Food Processing Blades Market Report by Product (Straight Blades, Curved Blades, Circular Blades), Application (Grinding, Slicing, Dicing, Skinning, Peeling, Cutting/Portioning), and Region 2025-2033

Food Processing Blades Market, 2024 Size and Share:

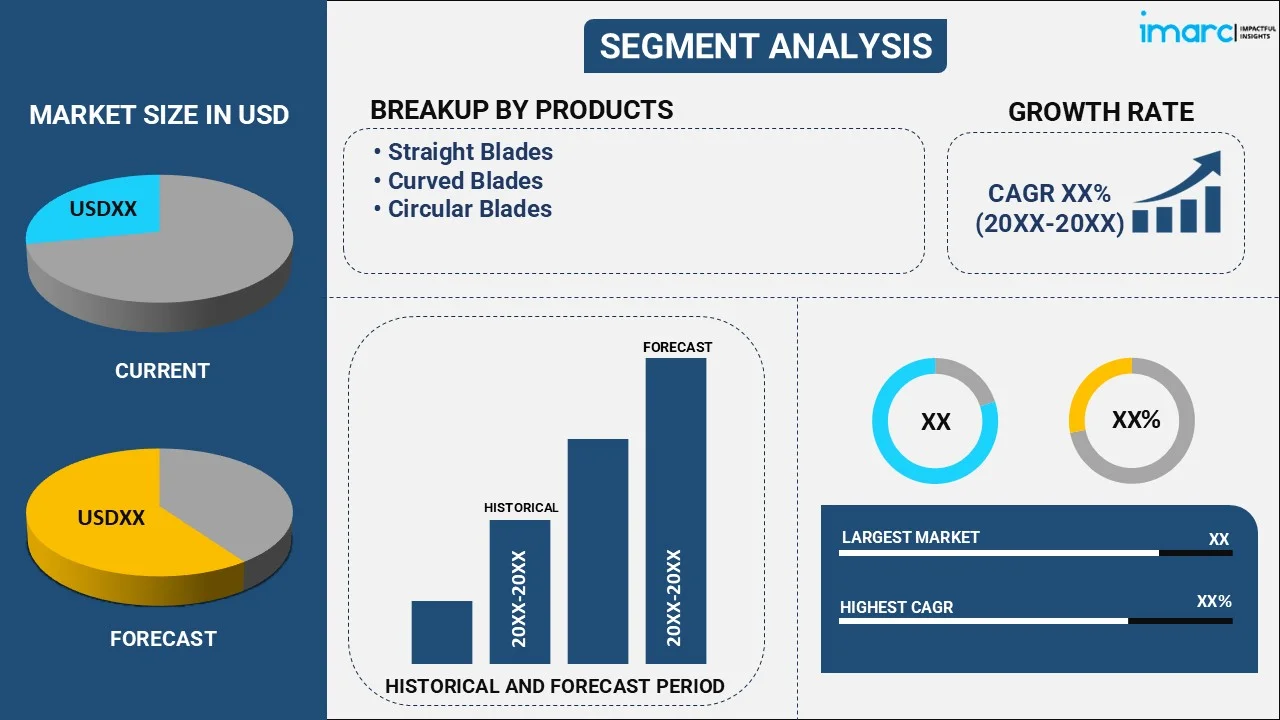

The global food processing blades market size reached USD 1,107.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,067.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.61% during 2025-2033. The market is experiencing steady growth driven by the rising demand for ready-to-eat (RTE) food products, rising need for adherence to food safety regulations and the increasing emphasis on maintaining high-quality standards in food production, and advancements in blade design.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,107.7 Million |

|

Market Forecast in 2033

|

USD 2,067.4 Million |

| Market Growth Rate 2025-2033 | 6.61% |

Food Processing Blades Market Analysis:

- Market Growth and Size: The market is witnessing moderate growth, driven by the escalating demand for processed food products. Additionally, the focus on food safety and quality standards is driving the adoption of advanced blades in food processing.

- Technological Advancements: Innovations in blade design and materials are playing a pivotal role in enhancing the efficiency and precision of food processing equipment. These innovations are leading to higher productivity and reduced wastage in food processing.

- Industry Applications: Food processing blades find applications across various segments of the food and beverage (F&B) industry, including meat processing, bakery, dairy, and fruit and vegetable processing.

- Geographical Trends: Asia Pacific leads the market, driven by its thriving food processing industry. However, Asia Pacific is emerging as a fast-growing market on account of the growing demand for advanced food processing equipment and blades.

- Competitive Landscape: The market is highly competitive, with several established players and new entrants. In addition, leading companies are investing in research and development (R&D) activities to maintain their competitive edge and offer innovative blade solutions.

- Challenges and Opportunities: While the market faces challenges, such as stringent regulatory requirements for food safety and the need for continuous innovation to meet evolving consumer preferences, it also encounters opportunities in the increasing demand for packaged and processed foods, especially in emerging markets.

- Future Outlook: The future of the food processing blades market looks promising, with the growing global population, urbanization, and changing consumer lifestyles. Besides this, continued innovation and a focus on sustainability is expected to propel the growth of the market.

Food Processing Blades Market Trends:

Consumer demand for convenience food products

The trend towards convenience and ready-to-eat (RTE) food products is propelling the growth of the market. As people are living busier lives, they are increasingly turning to processed and pre-packaged food products for quick and easy meal solutions. This rise in demand for convenience food products, ranging from frozen meals to pre-cut vegetables and packaged snacks, is supporting the market growth. Manufacturers in the food and beverage (F&B) industry are compelling to meet this demand by optimizing their production processes, and food processing blades play a crucial role in achieving efficiency. Blades are used for cutting, chopping, and slicing various food ingredients, ensuring uniformity and precision in the final product. This not only enhances the quality of convenience food products but also contributes to cost savings in the production process.

Focus on food safety and quality assurance

The strict adherence to food safety regulations and the increasing emphasis on maintaining high-quality standards in food production are strengthening the growth of the market. Contaminated or improperly processed food can pose significant health risks and damage the reputation of the brand. Consequently, the demand for advanced food processing blades that are designed for hygienic, easy cleaning, and precision cutting is rising around the world. Consumers are also becoming more discerning, demanding food that retains its taste, texture, and nutritional value. Blades that can process food without compromising these aspects are crucial to meet these expectations. Furthermore, manufacturers are striving to develop blades that not only meet regulatory requirements but also align with evolving consumer preferences for safe and high-quality food products.

Technological advancements in blade design

Ongoing advancements in blade design and materials have a profound impact on the food processing blades market. Innovations in blade technology are leading to improved efficiency, precision, and durability in food processing equipment. The development of high-quality stainless steel and ceramic blades is enhancing cutting performance and longevity. Additionally, specialized blade shapes and serrations are designed to optimize slicing and dicing for different food products. These technological advancements not only improve the quality of processed food products but also contribute to cost savings by reducing wastage and downtime for maintenance. As food processing equipment are becoming more sophisticated, manufacturers across the food and beverage (F&B) industry are seeking to upgrade their machinery with state-of-the-art blades to remain competitive.

Diverse industry applications

Food processing blades find applications across a diverse range of food and beverage (F&B) industry segments, including meat processing, bakery, dairy, and fruit and vegetable processing. This versatility represents one of the key factors driving the market, as blades cater to the specific needs of each sector. In meat processing, blades are crucial for slicing and portioning meat products accurately. In bakeries, they are used for dough cutting and shaping. Dairy processing relies on blades for cheese and butter production, while fruit and vegetable processing involves precise cutting and slicing for packaging. This wide range of industry applications ensures an increasing demand for specialized food processing blades across the globe.

Food Processing Blades Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product and application.

Breakup by Product:

- Straight Blades

- Single Edge

- Double Edge

- Serrated

- Curved Blades

- Single Edge

- Serrated

- Circular Blades

- Flat Edge

- Beveled Edge

- Scalloped Edge

- Toothed

- Notched

- Semi-Circular

- Involute

Circular blades account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes straight blades (single edge, double edge, and serrated), curved blades (single edge and serrated), and circular blades (flat edge, beveled edge, scalloped edge, toothed, notched, semi-circular, and involute). According to the report, circular blades represented the largest segment due to their widespread use in industrial food processing equipment. These blades are characterized by their circular or disc-like shape and are employed for continuous cutting, slicing, and portioning of food products in bulk. Circular blades find extensive application in meat processing plants, where they efficiently slice and portion large quantities of meat and poultry. They are also essential in the dairy industry for cutting cheese and butter blocks. The ability of circular blades to maintain a consistent cutting edge, even during high-volume operations, makes it a preferred choice for many food manufacturers.

Straight blades are a fundamental category in the food processing blades market. They are versatile and commonly used for slicing, dicing, and chopping various food products. Straight blades are preferred for tasks that require precision, such as cutting vegetables, fruits, and meats into uniform portions. Their simplicity and efficiency make them a staple choice in food processing equipment, and they find applications across different segments of the food and beverage (F&B) industry, ranging from bakeries to meat processing facilities.

Curved blades represent another significant segment within the food processing blades market. These blades are designed with a gentle curve, allowing them to excel in specific tasks that straight blades may find challenging. The curvature provides a rocking motion when cutting, making curved blades ideal for tasks like mincing herbs, filleting fish, or preparing delicate pastries. Their ability to follow the contours of various food items ensures a high level of precision and reduces the risk of food damage. Curved blades are commonly found in professional kitchens, bakeries, and seafood processing facilities, where precision and finesse in cutting are paramount.

Breakup by Application:

- Grinding

- Slicing

- Dicing

- Skinning

- Peeling

- Cutting/Portioning

Grinding represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes grinding, slicing, dicing, skinning, peeling, and cutting/portioning. According to the report, grinding represented the largest segment.

Grinding blades are designed for reducing solid food materials into smaller, uniform particles. They find extensive use in processes, such as meat grinding, where whole cuts of meat are transformed into minced or ground meat products. Grinding blades are also employed in the production of spices, coffee, and grains, where achieving consistent particle size is crucial. The efficiency and precision of grinding blades make them a fundamental component in various food processing operations, particularly in industries where particle size control and texture are critical factors.

Slicing blades are crucial for precise and uniform cutting of food products into thin slices. They are commonly used in applications like deli meat slicing, cheese cutting, and vegetable slicing for salads and packaged foods. Slicing blades help maintain the integrity of the product by ensuring consistent thickness, which is essential for both aesthetic appeal and portion control.

Dicing blades are designed to cut food products into small, uniform cubes or dice. These blades are commonly used in the preparation of ingredients for soups, stews, and various culinary dishes. The ability to create uniform-sized pieces is essential for ensuring even cooking and presentation in food products.

Skinning blades are specialized tools used primarily in meat processing. They are designed to remove the outer skin or membrane from meats, such as poultry or fish, efficiently and without damaging the underlying flesh. Skinning blades are essential for achieving the desired product quality in meat processing.

Peeling blades are used for the removal of the outer peel or skin from fruits and vegetables. They are commonly found in food processing operations that involve producing peeled and ready-to-eat (RTE) produce for salads, snacks, and canning. The precision of peeling blades ensures minimal product wastage during the peeling process.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

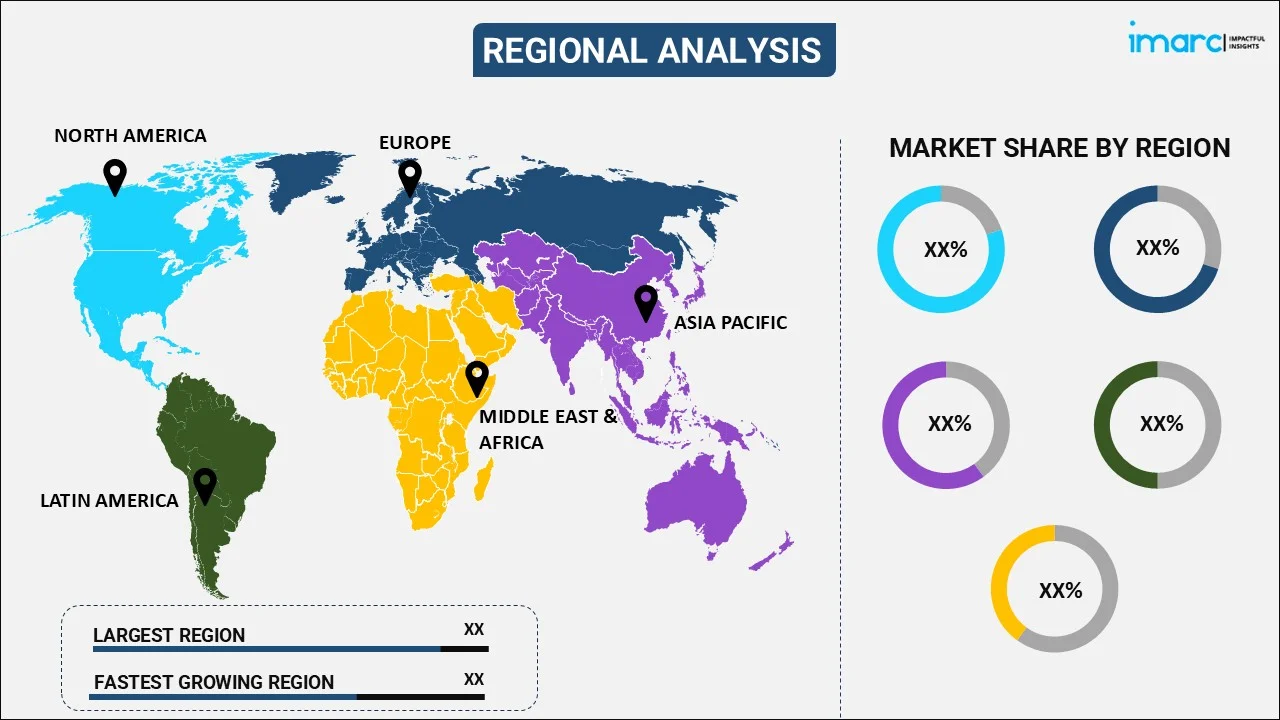

Asia Pacific leads the market, accounting for the largest food processing blades market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific is experiencing rapid industrialization and urbanization, catalyzing the demand for processed food products and a thriving food processing industry. Countries like China and India are witnessing significant growth in their food processing sectors, driving the demand for food processing blades. Additionally, Asia Pacific is known for its large-scale agricultural production, necessitating efficient food processing equipment. The burgeoning food and beverage (F&B) industry and commitment to technological advancements are contributing to the growth of the market in the region.

North America holds a substantial share in the food processing blades market, primarily due to its well-established food and beverage (F&B) industry. The United States is a significant player in this market, with a robust demand for advanced food processing equipment and blades. The preference of consumers for convenience food products and the presence of numerous food processing facilities are driving the need for high-quality blades to optimize production processes.

Europe is another prominent region in the food processing blades market, characterized by stringent food safety regulations and a focus on quality. European countries have a rich tradition of processed and specialty food products, necessitating precision equipment, such as food processing blades. The emphasis on maintaining high-quality standards and reducing food waste further catalyzing the demand for advanced blade technology.

Latin America is experiencing steady growth in the food processing blades market, driven by a growing middle-class population, changing dietary habits, and the expansion of the food industry. Countries like Brazil and Mexico are witnessing increased investment in food processing infrastructure, leading to higher demand for efficient blades to enhance productivity and product quality.

The Middle East and Africa represent an emerging market for food processing blades. The evolving food and beverage (F&B) industry, urbanization, and rising disposable incomes are contributing to the growth of the market in the region.

Leading Key Players in the Food Processing Blades Industry:

Key players in the market are actively engaged in several strategic initiatives to maintain their competitive edge. They are investing in research and development (R&D) activities to continually innovate blade designs, materials, and technologies. These innovations focus on enhancing blade durability, precision, and efficiency. Additionally, leading companies are emphasizing sustainability by developing eco-friendly blade materials and promoting energy-efficient manufacturing processes. They are also expanding their global presence through partnerships, collaborations, and acquisitions to tap into emerging markets and broaden their customer base. Furthermore, many key players are offering comprehensive consumer support services, including maintenance and blade sharpening, to ensure the longevity and optimal performance of their products. These strategies collectively contribute to their authority and leadership in the food processing blades market.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AB Hällde Maskiner

- BAADER

- Bettcher Industries Inc.

- Biro Manufacturing Company

- GEA Group Aktiengesellschaft

- Jarvis Equipment Pvt. Ltd.

- JBT Corporation

- Marel hf.

- Minerva Omega Group s.r.l.

- Nemco Food Equipment Ltd.

- Talsabell S.A.

- Zigma International

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- May 14, 2022: GEA Group Aktiengesellschaft launched its new CutMaster Generation 3, for preparing different kinds of sausage, a wide range of poultry, fish, plant-based, vegan and vegetarian products as well as processed cheese at the IFFA trade show in Frankfurt. The new CutMaster incorporates a number of consumer-driven technology upgrades, such as an integrated AC drive. The flexibility, reliability, hygienic properties, and longevity of the machine have been further enhanced by the innovations.

- October 7, 2022: JBT Corporation introduced all-new FVPGrow and chopper blender SE for juice and purée production. The FVPGrow separates seeds, skins, and extraneous particulate material to produce a liquid or semi-liquid product out of various fruits and vegetables. It offers a continuous, hygienic juice extraction at up to one ton per hour, depending on the raw product.

- May 24, 2022: Bettcher Industries Inc., a leading manufacturer of protein processing equipment, announced the signing of a definitive agreement under which it will acquire Frontmatec from Axcel. KKR, which acquired Bettcher in December 2021. This acquisition represents an important step in Bettcher and KKR’s strategy to build a scaled food processing automation platform serving food processing plants globally. In addition to delivering leading automation capabilities, the purchase of Frontmatec deepens Bettcher’s footprint in Europe.

Food Processing Blades Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Grinding, Slicing, Dicing, Skinning, Peeling, Cutting/Portioning |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Hällde Maskiner, BAADER, Bettcher Industries Inc., Biro Manufacturing Company, GEA Group Aktiengesellschaft, Jarvis Equipment Pvt. Ltd., JBT Corporation, Marel hf., Minerva Omega Group s.r.l., Nemco Food Equipment Ltd., Talsabell S.A., Zigma International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food processing blades market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global food processing blades market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food processing blades industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global food processing blades market to exhibit a CAGR of 6.61% during 2025-2033.

The advent of food processing blades, that offer improved precision in terms of cutting, slicing, and grinding raw materials is primarily driving the global food processing blades market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of various manufacturing units for food processing blades.

Based on the product, the global food processing blades market has been categorized into straight blades, curved blades, and circular blades. Among these, circular blades account for the majority of the global market share.

Based on the application, the global food processing blades market can be bifurcated into grinding, slicing, dicing, skinning, peeling, and cutting/portioning. Currently, grinding exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global food processing blades market include AB Hällde Maskiner, BAADER, Bettcher Industries Inc., Biro Manufacturing Company, GEA Group Aktiengesellschaft, Jarvis Equipment Pvt. Ltd., JBT Corporation, Marel hf., Minerva Omega Group s.r.l., Nemco Food Equipment Ltd., Talsabell S.A., and Zigma International.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)