France Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

France Cement Market Summary:

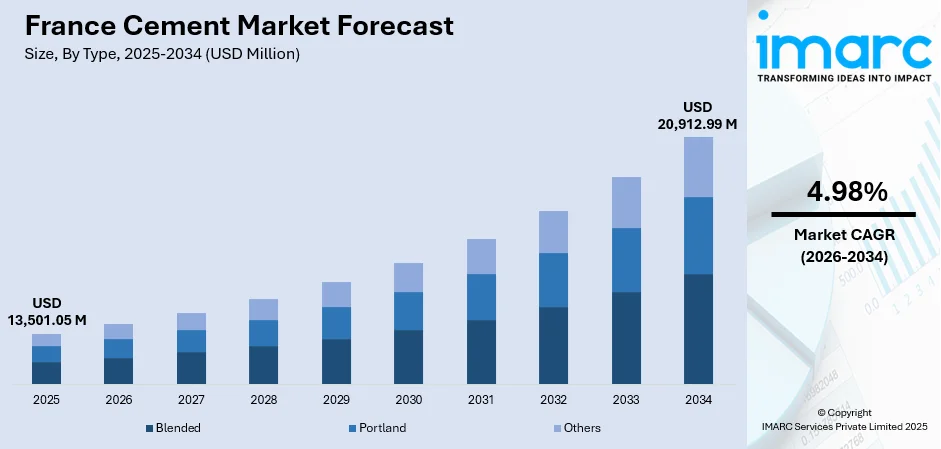

The France cement market size was valued at USD 13,501.05 Million in 2025 and is projected to reach USD 20,912.99 Million by 2034, growing at a compound annual growth rate of 4.98% from 2026-2034.

The France cement market is gaining traction as infrastructure renewal programs and residential energy efficiency mandates drive steady demand. Supportive government policies are encouraging cement producers to transition towards low-carbon technologies. Ongoing metropolitan construction projects and stringent building regulations are reshaping material specifications. The shift towards blended and eco-friendly cement formulations is influencing production strategies, while public-private collaborations strengthen supply chain resilience.

Key Takeaways and Insights:

-

By Type: Blended dominates the market with a share of 55% in 2025, owing to its lower clinker content, reduced carbon footprint, and compliance with France's environmental standards. This segment benefits from government incentives aimed at promoting sustainable construction materials.

-

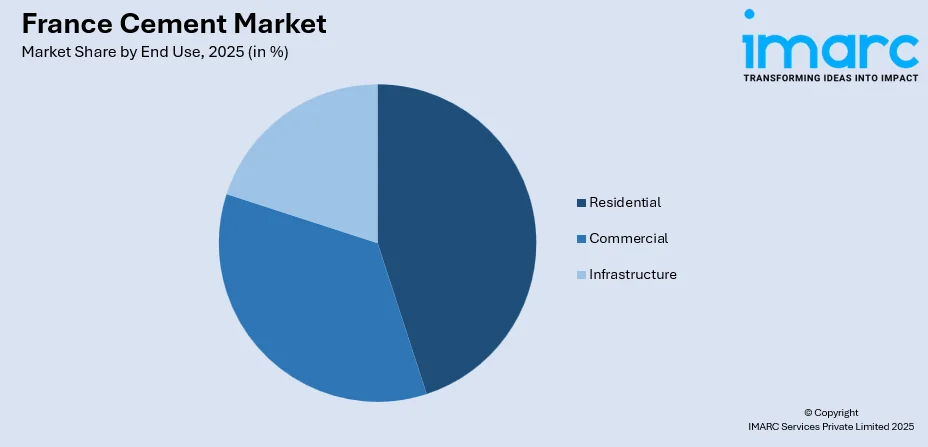

By End Use: Residential leads the market with a share of 40% in 2025. This dominance is driven by extensive housing renovation programs, energy efficiency upgrades, and government-backed subsidies supporting home improvement projects across metropolitan and regional areas.

-

Key Players: Key players drive the France cement market by investing in decarbonization technologies, expanding low-carbon product portfolios, and strengthening regional distribution networks. Their focus on carbon capture projects and calcined clay innovations supports compliance with stringent environmental regulations.

To get more information on this market Request Sample

The France cement market is undergoing structural transformation, as environmental mandates accelerate the adoption of sustainable production methods. Regulatory frameworks are encouraging builders to prioritize materials with verified environmental declarations, reshaping procurement patterns across residential, commercial, and infrastructure segments. Major cement producers are responding by expanding calcined clay facilities and launching certified low-carbon product lines that meet lifecycle assessment requirements. The Grand Paris Express infrastructure project, representing a EUR 36.1 Billion investment, continues to generate sustained demand for specialized cement formulations across the Île-de-France region. Public infrastructure investments are further supporting construction activities in transport corridors, educational facilities, and energy-efficient building retrofits. Carbon capture and utilization initiatives at key production facilities demonstrate industry commitment to achieving decarbonization targets. Additionally, digital process optimization through automated kiln control and real-time emissions monitoring is enhancing operational efficiency while ensuring compliance with evolving environmental standards that govern the France cement market growth.

France Cement Market Trends:

Increasing construction activities

Increasing construction activities are driving the France cement market as real estate projects expand across urban and regional areas. As per IMARC Group, the France real estate market size reached USD 236.29 Billion in 2024. Ongoing housing development, urban regeneration, and public building renovations generate steady cement demand. Investments in transport networks, logistics facilities, and energy infrastructure further support consumption. Sustainability-focused retrofitting of older buildings and expansion of mixed-use developments also increase cement usage. Together, these construction activities ensure consistent market growth by sustaining demand across multiple end use segments.

Accelerated Adoption of Low-Carbon Cement Technologies

The France cement market is witnessing rapid adoption of low-carbon cement technologies, as producers align with national climate objectives and regulatory requirements. Manufacturers are expanding blended cement production utilizing supplementary cementitious materials, including fly ash, slag, and calcined clay, to reduce clinker ratios. Environmental product declarations and lifecycle assessments are becoming standard requirements in public and private procurement processes, driving preference for certified low-carbon offerings that demonstrate measurable emissions reductions.

Digital Process Optimization for Environmental Compliance

Cement producers are scaling digital transformation initiatives to enhance environmental compliance and operational efficiency. Advanced digital twin models, automated kiln control systems, and real-time emissions monitoring platforms are being deployed across production facilities to optimize energy consumption and reduce environmental impact. These technological investments enable manufacturers to meet evolving regulatory requirements while maintaining competitive production costs and ensuring consistent product quality standards.

Market Outlook 2026-2034:

The France cement market outlook remains favorable as public infrastructure investments, residential renovation mandates, and industrial expansion drive sustained demand through the forecast period. Government-backed initiatives supporting energy-efficient building retrofits and metropolitan transport projects continue to anchor consumption patterns. The market generated a revenue of USD 13,501.05 Million in 2025 and is projected to reach a revenue of USD 20,912.99 Million by 2034, growing at a compound annual growth rate of 4.98% from 2026-2034. Moreover, carbon capture investments position the industry for long-term decarbonization. Strategic industrial investments supported by France 2030 programs are expected to generate additional cement-intensive construction activities across logistics, manufacturing, and data center facilities.

France Cement Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Blended | 55% |

| End Use | Residential | 40% |

Type Insights:

- Blended

- Portland

- Others

Blended dominates with a market share of 55% of the total France cement market in 2025.

The dominance of blended cement in France reflects the construction industry's systematic transition towards lower-carbon building materials, driven by stringent environmental regulations and evolving procurement standards. Blended formulations incorporating supplementary cementitious materials, such as fly ash, granulated blast furnace slag, and calcined clay, enable manufacturers to reduce clinker content while maintaining performance specifications. The share of CEM II blended cements has increased significantly, as producers optimize formulations for compliance with embodied carbon thresholds.

Blended cement offers improved durability, reduced heat of hydration, and enhanced resistance to chemical attack, making it suitable for infrastructure and marine applications. Contractors increasingly prefer these products due to their workability and long-term performance benefits. Public infrastructure tenders often prioritize low-carbon materials, accelerating adoption across transport and energy projects. Additionally, availability of industrial by-products within Europe supports consistent blended cement supply, strengthening its cost competitiveness and reinforcing widespread market acceptance across diverse construction segments.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

Residential leads with a share of 40% of the total France cement market in 2025.

The residential segment maintains its leading position in the France cement market, driven by extensive housing renovation programs and government-mandated energy efficiency upgrades targeting the existing building stock. France's building sector holds a major portion of national energy consumption, prompting comprehensive policy interventions requiring property owners to renovate energy-inefficient homes classified with enhanced ratings. The MaPrimeRénov' program, with anticipated allocation of EUR 5 Billion in 2024, was launched to support home energy renovation work, stimulating demand for cement-based construction materials across insulation, structural reinforcement, and finishing applications.

Beyond renovation, steady demand for new residential housing in urban and peri-urban areas supports cement consumption. Population growth in metropolitan regions and changing household structures encourage construction of multi-family buildings and affordable housing projects. Developers increasingly adopt durable concrete solutions to meet longevity and safety requirements. Low-interest financing mechanisms and public–private partnerships further support residential construction activities, ensuring the segment remains a key demand driver within the France cement market.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d'Azur

- Grand Est

- Others

The Paris Region represents a major cement consumption hub due to dense urbanization, continuous residential redevelopment, and large-scale commercial construction. Ongoing infrastructure upgrades, transport network expansions, and public housing renovation projects sustain steady cement demand. High-rise developments, mixed-use complexes, and sustainability-driven retrofitting initiatives further contribute to consistent regional consumption despite limited availability of new land for construction.

Auvergne-Rhône-Alpes shows strong cement demand, driven by industrial activities, transport infrastructure, and urban growth around cities, such as Lyon and Grenoble. The region benefits from investments in logistics hubs, energy infrastructure, and residential construction, supporting a growing population. Mountainous terrain also necessitates cement-intensive engineering projects, including tunnels, bridges, and flood control structures, reinforcing steady regional market demand.

Nouvelle-Aquitaine’s cement market is supported by infrastructure modernization, residential expansion, and tourism-related construction. Growing urban centers alongside coastal development projects generate demand for housing, hotels, and commercial facilities. Agricultural infrastructure, logistics facilities, and renewable energy installations further support cement consumption. The region’s balanced mix of urban and rural construction activities contributes to stable, long-term market growth.

Hauts-de-France maintains cement demand through industrial redevelopment, logistics infrastructure, and cross-border trade connectivity projects. Proximity to major European transport corridors encourages warehouse and distribution center construction. Urban regeneration initiatives and public infrastructure investments in former industrial zones further support cement usage. Residential renovation and social housing projects also contribute to sustained regional demand levels.

Occitanie’s cement consumption is driven by population growth, residential development, and infrastructure investments around major cities like Toulouse and Montpellier. Aerospace and technology clusters stimulate commercial construction, while transport upgrades and public facilities expand steadily. The region also benefits from tourism-related development and renewable energy projects, requiring cement-intensive construction solutions.

Provence Alpes Côte d’Azur demonstrates strong cement demand linked to urban development, tourism infrastructure, and transportation projects. High residential construction activities, hotel developments, and public works support consistent consumption. Coastal protection, port upgrades, and climate-resilient infrastructure initiatives further increase cement usage. Premium real estate and renovation of older structures also contribute to steady regional demand.

Grand Est’s cement market is supported by industrial activities, cross-border trade infrastructure, and logistics expansion. The region benefits from highway, rail, and freight corridor development connecting key European markets. Urban renewal programs and energy-efficient building upgrades drive residential and commercial cement consumption. Industrial facility modernization further reinforces stable demand across construction segments.

Market Dynamics:

Growth Drivers:

Why is the France Cement Market Growing?

Growth of Commercial and Mixed-Use Developments

Commercial construction continues to support cement demand across France, particularly in office redevelopment, retail modernization, and mixed-use urban projects. Cities are investing in business districts, innovation hubs, and technology parks that require robust structural materials. Adaptive reuse of older commercial buildings into offices, residential units, or hospitality spaces also drives cement consumption for structural reinforcement. Retail developments, warehouses, and data centers demand concrete for load-bearing capacity and fire safety. With increasing tourism activities, hospitality construction further contributes to steady market growth. In the second quarter of 2025, overall tourist attendance rose by 5.4% compared to 2024. Mixed-use developments combining residential, commercial, and leisure spaces rely heavily on concrete for flexibility and durability. As cities focus on compact urban development, vertical construction increases cement usage. These diverse commercial applications ensure consistent cement demand and reduce dependence on a single construction segment, supporting overall market stability.

Transition Towards Low-Carbon and Blended Cement Solutions

The French cement market is driven by the shift towards sustainable building materials. Adoption of blended cements with less clinker is encouraged by stringent environmental rules and carbon reduction goals. These products have additional materials that lower emissions without sacrificing durability or strength. Low-carbon cement is being more preferred in public procurement strategies for government-funded infrastructure projects. Materials that aid in meeting embodied carbon standards and sustainability certifications are given priority by construction companies. Additionally, blended cement supports wider use by providing better performance attributes, including decreased heat of hydration and increased durability. Cement manufacturers can gain a competitive edge by investing in innovations, alternative fuels, and optimal formulations. Demand for sustainable cement solutions is further accelerated by developers' and contractors' growing awareness about lifecycle emissions. This shift not only supports environmental objectives but also reshapes product portfolios, positioning low-carbon cement as a central growth driver of the market.

Increasing Industrial Investments

France's emergence as Europe's premier destination for industrial investment is generating substantial cement-intensive construction activities across manufacturing, logistics, and technology sectors. Strategic reforms in taxation, labor regulation, and foreign investment policies have positioned the country competitively for attracting international operations requiring purpose-built facilities. France recorded 415 new industrial projects in 2024, reinforcing its status as the leading European hub for manufacturing and logistics investments. These developments require extensive cement consumption for site preparation, foundation construction, warehouse facilities, and supporting infrastructure, including access roads and utility installations. Gigafactory construction for battery production and semiconductor manufacturing represents particularly cement-intensive applications requiring high-performance materials for thermal management and structural durability. The rise in industrial activity additionally prompts infrastructure upgrades surrounding new facilities, extending cement demand across transport connectivity, drainage systems, and energy grid installations supporting expanded manufacturing operations.

Market Restraints:

What Challenges the France Cement Market is Facing?

High Energy and Production Costs

Due to the energy-intensive nature of the production process, rising energy prices have a considerable impact on French cement manufacturing. Significant fuel and electrical inputs are needed for kiln operations, clinker generation, and grinding operations. Manufacturers' profit margins are under pressure due to rising operating expenses brought on by volatile energy markets. High capital expenditures are necessary for producers to invest in energy efficiency, alternative fuels, and process optimization. The cost burden on smaller facilities limits their ability to compete. Price-sensitive projects may see a slowdown in construction demand as a result of these cost pressures, driving up cement prices.

Stringent Environmental Regulations and Emissions Targets

France’s strict environmental regulations pose compliance challenges for cement producers. Carbon reduction targets, emissions monitoring requirements, and sustainability reporting obligations increase operational complexity. Investments in carbon capture, alternative raw materials, and low-clinker formulations demand significant capital. Compliance costs may reduce short-term profitability and delay capacity expansions. Regulatory uncertainty around future standards adds planning risk. Smaller and older plants face higher adaptation costs, potentially leading to consolidation or capacity rationalization within the market.

Limited Availability of Supplementary Cementitious Materials

The transition to blended and low-carbon cements depends on reliable access to supplementary materials, such as slag, fly ash, and calcined clays. Declining coal-fired power generation reduces fly ash availability, while competition for slag from other industries increases supply constraints. Transportation costs and supply inconsistencies add more challenges. Limited availability can restrict production of blended cements and increase input costs. Producers must invest in alternative materials and supply chains, adding complexity to operations.

Competitive Landscape:

The France cement market exhibits concentrated competition among established producers investing in decarbonization technologies and low-carbon product development to meet evolving regulatory requirements. Market participants are focusing on expanding calcined clay facilities, launching certified sustainable cement ranges, and deploying carbon capture infrastructure at production sites. Strategic partnerships between cement manufacturers, technology providers, and government bodies support pilot projects demonstrating innovative emissions reduction approaches. Competition increasingly reflects environmental performance credentials as public procurement processes favor suppliers with verified environmental declarations and transparent lifecycle assessments. Digital transformation investments enable operational efficiency improvements while supporting compliance with stringent emissions monitoring requirements across production operations.

Recent Developments:

-

In May 2025, Ecocem announced a EUR 170 Million investment to construct four new production lines in Fos-sur-Mer and Dunkirk and speed up the rollout of its ACT scalable low-emission cement technology. These facilities, expected to be operational between 2028 and 2030, will produce 1.9 Million Tons per year of low-carbon ACT cement and reduce CO₂ emissions by 800,000 Tons annually. The French government committed operational and financial support to accelerate project delivery.

France Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The France cement market size was valued at USD 13,501.05 Million in 2025.

The France cement market is expected to grow at a compound annual growth rate of 4.98% from 2026-2034 to reach USD 20,912.99 Million by 2034.

Blended dominated the market with a share of 55%, driven by lower clinker content, reduced carbon footprint, and compliance with environmental standards aimed at promoting sustainable construction materials.

Key factors driving the France cement market include government infrastructure investments, energy efficiency renovation mandates, industrial expansion as France emerges as Europe's leading investment destination, and regulatory frameworks promoting low-carbon construction materials.

Major challenges include elevated energy costs and carbon pricing pressures, workforce shortages delaying modernization initiatives, limited alternative fuel infrastructure, permitting constraints, and regulatory compliance costs associated with decarbonization requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)