Flash Memory Card Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2025-2033

Flash Memory Card Market Size and Share:

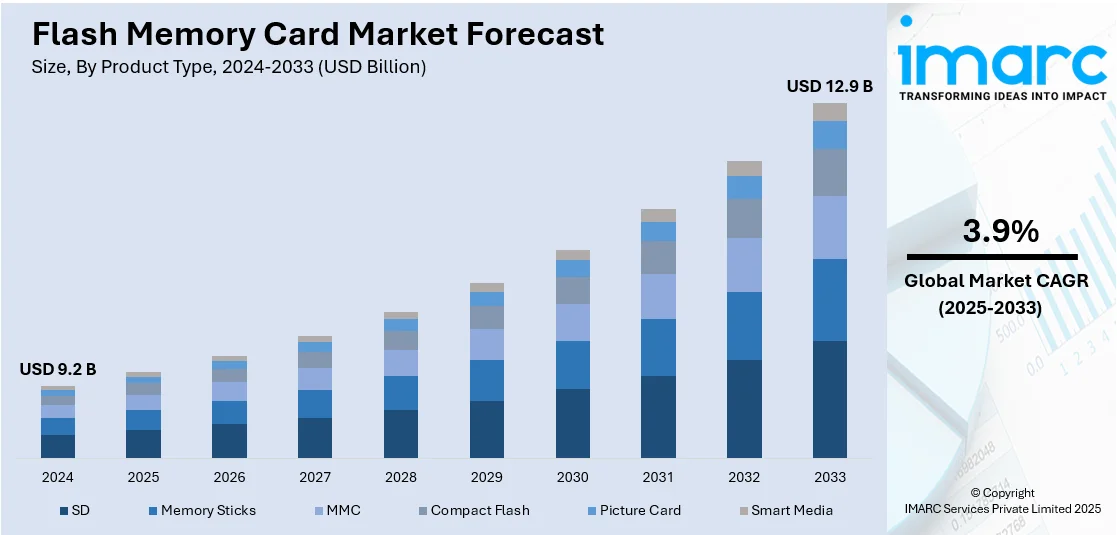

The global flash memory card market size was valued at USD 9.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.9 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 48.0% in 2024. The market is witnessing steady growth due to rising demand for portable, high-capacity storage across consumer electronics, automotive, and industrial devices. Technological advancements such as 3D NAND and UHS standards are enhancing product performance and reliability. Increasing data consumption, content creation, and smart device integration are also contributing positively to the flash memory card market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.2 Billion |

|

Market Forecast in 2033

|

USD 12.9 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

The flash memory card market is driven by rising demand for high-capacity data storage across smartphones, digital cameras, gaming devices, and surveillance systems. For instance, in March 2024, ATP Electronics launched new high-endurance SD and microSD memory cards, offering up to 512 GB capacity with advanced 176-layer 3D NAND technology. Designed for AI surveillance and edge technologies, these cards feature improved performance, high endurance ratings, and power loss protection, enabling reliable video recording in extreme conditions. Growth in content creation, particularly 4K and 8K video, has increased the need for faster, more reliable storage solutions. Expanding use of dashcams, drones, and IoT devices also supports market expansion. Advancements in NAND flash technology and the transition to 3D flash architecture further enhance performance, durability, and storage density, making flash memory cards essential in consumer and industrial electronics.

The United States flash memory card market is driven by the widespread use of smartphones, digital cameras, and gaming consoles, along with increasing consumer demand for portable, high-speed data storage. Rising adoption of surveillance systems and automotive infotainment further boosts usage. The growth of 4K/8K video content and professional photography also fuels demand for high-capacity cards. For instance, in April 2024, Western Digital unveiled innovations for media and entertainment workflows, emphasizing super speeds and massive storage capacities. Key products include the new SanDisk® SD and microSD Express cards, alongside groundbreaking 2TB and 4TB memory cards, all designed to enhance efficiency and meet growing content demands. Additionally, technological advancements in 3D NAND and UFS formats are improving speed and reliability, making flash memory cards critical across both consumer electronics and enterprise storage applications.

Flash Memory Card Market Trends:

Rising Demand for High-Capacity Cards

The growing use of 4K/8K video recording, immersive gaming, and high-resolution photography is fueling the need for flash memory cards with greater storage capacity. Devices such as DSLRs, drones, and smartphones now require cards that can handle large data volumes without compromising speed. For instance, in July 2024, Samsung Electronics launched 1TB microSD cards, PRO Plus and EVO Plus, utilizing advanced V-NAND technology for enhanced performance. With sequential read speeds of 180MB/s and write speeds of 130MB/s, they cater to content creators and tech enthusiasts. The cards offer exceptional durability and compatibility across various devices, available now. According to flash memory card market forecast, this demand is expected to accelerate as consumer and professional applications continue to evolve. As a result, manufacturers are focusing on expanding their high-capacity product lines to meet these performance expectations.

Adoption of 3D NAND Technology

3D NAND technology stacks memory cells vertically, allowing for higher data density and improved performance over traditional planar NAND. This structure not only increases storage capacity but also enhances reliability and power efficiency, making it ideal for advanced flash memory card applications. It enables faster read/write speeds, longer endurance, and smaller form factors critical for high-performance consumer electronics. For instance, in February 2025, Kioxia and Sandisk launched a next-generation 3D flash memory technology with a 4.8Gb/s NAND interface speed, enhancing power efficiency and bit density. The technology incorporates advanced features like Toggle DDR6.0 and CBA, aiming to meet the growing demands of AI and data centers. As per industry developments, 3D NAND is becoming standard in premium offerings, shaping the future of the flash memory card market outlook.

Integration in IoT and Automotive Devices

Flash memory cards are playing a vital role in the expanding landscape of IoT and automotive electronics. Devices such as dashcams, GPS systems, infotainment units, and connected home gadgets require compact, durable, and high-speed storage solutions. Flash cards provide reliable data recording and retrieval in environments where constant data flow and harsh conditions are common. Their small form factor and improved endurance make them ideal for embedded applications. According to recent industry analysis, this growing integration is expected to significantly contribute to flash memory card market growth across both consumer and industrial segments.

Flash Memory Card Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flash memory card market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, distribution channel, and application.

Analysis by Product Type:

- SD

- Memory Sticks

- MMC

- Compact Flash

- Picture Card

- Smart Media

SD stand as the largest product type in 2024, holding around 65.4% of the market. SD cards hold the largest share in the flash memory card market due to their widespread compatibility, ease of use, and balance between cost and performance. They are extensively used across digital cameras, smartphones, tablets, and portable gaming devices. Their broad availability in various capacities and speed classes makes them a versatile choice for both casual users and professionals. As demand for removable storage persists in consumer electronics, SD cards are expected to maintain their dominant position in the global flash memory card market.

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 57.8% of market share in 2024. Offline retail channels lead the flash memory card market, driven by strong consumer preference for physical inspection and immediate product availability. Electronics stores, supermarkets, and specialty outlets offer a wide range of brands and storage options, often bundled with devices like cameras or phones. Many consumers still rely on in-store assistance for choosing compatible cards, especially in developing regions. Despite the rise of e-commerce, offline sales remain dominant due to accessibility, trust, and the convenience of instant purchase in the flash memory card market.

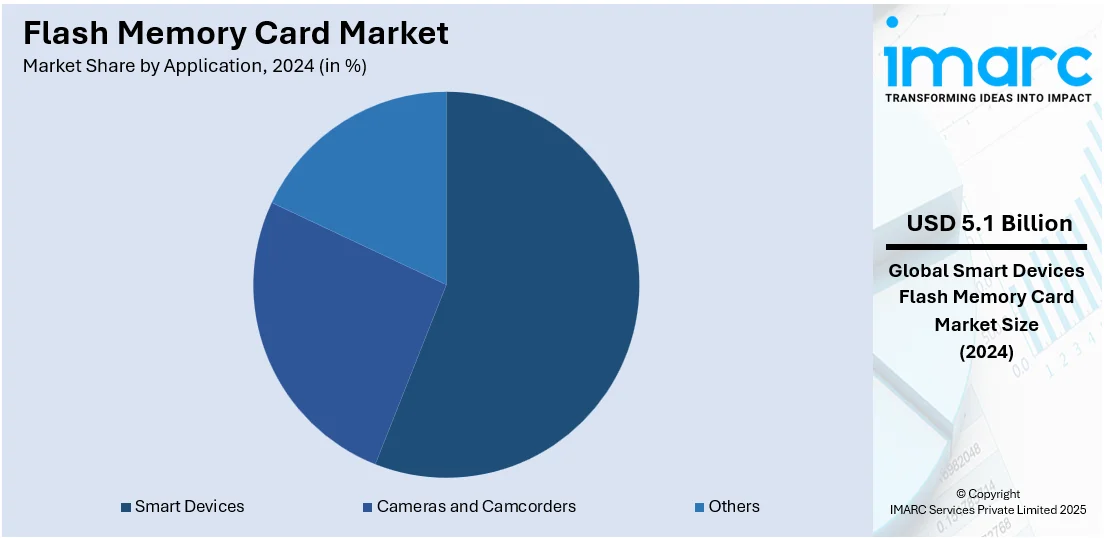

Analysis by Application:

- Smart Devices

- Cameras and Camcorders

- Others

Smart devices lead the market with around 55.8% of market share in 2024. Smart devices lead flash memory card market, driven by the widespread adoption of smartphones, tablets, digital cameras, and wearables. These devices require compact, high-speed, and high-capacity storage to handle apps, photos, videos, and system data efficiently. The rising consumption of multimedia content and mobile photography further boosts the need for external memory solutions. As smart device penetration deepens globally, flash memory cards—especially microSD variants—are expected to remain essential, reinforcing their dominance in the flash memory card market.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 48.0%. Asia-Pacific holds the largest share in the flash memory card market, supported by high consumer electronics demand, rapid smartphone adoption, and a strong manufacturing base. Countries like China, South Korea, and Japan are major producers and users of flash memory cards, driven by both domestic consumption and export-oriented industries. Expanding digital infrastructure, rising disposable incomes, and growth in photography, gaming, and IoT devices further support market expansion. With continuous tech innovation and rising device penetration, Asia-Pacific remains central to global flash memory card market growth.

Key Regional Takeaways:

North America Flash Memory Card Market Analysis

North America’s flash memory card market is benefiting from the widespread use of digital devices across both consumer and enterprise segments. The increasing reliance on smartphones, digital cameras, drones, and gaming consoles has fueled steady demand for compact, high-capacity storage solutions. Additionally, the popularity of content creation, remote work setups, and digital learning environments has strengthened the need for reliable memory expansion options. Flash memory cards are also finding broader applications in enterprise tools, surveillance systems, and automotive technologies, where rapid data processing and storage efficiency are critical. As users seek faster, more durable storage to manage high-resolution media and continuous data flow, manufacturers are focusing on innovation in speed, security, and form factor. The presence of major technology companies and a strong retail network further support the availability and adoption of advanced flash memory card formats across North America.

United States Flash Memory Card Market Analysis

In 2024, United States accounted for 88.30% of flash memory card market in North America. The United States is witnessing a significant increase in flash memory card demand driven by the rising number of smartphone users. Research indicates that the global smartphone market saw a 10% increase in year-on-year growth during the first quarter of 2024, totaling 296.2 million units. As smartphones have become the main tool for communication, photography, and content consumption, the demand for expanded storage options has surged. Flash memory cards provide a compact and dependable solution for storing the extensive multimedia data produced by smartphone apps. As smartphone users continue to increase across various demographics, flash memory cards are becoming essential for extending device capacity and maintaining performance. Mobile manufacturers and accessory providers are further promoting flash memory card compatibility to enhance user experience. This upward trend in smartphone adoption is encouraging higher production and innovation in flash memory card technologies, fuelling overall market momentum and creating long-term growth opportunities in the region.

Europe Flash Memory Card Market Analysis

Europe is observing growing flash memory card adoption as smart devices gain widespread traction across households and enterprises. For instance, in 2023, 218.2 Million smart home systems were used across the EU27+3 countries, including 28.9 Million multifunction or whole-home systems and 189.3-Million-point solutions. The expanding ecosystem of smart devices—including cameras, security systems, wearables, and home automation tools—is increasing the demand for efficient and compact storage solutions. Flash memory cards offer the adaptability and speed required to store and process data generated by these interconnected devices. With smart devices becoming integral to daily routines and business functions, users prioritize storage solutions that can seamlessly integrate with multiple platforms. This trend is driving investments in advanced flash memory card formats that ensure data integrity, fast read-write speeds, and extended device compatibility. As the smart device market continues to grow, flash memory card consumption is expected to follow a parallel trajectory across the region, bolstering technological innovation and adoption.

Latin America Flash Memory Card Market Analysis

Latin America is showing increasing flash memory card adoption supported by rising internet penetration. According to reports, over the past ten years, internet access in Latin America has increased significantly, rising from 43% to 78%. In countries like Chile, penetration has even reached 90%, exceeding that of China, largely due to the integration of middle and lower-income populations. As more users gain access to digital platforms, the consumption of media content and online applications is escalating. Flash memory cards provide users with a practical solution to store downloaded content, offline media, and application data. The widespread availability of affordable mobile devices and expanding digital access is further promoting the use of memory cards. This digital shift is strengthening the regional market outlook for flash memory cards.

Middle East and Africa Flash Memory Card Market Analysis

The adoption of flash memory cards is growing in the Middle East and Africa, driven by the increasing reliance on data centers and the automation of various business processes. For example, Saudi Arabia’s Advanced Manufacturing Hub Strategy has pinpointed over 800 investment opportunities totaling USD 273 billion, all intended to diversify the industrial sector. By 2035, Saudi Arabia plans to expand its number of factories from approximately 10,000 to 36,000, with 4,000 of those being fully automated. Organizations are deploying flash memory cards to handle high-volume data exchanges with improved efficiency and minimal latency. As businesses automate functions across industries, flash memory cards serve as reliable storage for real-time data processing and backup.

Competitive Landscape:

The flash memory card market is highly competitive, with numerous global and regional manufacturers striving to enhance product performance, storage capacity, and durability. Companies are investing in R&D to develop advanced card formats with faster read/write speeds, improved power efficiency, and greater reliability for demanding applications. The focus is also on miniaturization to support compact devices while maintaining high performance. Strategic partnerships with device manufacturers and retail distributors are common to expand market reach. Pricing strategies, product differentiation, and innovations in 3D NAND and UFS technologies continue to shape competition in both consumer and industrial segments of the market.

The report provides a comprehensive analysis of the competitive landscape in the flash memory card market with detailed profiles of all major companies, including:

- SanDisk LLC

- IMEC VZW

- Corsair Gaming, Inc.

- G.SKILL International Enterprise Co., Ltd.

- Mushkin Inc.

- Kingston Technology Corporation

- Samsung

- SK Hynix Inc.

- Toshiba Corporation

- Transcend Information, Inc.

Latest News and Developments:

- April 2025: Silicon Power launched the Inspire microSDXC Flash Memory Card, engineered for action cameras and content creation. The card featured read speeds up to 170 MB/s and write speeds up to 160 MB/s, supporting 4K video, handheld gaming, and mobile content workflows. With capacities up to 512 GB and a 1 TB version planned for Q2 2025, it targeted power users demanding speed and storage.

- April 2025: Lexar shipped the world’s first 1TB microSD Express Card, the PLAY PRO microSDXC™, designed to boost handheld gaming performance. Built with PCIe 3.0 and NVMe 1.3 technology, this flash memory card offered up to 900MB/s read and 600MB/s write speeds, enabling faster game loads and downloads. The card supported backward compatibility and targeted devices like the Nintendo Switch 2, marking a major leap in portable gaming storage.

- April 2025: Adata launched the industry’s first Premier Extreme SD 8.0 Express Flash Memory Card, delivering up to 1,600MB/s read and 1,200MB/s write speeds. The card supported PCIe Gen3 x2 interface, NVMe protocol, and 512GB capacity, outperforming SD Express 7.0 and traditional SSDs. It also featured LDPC ECC error correction and durability against water, shock, static, and temperature extremes.

- March 2025: Lexar launched the world’s first stainless steel Flash Memory Card in March 2025, introducing the ARMOR GOLD SDXC™ UHS-II and ARMOR SILVER PRO SDXC™ UHS-II cards. These stainless steel SD memory cards were made 37 times stronger than traditional ones and were tested for extreme durability, drop resistance, and water and dust protection. Designed for professional photographers, the Flash Memory Card resisted bending and snapping, ensured high-speed 6K video capture, and retained compatibility with standard camera slots.

- March 2025: Exascend introduced its flagship Nitro Pro CFexpress 4.0 Type B Flash Memory Card, available in 512 GB and 1 TB variants, aimed at professional creators. This card boasted impressive read speeds of up to 3,750 MB/s and sustained write speeds of 3,300 MB/s, effectively doubling the performance of the previous model. With VPG400 certification and pSLC technology, it offered enhanced reliability, endurance, and energy efficiency for high-demand shooting scenarios.

Flash Memory Card Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | SD, Memory Sticks, MMC, Compact Flash, Picture Card, Smart Media |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Smart Devices, Cameras and Camcorders, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | SanDisk LLC, IMEC VZW, Corsair Gaming, Inc., G.SKILL International Enterprise Co., Ltd., Mushkin Inc., Kingston Technology Corporation, Samsung, SK Hynix Inc., Toshiba Corporation, and Transcend Information, Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flash memory card market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global flash memory card market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flash memory card industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flash memory card market was valued at USD 9.2 Billion in 2024.

The flash memory card market is projected to reach USD 12.9 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033.

Key factors driving the flash memory card market include rising demand for portable storage in smartphones and cameras, growth in 4K/8K video content, expansion of smart devices and IoT applications, and advancements in 3D NAND technology that improve speed, capacity, and durability across consumer and industrial use cases.

Asia Pacific currently dominates the flash memory card market, driven by high consumer electronics demand, rapid smartphone adoption, strong manufacturing capabilities, and expanding use of digital devices across both urban and rural areas. The region’s tech innovation and competitive production landscape support its leading market share.

Some of the major players in the flash memory card market include SanDisk LLC, IMEC VZW, Corsair Gaming, Inc., G.SKILL International Enterprise Co., Ltd., Mushkin Inc., Kingston Technology Corporation, Samsung, SK Hynix Inc., Toshiba Corporation, and Transcend Information, Inc., , etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)