Fragrance Ingredients Market Size, Share, Trends, and Forecast by Type, Source, Application, and Region, 2025-2033

Fragrance Ingredients Market Size and Share:

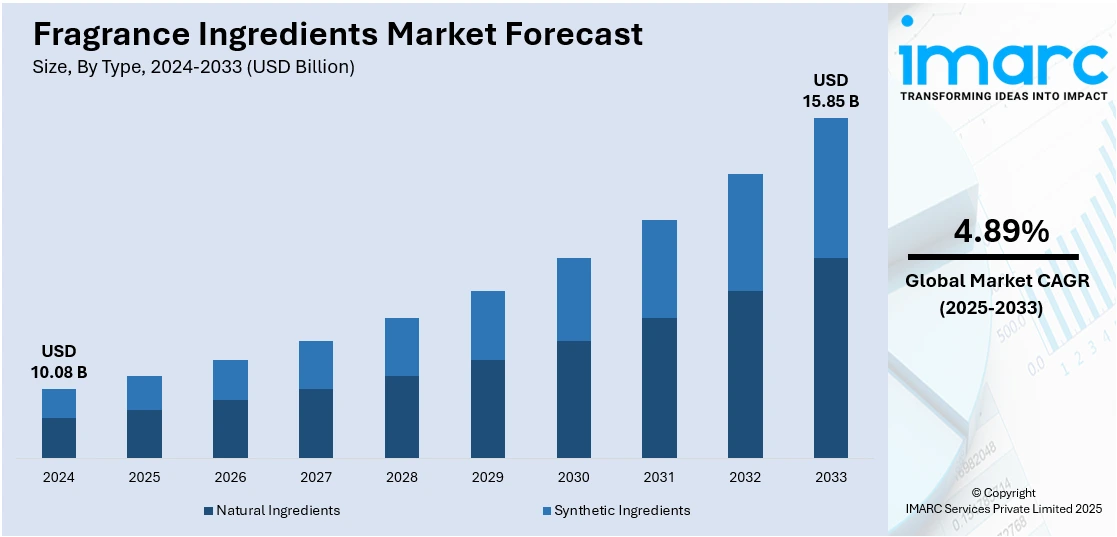

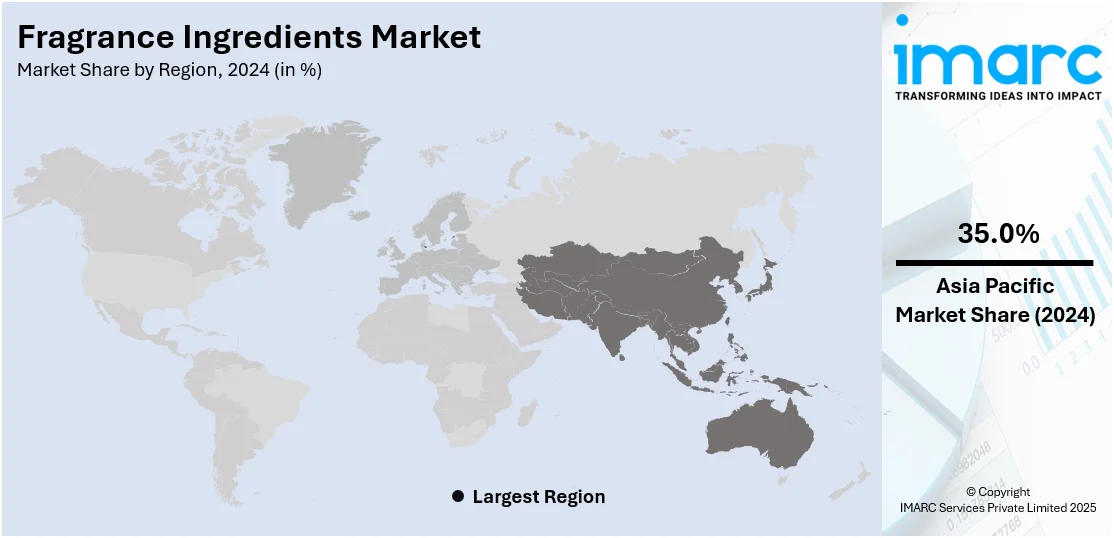

The global fragrance ingredients market size was valued at USD 10.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.85 Billion by 2033, exhibiting a CAGR of 4.89% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 35.0% in 2024. This can be attributed to rapid urbanization, rising disposable incomes, and increasing demand for personal care products. Growing awareness of premium fragrances and expanding middle-class consumers drive market growth. Additionally, strong manufacturing capabilities and innovation contribute to the region’s dominant position in the fragrance ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.08 Billion |

| Market Forecast in 2033 | USD 15.85 Billion |

| Market Growth Rate (2025-2033) | 4.89% |

The market is being propelled by increasing consumer preference for premium and personalized fragrances across both personal care and home care segments. Technological advancements in encapsulation and controlled-release systems are enabling longer-lasting scents, which appeal to quality-conscious consumers. Moreover, the rising influence of wellness trends has led to growing demand for therapeutic and aromatherapeutic products, incorporating natural essential oils and botanicals. Regulatory support for sustainable and biodegradable ingredients is further encouraging innovation in green chemistry. For instance, Firmenich launched the Re:New collection, featuring ten renewable and upcycled fragrance ingredients as part of its 2030 ESG goal to make 100% of fragrances renewable. Powered by Sylvergreen™, the collection uses sustainable pine-derived raw materials and green chemistry to replace fossil fuels without compromising scent quality. It enhances eco-friendly perfumery with diverse woody and floral notes, supporting brands’ demand for natural-origin fragrances while driving circular innovation and sustainable creation. Additionally, the expanding middle-class population in emerging economies is fostering increased spending on beauty and hygiene products, thus elevating demand for fragrance ingredients across a wide array of applications, including fine fragrances, detergents, and cosmetics.

To get more information on this market, Request Sample

In the United States, the fragrance ingredients market growth is primarily driven by increasing consumer inclination toward clean-label and allergen-free formulations. The shift in consumer behavior towards eco-conscious consumption has led brands to adopt sustainable sourcing and transparent ingredient disclosures, fostering trust and brand loyalty. The expansion of niche perfumery and artisanal fragrance brands has introduced new, sophisticated blends that appeal to diverse customer demographics. Additionally, heightened demand for multifunctional products, such as deodorants with skin-care benefits, has amplified the need for innovative scent compounds. The U.S. regulatory environment, which encourages product safety and traceability, also supports R&D investments, making the country a key driver in global fragrance formulation trends.

Fragrance Ingredients Market Trends:

Surge in Demand from the Expanding Cosmetic Industry

The rapid growth of the global cosmetics sector is a major catalyst for the fragrance ingredients market trends. According to the India Brand Equity Foundation (IBEF), the cosmetics industry is advancing at a CAGR of 4.3% and is expected to reach USD 450 billion by 2025. This upward trajectory directly translates to increased consumption of fragrance ingredients in products such as creams, shampoos, and toiletries. The market is further bolstered by rising disposable incomes, urbanization, and evolving grooming preferences, particularly in emerging economies. Additionally, the demand for unique and long-lasting fragrances in skincare and haircare has led to growing investments in advanced formulation techniques, thus reinforcing the link between cosmetic industry expansion and fragrance ingredient demand.

Shift Toward Natural and Eco-Friendly Fragrance Ingredients

Growing awareness about the adverse effects of synthetic chemicals in personal care products has prompted a significant shift toward natural and organic fragrance ingredients. Extracts from plants, fruits, and animals are increasingly preferred due to their perceived safety and sustainability. Supporting this trend, the National Sanitation Foundation (NSF) reports that 74% of consumers consider organic ingredients essential in personal care products. In response, governments and private entities are boosting R&D investments to develop eco-friendly, dermatologically safe fragrance formulations. This shift is not only improving consumer confidence but also reshaping brand strategies around clean-label products. As a result, the demand for transparent and ethically sourced ingredients is becoming a defining trend in the fragrance ingredient industry.

Therapeutic Applications and Customization Driving Innovation

The rising popularity of aromatherapy has introduced new avenues for the fragrance ingredients market. Consumers increasingly seek fragrances with therapeutic benefits, such as stress relief, improved sleep, and mood enhancement. This has led to the development of wellness-focused products using essential oils and natural scents, which, in turn, is creating a positive fragrance ingredients market outlook. Additionally, mergers and acquisitions among industry leaders have introduced international fragrance brands that cater to the demand for personalized scents. Consumers now have the ability to co-create perfumes with specific notes, such as floral, woody, or oriental. These innovations, coupled with strategic marketing and continuous product development, are fostering strong consumer engagement and brand differentiation, thereby accelerating the market’s evolution toward experiential and health-conscious scent solutions. For instance, Givaudan’s VivaScentz™ is an innovative fragrance technology designed to enhance consumer wellbeing by combining science and perfumery. Rooted in over 30 years of research, it measures wellbeing holistically, helping create scents that evoke positive emotions and optimism. Developed with academic partners and tested on 2,000 consumers, VivaScentz™ supports the growing self-care trend by offering mood-boosting, feel-good fragrance experiences. This technology enables brands to create products that improve mental and emotional health, strengthening consumer connections through scientifically backed scent innovations that promote overall quality of life.

Fragrance Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fragrance ingredients market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, source, and application.

Analysis by Type:

- Natural Ingredients

- Synthetic Ingredients

Synthetic ingredients stand as the largest type in 2024. The synthetic ingredients segment dominates the fragrance ingredients market primarily due to its cost-effectiveness, scalability, and consistent quality. Unlike natural extracts, synthetic ingredients can be mass-produced with precise chemical compositions, ensuring uniformity in scent and performance across large batches. They also offer a broader range of aromatic profiles that may not be available naturally, enabling formulators to create unique and long-lasting fragrances. Moreover, synthetic ingredients are less vulnerable to supply chain disruptions caused by seasonal or geographic limitations. Their stability, versatility, and compatibility with various product formulations make them a preferred choice among manufacturers across the cosmetics, personal care, and household product industries.

Analysis by Source:

- Flower

- Fruits

- Vegetables

- Plant Extracts

Flower leads the market with around 42.2% of market share in 2024. The flower segment dominates the fragrance ingredients market due to its longstanding association with pleasant, familiar, and universally appealing scents. Floral notes such as rose, jasmine, lavender, and ylang-ylang are highly valued for their versatility and emotional resonance, often evoking feelings of freshness, elegance, and romance. These extracts are integral to both premium and mass-market perfumes, personal care items, and household products. Additionally, the growing consumer preference for natural and plant-based ingredients has reinforced the popularity of floral sources. Their ability to blend harmoniously with other fragrance families further enhances their dominance across a wide spectrum of fragrance applications globally.

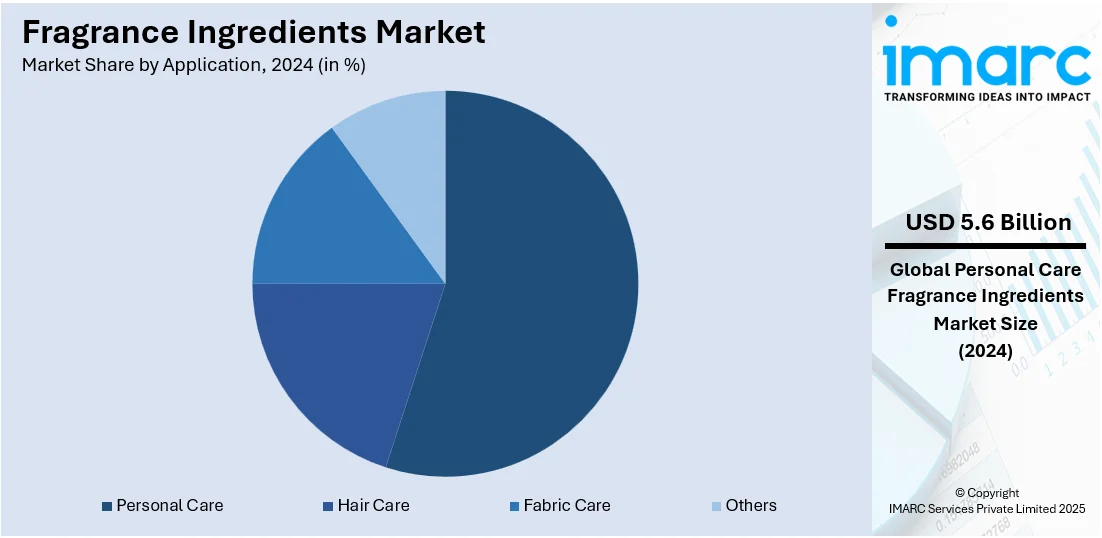

Analysis by Application:

- Hair Care

- Personal Care

- Fabric Care

- Others

Personal care leads the market with around 55.2% of market share in 2024. The personal care segment dominates the fragrance ingredients market primarily due to the high and consistent demand for scented products such as deodorants, shampoos, lotions, creams, and soaps. Fragrances play a crucial role in enhancing the sensory appeal and perceived effectiveness of these products, driving consumer preference and brand differentiation. As personal grooming becomes increasingly important across demographics, especially in emerging economies, the demand for fragranced personal care items continues to rise. Furthermore, innovations in formulations and the growing popularity of organic and customized products have led manufacturers to incorporate diverse fragrance ingredients, further strengthening the segment’s leading position in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.0%. The Asia-Pacific region dominates the fragrance ingredients market due to its large and rapidly growing population, coupled with increasing disposable incomes and urbanization. Rising consumer awareness about personal hygiene and grooming, especially in countries like China, India, and Japan, has significantly boosted the demand for fragranced personal care and household products. Additionally, the expansion of the cosmetics and wellness industries, along with a growing preference for premium and natural products, fuels market growth. For instance, in January 2024, Unilever launched the Lynx Fine Fragrance Collection, targeting Gen Z males with five premium yet affordable scents. The range addresses the demand for accessible fine fragrances, with 74% of young males seeking such options. Created with top perfumers, the collection includes Black Vanilla, Blue Lavender, Aqua Bergamot, Emerald Sage, and Copper Santal. The launch aims to drive category growth by blending fine fragrance quality with deodorant convenience. This innovation builds on Unilever’s strategy to boost deodorant sales through premium, affordable, and appealing personal care products. The presence of a strong manufacturing base and supportive government policies further strengthens the region’s dominance, making Asia-Pacific a key hub for both production and consumption of fragrance ingredients.

Key Regional Takeaways:

United States Fragrance Ingredients Market Analysis

In 2024, the United States held a market share of around 75.7% in North America. The United States fragrance ingredients market is witnessing robust growth, driven by the rising consumer preference for premium and personalized fragrances. Increasing demand for natural and organic components is reshaping product formulations across various segments, including fine fragrances, personal care, and home care. The expansion of wellness trends has further propelled interest in aromatherapy-based ingredients, aligning with consumers’ desire for mood-enhancing and stress-relieving products. Technological advancements in extraction and formulation processes are enabling the development of high-performing and long-lasting scent profiles. According to OEC, the United States imported USD 5.47 Billion worth of perfumes in 2024, highlighting the country’s strong appetite for fragrance-related products and the growing influence of imported aromatic formulations on domestic ingredient demand. Additionally, the surge in e-commerce and digital engagement is boosting the visibility of niche fragrances, encouraging experimentation and diversification. Regulatory support for sustainable ingredient sourcing is promoting innovation in botanical extracts and biodegradable materials. Clean beauty standards and environmental consciousness drive manufacturers to prioritize transparency and traceability in ingredient supply chains, leading to a shift in the U.S. fragrance ingredients landscape toward customization and sustainability.

Europe Fragrance Ingredients Market Analysis

The fragrance ingredients market in Europe is expanding steadily, supported by a strong cultural affinity for luxury and artisanal scents. Growing consumer awareness about product origin and formulation is fostering demand for ethically sourced and traceable ingredients. The increasing popularity of functional fragrances that offer therapeutic or sensory benefits is influencing innovation in olfactory science. Climate consciousness is also playing a crucial role, with brands seeking carbon-reduced and circular solutions within ingredient processing. According to the CBI Ministry of Foreign Affairs, European imports of natural ingredients for cosmetics amounted to 470,561 Tons, valued at approximately USD 2.4 Billion, reflecting the region’s increasing commitment to natural and sustainable inputs. The region’s stringent regulatory framework promotes the use of safe, compliant, and eco-conscious formulations, encouraging the adoption of synthetic biology and green chemistry techniques. The wellness and lifestyle sectors are boosting interest in fragrance ingredients for holistic applications, with multisensory integration and collaborations between perfumers and biotech firms driving innovation.

Asia Pacific Fragrance Ingredients Market Analysis

The Asia Pacific fragrance ingredients market is experiencing accelerated growth, fueled by rising disposable incomes and evolving grooming habits among younger demographics. Cultural diversity and rich olfactory traditions across the region are fostering the development of locally inspired scent profiles. The growing influence of global beauty standards is increasing the incorporation of fragrances into skincare and cosmetics. Notably, India’s cosmetics industry is emerging as a significant driver, with the India Brand Equity Foundation reporting that the sector is projected to reach USD 20 Billion by 2025, growing at a CAGR of 25%. This surge intensifies demand for innovative fragrance ingredients that enhance product appeal across beauty and personal care categories. Emerging markets are experiencing increased demand for functional cosmetics and mood-enhancing products due to rapid urbanization and expanding middle-class populations. Digital and social commerce platforms enhance consumer access to customized fragrances. Investment in innovation and sustainability is driving the development of complex scent compositions.

Latin America Fragrance Ingredients Market Analysis

The Latin American fragrance ingredients market is gaining traction, spurred by an expanding youth population and increasing urban consumption. Local preferences for expressive and bold scent profiles are influencing the formulation of distinctive fragrance blends. The growing role of social media and influencer culture is driving experimentation with unique personal care products infused with compelling aromatic ingredients. It has been reported that social media usage in Brazil has surged, with 144 million users, marking an increase of 2 million in just one year. Regional markets are experiencing a surge in demand for fragrances promoting emotional and sensory well-being, with a focus on botanical and locally sourced ingredients, driven by retail innovation and multi-brand beauty spaces.

Middle East and Africa Fragrance Ingredients Market Analysis

The Middle East and Africa fragrance ingredients market is expanding due to cultural appreciation for perfumery and olfactory experiences, resulting in demand for innovative ingredients that blend heritage with contemporary appeal. As consumers seek identity-driven and expressive fragrances, manufacturers are exploring novel ingredients that reflect regional sensibilities. Notably, according to official reports, the Moroccan government has invested USD 1.1 Million in aromatic and medicinal plant projects, signaling growing institutional support for indigenous ingredient development and sustainable sourcing. Increasing investments in lifestyle and luxury sectors are boosting interest in bespoke scent formulations. Rising disposable incomes, retail sophistication, tourism, and experiential retail enhance access to fragrance-infused products, positioning the region as a hub for fragrance innovation and cultural expression.

Competitive Landscape:

The fragrance ingredients market forecast projects the market to be characterized by intense rivalry among both global and regional players. Companies compete on the basis of product quality, pricing strategies, innovation, sustainability, and customer relationships. The market is witnessing increased investment in research and development to create eco-friendly, natural, and allergen-free fragrance ingredients, in line with shifting consumer preferences. Strategic partnerships, mergers and acquisitions, and global expansion efforts are common as players aim to strengthen their market positions. For instance, in November 2024, Robertet acquired Phasex, a U.S.-based pioneer in supercritical CO2 extraction, to expand its natural ingredients portfolio in North America. Phasex specializes in extracting high-value natural components for the biopharmaceutical, polymer, and natural products sectors. This eco-friendly method enhances Robertet’s R&D capabilities and reduces time to market. Additionally, technological advancements in extraction techniques and formulation processes are enabling the development of more complex and appealing scents. The rise of niche and personalized fragrances is also prompting firms to diversify their product portfolios and offer more customized solutions to attract a wider consumer base.

The report provides a comprehensive analysis of the competitive landscape in the fragrance ingredients market with detailed profiles of all major companies, including:

- BASF SE

- dsm-firmenich

- Fine Fragrances

- Givaudan

- International Flavors & Fragrances Inc

- Kao Chemicals Europe, S.L.U.

- Mane SA

- Robertet Group

- S H Kelkar and Company Limited

- Symrise AG

- T.Hasegawa Co. Ltd.

- Takasago International Corporation

- Treatt Plc

Latest News and Developments:

- April 2025: Citrus Magic launched its limited-edition Unicorn Toots fragrance, originally an April Fools’ joke, due to high consumer demand. Crafted with 100% active ingredients and natural citrus oils, the whimsical scent featured playful notes and was positioned as safe for kids, with only 10,000 bottles released exclusively on Walmart.com.

- March 2025: BASF’s Isobionics® launched two biotech-based flavor ingredients, Natural beta-Sinensal 20 and Natural alpha-Humulene 90, using fermentation technology. These sustainable, high-purity innovations offered citrus-peel and woody profiles, met EU and US food-grade standards, and catered to beverages and essential oils. They debuted at FlavourTalk 2025 in London, reinforcing BASF’s aroma ingredient innovation strategy.

- March 2025: Osmo launched Generation, the world’s first AI-powered fragrance house, integrating olfactory intelligence to create innovative, sustainable ingredients like Glossine, Fractaline, and Quasarine. The platform accelerated fragrance development using AI-driven tools, market intelligence, and exclusive formulations, enabling brands to craft distinctive scents more efficiently while aligning with modern consumer and regulatory demands.

- February 2025: CPL Aromas launched two exclusive captive ingredients, Aromalide™ and Sandalwave™, enhancing its innovation edge. Aromalide™ offers fruity-floral musk with ambrette warmth, while Sandalwave™ introduces creamy sandalwood with rose nuances. Both materials provided superior stability, performance, and olfactive uniqueness, reinforcing CPL’s creative control and leadership in high-performance fragrance ingredient development.

- January 2025: Azelis, through Vigon International, partnered exclusively with NATARA to distribute its botanical extracts and specialty aroma chemicals in North America. The collaboration expanded Vigon’s portfolio, enabling the creation of innovative, sustainable fragrances while aligning with ESG principles and meeting evolving consumer preferences for eco-conscious products.

Fragrance Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural Ingredients, Synthetic Ingredients |

| Sources Covered | Flower, Fruits, Vegetables, Plant Extracts |

| Applications Covered | Hair Care, Personal Care, Fabric Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, dsm-firmenich, Fine Fragrances, Givaudan, International Flavors & Fragrances Inc, Kao Chemicals Europe, S.L.U., Mane SA, Robertet Group, S H Kelkar and Company Limited, Symrise AG, T.Hasegawa Co. Ltd., Takasago International Corporation, Treatt Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fragrance ingredients market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fragrance ingredients market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fragrance ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fragrance ingredients market was valued at USD 10.08 Billion in 2024.

The fragrance ingredients market is projected to exhibit a CAGR of 4.89% during 2025-2033, reaching a value of USD 15.85 Billion by 2033.

The fragrance ingredients market is being driven by rising consumer demand for personal care and cosmetic products, growing awareness of natural and sustainable ingredients, and advancements in fragrance formulation technologies. Additionally, expanding applications across home care and fine fragrances support industry growth. These factors significantly influence fragrance ingredients market share.

Asia Pacific currently dominates the fragrance ingredients market, accounting for a share of 35.0%, driven by rising consumer spending on personal care products, expanding urban populations, and increasing demand for natural fragrances. Key markets like China, India, and Japan significantly contribute to regional growth, reinforcing Asia Pacific’s leading position in the global market.

Some of the major players in the fragrance ingredients market include BASF SE, dsm-firmenich, Fine Fragrances, Givaudan, International Flavors & Fragrances Inc, Kao Chemicals Europe, S.L.U., Mane SA, Robertet Group, S H Kelkar and Company Limited, Symrise AG, T.Hasegawa Co. Ltd., Takasago International Corporation, Treatt Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)