France ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

France ATM Market Overview:

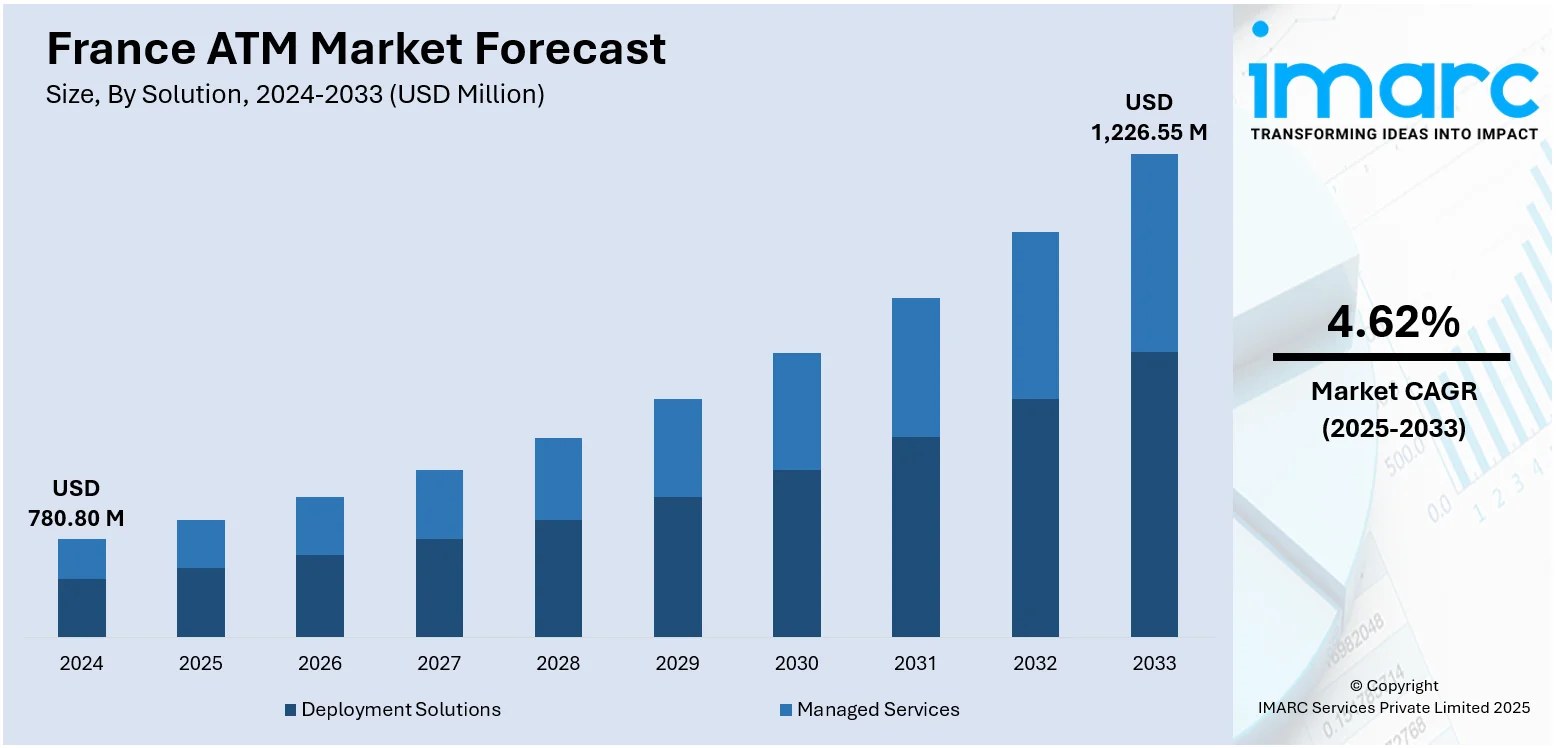

The France ATM market size reached USD 780.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,226.55 Million by 2033, exhibiting a growth rate (CAGR) of 4.62% during 2025-2033. Rising demand for cash access in rural areas, bank branch closures, tourism-driven withdrawals, and regulatory mandates are some of the factors contributing to France ATM market share. Emphasis on security upgrades, multi-functionality, and contactless technology also boosts deployment. Independent ATM deployers and bank partnerships add further momentum to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 780.80 Million |

| Market Forecast in 2033 | USD 1,226.55 Million |

| Market Growth Rate 2025-2033 | 4.62% |

France ATM Market Trends:

Decline in Cash Usage Reshaping ATM Demand

France has seen a significant reduction in cash-based transactions, driven by rapid growth in contactless payments, mobile wallets, and e-commerce. According to data from the Banque de France, the volume of card payments has outpaced cash withdrawals in recent years, especially post-COVID. Urban consumers are leaning toward cashless options, with tap-and-go payments becoming the norm in supermarkets, transit, and hospitality. This shift is pushing banks and ATM operators to rethink their ATM footprint. Rather than expanding networks, many are downsizing or consolidating ATM locations, particularly in city centers. ATMs are being upgraded with multi-functionality, cash recycling, check deposit, and even customer authentication, to stay relevant. Still, the overall number of transactions per ATM is declining, leading to closures of underperforming units. The market is no longer about growing ATM count but optimizing existing infrastructure to match shrinking demand. In rural areas, where banking access remains limited, some ATMs stay operational as part of financial inclusion efforts, often supported by government or cooperative initiatives. These factors are intensifying the France ATM market growth.

To get more information on this market, Request Sample

Surge in Independent ATM Deployments Outside Bank Branches

Amid reduced cash services from traditional banks, independent ATM deployers (IADs) in France are expanding aggressively, especially in non-bank locations. With bank branches closing or limiting cash withdrawal hours, private players are stepping into high-footfall areas, i.e., supermarkets, train stations, convenience stores, and nightlife zones, to meet continued, if niche, demand for cash access. This shift is carving out a new segment in the ATM market that’s less about banking and more about consumer convenience. IADs often charge withdrawal fees, but users trade off that cost for location and access. Some of these machines now integrate with mobile money platforms and QR code-based interfaces to tap into younger users. The profitability model is leaner: lower installation costs, minimal real estate, and selective targeting of cash-heavy localities. This is especially visible in tourist-heavy zones where foreign cardholders seek quick currency access. With regulatory oversight tightening but not restricting IAD expansion, this sector is likely to remain a pocket of growth even as the broader ATM network contracts.

France ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM Type

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15” and Below

- Above 15”

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15” and below and above 15”.

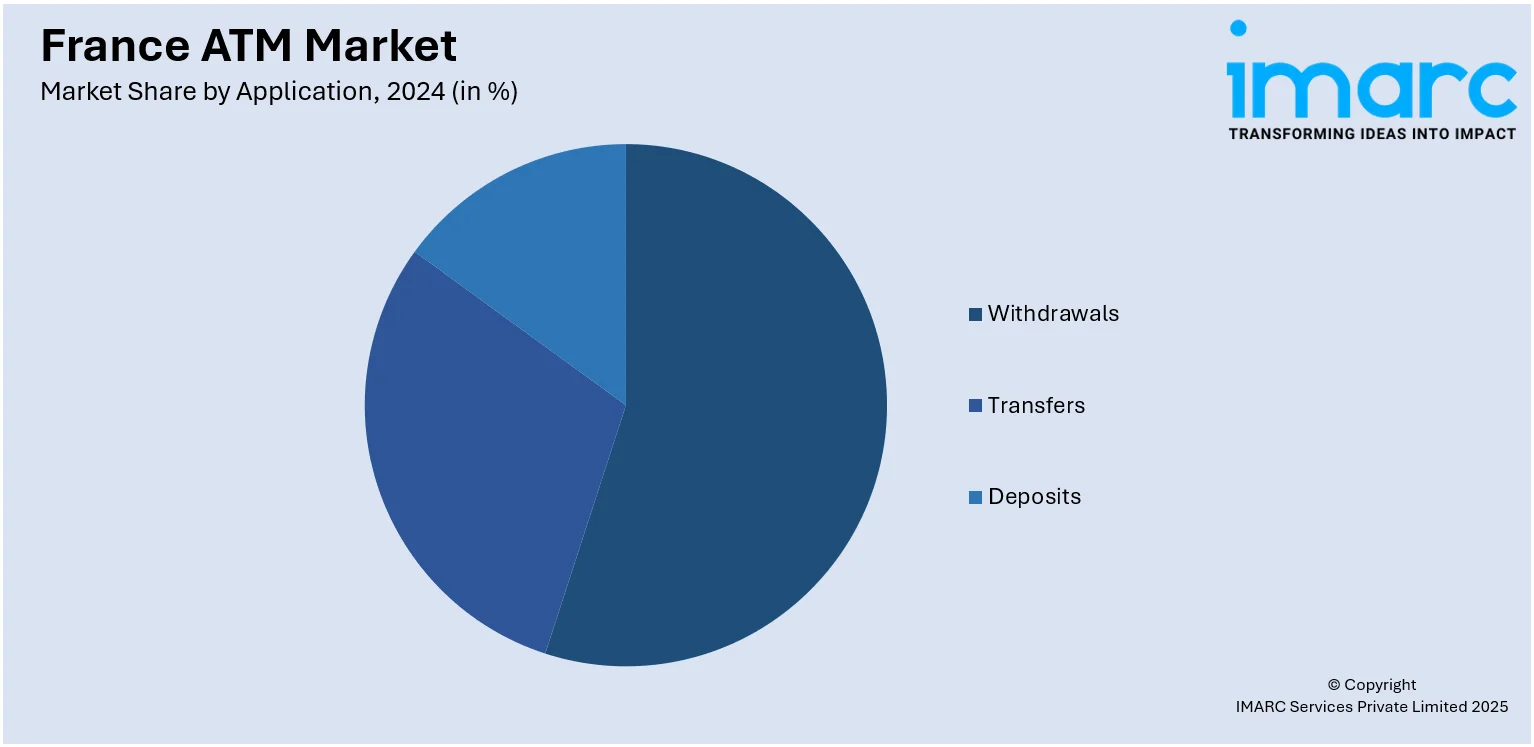

Application Insights:

- Withdrawals

- Transfers

- Deposits

The report has provided a detailed breakup and analysis of the market based on the application. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France ATM Market News:

- In February 2025, four major French banks, i.e., BNP Paribas, Société Générale, CIC, and Crédit Mutuel, announced the launch of shared, brand-free ATMs in rural areas under the ‘Cash Services’ initiative. Aimed at improving cash access in underserved communities, the rollout follows two years of testing. These neutral ATMs will feature a unified logo and start operating in 2025, offering a collaborative solution to ensure continued financial inclusion across France’s smaller towns and villages.

France ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the France ATM market on the basis of solution?

- What is the breakup of the France ATM market on the basis of screen size?

- What is the breakup of the France ATM market on the basis of application?

- What is the breakup of the France ATM market on the basis of ATM type?

- What is the breakup of the France ATM market on the basis of region?

- What are the various stages in the value chain of the France ATM market?

- What are the key driving factors and challenges in the France ATM market?

- What is the structure of the France ATM market and who are the key players?

- What is the degree of competition in the France ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)