Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Foreign Exchange Market Size and Share:

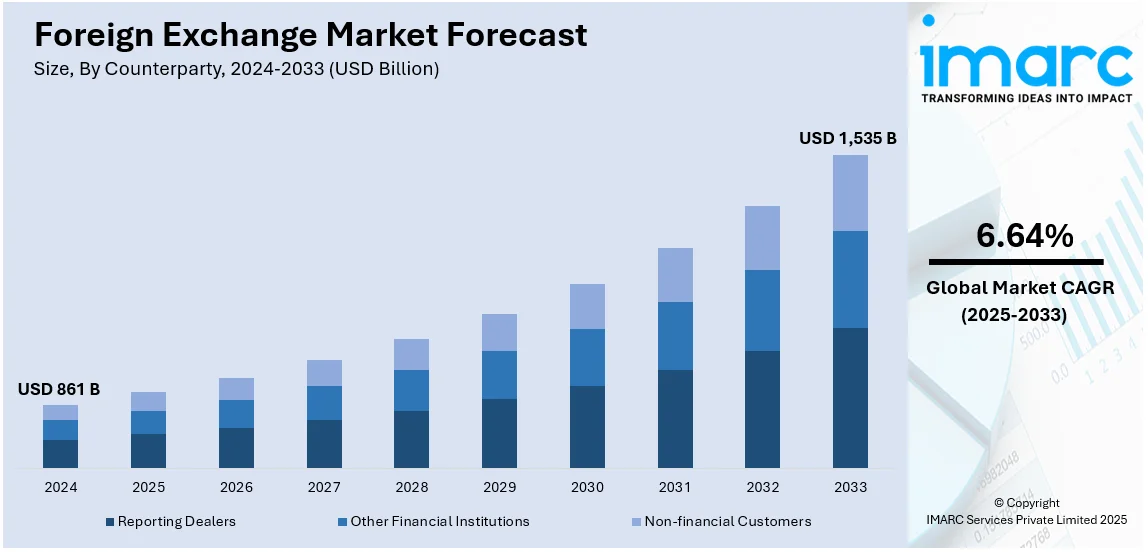

The global foreign exchange market size was valued at USD 861 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,535 Billion by 2033, exhibiting a CAGR of 6.64% from 2025-2033. North America currently dominates the market, holding a significant share of 25.8% in 2024. The dominance is attributed to the rising integration of modern technology in trading platforms, the globalization of businesses resulting in the consequent need for currency exchange services, and the growing influence of various economic factors such as inflation, interest rates, and GDP growth.

Foreign Exchange Market Overview:

- The FX market size was valued at USD 861 Billion in 2024 and is projected to reach USD 1,535 Billion by 2033.

- The market is estimated to grow at a CAGR of 6.64% from 2025 to 2033.

- Major drivers include interest rates, inflation, geopolitical events, economic data releases, central bank policy, trade balances, political stability, speculation, and natural disasters.

- Region-wise, North America held the largest share of 25.8% in the market in 2024. Additionally, the United States accounted for a market share of 88.9% in North America.

- In terms of counterparty, the reporting dealers segment dominated the foreign exchange market in 2024.

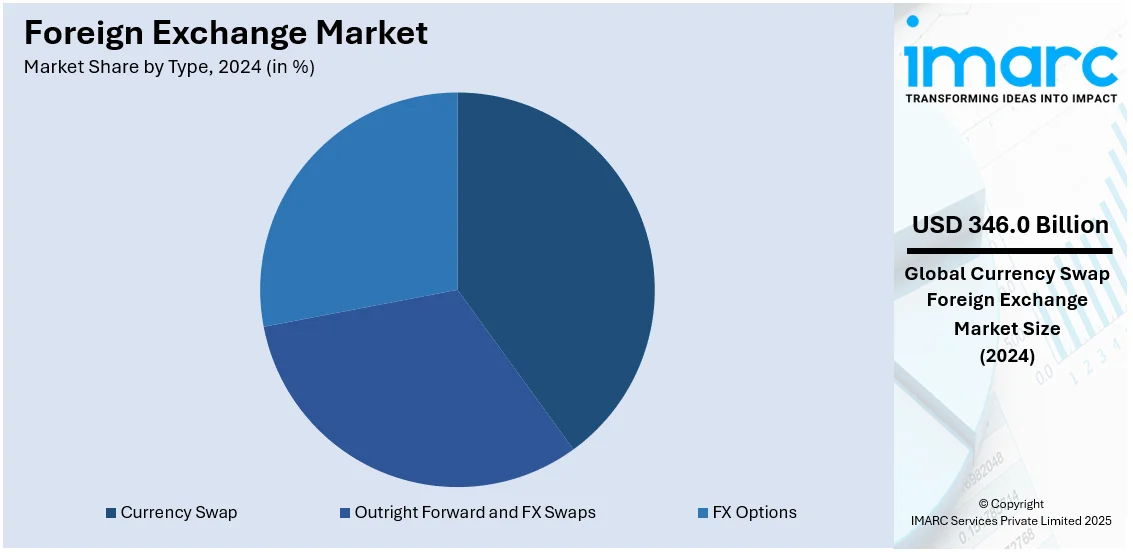

- Among types, the currency swap segment led the market, accounting for a share of 40.2% in 2024.

- Strategic implications for participants in the foreign exchange market include the need for platform providers to enhance speed, transparency, and interoperability. Banks must modernize systems and manage margin pressure. Fintechs gain ground through innovation but face regulatory and liquidity hurdles. All must respond to market volatility and evolving client demands.

A major driver in the foreign exchange (Forex) market is interest rate differentials between countries. Central banks set interest rates, and when a country's rate is higher compared to others, its currency tends to appreciate as investors seek higher returns. This demand for higher-yielding assets in a country with a strong interest rate drives forex trading activity. For example, if the U.S. Federal Reserve raises rates while the European Central Bank keeps rates unchanged, the U.S. dollar typically strengthens against the euro due to higher investment returns, influencing market sentiment and exchange rate movements.

The U.S. also plays a fundamental role in the Forex market, with USD being the world's primary reserve currency. The USD is involved in approximately 88% of global forex transactions, making it the most traded currency. U.S. economic indicators, such as gross domestic product (GDP) growth, inflation, and employment data, significantly influence market sentiment and currency valuations. In addition to this, in the foreign exchange market, the USD is involved in nearly 90% of all transactions, underscoring its dominance. Also, the actions by the U.S. Federal Reserve, such as adjusting interest rates or implementing monetary policy, can trigger substantial fluctuations in the forex market, impacting global currency pairs and international trade. The U.S. remains central to forex market dynamics.

Foreign Exchange Market Trends:

Increasing number of opportunities

The global foreign exchange market is a vast marketplace that provides many opportunities. According to the 2022 Triennial Survey, in April 2022, the global foreign currency (FX) market saw a daily turnover of USD 7.5 Trillion in a volatile market. The immense liquidity of the foreign exchange market presents participants with an array of trading opportunities. This offers liquidity, allowing for more efficient trade transactions. This also lowers the costs of trading, as there is no need to pay exchange fees and commissions. The global foreign exchange market offers a wide range of trading opportunities, including day trading, swing trading, scalping, trading breakouts and news, thereby bolstering the foreign exchange market share.

Rising number of partnerships and acquisitions amongst key players

Market players are making alliances with other companies, thus fueling the growth of the foreign exchange market. For instance, BNP Paribas, the top bank in the European Union, and Kayrros, a global environmental intelligence organization, have announced a major R&D partnership that will assist expedite methane abatement in the oil and gas industry. Additionally, the US-based capital holdings firm Rostro Group purchased the Belize-based FX services provider Scope Markets Group in January 2023. The tendency of financial organisations broadening their offerings through M&A was highlighted by this transaction, which extended Rostro's portfolio into foreign exchange trading. Some of the market players are also acquiring other companies to catalyze the market. For instance, BNP Paribas Group announced that its insurance subsidiary has signed a deal to acquire Fosun Group's approximately 9% share in Ageas.

Growing interconnection of countries

Deregulation of financial markets has resulted in increased interconnectedness among countries. Money can now be easily exchanged for 'global currencies' like the US dollar and the British pound. For example, it is simple to pay tuition fees for an online academic course in the United Kingdom while in Africa using online payment methods. This is conceivable due to the simplicity with which money may be exchanged from one's own currency to US dollars or British pounds. This has resulted in financial globalization, enabled by organizations such as PayPal, which operates sophisticated online payment systems that allow money to be transferred abroad. This interdependence of countries is driving the foreign exchange demand. Additionally, the digitalization is further shrinking the world in terms of connectedness. As per the Global Interconnection Index 2024 report by Equinix, businesses are establishing connections with 30% more business partners in twice as many places. Leaders are innovating 25% faster than their peers by integrating industrial value chains. Furthermore, by 2025, it is anticipated that 80% of business-to-business (B2B) sales exchanges between customers and suppliers will take place online.

Foreign Exchange Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global foreign exchange market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on counterparty and type.

Analysis by Counterparty:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Reporting dealers segment led the market in 2024, owing to the entities, including major banks and financial institutions, act as intermediaries in transactions, providing liquidity and facilitating large-scale trading activities. Their dominance is attributed to their extensive networks, robust trading platforms, and ability to handle complex financial instruments. Reporting dealers also play a crucial role in price discovery and risk management, enabling market efficiency. The surge in cross-border investments and the increasing complexity of financial products further solidified their position. Regulatory frameworks requiring detailed transaction reporting have highlighted their activities, underscoring their critical role in ensuring transparency and stability in the global financial system.

Analysis by Type:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Currency swap segment led the market, accounting for a share of 40.2% in 2024. The dominance is attributed to their strategic importance in managing currency risk and optimizing financial flexibility. A currency swap is a derivative instrument where two parties exchange principal and interest payments in different currencies. These instruments are widely used by multinational corporations, financial institutions, and governments to hedge against exchange rate fluctuations and secure funding in foreign currencies at competitive rates. The rising volume of international trade, cross-border investments, and global financial integration drove the demand for currency swaps. Additionally, the need for cost-effective risk management solutions in volatile currency markets boosted their adoption. Their ability to support liquidity and stabilize financial operations made currency swaps a dominant tool in global financial markets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 25.8%, due to its robust economic infrastructure, advanced technological adoption, and high consumer spending. The region's dominance is supported by strong industrial production, innovation, and the presence of leading global companies. Sectors such as technology, healthcare, and consumer goods particularly benefited from North America’s well-established supply chains and research capabilities. Additionally, favorable government policies and significant investments in renewable energy, manufacturing, and digital transformation contributed to the region’s market leadership. The United States played a central role, leveraging its vast resources, skilled workforce, and access to capital. This combination of economic resilience and innovation secured North America's position as a market leader in 2024.

Key Regional Takeaways:

United States Foreign Exchange Market Analysis

In 2024, the United States accounted for a market share of 88.9% in North America. Considering that according to the data released by Federal Reserve Board around 58% of world's central bank reserves constitutes with the U.S. dollar at the end of year 2022, the USD holds the position of main reserve currency in the world while having command over the U.S. foreign exchange (forex) market. Due to high international trade—The United States buys and exports more than USD 7 Trillion annually, according to the data of United States Trade Representative—FX transactions are required. Market liquidity is assured by the presence of some of the biggest international banks and currency trading platforms in the U.S. financial sector, including JPMorgan Chase and Citibank. The monetary policy decisions of the Federal Reserve, particularly in the context of interest rates, have a tremendous impact on the dynamics of the currency market. The market is also supported by the existence of sophisticated trading technology, such as algorithmic trading algorithms, which manage more than 70% of forex transactions. With almost 175,000 retail traders doing forex trading in the US in Q2 2022. in the United States alone, retail trading is also expanding. Growing investments in futures contracts and currency derivatives further boost market activity, demonstrating the United States' status as a major global financial center.

Europe Foreign Exchange Market Analysis

The euro, which accounts for about 32% of daily forex transactions and ranks as the second most traded currency in the world, drives the European forex market. The region's economic integration through the European Union has made cross-border trade more inviting. According to statistics by European Commission, in the area of exports, intra-EU trade, or trade in goods between EU countries, stood at Euro 4,102 Billion (USD 4,266.14 Billion) in 2023. This was 61% more than the Euro 2,556 Billion (USD 2,658.28 Billion) in exports to non-EU countries that were recorded as leaving the EU. Important financial centers like London, Paris, and Frankfurt account for much of the forex trading volume; London alone accounts for more than 38% of all forex transactions worldwide in 2022, according to media reports. Business risks associated with managing currency between the euro and the British pound related to Brexit has also arisen to raise hedging activity. Aggressive monetary policy by the European Central Bank and the diversity of economies in the continent produce volatility that feeds forex trading possibilities. Technological developments in trading platforms and regulatory measures such as MiFID II guarantee a safe and open forex trading environment. The market is also strengthened by the high level of participation from firms and institutional investors that deal with emerging European currencies.

Asia Pacific Foreign Exchange Market Analysis

The main drivers of the forex market in the Asia-Pacific area are high trade volumes, quickly growing economies, and the growing internationalization of currencies like the Chinese yuan. China, with yearly trade volumes topping USD 3.5 Trillion as per reports, is the world's largest exporter and has made the yuan one of the top five most traded currencies. The forex business of the region is backboned by South Korea growing currency power and Japan's yen, which makes up a huge 17% portion of all international forex exchanges. As their cross-border trading and FDI continue developing, emerging economies such as India and Indonesia also do contribute to a growth of currency trading. India receives more than USD 80 Billion in FDI a year. In economies like Japan, Australia, and Singapore—Singapore is one of the top three global forex hubs—notable trends include sophisticated forex trading platforms and increasing retail participation. Regional financial accords and regulatory policies play a significant role in Forex activity, too, with the Regional Comprehensive Economic Partnership (RCEP).

Latin America Foreign Exchange Market Analysis

High dependence of foreign trade and the geographical vulnerability to fluctuations in other currencies dominate the Latin America forex market. Brazil and Mexico dominate the business with an annual amount of USD 500 Billion in foreign trade, which is more than half of it, along with FDI inflow into Latin America and the Caribbean amounting to USD 193 Billion from World Investment Report 2024 that stimulates massive dollar transactions in the foreign exchange market. Commodity-based economies, particularly agricultural and oil-based economies, tend to drive exchange rates and hedges. The Bank for International Settlements estimates that the Mexican peso is the thirteenth most widely traded currency in the world and one of the most actively traded developing market currencies. Increasing foreign investment in technology and infrastructure, as well as changes in government regarding liberalization of financial markets, increase opportunities for foreign exchange trading. An increase in the number of retail traders and growing usage of digital trading platforms support market growth in the region.

Middle East and Africa Foreign Exchange Market Analysis

High remittance inflows, expanding financial sector development, and oil-exporting nations are the main drivers of the growth of the currency market in the Middle East and Africa (MEA). Having received more than 181.922 billion riyals (USD 48.40 Billion) in oil revenues for Q1 of 2024, Gulf Cooperation Council (GCC) countries are the biggest money makers in the region, as per industry reports, and they need a tremendous amount of foreign exchange transactions. More than USD 85 Billion is sent back annually in remittances to Africa, mainly from countries such as Nigeria and Egypt, accounting for 60 percent of remittances, according to a report, and thus driving the currency trading. It is driven by the financial position of the UAE in general, and in particular by its hosting one of the fast-growing FX markets within it; in developing African economies, currency volatility promotes speculation and hedging. Regional governments are gradually implementing changes to enhance the infrastructure of their financial markets; this is along with growing demand for mobile-based forex apps and digital trading platforms, which increase retail involvement in the market.

Competitive Landscape:

The competitive landscape in 2024 is characterized by intense rivalry among key players across industries, driven by innovation, technological advancements, and strategic collaborations. Companies are leveraging cutting-edge technologies such as artificial intelligence, data analytics, and automation to gain a competitive edge. Market participants focus on expanding their global footprint through mergers, acquisitions, and partnerships to access new markets and diversify portfolios. Sustainability and compliance with regulatory standards are emerging as critical factors, prompting investments in eco-friendly practices and products. Additionally, the shift towards digital transformation and customer-centric strategies is reshaping traditional business models. Competitive dynamics are further fueled by the increasing emphasis on research and development to introduce differentiated offerings and cater to evolving consumer demands.

The report provides a comprehensive analysis of the competitive landscape in the foreign exchange market with detailed profiles of all major companies, including:

- Barclays

- BNP Paribas

- Citibank

- Deutsche Bank

- Goldman Sachs

- HSBC Holdings plc

- JPMorgan Chase & Co.

- The Royal Bank of Scotland

- UBS AG

- Standard Chartered PLC

- State Street Corporation

- XTX Markets Limited

Latest News and Developments:

- In April 2025, a conference was held according to which India’s foreign exchange market nearly doubled in size, growing from USD 32 Billion in 2020 to USD 60 Billion in 2024. Daily volumes in the overnight money markets rose from INR 3 Lakh Crore to over INR 5.4 Lakh Crore, while government securities trading volumes jumped 40% to INR 66,000 Crore. Recent reforms have improved transparency, increased product and participant diversity, and strengthened links between onshore and offshore markets.

- In November 2024, NYK adopted CLSSettlement and Bloomberg FXGO-CMS to boost capital efficiency and simplify foreign exchange operations. CLS enables payment-versus-payment net settlement, cutting FX settlement risk by consolidating transactions into a single process. Through MUFG Bank’s CLS third-party service, NYK now settles FX trades with multiple institutions more efficiently, marking a shift toward reduced risk and smoother fund settlement in corporate foreign exchange handling.

- In September 2024, the Finance Ministry notified the Foreign Exchange (Compounding Proceedings) Rules, 2024, replacing the 2000 rules under FEMA. The update simplifies processes for foreign investors by enabling faster application handling, digital payments, and clearer procedures. Developed in consultation with the central bank, this reform aims to reduce regulatory hurdles and boost ease of doing business, aligning with the Union Budget 2024–25 announcement to make foreign investment rules more investor-friendly.

- In April 2024, Barclays announced extending its partnership with British Gas, which helps customers explore ways they could make their homes more energy efficient. The partnership now includes an offer for Barclays UK residential mortgage customers to get a British Gas Home Health Check, which usually costs GBP 99, for the discounted price of GBP 50.

- In February 2024, Tesco's retail banking division is set to be acquired by Barclays. In order to increase Barclays' customer offers in the UK, the purchase incorporates Tesco's banking businesses, credit cards, and savings accounts. By utilising Tesco's clientele, this action enhances Barclays' standing in the retail banking industry.

- In August 2023, Citibank announced that it successfully finalized the sale as well as a full migration of its Taiwan consumer businesses to DBS. Included in the retail banking, credit card, mortgage, and unsecured lending business, the nearly 3,000 employees transfer was part of the sale initially announced in January 2022.

- In July 2023, the European Central Bank announced that it approved the second tranche of 2.5 billion euros of the 2023 share buyback programme for BNP Paribas, which denotes a total amount of 5 billion euros. The execution will start at the beginning of August after the first tranche is completed.

Foreign Exchange Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC Holdings plc, JPMorgan Chase & Co., The Royal Bank of Scotland, UBS AG, Standard Chartered PLC, State Street Corporation, XTX Markets Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the foreign exchange market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global foreign exchange market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global foreign exchange market was valued at USD 861 Billion in 2024.

The global foreign exchange market is estimated to reach USD 1,535 Billion by 2033, exhibiting a CAGR of 6.64% from 2025-2033.

Key driving factors in foreign exchange include interest rate differentials, economic indicators like GDP and inflation, geopolitical events, trade balances, and central bank policies. Market sentiment, capital flows, and currency speculation also play significant roles, influencing currency demand and supply, which drive exchange rate fluctuations in the global Forex market.

North America currently dominates the global market, accounting for a market share of 25.8% in 2024. The dominance is driven by its robust economic infrastructure, advanced technological adoption, and high consumer spending.

Some of the major players in the global foreign exchange market include Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC Holdings plc, JPMorgan Chase & Co., The Royal Bank of Scotland, UBS AG, Standard Chartered PLC, State Street Corporation, XTX Markets Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)