Flavors and Fragrances Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034

Market Overview:

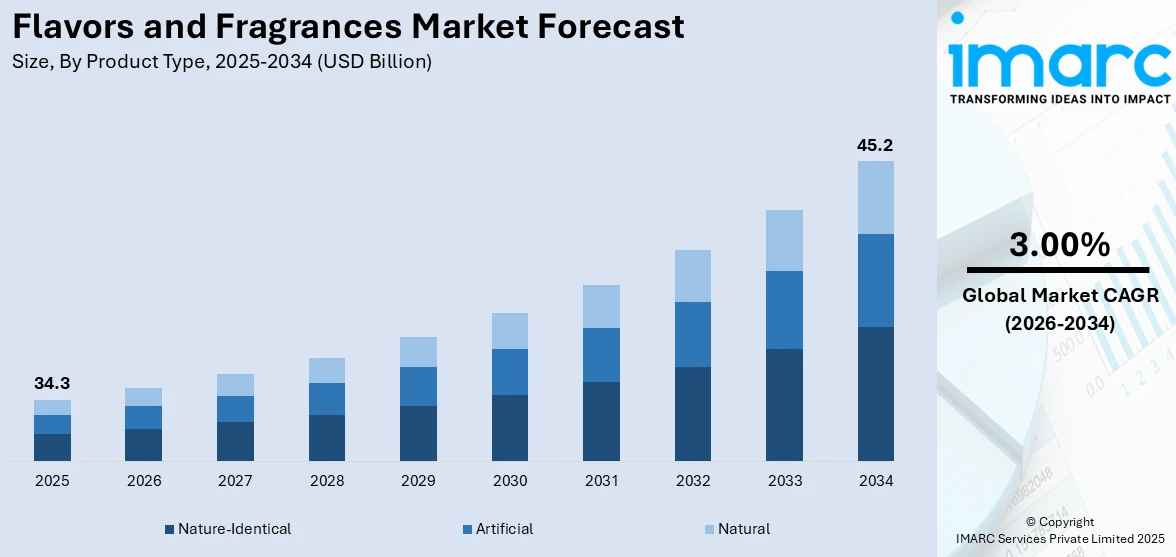

The global flavors and fragrances market size reached USD 34.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 45.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.00% during 2026-2034. The expanding food and beverage (F&B) industry, rising awareness about personal grooming and hygiene among consumers, changing consumer preferences, growing population and urbanization, and increasing emphasis on natural and organic ingredients are some of the major factors propelling the flavors and fragrances market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34.3 Billion |

| Market Forecast in 2034 | USD 45.2 Billion |

| Market Growth Rate 2026-2034 | 3.00% |

Fragrances and flavors are sensory perceptions that enhance experiences of smell and taste. Fragrances refer to the pleasant or appealing scents found in perfumes, cosmetics, and other products. They are composed of aromatic compounds that can be natural or synthetic. Flavors, on the other hand, are the characteristic tastes we perceive in food and beverages. They are created by a combination of taste buds and olfactory receptors. Flavors can be sweet, sour, salty, bitter, or umami. Both fragrances and flavors play a crucial role in the enjoyment and perception of various products, adding depth and complexity to the sensory encounters of consumers.

To get more information on this market Request Sample

At present, the growing population and urbanization are creating a positive market outlook. Additionally, the rising awareness regarding personal grooming and hygiene among consumers is escalating the demand for fragrances in various personal care products. Furthermore, the increasing emphasis on natural and organic ingredients is also influencing the market, as consumers seek healthier and sustainable options. Besides this, continuous innovation and product development in the food and beverage industry represents another major growth-inducing factor. Furthermore, the expanding personal care industry and increasing awareness about the harmful effects of synthetic products is leading to a rise in the adoption of natural and clean-label flavors and fragrances.

Flavors and Fragrances Market Trends/Drivers:

Expanding Personal Care Industry Driving the Market Growth

The expanding personal care industry is one of the primary factors driving the flavors and fragrances market. As consumers increasingly focus on self-care and grooming, there is a growing demand for a wide variety of personal care products such as skincare, haircare, and cosmetics. Fragrances are essential components of these products, as they contribute to the overall sensory experience and help create a positive association with the brand. Fragrances in personal care products serve multiple purposes. They enhance the product's appeal by providing pleasant scents that evoke emotions and create a sense of luxury. Fragrances can also mask any potential unpleasant odors from certain active ingredients.

Continuous Innovations in the Food and Beverage (F&B) Industry

Continuous innovations in the food and beverage industry are propelling the flavors and fragrances market in several ways. Manufacturers in the food and beverage sector are constantly striving to meet evolving consumer preferences and expectations, seeking to create unique and memorable sensory experiences. This drive for innovation has a direct impact on the demand for flavors and fragrances. The rising number of health-conscious consumers have led to the development of healthier alternatives and functional food products, which has increased the need for flavors and fragrances that can enhance the taste of these products, making them more palatable and enjoyable while still meeting consumers' dietary requirements.

Rising Awareness of Personal Grooming and Hygiene

The rising awareness about personal grooming and hygiene among individuals is a key factor propelling the flavors and fragrances market. As people become more conscious of their appearance, there is a growing demand for products that enhance personal care routines. Personal grooming products such as soaps, shampoos, lotions, and deodorants heavily rely on fragrances to provide a pleasant and refreshing sensory experience. Fragrances help mask unpleasant odors and impart a clean and appealing scent to these products, making them more enjoyable to use and enhancing the overall grooming process. Moreover, fragrances contribute to personal identity and self-expression. Individuals often associate specific scents with their personality or style, and they use fragrances to convey a desired image or make a lasting impression. This drives the demand for a diverse range of fragrances that cater to individual preferences and lifestyles.

Flavors and Fragrances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flavors and fragrances market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on product type, form, application and ingredients.

Global Flavors Market:

Breakup by Product Type:

- Nature-Identical

- Artificial

- Natural

Nature-identical products are dominating the market

The report has provided a detailed breakup and analysis of the flavors market based on the product type. This includes nature-identical, artificial and natural. According to the report, nature-identical represented the largest segment.

Nature-identical substances are synthetic compounds that are chemically identical to the compounds found in nature. These substances are created through laboratory processes that mimic the chemical composition and structure of naturally occurring flavors. They offer a cost-effective and reliable alternative to natural ingredients. Natural ingredients can be limited in availability, vary in quality, and be subject to price fluctuations. Nature-identical substances provide a consistent and readily available supply, ensuring stable production and formulation. Additionally, nature-identical substances allow for the recreation of specific flavors that may be challenging to obtain from natural sources. They offer greater control over the desired sensory profile, allowing manufacturers to achieve precise and consistent results. This enables the development of a wide range of flavors, catering to diverse consumer preferences and market demands.

Breakup by Form:

- Liquid

- Dry

Liquids hold the largest share in the market

A detailed breakup and analysis of the flavors market based on the form has also been provided in the report. This includes liquid and dry. According to the report, liquid accounted for the largest market share.

Liquids are a crucial form of delivery for flavors, playing a key role in propelling the flavors market. Liquid formulations offer several advantages that contribute to their widespread use in the industry. Firstly, liquids provide ease of application and incorporation into various products. They can be easily mixed with other ingredients, allowing for precise and consistent blending of flavors. This versatility makes liquids highly desirable for use in a wide range of applications, including beverages, personal care products, and household goods. Furthermore, liquids offer better solubility, dispersion, and stability compared to other forms. They can dissolve and disperse flavors more effectively, ensuring even distribution and optimal sensory impact. Liquid formulations also tend to have longer shelf lives and are less prone to degradation, preserving the desired sensory characteristics over time.

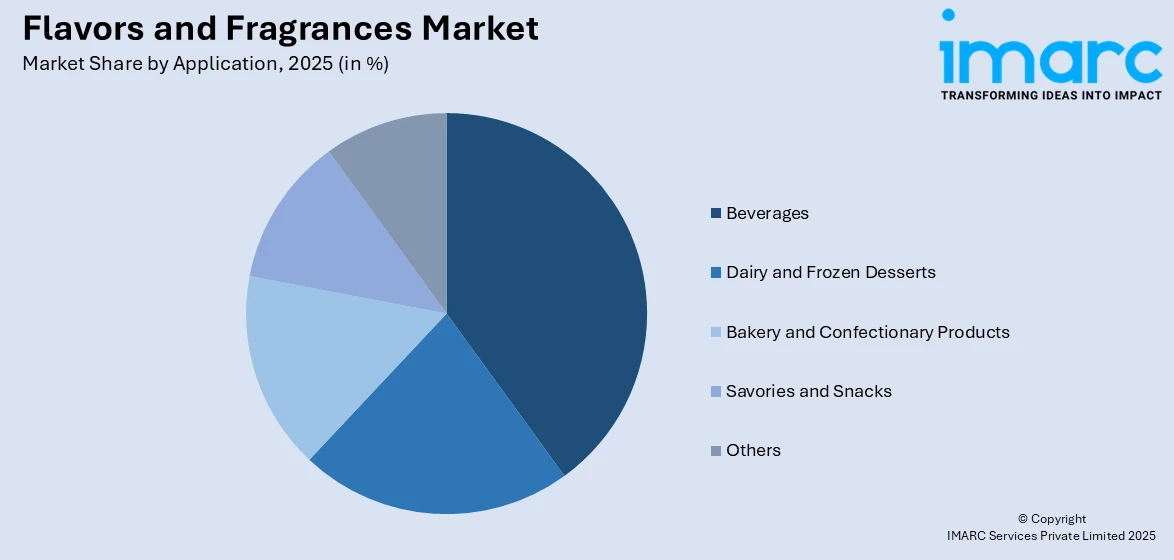

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Beverages

- Dairy and Frozen Desserts

- Bakery and Confectionary Products

- Savories and Snacks

- Others

Beverages represent the leading application segment

The report has provided a detailed breakup and analysis of the flavors market based on the application. This includes beverages, dairy and frozen desserts, bakery and confectionary products, savories and snacks, and others. According to the report, beverages represented the largest segment.

Beverages are liquid-based drinks that are consumed to quench thirst, provide hydration, or for enjoyment. They encompass a wide range of products, including soft drinks, juices, tea, coffee, alcoholic beverages, and more. Beverages play a significant role in propelling the flavors market due to several key factors. They offer an ideal medium for showcasing and enhancing flavors. The taste and aroma of a beverage greatly influences the overall sensory experience and consumer satisfaction. Flavors are carefully formulated and added to beverages to create unique and appealing taste profiles. Moreover, beverages provide a platform for innovation and creativity in flavor development. Manufacturers are continuously introducing new and exciting flavor combinations and blends to captivate consumer interest and meet evolving preferences. This drives the demand for a diverse range of flavors, spurring innovation and market growth.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- Latin America

- Brazil

- Argentina

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

North America exhibits a clear dominance in the market, accounting for the largest flavors market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada), Europe (Germany, the United Kingdom, France, Italy, Spain, and others), Asia Pacific (China, Japan, India, South Korea, and others), Latin America (Brazil, Argentina, and others) and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others).

North America holds the largest market share in the flavor market as it has a highly developed and diverse food and beverage industry. The presence of numerous major food and beverage companies, coupled with a culture of culinary exploration and innovation, drives the demand for a wide variety of flavors. Additionally, North America has a large consumer base with high disposable incomes. The region's affluent population is willing to spend on premium and specialty food and beverage products, which are often incorporated with unique and sophisticated flavors. This consumer willingness to explore and experiment with different tastes is contributing to market growth.

Global Fragrances Market:

Breakup by Application:

- Soap and Detergents

- Cosmetics and Toiletries

- Fine Fragrances

- Household Cleaners and Air Fresheners

- Others

Soap and Detergents represent the leading application segment

The report has provided a detailed breakup and analysis of the fragrances market based on the application. This includes soap and detergents, cosmetics and toiletries, fine fragrances, household cleaners and air fresheners, and others. According to the report, soap and detergents represented the largest segment.

Soap and detergents play a significant role in propelling the fragrances market. Fragrances are added in soaps to create pleasant scents that linger on the skin after use. These fragrances help to mask any potential unpleasant odors from the soap's raw materials, making the washing experience more enjoyable. Moreover, the use of different scents allows soap manufacturers to cater to a wide range of consumer preferences, offering options such as floral, fruity, or herbal fragrances. Similarly, fragrances are often added to laundry detergents to impart a fresh and clean scent to the clothes. Fragrances in detergents also help eliminate or neutralize unpleasant odors from fabrics during the washing process, leaving a pleasant and long-lasting scent.

Breakup by Ingredients:

- Natural

- Synthetic

Synthetic ingredients account for the majority of the market share

The report has provided a detailed breakup and analysis of the fragrances market based on the ingredients. This includes natural and synthetic. According to the report, synthetic represented the largest segment.

Synthetic fragrances are artificially created aromatic compounds designed to mimic or replicate the scents found in nature. These fragrances are synthesized in laboratories using a combination of chemicals, allowing for a wide range of scents to be produced. They provide cost-effective alternatives to natural fragrances. Natural fragrances can be expensive and limited in supply, making them less viable for large-scale production. However, synthetic fragrances offer a more affordable and accessible option for fragrance developers and manufacturers, driving the overall market growth. Additionally, synthetic fragrances offer versatility and consistency. They can be precisely formulated to achieve specific scent profiles, allowing for greater control over fragrance characteristics such as intensity, longevity, and complexity. This consistency is crucial for manufacturers aiming to create products with consistent sensory experiences, ensuring brand loyalty and consumer satisfaction.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- Latin America

- Brazil

- Argentina

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

North America exhibits a clear dominance in the market, accounting for the largest fragrances market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada), Europe (Germany, the United Kingdom, France, Italy, Spain, and others), Asia Pacific (China, Japan, India, South Korea, and others), Latin America (Brazil, Argentina, and others) and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). North America holds the largest market share in the fragrances market.

The region has a strong consumer base with high disposable incomes, making it an attractive market for fragrance products. The purchasing power of consumers in North America enables them to indulge in luxury and premium fragrances, driving the overall market demand. Additionally, North America is home to several major global fragrance companies and renowned fragrance houses. These companies have established a strong presence and reputation in the market, leveraging their expertise in fragrance creation, marketing, and distribution. Their extensive product portfolios and established brand recognition contribute to the dominance of North America in the fragrances market. Furthermore, North America has a well-developed retail infrastructure, including department stores, specialty fragrance boutiques, and online platforms, providing easy access to a wide range of fragrance products. This accessibility and distribution network facilitate the availability and visibility of fragrances to consumers, further driving the market growth. Moreover, the region's cultural diversity and evolving consumer preferences play a key role. North American consumers embrace a variety of fragrance styles, from classic and sophisticated to niche and avant-garde, leading to a vibrant and diverse fragrance market.

Competitive Landscape:

The key players focus on understanding consumer preferences through market research and engaging with customers to gather feedback. They use this information to develop tailored flavors and fragrances and implement targeted marketing campaigns to create brand awareness and drive product sales. Additionally, they also invest heavily in research and development to create innovative flavors and fragrances. They focus on developing unique and differentiated product offerings that cater to changing consumer preferences and emerging trends. Other than this, numerous companies are actively working to reduce their environmental footprint by adopting sustainable sourcing practices, using renewable ingredients, and implementing eco-friendly production processes. They are also responding to consumer demands for clean label and natural products. Key players continuously expand their product portfolios through acquisitions, mergers, and new product launches. This allows them to offer a comprehensive range of flavors and fragrances to cater to various industries and customer segments.

The report has provided a comprehensive analysis of the competitive landscape in the global flavors and fragrances market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ADM

- Bell Flavors & Fragrances, Inc.

- DSM-Firmenich

- Givaudan S.A.

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Mane SA

- Robertet Group

- Sensient Technologies Corporation

- Symrise AG

- T. Hasegawa USA Inc.

- Takasago International Corporation

- Vigon International, Inc.

Recent Developments:

- Takasago International Corporation is engaging in the research and development of flavors and fragrances using artificial intelligence, computational science, bioscience, and human science. They are also developing efficient and environment-friendly synthesis processes using catalytic and flow manufacturing technologies.

- Firmenich SA, the world’s largest privately-owned perfume and taste company, is focusing on developing Firmenich’s 2030 Conscious Perfumery ambitions wherein the fragrance portfolio will comprise 99% of ultimately or partially biodegradable ingredients.

- V. MANE FILS SA launched its eco-friendly fragrance microcapsule for fabric softeners. The product is suitable for consumers seeking a sustainable alternative to traditional encapsulation. It is also using both biotechnology and new synthetic molecules to define its vision of natural flavors and fragrances. The resulting gustative and olfactory creations enrich its palette of ingredients and provide MANE with its consistent competitive edge.

Flavors and Fragrances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

Global Flavors Market

Global Fragrances Market

|

| Product Types Covered | Nature-Identical, Artificial, Natural |

| Forms Covered | Liquid, Dry |

| Applications Covered | Global Flavors Market: Beverages, Dairy and Frozen Desserts, Bakery and Confectionary Products, Savories and Snacks, Others Global Fragrances Market: Soap and Detergents, Cosmetics and Toiletries, Fine Fragrances, Household Cleaners and Air Fresheners, Others |

| Ingredients Covered | Natural, Synthetic |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | ADM, Bell Flavors & Fragrances, Inc., DSM-Firmenich, Givaudan S.A., International Flavors & Fragrances Inc., Kerry Group plc, Mane SA, Robertet Group, Sensient Technologies Corporation, Symrise AG, T. Hasegawa USA Inc., Takasago International Corporation, Vigon International, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flavors and fragrances market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global flavors and fragrances market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flavors and fragrances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global flavors and fragrances market was valued at USD 34.3 Billion in 2025.

We expect the global flavors and fragrances market to exhibit a CAGR of 3.00% during 2026-2034.

The changing consumer inclination from chemical-based flavors and fragrances towards naturally-sourced alternatives for numerous health and environmental benefits, is primarily driving the global flavors and fragrances market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of flavors and fragrances.

Based on the product type, the global flavors market can be segmented into natural-identical, artificial, and natural. Currently, natural-identical holds the majority of the total market share.

Based on the form, the global flavors market has been divided into liquid and dry, where liquid currently exhibits a clear dominance in the market.

Based on the application, the global flavors market can be categorized into beverages, dairy and frozen desserts, bakery and confectionery products, savories and snacks, and others. Currently, beverages account for the majority of the global market share.

Based on the application, the global fragrances market has been segregated into soap and detergents, cosmetics and toiletries, fine fragrances, household cleaners and air fresheners, and others. Among these, soap and detergents currently hold the largest market share.

Based on the ingredients, the global fragrances market can be bifurcated into natural and synthetic. Currently, synthetic exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global flavors and fragrances market include ADM, Bell Flavors & Fragrances, Inc., DSM-Firmenich, Givaudan S.A., International Flavors & Fragrances Inc., Kerry Group plc, Mane SA, Robertet Group, Sensient Technologies Corporation, Symrise AG, T. Hasegawa USA Inc., Takasago International Corporation, and Vigon International, Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)