Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Fintech Market Size and Share:

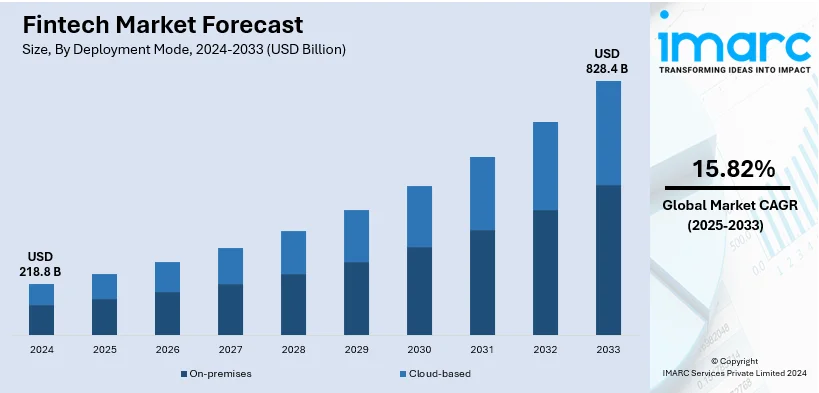

The global fintech market size was valued at USD 218.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 828.4 Billion by 2033, exhibiting a CAGR of 15.82% from 2025-2033. North America currently dominates the market, holding a market share of over 35.8% in 2024. The market is majorly driven by increasing requirements for advanced solutions in the banking process to enhance efficiency and rapid adoption of digital payment methods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 218.8 Billion |

|

Market Forecast in 2033

|

USD 828.4 Billion |

| Market Growth Rate 2025-2033 | 15.82% |

The fintech market is advancing due to the increasing adoption of digital payment systems driven by widespread smartphone and internet penetration. According to the GSMA 2024 report, 4.6 billion people, or 57% of the global population, now use mobile internet, while ITU data shows four out of five people over age 10 own a mobile phone. Expanding 5G coverage, expected to reach 51% of the global population in 2024, further supports this growth. Artificial intelligence (AI) and machine learning enable personalized financial solutions, enhancing user engagement. Blockchain adoption is streamlining transaction processes, while regulatory support for open banking fosters innovation. Peer-to-peer lending platforms are improving financial inclusion across underserved demographics.

To get more information on this market, Request Sample

The United States is key regional market and is expanding rapidly, primarily driven by consumer demand for digital financial services. Venture capital investment fosters innovation, as highlighted by GGV Capital's 2024 Fintech Innovation 50, featuring startups that collectively raised USD 12 Billion. Artificial intelligence (AI) advancements further accelerate fintech's growth, challenging traditional financial systems. Contactless payments and digital wallets are transforming transactions, with a predicted rise in digital wallet usage from 15% in 2023 to 31% by 2027, while point-of-sale debit transactions are expected to decline from 28% in 2023 to 23% in 2027 as per fintech market insights. Regulatory frameworks enhance innovation and security, while neobanks cater to tech-savvy users and small businesses. Financial literacy initiatives and growing interest in robo-advisors contribute to fintech’s ongoing transformation of the U.S. financial ecosystem.

Fintech Market Trends:

Integration of AI and Machine Learning Technologies

The adoption of artificial intelligence (AI) and machine learning (ML) in financial technology is significantly enhancing service delivery and operational efficiency, thereby accelerating market expansion. These technologies are widely employed for advanced fraud detection by identifying anomalies and flagging suspicious transactions in real time, reducing financial crime risk. AI-powered chatbots and virtual assistants are reshaping customer service by offering instant query resolution and 24/7 support, improving user engagement and retention. In credit scoring, ML algorithms analyze a broader range of behavioral and transactional data than traditional models, allowing for more accurate and inclusive lending decisions. Personalization has also improved, with AI systems tailoring financial product recommendations and user interfaces based on individual preferences and usage patterns. Enhanced cybersecurity measures—such as AI-driven threat detection and automated risk response—are bolstering consumer trust in digital platforms. Moreover, AI plays a vital role in streamlining real-time payments, ensuring faster settlements and reducing transaction errors. For instance, in July 2024, Slope, an AI-driven B2B payments platform, secured $65 million in strategic equity and debt funding led by J.P. Morgan to expand its AI-powered order-to-cash automation, covering checkout, risk assessment, and payment reconciliation for enterprises. The launch of SlopeAI has introduced advanced underwriting tools for financial institutions and wholesalers, further demonstrating how AI is reshaping core financial functions.

Increase in customer expectations

One of the main reasons for the increasing traction of the fintech market size is the shift in user demands. Conventional financial services that are known for the old and tedious paperwork and long processing time usually need to be updated in the digital age. According to a 2021 World Bank report, 76% of adults worldwide possessed an account with a bank or regulated financial institution, including credit unions, microfinance organizations, or mobile money providers. Individuals accustomed to the efficiency of other online services increasingly expect similar convenience in managing their finances.

Fintech companies address these demands by offering user-focused solutions aimed at enhancing customer satisfaction. By providing faster and more efficient services—such as mobile banking, cash transactions, and personalized financial consultations—these companies are driving the growing appeal of fintech innovations. As a result, the fintech sector is experiencing substantial revenue growth as both individuals and businesses adopt digital financial tools for banking, investment, and payment needs. For instance, Savana, a pioneer in fintech software, and Capco, a global financial services consultant, partnered strategically in November 2022 to accelerate the digital transitions of banks. They collaborated to enhance banking functions, resolve technological problems, and offer better technologies to clients.

Rise in regulatory support

As per fintech industry analysis, the increasing regulatory support for fintech innovation is one of the main factors strengthening the market growth. National and international regulatory organizations are beginning to recognize that fintech can promote economic growth and reach underprivileged populations with financial services. Policies like open banking, which allow for secure data sharing between fintech companies and traditional banks, enable more creative and cooperative financial ecosystems. In 2023, the size of the global open banking market was USD 25.6 Billion. The IMARC Group projects that the market will expand at a CAGR of 17.46% from 2024 to 2032, reaching USD 113.3 Billion by 2032. This regulatory backing not only instils confidence in potential customers but also encourages investment in fintech startups, thereby driving the demand.

Growing cybersecurity measures

There is an increase in the development of safe financial transactions due to the growing number of cyber risks. This is one of the significant fintech market trends. Fintech organizations are implying sturdy security measures to safeguard user financial data. These measures include multi-factor authentication, sophisticated encryption, and real-time fraud detection. This security-centric nature of fintech is particularly appealing to people who are conscious about the security of their financial transactions. The Identity Theft Resource Center report in 2023 claimed that 343,338,964 people were the victims of 2,365 cyberattacks in 2023.

Fintech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fintech market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on deployment mode, technology, application, and end user.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises stand as the largest component in 2024, holding around 73.7% of the market. In an on-premises deployment, fintech solutions are hosted and operated on the hardware and servers of the company, which are inside their premises. This mode ensures that the enterprise has complete control over the data and systems. They frequently need significant initial costs for infrastructure and software purchases and daily fees that are related to maintenance and updates. On-premises deployment is preferred by large enterprises with intricate financial systems as well as the ability to maintain it.

Analysis by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application programming interface (API) primarily serves as a base component of a wider range of fintech services that integrate different software apps. Banking APIs render it possible for third-party apps to access the financial data of users securely, and this makes services like personal financial management, making payments, or online lending easy.

Fintech companies often use artificial intelligence (AI) for customer service, fraud detection, and financial advice. Automation of the process and improvement can be carried out by algorithms like machine learning (ML), which perform deep analytics of massive data sets to discover patterns and anomalies. Chatbots with AI capabilities offer superior service to users by consistently answering questions from clients.

Blockchain technology is most often associated with cryptocurrencies like Bitcoin. Its decentralized nature makes transactions more transparent and secure. It is being used for tasks like contract validation, identity verification, and transaction auditing, which Removes reliance on a central authority or intermediaries. Furthermore, the IMARC group predicts that the value of the cryptocurrency market would increase from USD 2,255.2 Billion in 2023 to USD 5,552.8 Billion by 2032.

Robotic process automation (RPA) is employed to automate routine and mundane tasks within financial operations. It can automatically process loan applications, verify customer information, or handle data entry tasks. This automation leads to increased efficiency, cost savings, and reduced human error.

Data analytics tools process large amounts of unstructured and structured data to derive insights. These insights can help in personalized marketing, risk assessment, and customer segmentation.

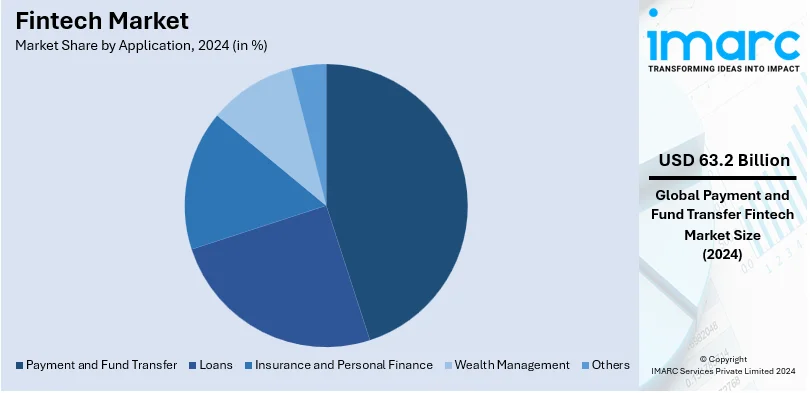

Analysis by Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payment and fund transfer continue to dominate the market, accounting for approximately 28.9% of the market share in 2024. Fintech industry overview highlights how financial technology has significantly enhanced the speed and ease of commerce. Mobile payment apps enable fast, contactless transactions, while peer-to-peer platforms simplify money transfers between individuals. Fintech's influence extends to the insurance sector—commonly known as Insurtech—which was valued at USD 3.1 billion globally in 2023, according to data from IMARC Group. Additionally, technologies such as AI and data analytics are being leveraged to customize insurance offerings and lower costs. In the realm of personal finance, AI-driven apps analyze user spending patterns and provide tailored savings or investment advice, empowering consumers to make more informed financial decisions.

Analysis by End User:

- Banking

- Insurance

- Securities

- Others

Banking leads the market with around 45.06% of market share in 2024. Fintech has a broad user base in the banking sector. Online banking platforms, mobile apps, and digital-only banks have drastically altered the way consumers interact with their bank accounts. Fintech solutions like instant payments, financial tracking, and automated customer service are rapidly replacing traditional banking services. Additionally, AI-powered chatbots and virtual assistants enhance customer engagement by providing real-time assistance and personalized recommendations. Blockchain technology guarantee secure and evident transactions, decreasing fraud risks. Moreover, fintech-enabled lending services offer quicker loan approvals and tailored financial products, further transforming traditional banking into a more agile and customer-centric model.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.8%. The increasing adoption of contactless payments represents one of the primary factors driving the fintech market demand in the North American region. Moreover, the rising demand for mobile-centric solutions is contributing to the fintech market growth in the region. Besides this, the growing collaboration between financial institutions and national regulators is offering a favorable fintech market outlook in the region. The expansion of neobanks and peer-to-peer lending platforms is addressing underserved customer segments, while the integration of artificial intelligence and blockchain enhances operational efficiency and customer experience. Moreover, increased venture capital investments in fintech startups are fueling technological innovations and solidifying North America’s position as a leading fintech hub.

Key Regional Takeaways:

United States Fintech Market Analysis

In 2024, the United States accounted for 85.80% of the North America fintech market. The U.S. fintech market continues to grow, with widespread digital adoption, a dynamic startup ecosystem, and significant progress in internet accessibility. As per a NTIA Internet Use Survey, internet usage in the U.S. increased by 13 million people in 2023 compared to 2021, reflecting a broader digital transformation and expanding opportunities for fintech innovation. High internet and smartphone penetration rates are driving demand for digital financial solutions such as digital wallets, online lending platforms, and mobile banking. The pandemic has even further accelerated a shift to digital payments and contactless transactions in altering consumer behavior. Supportive regulatory environment balances innovation with compliance is fostering the growth of financial services technologies, including blockchain, artificial intelligence, and data analytics. The presence of major financial hubs such as New York City and Silicon Valley enhances access to talent, collaboration opportunities, and advanced technologies. As competition intensifies, the fintech landscape is witnessing rapid advancements in embedded finance, decentralized finance, and wealth management solutions, ensuring sustained growth.

Europe Fintech Market Analysis

Europe's fintech market is booming, with progressive regulations, a tech-savvy population, and a focus on sustainable finance driving the industry forward. For example, the Revised Payment Services Directive (PSD2) has led to open banking, which promotes collaboration between traditional banks and fintech startups and innovation. The European Union's drive to advance e-commerce and online transactions also supports digital transformation. The European Commission reports that 75% of EU internet users shopped or ordered products online in 2023. Such increases show the growing need for electronic means of payment and fueled the demand for efficient cross-border payments solutions, with firms like Wise playing a huge role in the simplification of cross-border transactions. Countries like the United Kingdom, Germany, and Sweden lead the fintech landscape due to their strong financial ecosystems and a very vibrant startup culture. Besides this, green finance in Europe is driving ESG principles into solutions offered by fintech. Adoption of blockchain, artificial intelligence, and digital banking has gone further, businesses and consumers are increasingly demanding contactless payments and virtual banking options. This highly innovative and inclusive ecosystem ensures robust growth for Europe's fintech sector.

Asia Pacific Fintech Market Analysis

The Asia Pacific fintech market is booming as a result of rapid urbanization, high smartphone penetration, and a vast unbanked population seeking to access financial services. Regional governments have also been instrumental in driving financial inclusion, for example, the India government's Unified Payments Interface. As per PwC, UPI emerged as the most used digital payment method in India in 2023, accounting for over 75% of the country's retail digital payments. This achievement underscores the region's adoption of innovative payment methods. Singapore, Hong Kong, and Australia have become fintech hubs, supported by favorable regulatory frameworks and government incentives. The rise of middle-class adoption of digital payment platforms, investment apps, and lending services, particularly in India, China, and Southeast Asia, underscores this growth. Collaboration between traditional banks and fintech startups, along with the increasing adoption of advanced technologies such as blockchain, artificial intelligence, and big data, continues to drive innovation. Digital-only banks are gaining more traction, and the APAC fintech market is a growth and transformation hotspot.

Latin America Fintech Market Analysis

The fintech industry growth in Latin America is driven by a large unbanked population, increasing smartphone usage, and the demand for accessible financial services. Digital payment platforms and mobile banking are becoming essential tools, addressing the challenges of traditional banking systems. As of 2022, according to Payment Cards and Mobile, transactions were processed for 29 Million buyers in Latin America, which emphasizes the growing importance of understanding and adapting to digital consumer behavior in the competitive environment of the region. Brazil, Mexico, and Colombia are key markets, supported by government initiatives that promote financial inclusion. The expanding e-commerce sector is further accelerating the adoption of fintech solutions.

Middle East and Africa Fintech Market Analysis

The Middle East and Africa fintech market is expanding continuously. This growth is fueled by the efforts to increase financial inclusion and growing smartphone penetration. Canalys reports that smartphone shipments in the Middle East, excluding Turkey, totaled 12.2 million. Units in Q1 2024, reflecting a 39% year-on-year increase. This increase in smartphone use is fueling the shift towards digital payments and mobile banking services, especially in areas with a high percentage of unbanked populations. The government is supporting this shift with favorable regulatory frameworks, while the emergence of blockchain and cryptocurrency platforms is repositioning remittance services, fueling growth in the fintech sector in the region.

Competitive Landscape:

As per fintech market research, the leading companies are integrating advanced technologies, such as artificial intelligence (AI), blockchain, quantum computing, robotic process automation (RPA), augmented reality (AR), big data analytics, and the internet of things (IoT), in fintech. These advancements can process vast amounts of structured and unstructured data to extract actionable insights for personalized marketing, credit risk modeling, and customer segmentation, among other applications. These technologies also handle repetitive tasks, such as data extraction and processing, which allow human employees to emphasize on value-added and complex activities. Besides this, leading players are developing open banking platforms that use application programming interface (API) to create a network of financial institutions and third-party providers, which offers consumers more choices and easier access to a variety of services from a single interface.

The report provides a comprehensive analysis of the competitive landscape in the fintech market with detailed profiles of all major companies, including:

- Adyen

- Avant, LLC

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- Klarna Bank AB

- Mastercard Inc.

- Nubank

- PayPal Holdings, Inc.

- Revolut Ltd

- Robinhood Markets, Inc.

- SoFi Technologies, Inc.

- Stripe, Inc.

Latest News and Developments:

- April 2025: eBay expanded its global strategic partnership with Klarna to the U.S., offering millions of eBay shoppers flexible payment options like Klarna’s Pay in 4 (four interest-free payments) and Financing plans for larger purchases. Since December 2024, Klarna’s features have enabled shoppers in Europe to split payments on high-value items, and its new resell feature allows easy listing of past Klarna purchases on eBay, promoting circular economy and sustainable consumption. This partnership enhances affordability, choice, and control, driving growth and innovation in eBay’s Payments and Financial Services.

- April 2025: Amazon invested ₹350 crore into Amazon Pay India, intensifying its competition in the fintech sector against dominant players like PhonePe and Google Pay. This investment follows prior infusions of ₹300 crore and ₹600 crore in 2024. Amazon Pay recently secured a payment aggregator license from RBI, enhancing merchant transaction capabilities. The platform offers UPI, bill payments, insurance, and partners with services in travel and wealth management.

- April 2025: Vietnam Airlines expanded its partnership with Adyen, leveraging Adyen’s global acquiring network to process transactions worldwide. This collaboration, which began in 2017 and deepened in 2024, enables seamless payments in key markets like Japan, Australia, the U.S., and Europe. By integrating Adyen’s advanced payment solutions, Vietnam Airlines benefits from higher authorization rates (up to 5% uplift), lower transaction fees, and support for major cards and local payment methods, enhancing passenger experience and operational efficiency as part of its digital transformation.

- April 2025: Square, a Block, Inc. company, expanded its banking services to help small business sellers better manage cash flow with integrated checking and savings accounts. Sellers can now open a Square Checking account instantly when signing up for Square Payments, gaining 24/7 access to funds with no fees or minimum balances. Square Savings offers personalized recommendations to allocate money for expenses like taxes and payroll, using cash flow data and industry insights.

- February 2025: The Department for Promotion of Industry and Internal Trade (DPIIT) and Paytm signed an MoU to boost innovation and scale manufacturing and fintech startups in India. Paytm will offer mentorship, infrastructure, market access, funding, and regulatory guidance to startups, particularly fintech hardware makers. The collaboration includes workshops, incubation, and impact assessments. This initiative, under Paytm’s startup program and CSR arm, aims to empower entrepreneurs, enhance product development, and position India as a global innovation hub, driving technological advancement and economic growth.

- November 2024: Cedar-IBSi Capital is investing in 10-15 fintech startups specializing in banking and insurance technology to drive innovation and efficiency. The fund aims to support high-performing companies offering unique products and advanced technologies to enhance financial institutions' operations. Its first investment is in Cogniquest, an intelligent document processing firm, with plans for additional investments underway.

Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adyen, Avant, LLC, Fidelity National Information Services, Inc., Fiserv, Inc., Klarna Bank AB, Mastercard Inc., Nubank, PayPal Holdings, Inc., Revolut Ltd, Robinhood Markets, Inc., SoFi Technologies, Inc., Stripe, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fintech market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fintech market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Fintech, short for financial technology, refers to the integration of technology into financial services to enhance efficiency, accessibility, and customer experience. It encompasses innovations such as mobile payments, blockchain, digital lending, and robo-advisors, transforming traditional banking and financial operations into more streamlined and user-friendly solutions.

The fintech market was valued at USD 218.8 Billion in 2024.

IMARC estimates the global fintech market to exhibit a CAGR of 15.82% during 2025-2033.

The global market is primarily driven by increasing smartphone and internet penetration, growing adoption of digital payment systems, continual advancements in artificial intelligence (AI) and blockchain, supportive regulatory frameworks, and rising financial inclusion through neobanks and peer-to-peer lending platforms.

In 2024, on-premises represented the largest segment by deployment mode, driven by the need for data control and security.

Payment and fund transfer leads the market by application attributed to the growing demand for quick, contactless, and seamless payment solutions.

Banking is the leading segment by end user, driven by the widespread use of digital banking, mobile apps, and online financial services.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global fintech market include Adyen, Avant, LLC, Fidelity National Information Services, Inc., Fiserv, Inc., Klarna Bank AB, Mastercard Inc., Nubank, PayPal Holdings, Inc., Revolut Ltd, Robinhood Markets, Inc., SoFi Technologies, Inc., and Stripe, Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)