Flight Management Systems Market Size, Share, Trends and Forecast by Fit, Aircraft Type, Hardware, and Region, 2025-2033

Flight Management Systems Market Size and Share:

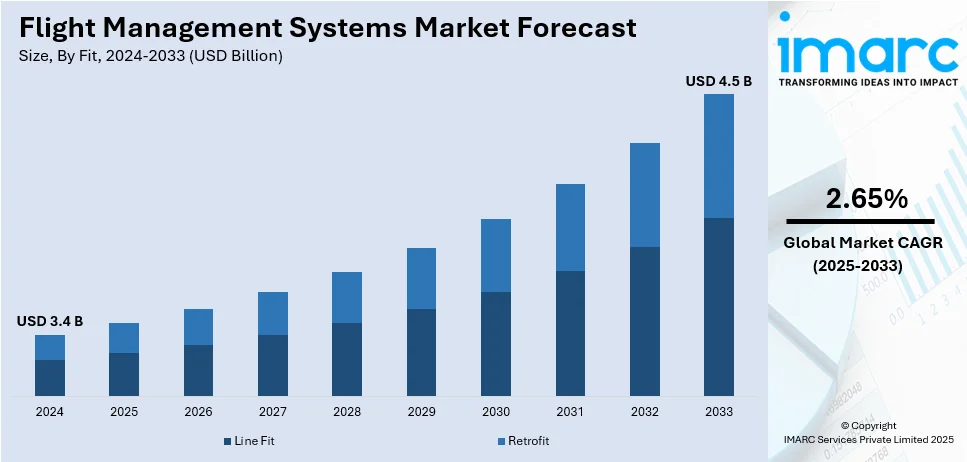

The global flight management systems market size was valued at USD 3.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.5 Billion by 2033, exhibiting a CAGR of 2.65% from 2025-2033. North America currently dominates the market, holding a market share of over 35.5% in 2024. The rapid adoption of improved automation and digitalization, increasing utilization of predictive maintenance and health monitoring in aircraft, and rise in construction of airports around the globe to connect numerous locations are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 2.65% |

The Flight Management Systems (FMS) market is expanding due to rising demand for efficient and fuel-saving avionics in modern aircraft. The rise in air travel, particularly in emerging economies, highlights the need for advanced navigation systems to optimize routes and reduce costs. On November 17, 2024, India recorded a historic 5,05,412 domestic passengers in a single day, with more than 3,100 flights, highlighting aviation growth. The adoption of next-generation aircraft with integrated avionics and regulatory mandates for safety and precision further augment the market. Additionally, retrofitting older aircraft with upgraded FMS to extend their lifespan and the increasing use of satellite-based navigation systems drive innovation, catering to the shifting requirements of commercial, military, and private aviation.

The United States is an important region in the market and is primarily driven by increasing adoption of advanced avionics for efficiency, safety, and compliance with Federal Aviation Administration (FAA) regulations. Investments in modernizing legacy aircraft fleets with updated FMS to extend operational life significantly contribute to market growth. On September 26, 2024, Southwest Airlines announced a three-year plan focusing on customer experience enhancements, assigned seating, global partnerships, and operational optimization, emphasizing the role of FMS in achieving these goals. The rising demand for unmanned aerial vehicles (UAVs) in commercial and military applications also augments FMS advancements. Additionally, the implementation of NextGen air traffic systems and growing domestic air travel, driven by low-cost carriers, increase demand for navigation and route optimization technologies.

Flight Management Systems Market Trends:

Growing adoption of advanced automation and digitalization

The rising adoption of advanced automation and digitalization to enhance the efficiency and accuracy of flight management systems is positively influencing the FMS market. Automation reduces human errors, streamlines processes, and enables real-time data processing, leading to more precise flight planning, navigation, and control. This improves overall flight operations and reduces operational costs. Digitalized FMSs can access and analyse a vast amount of data, including weather conditions, air traffic congestion, and aircraft performance parameters. For instance, flight management systems are redefining aviation with connectivity-ready ecosystems, enhancing efficiency, safety, and cost-effectiveness post-COVID-19. According to Wipro, with disruptions costing airlines USD 60 Billion annually, integrated solutions like real-time weather apps and inflight connectivity streamline operations and optimize decision-making are driving sustainable growth. This data-driven approach allows for optimized flight planning, which can lead to shorter flight times, reduced fuel consumption, and minimized environmental impact. Moreover, automation and digitalization enable FMSs to incorporate advanced safety features, including collision avoidance systems, predictive maintenance, and real-time monitoring. These features help prevent accidents, improve aircraft maintenance scheduling, and ensure a higher level of passenger and crew safety.

Rising adoption of predictive maintenance and health monitoring in aircraft

At present, the rising adoption of predictive maintenance and health monitoring in aircraft to continuously monitor the condition of numerous aircraft components and systems is positively influencing the FMS market. Predictive maintenance and health monitoring systems help identify and address potential safety concerns proactively. For instance, the integration of AI-driven Flight Management Systems enhances aviation efficiency, reducing maintenance costs by 25% and operational disruptions by up to 70%, while improving passenger satisfaction through personalized experiences and optimized services. This translates to increased reliability and reduced chances of in-flight system failures. Additionally, a robust flight management system plays a crucial role in integrating data from these monitoring systems and aiding pilots in making informed decisions, thus enhancing the overall safety of flights. Furthermore, predictive maintenance allows for more precise planning, avoiding unnecessary component replacements and reducing overall maintenance costs.

Increasing volume of air traffic

At present, there is a rise in the volume of air traffic due to increasing traveling activities among the masses. Besides this, as air traffic increases, airlines and aviation authorities seek more efficient ways to manage and navigate flights to ensure safety and timely operations. FMS plays a crucial role in optimizing flight routes, fuel consumption, and overall operational efficiency. For instance, the FAA's Air Traffic Organization manages over 16.4 Million flights and 2.9 Million daily passengers across 29 Million Square Miles annually, supported by 14,000+ controllers and 520 traffic towers. Flight management systems enhance efficiency, aiding air traffic control in handling 5,400 peak-time aircraft within U.S. and oceanic airspaces. FMS providers continuously develop and enhance their systems to keep up with the increasing demand for more advanced and capable solutions. This drives innovation and investment in the FMS market. Furthermore, FMS systems help pilots comply with these regulations by providing accurate navigation, collision avoidance, and situational awareness tools.

Flight Management Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flight management systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fit, aircraft type, and hardware.

Analysis by Fit:

- Line Fit

- Retrofit

Line fit stand as the largest component in 2024, holding around 62.8% of the market. Installing an FMS during the aircraft's assembly line manufacturing process before to delivery to the airline is known as "line fit installation". This integration is designed and tested by the aircraft manufacturer to ensure compatibility and optimal performance. FMS plays a crucial role in enhancing flight safety by providing accurate navigation, precise route planning, and efficient fuel management. These safety-critical features are guaranteed to be present and functional from the beginning with line fit installation. Furthermore, line fit installation standardizes the FMS configuration across the fleet of an airline.

Analysis by Aircraft Type:

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

Narrow body aircraft leads the market with around 47% of market share in 2024. Their dominance in the market is due to their widespread use in short-to-medium-haul routes, which comprise the majority of global air travel demand. These aircraft, favored by low-cost carriers and major airlines alike, require advanced FMS to optimize fuel efficiency, navigation, and operational performance. The ongoing growth of domestic and regional air travel, coupled with airline fleet expansion, augments demand for FMS tailored to narrow-body models. Additionally, advancements in avionics technology further enhance their market leadership.

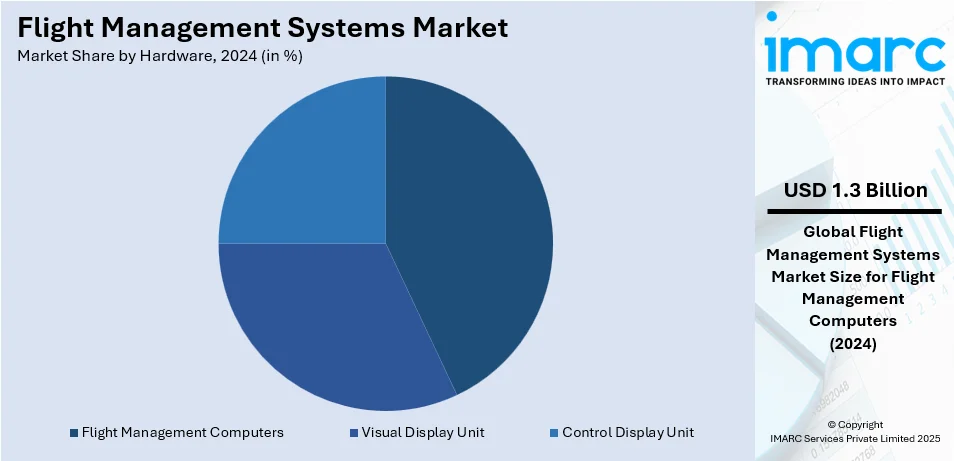

Analysis by Hardware:

- Visual Display Unit

- Control Display Unit

- Flight Management Computers

Flight Management Computers leads the market with around 39% of market share in 2024. Flight management computers (FMCs) are crucial components in modern aircraft that assist pilots in planning and executing flights. They are sophisticated onboard computers that handle various aspects of flight navigation, guidance, and management. They allow pilots to input information, such as the flight route, waypoints, departure and arrival airports, and alternate routes. FMCs utilize various navigation sources, including global positioning systems (GPS), inertial navigation systems (INS), and radio navigation aids, such as VOR and DME, to accurately determine the position of the aircraft and track its progress along the planned route. They can automatically update the position of the aircraft and make real-time adjustments to the flight path.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 35.5%. North America's increasing volume of air traffic, along with rising traveling activities among the masses to explore new regions is the prime factor driving the market in the region. Furthermore, the increasing modernization of aircraft fleets is contributing to the market growth. Besides this, airline businesses' increased focus on safety and regulatory compliance is fueling the market's expansion. In addition, increasing initiatives taken by airline companies to reduce fuel expenditure and minimize the environmental impact of their operations are strengthening the growth of the market. Asia Pacific is estimated to expand further in this domain due to the rising adoption of data-driven decision-making and digitalized processes by the aviation industry. Besides this, the increasing popularity of electric vertical takeoff and landing (eVTOL) vehicles is bolstering the growth of the market.

Key Regional Takeaways:

United States Flight Management Systems Market Analysis

In 2024, the United States accounted for 82.70% of the North America flight management systems market. Flight management systems (FMS) in the United States benefit from robust technological advancements and a well-established aviation industry. According to the Bureau of Transportation Statistics (BTS), 78.7 million local and global scheduled service passengers were transported by U.S. airlines in December 2023. Seasonality-adjusted December enplanements are up 0.5% from November and hit a record high, surpassing the previous high set in December 2023. Furthermore, the region's drivers for the growth of FMS market include extensive adoption of NextGen air traffic management initiatives and a strong demand for fuel-efficient operations due to rising environmental regulations. A key strength lies in the presence of leading aerospace manufacturers and suppliers, which enhances innovation and integration capabilities. For instance, companies like Honeywell and Collins Aerospace are at the forefront of developing advanced FMS solutions tailored to regional and international needs. With the growing adoption of autonomous flight systems and electric aviation, the United States provides a significant growth for research and development (R&D) in FMS. The market benefits from increasing commercial and military aviation investments, particularly in enhancing route optimization and reducing operational costs. Additionally, collaborations between private and government bodies facilitate modernization efforts, is further solidifying the role of FMS in next-generation aircraft.

Europe Flight Management Systems Market Analysis

Europe's flight management systems market is shaped by stringent environmental policies and a focus on sustainability within the aviation sector. Regional drivers include initiatives like the European Union's Single European Sky (SES) project, which aims to minimize delays and optimize air traffic management. A notable strength is the region’s leadership in integrating green aviation technologies, supported by companies like Thales and Lufthansa Systems. European countries also emphasize the adoption of satellite-based navigation systems such as Galileo, enhancing precision and reliability. The presence of established aircraft manufacturers, including Airbus, drives consistent innovation in FMS software and hardware. For instance, according to the European commission, the European civil aeronautics industry, a global leader in civil aircraft production, contributed approximately USD 137 Billion in annual revenues and supported 405,000 high-skilled jobs in 2019. In 2019, the industry invested around USD 8.5 Billion in research and development, fostering innovation in safer and more efficient flight management systems. This ecosystem is bolstered by a network of dynamic small and medium-sized enterprises across the EU. Efforts to modernize legacy systems have accelerated due to increased demand for streamlined operations in both commercial and private aviation. Furthermore, Europe’s emphasis on multimodal transportation systems encourages the integration of FMS with broader transport networks.

Asia Pacific Flight Management Systems Market Analysis

Asia-Pacific’s growing aviation sector is driving the demand for flight management systems, fueled by rising air travel and expanding low-cost carriers in countries like China and India. The region's strengths include a rapidly increasing fleet size and substantial investments in airport infrastructure, supporting advanced navigation systems. Airbus and Boeing’s manufacturing hubs in China and India, respectively, exemplify the region's integration of cutting-edge FMS technologies. According to Boeing India, Boeing's sourcing from India stands at USD 1.25 Billion a year from an extensive network that consists of more than 300 suppliers. Governments across the region are emphasizing digital transformation in aviation, integrating satellite-based navigation and real-time flight data systems to enhance efficiency and safety. For instance, India’s aviation sector, the 7th largest globally, is set to reach 3rd by 2032, according to the India Investment Grid, fueled by rapid airport expansion from 136 to 216 in five years. With a 3.1x economic multiplier and 6.1x employment multiplier, investments in aviation infrastructure offer immense growth potential, directly benefiting advanced flight management systems through enhanced airport operations and scalability. Initiatives such as SESAR’s collaboration with Asia-Pacific countries have bolstered the implementation of performance-based navigation, particularly in busy airspace corridors. The focus on sustainability is driving interest in electric and hybrid aircraft, opening new avenues for FMS tailored to energy-efficient operations.

Latin America Flight Management Systems Market Analysis

The Latin America’s flight management systems market is primarily driven by the growth of regional airlines and increasing air travel demand in countries like Brazil and Mexico. The region's strengths include its efforts to improve aviation infrastructure, which promotes the adoption of advanced FMS for route optimization. For instance, the Brazilian aviation industry, home to the world’s 3rd largest civilian aviation system and 5th largest airspace, according to the ITA, offers vast opportunities for flight management systems. With a rapidly recovering market with 831,000 flights in 2022, up 39% from 2021—and robust domestic demand, partnerships with OEMs like Embraer, importing 60% of components from North America, present significant growth potential. Challenges like high operational costs and airspace congestion have encouraged the deployment of systems that enhance fuel efficiency and reduce delays. The region is also observing an increasing shift toward satellite-based navigation systems, supporting smoother and safer flight operations.

Middle East and Africa Flight Management Systems Market Analysis

The Middle East and Africa’s FMS market is supported by expanding fleets and the establishment of new aviation hubs, particularly in the Gulf Cooperation Council (GCC) countries. Drivers such as the growth of international carriers like Emirates and Qatar Airways, prioritize advanced technologies for efficient long-haul operations. The region's strategic geographical position makes it a vital connecting hub for global air traffic. Investments in airport modernization and airspace management systems further highlight the demand for cutting-edge FMS solutions. For instance, the UAE's robust aviation sector, supported by flagship airlines like Emirates and Etihad Airways and seven international airports, benefits flight management systems through advanced technology integration. With over USD 22.9 Billion invested in airport expansions and fleets comprising over 500 modern aircraft, the sector drives efficiency, cost management, and enhanced passenger experiences. Additionally, Africa’s adoption of performance-based navigation systems aims to address airspace inefficiencies, supporting enhanced connectivity within and beyond the continent.

Competitive Landscape:

Key market players are investing in research operations to enhance the technology and capabilities of their systems, involving improvements in navigation accuracy, fuel efficiency, automation, and integration with other avionics systems. They are also working on integrating these technologies into their systems to offer more accurate and efficient flight planning and navigation. Top companies are incorporating data analytics and predictive maintenance capabilities into their systems. They are also focusing on developing user-friendly interfaces for pilots and operators to reduce pilot workload, enhance situational awareness, and improve the overall flight experience. Leading companies are ensuring that their systems meet the latest regulatory requirements and industry standards, providing airlines and operators with compliant solutions.

The report provides a comprehensive analysis of the competitive landscape in the flight management systems market with detailed profiles of all major companies, including:

- Honeywell International Inc.

- Thales Group

- General Electric Company

- Rockwell Collins

- Esterline Technologies Corporation

- Garmin Ltd.

- Universal Avionics Systems Corporation

- Jeppesen Sanderson, Inc.

- Navtech, Inc.

- Lufthansa Systems GmbH & Co. Kg

- Leonardo-Finmeccanica Spa

Latest News and Developments:

- April 2024, TrustFlight's Electronic Tech Log was seamlessly integrated into FL3XX's aviation management platform, enhancing operational efficiency. The integration eliminates the manual entry of flight, passenger, and crew data, significantly reducing potential errors. This collaboration enables real-time updates, ensuring that aircraft records are consistently accurate and current. The streamlined workflow benefits both operators and aviation management by improving data reliability. It marks a progressive step towards digitization in aviation management processes.

- March 2024, SAB Aviaçâo in Brazil was authorized to install twin Avidyne Atlas Flight Management Systems (FMS) in a Dassault Falcon 50 aircraft. These advanced systems enable fully automated GPS approaches, enhancing navigation precision. The upgrade is a cost-effective solution compared to replacing Collins Pro Line units, providing significant savings.

- May 2022, Honeywell International Inc. was chosen by Airbus to support the air traffic management systems for its next-generation A320, A330, and A350 aircraft. This collaboration aims to enhance the efficiency and sustainability of air traffic operations. The advanced systems are expected to improve navigational precision and overall operational performance. These aircraft are planned to enter service by the end of 2026.

- July 2023, Garmin Ltd. launched PlaneSync to streamline aircraft ownership with cutting-edge digital solutions. It features automatic updates for databases, cloud-based flight log uploads, and real-time aircraft status monitoring. PlaneSync enhances convenience and operational efficiency for aircraft owners and operators. It aims to reduce the complexities of maintenance and data management. This initiative reinforces Garmin's commitment to innovation in avionics technology. The service is poised to set new standards in digital aircraft management.

- June 2022, Universal Avionics Systems Corporation secured a contract with Aeronaves TSM to upgrade cockpits in 26 cargo aircraft. This includes enhancements for 15 McDonnell Douglas MD-80s and 11 Douglas DC-9s. The upgrades focus on improving cargo operations' efficiency and modernizing avionics systems. Universal Avionics aims to bolster Aeronaves TSM’s operational performance and safety standards.

Flight Management Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fits Covered | Line Fit, Retrofit |

| Aircraft Types Covered | Narrow Body Aircraft, Wide Body Aircraft, Very Large Aircraft, Regional Transport Aircraft |

| Hardwares Covered | Visual Display Unit, Control Display Unit, Flight Management Computers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Honeywell International Inc., Thales Group, General Electric Company, Rockwell Collins, Esterline Technologies Corporation, Garmin Ltd., Universal Avionics Systems Corporation, Jeppesen Sanderson, Inc., Navtech, Inc., Lufthansa Systems GmbH & Co. Kg, Leonardo-Finmeccanica Spa, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flight management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global flight management systems market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flight management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flight management systems market was valued at USD 3.4 Billion in 2024.

The flight management systems market to exhibit a CAGR of 2.65% during 2025-2033, reaching a value of USD 4.5 Billion by 2033.

The market is primarily driven by rising air travel, adoption of advanced automation, predictive maintenance, and satellite-based navigation, alongside increasing airport construction, regulatory mandates, and demand for efficient, fuel-saving avionics across commercial, military, and private aviation.

North America currently dominates the flight management systems market, accounting for a share of 35.5% due to the robust aviation infrastructure, significant defense and commercial aviation investments, advanced technology adoption, and the presence of major aerospace manufacturers driving innovation.

Some of the major players in the flight management systems market include Honeywell International Inc., Thales Group, General Electric Company, Rockwell Collins, Esterline Technologies Corporation, Garmin Ltd., Universal Avionics Systems Corporation, Jeppesen Sanderson, Inc., Navtech, Inc., Lufthansa Systems GmbH & Co. Kg, and Leonardo-Finmeccanica Spa, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)