Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Region, 2025-2033

Flexible Packaging Market Size and Share:

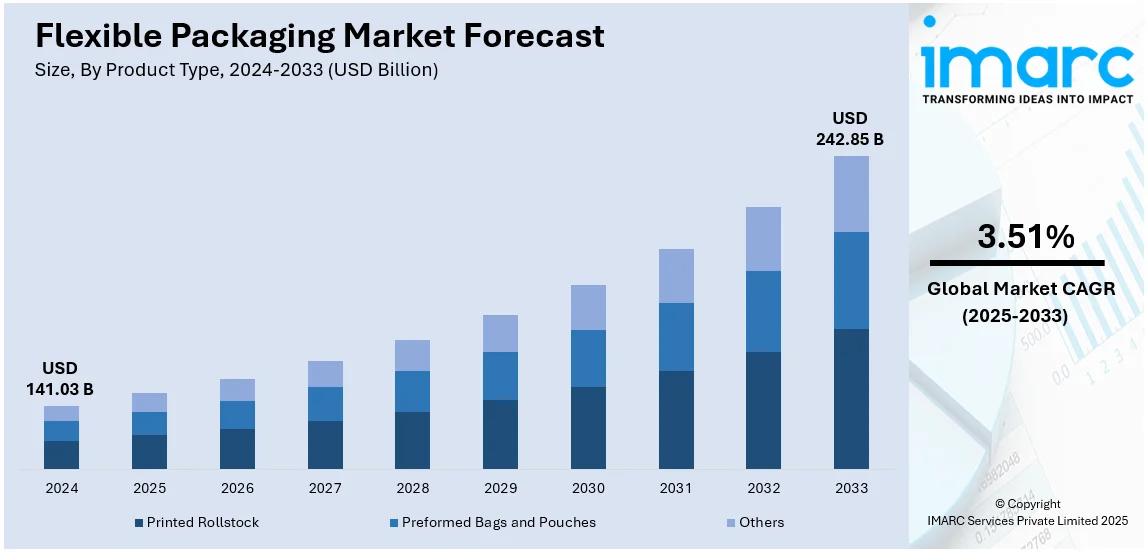

The global flexible packaging market size reached USD 141.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 242.85 Billion by 2033, exhibiting a growth rate CAGR of 3.51% from 2025-2033. Asia Pacific currently dominates the market, accounting for a share of 45.8% in 2024. The market is witnessing stable growth due to increasing focus on maintaining environmental sustainability, rising need for enhanced convenience, and technological advancements, such as superior barrier properties to extend the shelf life of various products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 141.03 Billion |

| Market Forecast in 2033 | USD 242.85 Billion |

| Market Growth Rate (2025-2033) | 3.51% |

The surge in online shopping is one of the major factors boosting the growth of flexible packaging market. As per recent data, 76% of adults in the United States shop online. Flexible packaging is a suitable match for e-commerce because it is lightweight and durable, which helps reduce shipping costs and product damage during transit. Additionally, flexible packaging often takes up less space, which makes it a preferable option for warehouse storage and shipping efficiency. With more people buying online, including food and cosmetics, brands are turning to flexible packaging as a way to make their products more shipping-friendly while still looking attractive when they arrive at customers’ doors.

The United States is a major market disruptor as its consumption pattern change owing to the burgeoning middle class and increasing development in cities. Just over half of Americans, which accounts for 51%, were considered middle class in the year 2023. This led to a higher demand for packaged food, beverages, and household products, all of which benefit from flexible packaging. Urban lifestyles tend to favor products that are easy to store, carry, and use, which makes flexible packaging a natural choice. In many cases, flexible packaging also helps extend the shelf life of products, which is crucial in areas where refrigeration or distribution infrastructure might be limited. The combination of urbanization and rising disposable incomes is a major driver for this market in the United States.

Flexible Packaging Market Trends:

Increasing Need to Maintain Environmental Sustainability

There is a rise in the focus on environmental conservation among individuals around the world. People are preferring greener packaging alternatives that lower greenhouse gas (GHG) emissions and align with sustainability goals. Flexible packaging usually requires less energy and fewer materials to produce as compared to rigid packaging. Furthermore, governing agencies of various countries are encouraging the adoption of sustainable packaging solutions to reduce carbon footprint. For instance, on January 11, 2022, the U.S. Department of Energy (DOE) announced a $13.4 million investment in seven projects focused on developing innovative recycling processes and technologies. This initiative aims to reduce plastic waste, lower energy consumption, and minimize carbon emissions associated with single-use plastics throughout their lifecycle.

Rising Focus on Enhanced Convenience Among Individuals

Individuals with modern and busy lifestyles are preferring portability, resealability, and ease-of-use packaging solutions. The rising demand for single-serve and on-the-go packaging options in the food and beverage (F&B) sector to lower food wastage is supporting the market growth. In line with this, major manufacturers are focusing on providing portion-sized packaging options to cater to diverse needs and preferences of individuals. Berry Global Group, Inc. partnered with snack and treats leader Mars on 27 September 2022. The partnership aimed to launch pantry-sized treats in polyethylene terephthalate (PET) jars that are designed to be lightweight and include 15% post-consumer resin (PCR).

Technological Innovations

Advancements in material science benefit in enabling the development of flexible packages that offer improved barrier properties, extend the product shelf life, and maintain freshness. Moreover, several key players are engaging in collaboration to introduce innovative packaging solutions. For instance, Mondi collaborated with Norwegian pet food manufacturer Felleskjøpet on 3 October 2022, to switch to recyclable high-barrier packaging. The product ‘FlexiBag Recyclable’ of the company Mondi provides superior product protection and preserves premium pet food on account of its high barrier material.

Flexible Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flexible packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, raw material, printing technology, and application.

Analysis by Product Type:

- Printed Rollstock

- Preformed Bags and Pouches

- Others

Printed rollstock packaging leads the market with a share of 59.7% in 2024. Printed rollstock is a continuous roll of flexible packaging material that is pre-printed with text, graphics, and other design elements. It offers customizable properties that allow companies to incorporate their product information. Apart from this, there are various key players in the packaging market that are providing specialized and customized packaging solutions by forming strategic mergers and acquisitions (M&A) and partnerships. CCL Industries Inc. signed an agreement on June 16, 2023, to acquire Pouch Partners s.r.l., based in Italy. Pouch Partners specializes in providing highly specialized, gravure-printed, and laminated flexible film materials for pouch forming, including recyclable solutions.

Analysis by Raw Material:

- Plastic

- Paper

- Aluminium Foil

- Cellulose

Plastic leads the market with a share of 61.8% in 2024. Due to its increased price and flexibility, plastic packaging is becoming increasingly popular, which is driving the market expansion. Plastic is a very adaptable material that is produced to meet the unique needs of many industries and goods. It guarantees the freshness and quality of the goods and is resistant to light, air, moisture, and odor. The market expansion for flexible packaging is being aided by the growing need for recyclable plastic solutions. For instance, Cadbury's goal to reduce its use of virgin plastic was accelerated on February 5, 2024, when Amcor, a global leader in responsible packaging solutions, signed an agreement with Cadbury to supply approximately 1,000 tons of post-consumer recycled plastic for packaging its core Cadbury chocolate range.

Analysis by Printing Technology:

- Flexography

- Rotogravure

- Digital

- Others

Flexography leads the market with a share of 62.7% in 2024. Flexography printing technology is a high-speed and roll-feed web printing process. It relies on flexible photopolymer printing plates are used to print high-resolution images on various substrates. It is believed to achieve speeds up to 2000 linear feet per minute. It benefits in producing minimal waste in terms of materials, time, and resources. It is majorly used to manufacture larger quantities of corrugated packaging and folding cartons. The need for this packaging technology is also being backed by the growing use of corrugated packaging as a result of the flourishing e-commerce industry. Forbes projects that the global e-commerce business will grow from $5.8 trillion in 2023 to $6.3 trillion in 2024, thereby creating the need for flexible packaging solutions.

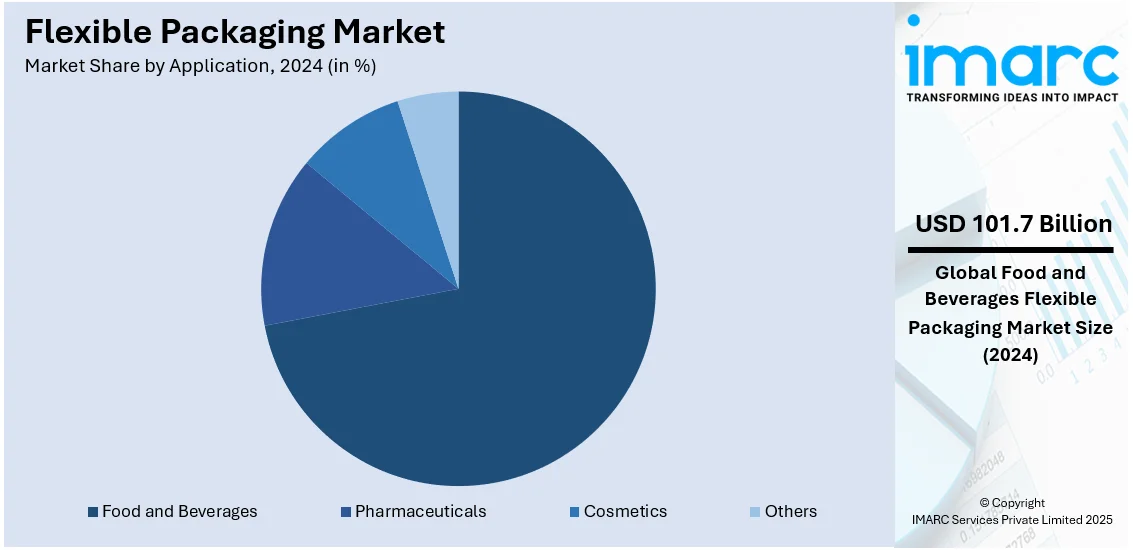

Analysis by Application:

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

In 2024, food and beverages held the largest market share of 72.1%. The food and beverage (F&B) industry's increasing use of flexible packaging to package a variety of products, including as dairy, snacks, beverages, and frozen meals, is driving the market expansion. Packaging products retain temperature sensitivity, prolong shelf life, and provide barrier properties. By offering conveniences like single-serve substitutes or resealable packaging, they appeal to a wider range of consumers. The market is also expanding because to the rising need for flexible packaging solutions brought on by the increased consumption of ready-to-eat (RTE) food items by the global population. The report from the IMARC Group projects that by 2032, the global RTE food market will be worth US$262.4 billion, thus increasing the need for flexible packaging solution in this sector.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of 45.8%. This area provides a profitable industry for flexible packaging makers, particularly in China and India. Alongside this, the increase of distribution channels is driving the demand for flexible packaging solutions at these retailers. Furthermore, the growing use of flexible packaging due to the expanding pharmaceutical industry is driving the market expansion. According to Invest India, India's pharmaceutical business is expected to reach $65 billion by 2024 and $130 billion by 2030, thus leading to an increased need for this packaging solution.

Key Regional Takeaways:

North America Flexible Packaging Market Analysis

North America's flexible packaging market is expanding significantly because of a strong e-commerce industry, changing customer tastes, and growing ecological consciousness. In sectors including food and beverage, medicines, and personal care, there is a particularly high need for packaging that is lightweight, robust, and resealable. Convenience and environmentally friendly alternatives are top priorities for consumers in the area, which encourages manufacturers to use recyclable and biodegradable materials in their packaging. Additionally, packaging that can withstand shipment without compromising product integrity is necessary due to the increased popularity of online purchasing. The North American market's use of flexible packaging is being accelerated by the legislative drive for waste reduction and sustainable practices, as well as advancements in materials and design.

United States Flexible Packaging Market Analysis

Consumer convenience preference, sustainability tendencies, and expansions in the essential sectors, including e-commerce, food and beverages, and pharmaceutical, fuel the market for flexible packaging in the United States. There are around 950 production sites and nearly 79,000 employment opportunities within the US from the flexible packaging sector alone, as stated in industry reports. More than 60% of Americans are prepared to pay additional for over 60% packaging benefits to ensure concrete and beneficial packaging. This is one of the reasons why flexible packaging will continue to expand and why it is so critical that the industry figure out how to make sustainable solutions appealing to companies. Flexible materials, such as pouches and wraps, are becoming increasingly popular because of the increasing demand for single-serve and ready-to-eat meals. The rise is supported by the pharmaceutical industry's transition to unit-dose and resealable flexible packaging; in 2021, U.S. pharmaceutical revenue has surpassed USD 550 Billion, as per an industry report. E-commerce, which is expanding by 20% a year, fuels the need for strong, lightweight packaging that lowers shipping expenses.

Businesses will be encouraged by sustainability concerns to use recyclable materials and cut down on plastic waste as over 60% of American consumers favor environmentally friendly packaging. Regulation support through legislation such as the Save Our Seas 2.0 Act pushes businesses to invest in innovative and flexible solutions. Major companies, such as Amcor and Berry Global, are investing in state-of-the-art flexible packaging technology that will continue to drive growth within the industry.

Europe Flexible Packaging Market Analysis

Stricter environmental laws, more importance on recycling, and increasing demand in the food and beverage sector are affecting the flexible packaging market in Europe. The EU's Circular Economy Action Plan states that by 2025, 55% of plastic packaging should be recyclable and forces producers to develop eco-friendly products. Because of its advantages of being lightweight and having a longer shelf life, flexible packaging dominates the European food industry, making up most of the food packaging, especially in Western Europe. The need for vacuum-sealed materials and resealable pouches is increasing as the consumption of processed foods climbs is rising. The pharmaceutical industry is increasingly using flexible blister packs and sachets with an annual trade surplus of Euro 109.4 Billion (USD 113.88 Billion), as per industry reports. Moreover, the growth of private-label brands in the retail industry, especially in nations like the UK and Germany, encourages the use of affordable flexible packaging. Trends in consumer demand for convenience are shaping the European market, for instance, by the dramatic rise in consumption of food eaten on the go and focus on biodegradable materials, such as bio-based films.

Asia Pacific Flexible Packaging Market Analysis

The fast pace of urbanisation, increase in disposable income, and growth in the food, beverage, and personal care industries have made the Asia-Pacific region the biggest and fastest-growing market for flexible packaging. Convenient packaging options such as stand-up pouches and sachets are increasingly in demand due to the urban population that continues to expand and grow by 50% by 2050 according to UN habitat data. Flexible packaging is a critical aspect of the food processing business that has attracted FDI over INR 500 billion (USD 5.99 Billion) in India alone, as per industry report. It is economical and functional. Other fuelling drivers of the lightweight, protective material market include rapidly rising e-commerce activities, primarily in China. Reports indicate online sales in China surpassed USD 2 Trillion in 2023. Additional encouragement comes in the form of government programs for developing cutting-edge flexible packaging technologies under India's PLI Scheme for Packaging and China's "Made in China 2025.". More than 50% of the global consumer class is in Asia Pacific, and their preference for packaged goods made of eco-friendly materials is driving advancements in biodegradable film technology.

Latin America Flexible Packaging Market Analysis

The growth of the food and beverage industry, flexibility in material prices, and increasing demand for eco-friendly packaging are boosting the Latin American market. The major markets are Brazil and Mexico, where the consumption of processed foods is increasing considerably every year. According to studies, the thriving food export sector in Latin America and the Caribbean, which is valued at USD 349 billion annually, is supported by the versatility of flexible packaging for a wide range of applications, such as snack packs and coffee pouches. In the personal care sector, flexible cream and shampoo tubes and pouches are growing in popularity, particularly in Brazil, which has the fourth-largest cosmetics market globally. Due to the region's economic recovery, e-commerce is growing quickly, which raises demand for safe and lightweight packaging. Programs of sustainability, such as Chile's plastic ban, require businesses to shift towards flexible materials that are recyclable and compostable, propelling the market more.

Middle East and Africa Flexible Packaging Market Analysis

Middle East and Africa is being driven by rapid urbanisation, increasing food security concerns, and investments in modern retail infrastructure. Consumption of packaged food is growing as urban populations expand. More than half of the demand for flexible packaging comes from the food and beverage sector, because expanded exports of perishable commodities like meat and dates require using sophisticated vacuum-sealed pouches. In Saudi Arabia, through Vision 2030, a government program promoting sustainability and diversification, programs encourage the use of recyclable flexible materials. Additionally, expansion in e-commerce-online sales in the UAE reached USD 4.8 Billion in 2021, as reported-help the need for low-cost, safe packaging options. The development of the pharmaceutical industry and localisation policies to produce medicines push the growth of the flexible blister packs and sachets market in the region.

Competitive Landscape:

To keep a competitive edge, major industry participants are concentrating on innovation and sustainability. They are spending money on research and development (R&D) to produce recyclable, biodegradable, or environmentally friendly materials that satisfy customer demands and legal requirements while raising the market price of flexible packaging. Major manufacturers are also utilizing cutting-edge technologies, such nanotechnology and three-dimensional (3D) printing, to increase product shelf life and enhance package integrity. Additionally, they frequently engage in strategic alliances and acquisitions to broaden their product lines, penetrate new markets, and boost sales in the flexible packaging industry. On July 19, 2023, SEE, previously Sealed Air, partnered with ExxonMobil on a cutting-edge food-grade plastic recycling project. This partnership marks a significant milestone in utilizing certified circular resins to create tray packaging solutions for the retail sector.

The report provides a comprehensive analysis of the competitive landscape in the flexible packaging market with detailed profiles of all major companies, including:

- Amcor Limited

- Bemis Company,

- Berry Global Group, Inc

- Mondi Limited

- Sealed Air

- Aluflexpack AG

- Bak Ambalaj Sanayi

- Constantia Flexibles

- Clondalkin Group

- Danaflex Group

- DS Smith Plc

- Glenroy, Inc

- Huhtamaki PPL Limited

- Printpack, Inc.

- ProAmpac Intermediate, Inc.

Latest News and Developments:

- December 2024: UFlex is spending over USD 200 million in Egypt to increase its production capacity. In order to meet the rising demand worldwide, our expansion incorporates state-of-the-art packaging solution manufacturing facilities. The investment demonstrates UFlex's dedication to expanding its business in foreign markets and taking advantage of Egypt's advantageous geographic position for exports worldwide.

- December 2024: Toppan Holdings purchased Sonoco's TFP (Thermally Formed Plastics) division to bolster its global packaging portfolio. The goal of the acquisition is to increase Toppan's capacity to offer sustainable, high-performing packaging solutions. This action is in line with Toppan's strategic objectives to increase its market share and meet the growing demand for environmentally friendly packaging options. Toppan is able to provide a wider selection of products since the TFP business offers specialised solutions that serve different sectors.

- August 2023: Amcor, a global leader in responsible packaging solutions, has entered into an agreement to acquire Phoenix Flexibles, enhancing its presence in the rapidly growing Indian market. Based in Gujarat, India, Phoenix Flexibles operates a single plant and generates approximately USD 20 million in annual revenue through the sale of flexible packaging for food, personal care, and home care applications.

- September 2022: Huhtamaki announced its investment in Emerald Technology Ventures' sustainable packaging fund, aiming to drive the development of next-generation sustainable packaging solutions while leveraging innovative advancements from start-ups.

Flexible Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Printed Rollstock, Preformed Bags and Pouches, Others |

| Raw Materials Covered | Plastic, Paper, Aluminium Foil, Cellulose |

| Printing Technologies Covered | Flexography, Rotogravure, Digital, Others |

| Applications Covered | Food and Beverages, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor Limited, Bemis Company, Berry Global Group, Inc, Mondi Limited, Sealed Air, Aluflexpack AG, Bak Ambalaj Sanayi, Constantia Flexibles, Clondalkin Group, Danaflex Group, DS Smith Plc, Glenroy, Inc, Huhtamaki PPL Limited, Printpack, Inc., ProAmpac Intermediate, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flexible packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global flexible packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flexible packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Flexible Packaging market was valued at USD 141.03 Billion in 2024.

The global flexible packaging market is estimated to reach USD 242.85 Billion by 2033, exhibiting a growth rate (CAGR) of 3.51% from 2025-2033.

The key factors driving the global flexible packaging market include the rising demand for convenience, rapid advancements in packaging technology, growth of the e-commerce sector, rising urbanization, increasing disposable incomes, and a focus on reducing shipping costs and product waste.

Asia Pacific currently dominates the market, accounting for a share of 45.8% in 2024. The region’s dominance is driven by increasing focus on maintaining environmental sustainability, rising need for enhanced convenience, and technological advancements, such as superior barrier properties to extend the shelf life of various products.

Some of the major players in the global Flexible Packaging market include Amcor Limited, Bemis Company, Berry Global Group, Inc, Mondi Limited, Sealed Air, Aluflexpack AG, Bak Ambalaj Sanayi, Constantia Flexibles, Clondalkin Group, Danaflex Group, DS Smith Plc, Glenroy, Inc, Huhtamaki PPL Limited, Printpack, Inc., ProAmpac Intermediate, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)