market is driven by technological innovation and regulatory standards that focus on efficiency and sustainability. EU Science Hub reports that the EU manufacturing industry accounted for 15.02% of the EU’s GDP in 2023, with food and beverages being one of the sectors driving demand for filling equipment. Germany, the UK, and France are leaders in advanced automation solutions, reflecting investments in Industry 4.0 technologies. The European Commission's 2030 Climate Target Plan motivates producers to use energy-efficient machines, thus supporting the green technology that is the servo-driven filler. Regional leaders of this market include Tetra Pak and KHS Group with their tailored and sustainable filling solutions. Besides, the European pharma market triggers demand for precision filling of liquid pharmaceuticals products adhering to the very strict regulation required by EU regarding both efficiency and safety.

Latin America Filling Equipment Market Analysis

Latin America's filling equipment market is growing at a rocketing pace, with the Mexican market becoming a noteworthy contributor. According to International Trade Administration, the Mexican packaging machinery market has grown from USD 710 million in the year 2021 to USD 906 million in 2022, which shows the momentum in the region's manufacturing and export sectors. With drivers such as 23% growth in eCommerce, 18% annual increment in retail sales, and 12% growth of agricultural product exports, a positive outlook can be identified. Packaging material production constitutes 1.8% of the overall GDP of Mexico and 8.6% of manufacturing GDP. U.S. is Mexico's largest supplier of packaging machinery, though Germany and Italy do pose serious competition. The current investments in agribusiness, pharmaceuticals, and eCommerce sectors are giving way to increasing machinery demands. In 2023, machinery and equipment would continue to be purchased 7–12% above with trends that include "Green Packaging" and health-conscious products. Mexico is the strategic focus of capacity expansion for filling equipment demand in a region.

Middle East and Africa Filling Equipment Market Analysis

The filling equipment market in the Middle East and Africa is being driven by increasing industrialization, especially in food and beverage production. According to an industrial report, in the UAE, the beverage market grew by 9% in 2023, and the investment in automated filling systems increased to meet the needs of production. South Africa is the most developed in Africa, with an advanced packaging sector that contributed USD 10.38 Billion to GDP in 2023, according to Statistics South Africa. The government also offers programs like Saudi Vision 2030, which promote the modernization of manufacturing sectors, including filling equipment. Local manufacturers like Nigeria's Crown Packaging are currently partnering with international firms to enhance production efficiency. Also, demand for pharmaceutical filling equipment is on the rise in Africa, attributed to increased investment in health care infrastructure by global bodies like WHO.

Competitive Landscape:

Companies are continuously investing in research and development (R&D) activities to introduce cutting-edge technologies. This includes the incorporation of Industry 4.0 principles, IoT connectivity, and AI-driven automation to enhance efficiency, reliability, and data-driven decision-making in their machines. Additionally, they are designing filling equipment with modular components and quick-changeover features. This enables customers to customize machines for various product types, container sizes, and production volumes, reducing downtime during transitions. For instance, in October 2024, Accutek Packaging unveiled its new filling machines solutions, developed to address the diverse demands of the packaging sector. This latest equipment exhibits multi-stroke functionality and allows percentage-based fills, improving fill accuracy while remaining easily controllable via touchscreen interface. Apart from this, industrial leaders are creating equipment with easy-to-clean surfaces, sanitary materials, and compliance with stringent regulatory standards to ensure product safety and quality. Moreover, various manufacturers are developing machines that minimize material waste, reduce energy consumption, and optimize resource utilization, aligning with global sustainability goals.

The report provides a comprehensive analysis of the competitive landscape in the filling equipment market with detailed profiles of all major companies, including:

- Accutek Packaging Companies

- Coesia S.p.A

- GEA Group Aktiengesellschaft

- JBT Corporation

- KHS GmbH (Salzgitter AG)

- Krones AG

- Ronchi Mario S.p.A.

- Scholle IPN

- Syntegon Technology GmbH

- Tetra Laval International S.A.

Latest News and Developments:

- July 2024: Coesia announced that it acquired a minority share in PWR, a market leader in automated robotic packaging systems for the food industry. The company will take advantage of the technological and geographical synergies to push forward new business opportunities. It is part of the portfolio expansion to provide full-line automated solutions with robotics and vision systems to boost productivity and flexibility in complex production environments. PWR will be integrated into Coesia's portfolio companies, with an expanded focus on personal care and e-commerce sectors, supporting its bakery, confectionery, snacks, and pet food customers. With its operations in Europe and Australia, PWR looks to expand its base to North America with support from Coesia's infrastructure.

- March 2024: Global leader in engineering solutions GEA introduced its new cloud-based web application, GEA InsightPartner, at the Anuga FoodTec trade fair in Cologne, Germany from March 19 to 22, 2024. The new application upgrades food processing and packaging lines by utilizing machine data to address production challenges and efficiency improvements. InsightPartner allows for real-time monitoring, supports maintenance planning, and provides rapid troubleshooting, thus preventing costly downtime and shutdowns.

- March 2024: JBT Corporation introduced SeamTec™ 2 Evolute, a new seamer technology for the powder product market, in Anuga FoodTech 2024. The technology highlights better hygienic design, cleanability, and ergonomics while preserving its high-performance features: spill reduction and packaging flexibility. Its simplified design is designed to make it easier to operate and maintain, with a redesigned footprint that can help optimize layout and reduce cost. Additionally, it has explosion-proof capabilities, so that a number of configurations can be accommodated, such as infant formula manufacturers.

- January 2024: As stated by Krones' corporate news release, the company will acquire over 100% of Netstal Maschinen AG from KraussMaffei. Located in Naefels, Switzerland, Netstal is one of the leading suppliers of injection molding machines for the beverage markets (PET preforms and caps), medical, and thin-wall packaging. This acquisition will enrich Krones' portfolio by incorporating PET and cap technologies that complement its filling/packaging and recycling solutions. Netstal will be integrated into Krones' Filling and Packaging Technology segment, which is supposed to enhance market diversification for Krones in the medical/pharma sector. The transaction was valued over EUR 200 million and is expected to close before mid-2024.

- In May 2023, Coesia S.p.A finalized agreement with Oji Holdings Corporation, a leader in the pulp and paper industry in Japan, for the sale of IPI Srl, a leading supplier of aseptic carton packaging for the beverage and liquid food industry.

Filling Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Types Covered | New Machinery, Spare Parts |

| Process Types Covered | Manual, Semi-Automatic, Automatic |

| Product Types Covered | Solid, Semi-Solid, Liquid |

| End Use Industries Covered | Food and Beverages, Pharmaceutical, Personal Care, Chemical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accutek Packaging Companies, Coesia S.p.A, GEA Group Aktiengesellschaft, JBT Corporation, KHS GmbH (Salzgitter AG), Krones AG, Ronchi Mario S.p.A., Scholle IPN, Syntegon Technology GmbH, Tetra Laval International S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the filling equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global filling equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the filling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Filling equipment refers to specialized machinery designed to accurately dispense liquids, powders, or granular products into containers. Widely used in industries such as food, beverages, pharmaceuticals, and cosmetics, these machines enhance operational efficiency, ensure precision, and support high production demands through automated or semi-automated processes.

The global filling equipment market was valued at USD 19.9 Billion in 2024.

IMARC estimates the global filling equipment market to exhibit a CAGR of 2.65% during 2025-2033.

The market is driven by increasing demand for automation, growth in packaged food and beverage consumption, advancements in liquid filling technology, rising pharmaceutical production, and expanding cosmetic and personal care industries. Enhanced efficiency, precision, and cost-effectiveness further fuel market adoption across diverse sectors.

In 2024, new machinery represented the largest segment by sales type, driven by high demand for efficiency and precision across several sectors.

Automatic leads the market by process type, driven by advancements in automation technologies that enhance productivity and reduce manual intervention.

The liquid is the leading segment by product type, driven by the widespread use of liquid packaging across several key industries.

In 2024, food and beverages represented the largest segment by end use industry, driven by the growing consumption of packaged goods globally.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global filling equipment market include Accutek Packaging Companies, Coesia S.p.A, GEA Group Aktiengesellschaft, JBT Corporation, KHS GmbH (Salzgitter AG), Krones AG, Ronchi Mario S.p.A., Scholle IPN, Syntegon Technology GmbH, Tetra Laval International S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)