Frac Sand Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Frac Sand Market Size and Forecast 2025-2033:

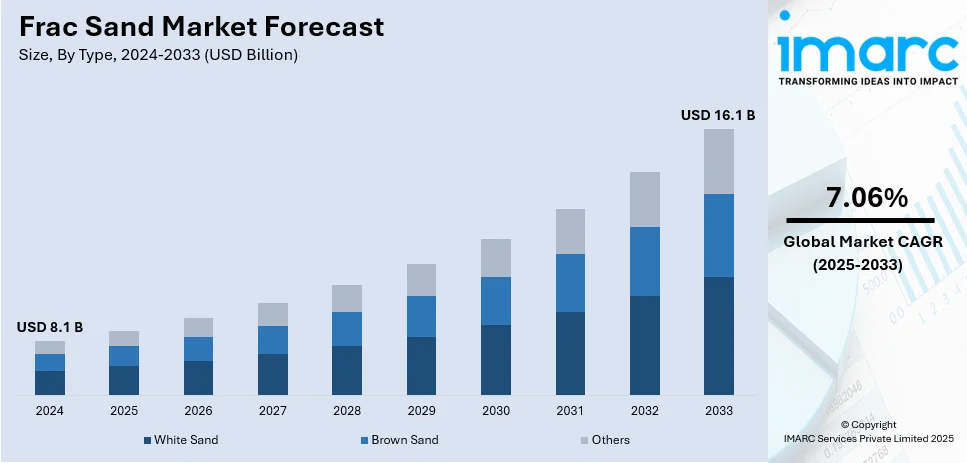

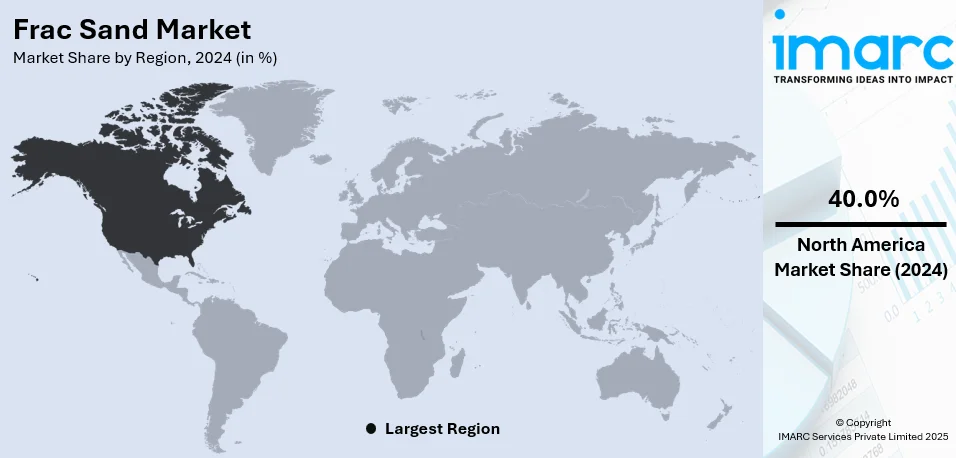

The global frac sand market size was valued at USD 8.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.1 Billion by 2033, exhibiting a CAGR of 7.06% during 2025-2033. North America currently dominates the market. The market is experiencing consistent growth, particularly in hydraulic fracturing activities, driven by swift technological progress and enhancements in efficiency. This growth is further fueled by the increasing demand for oil and gas exploration, alongside the expansion of infrastructure in developing oil and gas areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.1 Billion |

|

Market Forecast in 2033

|

USD 16.1 Billion |

| Market Growth Rate (2025-2033) | 7.06% |

The global frac sand market is driven by increasing hydraulic fracturing activities in the oil and gas industry, particularly in shale exploration. Along with this, rising energy demand, technological advancements in fracking techniques, and the growing adoption of horizontal drilling are further propelling the frac sand market share. On 28th January 2025, MATCOR, a BrandSafway company, re-launched its patented Iron Gopher linear anode for horizontal directional drilling (HDD) at a lower price after moving the production inhouse. It improves quality, eliminates supply chain delays, reduces costs, and makes this anode more affordable without compromising strength or reliability. Additionally, the expansion of unconventional oil and gas resources, coupled with investments in infrastructure and transportation, supports market expansion. Besides this, the availability of high-quality silica sand and favorable government policies promoting energy independence also contribute to demand. Moreover, environmental concerns and regulatory constraints are necessitating sustainable practices and innovations in proppant alternatives.

The U.S. frac sand market is expanding due to the rising adoption of hydraulic fracturing in shale oil and gas extraction. In 2023, the United States achieved a historic milestone by averaging 12.9 million barrels per day (b/d) of crude oil production, surpassing its previous record of 12.3 million b/d set in 2019. Together, the U.S., Russia, and Saudi Arabia represented 40% of the world's total oil production, amounting to 32.8 million b/d, with the U.S. taking the lead due to innovations in hydraulic fracturing and horizontal drilling techniques. Notably, U.S. crude production reached a peak of over 13.3 million b/d in December 2023, exceeding Saudi Arabia's maximum production capacity of 12.3 million b/d. Concurrently, increased drilling activity, particularly in regions such as Texas and North Dakota, is amplifying demand for high-quality sand. Advancements in drilling technology and efficiency improvements are further strengthening the market growth. Concurrently, the presence of abundant sand reserves and well-developed transportation networks supports supply chain optimization. Furthermore, favorable government policies promoting domestic energy production also play a crucial role in the frac sand market outlook.

Frac Sand Market Trends:

Growing Demand in Hydraulic Fracturing Operations

The main catalyst for market growth is the increasing demand in the hydraulic fracturing (fracking) sector. Frac sand plays an essential role as a proppant in this procedure, which involves the injection of high-pressure fluid into subterranean rock formations to facilitate the release and extraction of oil and natural gas. According to the U.S. Energy Information Administration (EIA), the number of horizontal wells drilled in the U.S. increased by 50% from 2016 to 2022, reflecting the increased reliance on hydraulic fracturing to extract oil and gas. As global energy demands continue to rise, particularly with the increasing reliance on unconventional oil and gas reservoirs, the need for the product is amplified. The expansion of hydraulic fracturing activities across regions such as North America has been a significant catalyst for the market's growth. Additionally, the environmental and regulatory considerations associated with fracking are driving innovation in frac sand technologies to minimize environmental impact.

Rapid Technological Advancements and Efficiency Improvements

Ongoing technological advancements and efficiency improvements in the extraction of oil and gas have contributed significantly to the frac sand market demand. Innovations in fracking techniques, such as horizontal drilling and multi-stage hydraulic fracturing, have led to increased sand consumption per well. According to the U.S. Energy Information Administration (EIA), the average amount of frac sand used per horizontal well increased by 50% between 2017 and 2022. As a result, the demand for higher-quality frac sand, including finer grains and resin-coated sand, has increased. The demand for finer, high-quality frac sand has risen as operators seek to enhance well productivity and maximize hydrocarbon recovery. This evolution in technology has created a shift towards the use of resin-coated sand and other specialized proppants, further influencing market trends. Moreover, the integration of digital monitoring and automation systems in fracking operations has improved precision and reduced downtime, enhancing overall efficiency.

Rising Infrastructure Development in Emerging Oil and Gas Regions

Infrastructure development in emerging oil and gas regions is one of the significant frac sand market trends. As exploration and production activities expand into previously untapped areas, the need for reliable and efficient transportation networks for frac sand becomes paramount. The U.S. Securities and Exchange Commission reported that in the second quarter of 2024, revenues for a commodity group, including frac sand, risen by 6% compared to the same period in 2023, primarily due to higher volumes. Investment in rail, road, and port facilities to support the movement of sand from mines to well sites is also an important investment by industry players. In addition, logistics infrastructure establishment adequately responds to the rising demand for the product in new and developing energy reservoirs. Moreover, environmentally friendly considerations in terms of minimizing carbon emissions in the logistics of frac sands have been emerging as concerns that necessitate the optimization of transportation routes.

Frac Sand Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global frac sand market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- White Sand

- Brown Sand

- Others

White sand leads the market with around 45.7% of the market share in 2024, due to its superior quality, high purity, and strong crush resistance. Composed primarily of high-purity quartz, it is widely preferred in hydraulic fracturing operations for its ability to enhance oil and gas extraction efficiency. Its uniform grain size, round shape, and durability make it ideal for proppant applications, ensuring better permeability and conductivity in fractured rock formations. The rising demand for energy, coupled with the increasing adoption of hydraulic fracturing techniques, continues to drive frac sand market growth. North America, particularly the United States, remains the leading consumer of white frac sand, with major shale formations such as the Permian Basin fueling its high demand.

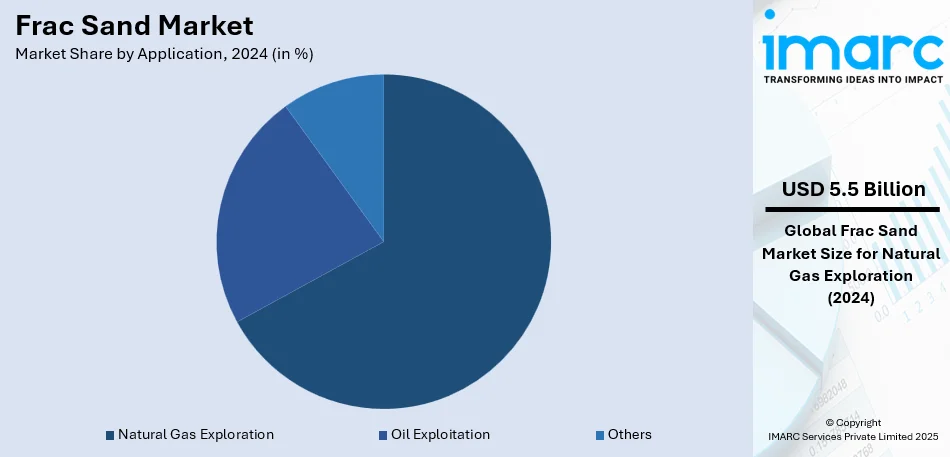

Analysis by Application:

- Oil Exploitation

- Natural Gas Exploration

- Others

Natural gas exploration leads the market with around 67.1% of the market share in 2024. Natural gas exploration stands out as the largest segment in the market based on application. Frac sand plays a pivotal role in hydraulic fracturing activities associated with natural gas extraction from unconventional reserves, such as shale formations. The proppant qualities of sand are essential for creating fractures that enhance permeability, allowing for the efficient flow of natural gas. With the growing emphasis on natural gas as a cleaner energy source and the increasing exploration of unconventional gas reservoirs, the demand for this sand in natural gas exploration continues to rise, making it a key driver in the market's expansion. The effectiveness of frac sand in optimizing the extraction of natural gas positions it as a critical component in the success of hydraulic fracturing operations within the natural gas sector

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share, driven by the rapid expansion of hydraulic fracturing and horizontal drilling in the region. The United States, in particular, dominates demand, with major shale basins such as the Permian, Eagle Ford, and Bakken fueling significant consumption. The region's abundant natural sand reserves, advanced extraction technologies, and well-established energy sector contribute to its market leadership. Increased investments in oil and gas exploration, along with the growing need for high-quality proppants, further enhance demand. Additionally, the presence of key frac sand suppliers and logistical advantages, such as proximity to shale formations, enhance North America's position as the largest regional segment. As energy production rises, the demand for frac sand is expected to remain strong.

Key Regional Takeaways:

United States Frac Sand Market Analysis

In 2024, the US accounted for around 89.70% of the total North America frac sand market. The market is expanding hugely due to a significant rise in drilling activities of oil and gas and advancing hydraulic fracturing technology. Based on the EIA, in 2023, the U.S. produced 12.9 million barrels of oil per day, making shale formations one of the top consumers of frac sand. This demand is also supplemented by an increase in the number of active drilling rigs. Baker Hughes estimates that the number of such rigs in 2023 would be around 700. Players such as U.S. Silica and Hi-Crush have managed to produce and meet the demand with facilities located across important regions, including Texas and Wisconsin. In-basin production has been able to decrease transportation costs and increase access to markets. Innovations in technology and consolidation of the sand mining industry also drive market dynamics. This is enhanced with more efficient extraction methods for growing operators' needs in shale plays.

Europe Frac Sand Market Analysis

The market in Europe is growing with the increase in oil and gas exploration activities, especially in unconventional reservoirs. According to the European Petroleum Survey Group, unconventional oil production is really picking up steam, especially in countries including the UK and Norway. Europe is producing less volume than the U.S., but exploratory activity is increasing in the North Sea and shale gas opportunities are growing in Poland and Hungary, which enhance demand for frac sand. Based on data from Rigzone, at the end of 2023, about 115 drilling rigs were working in Europe. The demand for quality sand is increasing, with companies focusing on advanced frac sand production and logistics to ensure supply in critical regions. In addition, stricter environmental regulations are driving technological innovations, leading to cleaner, more sustainable frac sand mining operations. Local suppliers are focusing on improving logistics capabilities and entering strategic partnerships to provide frac sand that meets the specifications required for hydraulic fracturing.

Asia Pacific Frac Sand Market Analysis

With growing exploration for oil and gas in China, India, and Australia, among other Asia-Pacific countries, demand in the market has witnessed growth. In fact, international agencies, including the International Energy Agency, expect that in 2022 China alone would be consuming approximately 15 million barrels a day in terms of oil and gas. Indian demand is likely to continue to rise 4% yearly, offering an expanded demand opportunity for the frac sand producers. The company is concentrating efforts on the enlargement of its manufacturing plant in major places such as Queensland, Australia, with the rise of shale gas explorations in this region. It is in light of these conditions that high-grade frac sand finds more application. Increased investment in Asian infrastructures as well as capacity of local productions and the regional Asian oil and gas suppliers moving closer towards country-by-country manufacturing are also gaining importance in Asian markets.

Latin America Frac Sand Market Analysis

Frac sand market is becoming larger as Latin American countries continue to explore and develop shale gas reserves in regions such as Brazil and Argentina. As of the report by Latin American Energy Organization, Argentina has one of the largest shale plays in the world, known as Vaca Muerta, driving up the demand for frac sand in that region. Argentina shale oil and gas production rose 8% in 2023, thus increasing the demand for frac sand. Brazil is also expanding its oil industry, with deepwater offshore reserves, and increased frac sand usage in hydraulic fracturing. Local players are improving their capacities to cater to regional demand, and international players are investing in Latin American operations to support growing exploration activities. In addition, Latin American countries are focusing on developing sustainable mining practices to address the environmental concerns and ensure a reliable supply of frac sand for the energy sector.

Middle East and Africa Frac Sand Market Analysis

This frac sand market in the MEA is being shaped by increases in oil and gas exploration happening in Saudi Arabia, the UAE, South Africa, etc. According to the International Energy Agency, Saudi Arabia was producing around 9.5 million barrels per day in 2023, which still reflected a production cut due to OPEC+, but was yet to drive steady demand for frac sand in hydraulic fracturing in an unconventional reservoir. In South Africa, shale gas exploration in the Karoo Basin continues to drive frac sand demand. Companies are investing in supply chain infrastructure that would fill the needs of operators in these regions. But the market itself has challenges such as transportation logistics, in addition to the free-thrown high cost of importing frac sand into the region. Growing interest in the development of shale oil and expanded oilfields in Africa is pushing the market forward, as local producers concentrate on building up their capacity to supply exploration activities.

Competitive Landscape:

The key players in the market are actively engaged in strategic initiatives to enhance their market position and meet changing industry demands. These industry leaders focus on operational efficiency, cost optimization, and ensuring a consistent supply of high-quality frac sand to oil and gas exploration activities. Investments aimed at enhancing production capacities, optimizing logistics and distribution systems, and investigating sustainable mining methods are prevalent strategies. Furthermore, due to the cyclical characteristics of the oil and gas sector, major stakeholders diligently observe market trends, modify production levels as necessary, and broaden their product range to meet the diverse proppant needs of hydraulic fracturing activities globally. Their strategic initiatives are designed to sustain competitiveness, respond to environmental concerns, and adapt to the transforming dynamics of the global energy market.

The report provides a comprehensive analysis of the competitive landscape in the frac sand market with detailed profiles of all major companies, including:

- CARBO Ceramics

- Emerge Energy Services

- Covia Holdings

- Hi Crush

- Source Energy Services

- U.S Silica

- Preferred Sands

- Badger Mining Corporation

- Mammoth Energy Service, Inc.

- Smart Sand Inc.

- Chongqing Changjiang

Latest News and Developments:

- May 2024: Covia completed the acquisition of R.W. Sidley’s Industrial Minerals Division. This acquisition includes a silica sand mining operation in Thompson, Ohio, expanding Covia’s portfolio with premium sands for filtration, athletic fields, construction, and golf courses, enhancing product offerings and customer service.

- April 2024: Apollo Global Management acquired frac sand provider U.S. Silica for USD 1.21 billion. This strategic acquisition aims to expand Apollo's portfolio within the industrial sector, capitalizing on the growing demand for frac sand used in hydraulic fracturing operations in the energy industry.

- March 2024: Mammoth Energy Services Inc. successfully bid USD 35.25 million to acquire a 1.5 million tons per annum (mtpa) frac sand mine and processing plant. The acquisition will be funded through available cash reserves and loans obtained from its revolving credit line.

- March 2024: Source Energy Services acquired RWR Trucking Inc.’s sand trucking assets, including 27 tractors and 52 trailers, strengthening its Last Mile Logistics service. The acquisition aligns with Source’s strategy to grow free cash flow and enhance logistics capabilities for frac sand distribution and other bulk materials.

- February 2024: Atlas Energy Solutions Inc. (AESI) announced its acquisition of Hi-Crush Inc., valued at USD 450 million. The deal includes USD 150 million in cash, USD 175 million in AESI shares, and USD 125 million in deferred cash payments. This acquisition will position Atlas as the largest proppant producer and logistics provider in the U.S.

Frac Sand Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | White Sand, Brown Sand, Others |

| Applications Covered | Oil Exploitation, Natural Gas Exploration, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CARBO Ceramics, Emerge Energy Services, Covia Holdings, Hi Crush, Source Energy Services, U.S Silica, Preferred Sands, Badger Mining Corporation, Mammoth Energy Service, Inc, Smart Sand Inc., Chongqing Changjiang, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the frac sand market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global frac sand market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the frac sand industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frac sand market was valued at USD 8.1 Billion in 2024.

IMARC estimates the frac sand market to exhibit a CAGR of 7.06% during 2025-2033, reaching a value of USD 16.1 Billion by 2033.

The frac sand market is driven by the rising demand for hydraulic fracturing in oil and gas exploration, advancements in drilling technologies, increasing energy consumption, expanding shale gas extraction, and favorable government policies supporting domestic energy production. Additionally, improvements in proppant quality and logistics infrastructure contribute to market growth.

North America currently dominates the frac sand market. This dominance is fueled by the rapid expansion of hydraulic fracturing, extensive shale reserves, technological advancements, and a well-developed supply chain network.

Some of the major players in the frac sand market include CARBO Ceramics, Emerge Energy Services, Covia Holdings, Hi Crush, Source Energy Services, U.S Silica, Preferred Sands, Badger Mining Corporation, Mammoth Energy Service, Inc, Smart Sand Inc., and Chongqing Changjiang, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)