Flow Chemistry Market Size, Share, Trends and Forecast by Reactor, Application, and Region, 2025-2033

Flow Chemistry Market Size and Share:

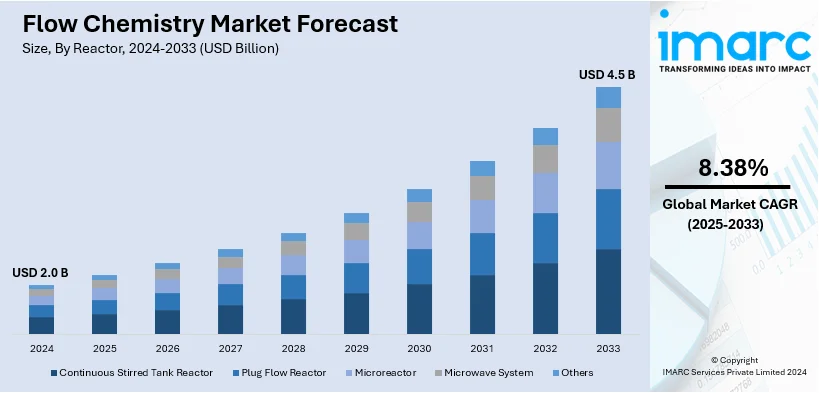

The global flow chemistry market size was valued at USD 2.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.5 Billion by 2033, exhibiting a CAGR of 8.38% from 2025-2033. North America currently dominates the market, holding a market share of over 37.7% in 2024. The market is majorly being supported by the growing emphasis on sustainability, the escalating requirement for exact synthesis, modular scalability, and automation, along with extensive product use across the pharmaceuticals, chemicals, and materials sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 8.38% |

The global flow chemistry market is propelled by the flourishing demand for sustainable manufacturing processes across industries such as pharmaceuticals, chemicals, and petrochemicals. Flow chemistry's ability to minimize waste, reduce energy consumption, and enhance reaction selectivity aligns with rising environmental regulations and sustainability goals. Moreover, its precise control over reaction conditions enables cost-effective production and scalability, fostering adoption in drug development and specialty chemical manufacturing. Additionally, advancements in modular flow systems and increased collaborations between academia and industry are accelerating innovation, while growing investments in research and development further strengthen the market's growth trajectory. For instance, in August 2024, The Telangana government signed an MoU with Corning Incorporated to enhance its involvement in the Flow Chemistry Technology (FCT) hub, a collaboration with Dr. Reddy’s Limited, University of Hyderabad and Laurus Pharma Limited. Corning also introduced its advanced Corning advanced-flow reactors (AFR) technology to strengthen chemical engineering technologies in Indian market.

The United States plays a pivotal role in the global flow chemistry market, driven by its advanced pharmaceutical, agrochemical, and specialty chemical industries. For instance, as per industry reports, the U.S. is anticipated to spend around USD 605 to 635 billion on medicine in the year 2025. This magnifying expenditure, in turn, will positively impact flow chemistry industry. Furthermore, the country’s emphasis on innovation, supported by robust research and development infrastructure and collaboration between industry giants, fosters the adoption of continuous flow technologies. Stringent environmental regulations and the push for sustainable manufacturing practices further accelerate market growth. In addition, significant investments in scaling flow chemistry for industrial applications ensure high efficiency and reduced waste.

Flow Chemistry Market Trends:

Sustainability And Efficiency Demands

The rising trend toward sustainable and environmentally friendly industrial practices has heightened the adoption of flow chemistry, which, in turn, is favoring the market growth. This strategy supports the industry's growing emphasis on reducing waste, conserving resources, and reducing the environmental effect of chemical operations. In addition, flow chemistry offers accurate control of reaction parameters, resulting in a lowered byproduct formation, better yield, and selectivity. Moreover, the continuous-flow attribute of the process enables for real-time changes, leading to reduced energy utilization and more effective reactions. As regulatory constraints and consumer expectations for eco-friendly items amplify, businesses are inclining towards flow chemistry to address these needs while maintaining competitive edge, hence boosting market expansion. For instance, in July 2024, BASF and Imperial unveiled SOLVE, a spinout leveraging experimental methods and AI to optimize chemical production methodologies. SOLVE aims to accelerate drug and fertilizer production while reducing costs, waste, and toxic raw materials through advanced data-driven techniques. Its innovative approach enhances sustainability by improving solvent selection and manufacturing efficiency, aligning with the sustainability goals of the flow chemistry market.

Precise And High-throughput Synthesis Needs

Flow chemistry complements the growing need for precise and high-throughput synthesis, particularly in pharmaceuticals, agrochemicals, and specialty chemicals sectors. The controlled flow of reactants through microreactors or channels improves efficient mixing, resulting in faster reaction kinetics and higher yields. This degree of precision is particularly beneficial for intricate multi-step synthesis, as it minimizes the likelihood of side reactions while increasing result reproducibility. Industries are inclined toward flow chemistry's capability to quickly develop a broad range of chemicals, enabling rapid optimization as well as development of new products, significantly contributing to its magnifying preference. Furthermore, the market is being driven forward by growing product utilization to accelerate drug discovery and process development by providing a platform for systematic testing of reaction conditions. For instance, the government of India (GOI) stated that India's chemical industry (encompassing pharmaceuticals and fertilizers) expanded by 18 to 23% in recent years and is anticipated to elevate to USD 304 Billion by the year 2025. Therefore, the rise in drug production will significantly impact the flow chemistry market dynamics.

Modular Automation and Scalability

The evolution of modular and automated flow systems is a pivotal driver of the flow chemistry market, revolutionizing production processes with versatility and efficiency. Modular systems, such as Chemtrix’s Plantrix reactors, are increasingly used across over 1,000 laboratories globally, offering plug-and-play setups that integrate seamlessly into production lines, reducing downtime by 40%. These systems can handle reactions ranging from milliliters to hundreds of liters, showcasing scalability from research to industrial levels. For instance, the University of Cambridge developed a modular flow system for multistep pharmaceutical synthesis, demonstrating a 30% reduction in process time. Corning’s Advanced-Flow Technology Academy in China provides practical training to over 200 professionals annually, enhancing skills in scaling up processes with minimal modification. By enabling faster time-to-market and minimizing the risks of scaling, modular automation is unlocking significant growth opportunities and transforming chemical manufacturing globally.

Flow Chemistry Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global flow chemistry market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on reactor and application.

Analysis by Reactor:

- Continuous Stirred Tank Reactor

- Plug Flow Reactor

- Microreactor

- Microwave System

- Others

Continuous stirred tank reactor leads the market with around 36.7% of market share in 2024. One key factor driving market growth is the growing need for continuous stirred tank reactor (CSTR) flow chemistry, which has distinct qualities that adapt to the changing demands of chemical industries. CSTR flow chemistry offers a balance between the advantages of classic batch techniques and those of continuous flow systems. Its ability to function in a continuous state while providing efficient mixing and response control is quite helpful. Furthermore, the versatility of CSTR flow systems allows for a wide range of reactions and reaction conditions, making them suitable for several applications such as fine chemicals, pharmaceuticals, and petrochemicals, which contributes to market growth. Besides this, the inherent safety features of continuous flow promote the usage of CSTR flow chemistry. This results in market expansion. As industries strive for improved efficiency, safety, and product quality, the demand for CSTR flow chemistry continues to rise as a dependable and adaptable technology. For example, in October 2023, Vapourtec launched a new continuous stirred tank reactor (CSTR) designed to enhance continuous process synthesis, offering compatibility with their renowned flow chemistry systems. The CSTR cascade system enables the incorporation of eight reactors within the flow chemistry system of R-Series, like two R4 modules, positioning it as a preferable choice for managing flow reactions that include liquids as well as solids. It functions at pressures reaching up to 5.0 bar, offering a reactor volume capacity between 5 ml and 40 ml, with precise temperature control from -10°C to +150°C. Additionally, Vapourtec offers the option of integrating a photochemical CSTR that leverages LED-based light source spanning from the range between 365nm- 700nm. The CSTR design resulted from a partnership with major flow chemists of academia as well as industry.

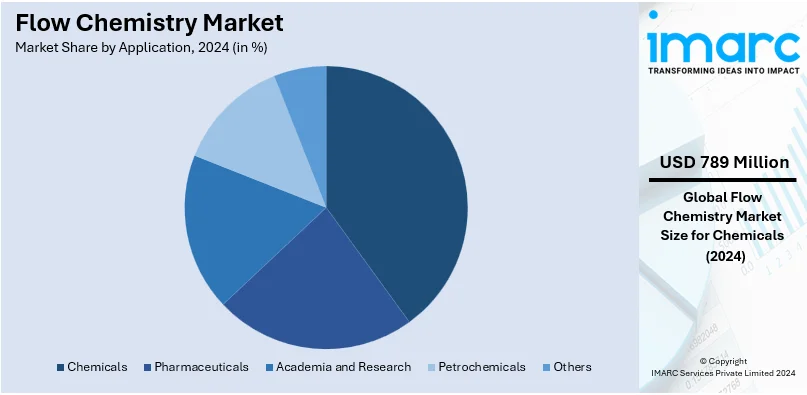

Analysis by Application:

- Pharmaceuticals

- Chemicals

- Academia and Research

- Petrochemicals

- Others

Chemicals leads the market with around 39.2% of market share in 2024. Another key growth driver is the growing need for flow chemistry in the thriving chemical industry, which has the potential to disrupt traditional chemical manufacturing methods. Concurrently, the objective of cost-effectiveness and operational efficacy propels market prospect. Furthermore, flow chemistry's ability to elevate yields, enhance reaction conditions, and reduce waste, caters to the industry's strategy of magnifying resource usage and minimizing costs of production, resulting in a positive market outlook. In line with this, its ability to perform hazardous reactions safely and effectively within limited systems, hence improving worker safety and regulatory compliance, is propelling the industry forward. Moreover, the utilization of modular and automated flow systems accelerates process development and scalability, allowing new goods to join the market faster. As the chemical sector experiences increase in sustainability issues, flow chemistry offers a greener alternative by reducing environmental impact via efficient resource utilization and waste reduction, hence facilitating the significant market expansion. For instance, Evonik heavily invested in amplifying manufacturing capacity for derivatives of isobutene at its facility in Marl by 50%. The C4 production network’s isobutene segment yields the petrochemical specialties 3,5,5 Trimethylhexanal (TMH), Tertiary Butanol (TBA), and Di- isobutene (DiB).

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.7%. The North America flow chemistry market is largely driven by the region's focus on innovation and sustainability. Furthermore, significant product demand from the developing pharmaceutical sector for simplified drug development methods and effective manufacturing techniques is propelling the market growth. Additionally, the increased emphasis on green chemistry, as well as the capabilities of flow chemistry to reduce waste and environmental impact, are driving up demand. Besides, the strong presence of excellent research institutions in North America, combined with heightened collaboration efforts between industry and academia, prompts constant technological innovations, which bolsters flow chemistry utilization. Apart from this, regulatory benefits for more effective and secure operations facilitate the adoption of continuous flow systems. As various businesses in this region are actively navigating technological innovations, high efficacy, and environmental responsibility, the market will constantly showcase significant expansion. For instance, in North America, the United States accounts for the largest share of the revenue generated by global pharmaceutical sales. In 2024, the United States is projected to spend between US$ 605 Billion and US$ 635 Billion on medicines, according to AstraZeneca. It will make the country achieve the highest pharmaceutical spending by far. This pharmaceutical growth drives flow chemistry adoption in the region by demanding efficient, sustainable, and scalable drug manufacturing solutions.

Key Regional Takeaways:

United States Flow Chemistry Market Analysis

In 2024, United States accounted for 79.70% of the market share in North America. The U.S. stands at the forefront of applying flow chemistry technologies, supported by its strong emphasis on innovation and process intensification. Flow chemistry is becoming highly integrated into research laboratories and production facilities, with more than 500 academic and industrial labs across the country utilizing the systems for advanced synthesis and reaction optimization. An example of this kind is the Continuum Laboratory at Heriot-Watt University, exploring advanced flow chemistry applications, for instance, in real-time monitoring and analysis of reactions. In 2023, Corning launched Lab Reactor System 2, providing safer, efficient solutions for scaling up chemical flow processes widely adopted in pharmaceutical and specialty chemical production. For example, at MIT and UC Berkeley, flow chemistry is leading the research on the academic side, driving forward advancements in automated and continuous manufacturing. Collaboration with private firms has improved the development of modular flow reactors to enable safer and more environmentally friendly chemical processes. Flow chemistry is now revolutionizing drug development and fine chemical production throughout the U.S.

Europe Flow Chemistry Market Analysis

Europe has become a hub in terms of innovation in flow chemistry supported by stringent environmental regulations along with a focus on green chemistry. The continent hosts more than 300 laboratories that have been equipped with state-of-the-art flow reactors, such as the Kappe Laboratory based in Austria, dedicated toward the improvement of reaction efficiency toward challenging syntheses. Chemtrix, a major player in Europe, has increased its Plantrix flow reactor line in 2022, designed for larger-scale chemical production using aggressive reagents. Examples of research groups include the Noël Research Group at the University of Amsterdam, interested in automated multi-step processes and gas-liquid processes, continuous manufacturing for pharmaceuticals and materials. European governments, like Germany, support R&D through various resources. These efforts have spurred collaborations among industry leaders such as Syrris and Vapourtec, further driving the adoption of flow chemistry in the production of fine chemicals, agrochemicals, and APIs across Europe.

Asia Pacific Flow Chemistry Market Analysis

In Asia Pacific, the adoption of flow chemistry is growing at an explosive pace, driven by heavy investment in R&D and manufacturing. Institutions such as Shanghai Xiangrui Chemical Research Lab have a pioneering approach to the integration of flow chemistry for green synthesis and process safety while also finding over 200 laboratories using this technology in China and India. Apeloa CDMO opened a flow chemistry site in Boston, USA, with its network of capabilities across Asia by its chemical and new modality development facility. Notable product launches included Asynt's benchtop fReactor system in 2022. This accessible and versatile solution is geared toward users both in academia and industry from Asia. Co-operative R&D activities between Japan and South Korea will innovate microreactor technology and continuous synthesis processes. The widespread applicability of flow chemistry in pharmaceuticals, agrochemicals, and energy-efficient catalysis showcases the region's transformation to a global manufacturing powerhouse using cutting-edge technology.

Latin America Flow Chemistry Market Analysis

Latin America is embracing flow chemistry technology steadily, for sustainable production and industrial efficiency. Research in the University of São Paulo is focused on developing reactors for sustainable and scalable manufacture. To date, more than 50 laboratories in Brazil have integrated flow chemistry in pharmaceuticals and petrochemicals. CHEMIUM's 2022 MgFlow® technology launch has brought Grignard reagent production on an industrial scale to the market. Local chemical processes are now much more affordable; collaborative programs, such as partnership between Brazilian institutions and European firms, have boosted knowledge transfer in flow chemistry technology. Additionally, agrochemical companies in Argentina and Chile are using flow reactors on a wider scale to promote reaction safety and yield. These are supported by governments, which promote the adoption of innovative manufacturing techniques, thereby allowing the region to gradually transit to sustainable chemical production processes.

Middle East and Africa Flow Chemistry Market Analysis

The area is becoming more prominent to Middle Eastern and African acceptance for flow chemistry as demand rises in respect to more eco-friendly production means and their efficient approach. University of Cape Town has led local research and thus pioneered efforts into adopting these reactors that may hold flow synthesis towards catalytic purposes to facilitate local utilization. In 2023, Saudi Aramco collaborated with a global engineering firm to develop modular flow reactors for high-temperature and pressure reactions, targeting applications in petrochemical refining and specialty chemicals. Over 20 labs in South Africa explore flow chemistry, mainly at academic institutions like Stellenbosch University, which is working on making synthesis sustainable. The UAE's industrial strategy, Operation 300 Billion, is set to drive the adoption of advanced manufacturing technologies, such as flow chemistry, to strengthen and support the nation's local industries. Regional approaches, then, towards novel methodology applications reflect progress towards more sustainable chemical production.

Competitive Landscape:

The market includes intense competition between key players that are highly focusing on innovation and technological advancements. Major companies are actively developing advanced continuous flow systems to cater to diverse industries such as pharmaceuticals, chemicals, and petrochemicals. Moreover, strategic partnerships, mergers, and acquisitions are prevalent as firms aim to expand their market presence and enhance product portfolios. For instance, in October 2024, Arctoris and SpiroChem announced a strategic partnership to accelerate global drug discovery by integrating Arctoris' automated biology capabilities with SpiroChem's medicinal and synthetic chemistry platforms, including flow chemistry. This collaboration aims to streamline drug discovery processes for biotechnology and pharmaceutical companies, enabling faster and more efficient development timelines. Additionally, increased investment in research and development drives innovation, enabling players to introduce energy-efficient and sustainable solutions. With rising regulatory demands for safer manufacturing processes, companies are emphasizing compliance-driven technologies, further intensifying competition. Additionally, the market’s dynamic nature continues to foster growth and consolidation among established and emerging participants.

The report provides a comprehensive analysis of the competitive landscape in the flow chemistry market with detailed profiles of all major companies, including:

- AM Technology

- Chemtrix BV

- Corning Incorporated

- Ehrfeld Mikrotechnik GmbH

- FutureChemistry Holding B.V.

- HEL Ltd.

- Lonza Group AG

- Milestone Srl

- Parr Instruments Company

- Syrris Ltd (Asahi Glassplant Inc.)

- ThalesNano Inc

Latest News and Developments:

- Nov 2024: Asymchem, a prominent contract development and manufacturing organization (CDMO), developed an artificial intelligence (AI) platform to mitigate major challenges in protein design. This platform, called STAR (Sequence Recommendation via Artificial Intelligence), was successfully produced by Asymchem’s Center of Synthetic Biology Technology (CSBT) and AI team.

- Jan 2024: AGI Group acquired Chemtrix B.V. Chemtrix, a Dutch company, is focused on scalable flow reactors and adds to the capabilities of AGI Group in terms of flow chemistry and process intensification for pilot and manufacturing solutions.

- July 2023: H.E.L Group announced a collaboration with IIT Kanpur to leverage sustainable energy driven by the institute. The aim of this initiative was to establish advanced testing laboratories focused on exploring innovations in chemistry, analyzing battery storage capabilities, and studying thermal properties.

- June 2023: ACI Sciences fortified its tactical collaboration with Vapourtec. Through this transaction, ACI Sciences aimed to be the official Vapourtec's distributor in Southeast Asia region. By implementing Vapourtec’s leading-edge continuous flow chemistry systems, scientists can utilize the accuracy and productivity of experiments while reducing costs and lowering waste.

- June 2023: H.E.L Group announced the proliferation of its BioXplorer product range by unveiling two automated parallel bioreactors, BioXplorer 400P and BioXplorer 400XL. These bioreactors are specifically designed for several upgrading, research, and screening applications, cell strain/line screening, and small-scale process development in flow chemistry and bioprocessing.

- March 2023: Uniqsis launched its Solstice multi-position batch photoreactor that can attain 12 small-scale reactions simultaneously. Post determination of the ideal conditions via simultaneous reactions, researchers can shift to continuous flow reactor, like Borealis Flow photoreactor, to magnify the process and achieve elevated throughput.

Flow Chemistry Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Reactors Covered | Continuous Stirred Tank Reactor, Plug Flow Reactor, Microreactor, Microwave System, Others |

| Applications Covered | Pharmaceuticals, Chemicals, Academia and Research, Petrochemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AM Technology, Chemtrix BV, Corning Incorporated, Ehrfeld Mikrotechnik GmbH, FutureChemistry Holding B.V., HEL Ltd., Lonza Group AG, Milestone Srl, Parr Instruments Company, Syrris Ltd (Asahi Glassplant Inc.), ThalesNano Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flow chemistry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global flow chemistry market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flow chemistry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Flow chemistry, also known as continuous flow or continuous chemistry, is a process in which chemical reactions are conducted in a continuously flowing stream rather than batch production. This method enhances efficiency, scalability, and safety, making it ideal for industries like pharmaceuticals, chemicals, and materials manufacturing.

The flow chemistry market was valued at USD 2.0 Billion in 2024.

IMARC estimates the flow chemistry market to exhibit a CAGR of 8.38% during 2025-2033.

Key factors driving the market include rising demand for efficient drug manufacturing, growing emphasis on green chemistry, advancements in chemical process automation, increased adoption in petrochemicals and agrochemicals, regulatory support for sustainable processes, and technological innovations in continuous production methods.

In 2024, continuous stirred tank reactor represented the largest segment by reactor, driven by their versatility and scalability. They enable consistent mixing and reaction control, making them a preferable reactor.

Chemicals lead the market by application, driven by widespread usage in chemical synthesis. Flow chemistry finds extensive adoption in producing specialty and bulk chemicals.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global flow chemistry market include AM Technology, Chemtrix BV, Corning Incorporated, Ehrfeld Mikrotechnik GmbH, FutureChemistry Holding B.V., HEL Ltd., Lonza Group AG, Milestone Srl, Parr Instruments Company, Syrris Ltd (Asahi Glassplant Inc.), ThalesNano Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)