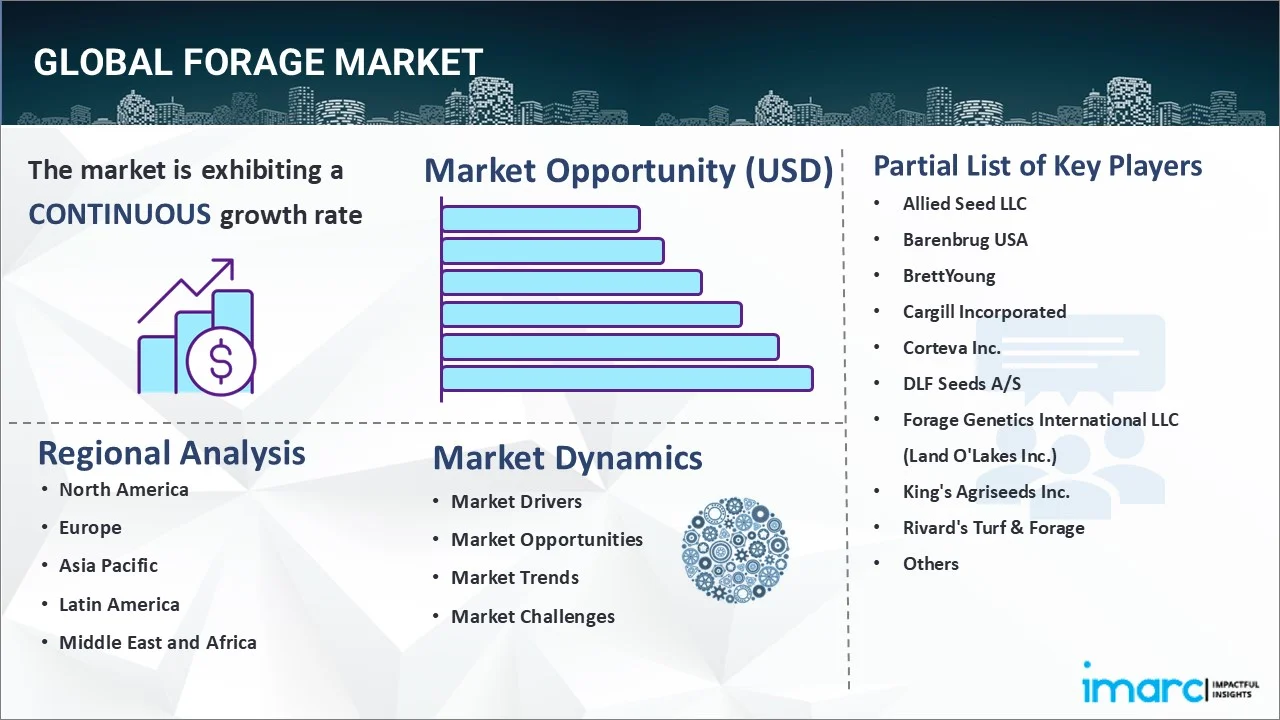

Forage Market Report by Crop Type (Cereals, Legumes, Grasses), Product Type (Stored Forage, Fresh Forage), Animal Type (Ruminants, Swine, Poultry, and Others), and Region 2026-2034

Forage Market Size:

The global forage market size reached USD 97.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 136.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.77% during 2026-2034. The market is experiencing steady growth driven by the escalating demand for meat and dairy products, necessitated by a growing population, the rising awareness of sustainability issues encouraging the adoption of environmentally friendly farming techniques, and the increasing shift towards organic and sustainable forage production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 97.6 Billion |

|

Market Forecast in 2034

|

USD 136.1 Billion |

| Market Growth Rate 2026-2034 | 3.77% |

Forage Market Analysis:

- Major Market Drivers: According to the forage market report, the primary factor driving the forage market is the escalating demand for dairy and meat products as it is a key ingredient in the diet of livestock. Global population growth and increasing income levels are also drivers, as they further contribute to a rise in the consumption of animal-based products.

- Key Market Trends: Organic and sustainable forage production is becoming one of the key market trends due to the rising consumer awareness of environmental and health impacts. Moreover, the use of technology, such as precision agriculture and drones for monitoring, is also on the rise to enhance the yield and quality of the forage.

- Geographical Trends: According to the forage market analysis, North America and Europe are at the forefront of high-quality forage exports and technology use. On the contrary, Asia Pacific is growing rapidly due to the need to make animal feed of higher quality to satisfy the requirements of exports to Western markets.

- Competitive Landscape: The forage market is moderately fragmented, with major players investing in research and development to devise crops with higher nutritional content and then venture into new markets.

- Challenges and Opportunities: A major challenge is the price volatility and availability of forage impacted by climate changes and unfavorable weather conditions. However, it also acts as one of the forage market recent opportunities to develop crops resistant to drought and introduce more efficient water management techniques.

To get more information on this market Request Sample

Forage Market Trends:

Escalating global demand for animal products

The market is majorly driven by the rising necessity for dairy and meat products across the globe. Due to the rising population and the addition of new countries particularly new emerging countries, there is a growing middle class with more money to spend. Therefore, the consumption of animal products is significantly accelerating. Along with this, there is a need for more production of livestock for which forage is an essential aspect of the animal’s good health and productivity. Apart from this, governments and the agricultural industry are striving to make feed more efficient and increase its nutritional value. This step also contributes to a greater forage demand, particularly the high-quality product varieties. In certain situations, consumers opt for animal products from production systems that are understood to be more sustainable to animals and producers work to maintain a high standard of feed for their animals to guarantee their health and productivity.

Technological advancements in forage production

Continuous tech innovations in agriculture, such as precision farming, genetic modification, and semi-automated harvesting technologies are propelling the forage market growth. These technologies aid in the perfection of the process of production by increasing the yield and crop quality. For example, satellites and drones could be used to monitor the health of the crops and the water in the soil, ensuring that any noted deficits are corrected in good time through corrective farming measures which may result in exponential gains in the yield of forage crops. Recently, after the first round of trials concerned with the use of drones in agriculture, the University of Agricultural Sciences reported that the right use of drones can reduce the volume of pesticides by at least 15% and maximize efficiency. Additionally, the integration of GM foods is leading to the generation of forage crops that are more resistant to the vagaries of the changing climate such as reduced rainfall. In addition, the use of IoT devices lowers commercial expenses and improves the efficiency of operations making forage cultivation more economically advantageous. Therefore, this is creating a positive forage market outlook.

Sustainability and organic farming trends

One of the forage market recent developments includes the escalating inclination towards sustainability and organic farming in the forage industry, which is expressed in the supply of organic feed. According to a report, the global organic food market size reached US$ 207.4 Billion in 2023. IMARC Group expects the market to reach US$ 528.9 Billion by 2032, exhibiting a growth rate (CAGR) of 10.97% during 2024-2032. In confluence with this, the increasing environmental awareness among consumers and producers is driving a shift towards organic feed production. The harmful effects of traditional farming on the environment due to pesticide pollution, soil erosion, and loss of biodiversity contribute to the development of environment-friendly forage production. Moreover, organic feed is considered safer and healthier for livestock and, ultimately, for the animals’ end customers due to supportive environmental standards. The trend toward organic and environmentally friendly farming methods affects production and a new niche in the market for organic feed. This trend contributed to ensuring the global development of environmental consensus and consumption monitoring.

Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on crop type, product type and animal type.

Breakup by Crop Type:

To get detailed segment analysis of this market Request Sample

- Cereals

- Legumes

- Grasses

Cereals account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses. According to the report, cereals represented the largest segment.

The largest crop type within the forage market is cereals, which play a crucial role in the market due to their versatility and high nutritional value necessary for livestock diets. The category consists mainly of corn, oats, barley, and sorghum, which are integral elements of both silage and grain-based feeds. Such prevalence of cereals in the forage market is explained by their high efficiency in converting solar energy into livestock-digestible forms of energy, thus making them a viable, inexpensive, and energy-rich feed option. Additionally, cereals can be grown in a variety of soil compositions and climatic conditions, which means that they are suited for a broader range of farming types and geographical areas. In addition, high yield potential and food sustainability are enhanced by the ability to store cereals for long periods without a significant nutritional quality decline, contributing to an efficient supply chain across the industry. Since demand for meat and dairy products growing globally, it is expected that cereals will remain the leading forage type.

Breakup by Product Type:

- Stored Forage

- Silage

- Hay

- Fresh Forage

Stored forage holds the largest share of the industry

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stored forage (silage, and hay), and fresh forage. According to the report, stored forage accounted for the largest market share.

The largest type of product in the forage market is stored forage, including hay, silage, and haylage. This fact is grounded in its vital role in ensuring livestock has feed available year-round. Additionally, stored forage is essential in providing the necessary feed components when the fresh pasture cannot be taken, especially in terms of cold season and dry conditions. Hay, as the traditional approach to harvesting and preserving forage, is most renowned for its opportunity to store for a longer time. Simultaneously, silage and haylage are considered preferable due to the fermentation process that occurs there under anaerobic conditions to maintain the nutritive value and palatability. This approach allows one to store and at the same time enhance the digestibility and energy level of stored forage, which is important for ruminant health and productivity, such as cattle and sheep. According to the forage market overview, the prevalence of storing forage is justified by its usage from small farms to large dairy operations due to its generalist applicability. Furthermore, technological advances in storage methods, additives, and preservatives are expanding the market share of this product type.

Breakup by Animal Type:

- Ruminants

- Swine

- Poultry

- Others

Ruminants represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes ruminants, swine, poultry, and others. According to the report, ruminants represented the largest segment.

Ruminants, such as cattle, sheep, and goats, top the animal type segment due to their high contribution to agricultural economies across the globe. This high share is linked to their diets, which demand the feeding of fibrous plant material, referred to as forage, to meet the unique digestion process of these animals. Ruminants have a fore-stomach known as the rumen, which is highly effective in cellulose breakdown and digestion. Here, cellulose is broken down using a microbial ecosystem into energy and nutrients through fermentation. After this initial process, the broken-down cellulose proceeds through a two-compartment digestive tract. The wide availability of forage types, including grasses, legumes, and silages, makes ruminants an essential part of pastoral and mixed farming. Additionally, the high demand for ruminant products, such as milk, meat, and wool, globally necessitates the feeding of high-quality forage to enhance productivity and reproductive performance. Ruminants are present, and as per the forage market forecast, their role is set to widen in the future as the world’s population grows and shifts to protein-based diets, increasing food security and nutritional demands.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest forage market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for forage.

North America is the largest region in the forage market due to its well-established agricultural industry, sizeable livestock sector, and focus on farming technology research. All this is facilitated by the vast amount of arable acreage and favorable climatic conditions that are conducive to the growth of various forage crops -alfalfa, corn silage, along multiple types of grass. In addition, the U.S. and Canada have a large number of producers and consumers. Thus, the two countries have extensive dairy and beef production. They satisfy their own needs and export significant amounts of high-quality products to the worldwide markets. Technology, such as precision farming, GM crops, and sophisticated machinery for harvesting, are factors that are employed to increase the yield and quality of forage in the North American region. With active protection of the environment and the most sustainable agriculture and livestock production due to the government’s policies, the region holds the largest forage market share. Hence, the future of the forage market is ensured.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the forage industry include:

- Allied Seed LLC

- Barenbrug USA

- BrettYoung

- Cargill Incorporated

- Corteva Inc.

- DLF Seeds A/S

- Forage Genetics International LLC (Land O'Lakes Inc.)

- King's Agriseeds Inc.

- Rivard's Turf & Forage

- Standlee Premium Products LLC

(Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.)

The major forage companies in the forage market have carried out aggressive research and development work. Innovations help manufacturers the nutritive worth and efficiency of their merchandise to deliver required feed, as an increasing need for quality feed worldwide leads to more significant costs and viable production. Some advances have been pioneered by companies such as Cargill, DowDuPont, and ADM. Therefore, new trends are driving the latest and cutting-edge technologies, including biotechnology and precision farming. They are also expanding their market reach across multiple regions, reaching out to developing countries with fast-growing demand for livestock products. Furthermore, they are incorporating sustainable means in the production process to combat environmental concerns, reducing water usage and minimizing the carbon footprint as the world shifts towards sustainability, which in turn is bolstering the forage market revenue.

Forage Market News:

- January 25, 2023: Growmark Inc. reported that it has obtained Allied Seed LLC. Allied Seed is based in Nampa, Idaho, and has a wide range of forage, turfgrass, and cover crop seed products, as well as tailored production, mixing, packing, and seed treatment capabilities.

- March 21, 2024: BrettYoung admitted a new 60,000-square-foot facility made for cleaning, sorting, and packaging turf seed. The $20-million facility named NorthCore is placed in Winnipeg and was constructed to handle a new level of capacity.

Forage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered |

|

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Seed LLC, Barenbrug USA, BrettYoung, Cargill Incorporated, Corteva Inc., DLF Seeds A/S, Forage Genetics International LLC (Land O'Lakes Inc.), King's Agriseeds Inc., Rivard's Turf & Forage, Standlee Premium Products LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the forage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global forage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the forage industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global forage market was valued at USD 97.6 Billion in 2025.

We expect the global forage market to exhibit a CAGR of 3.77% during 2026-2034.

The growing usage of forage for feeding livestock to obtain high-quality products, as it aids in maintaining the rumen health of the animals, is primarily driving the global forage market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary shortage of raw materials and labors, thereby negatively impacting the growth of the forage market.

Based on the crop type, the global forage market can be categorized into cereals, legumes, and grasses. Among these, cereals exhibit clear dominance in the market.

Based on the product type, the global forage market has been segmented into stored forage and fresh forage. Currently, stored forage represents the largest market share.

Based on the animal type, the global forage market can be bifurcated into ruminants, swine, poultry, and others. Among these, ruminants account for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global forage market include Allied Seed LLC, Barenbrug USA, BrettYoung, Cargill Incorporated, Corteva Inc., DLF Seeds A/S, Forage Genetics International LLC (Land O'Lakes Inc.), King's Agriseeds Inc., Rivard's Turf & Forage, and Standlee Premium Products LLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)