France Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

France Craft Beer Market Overview:

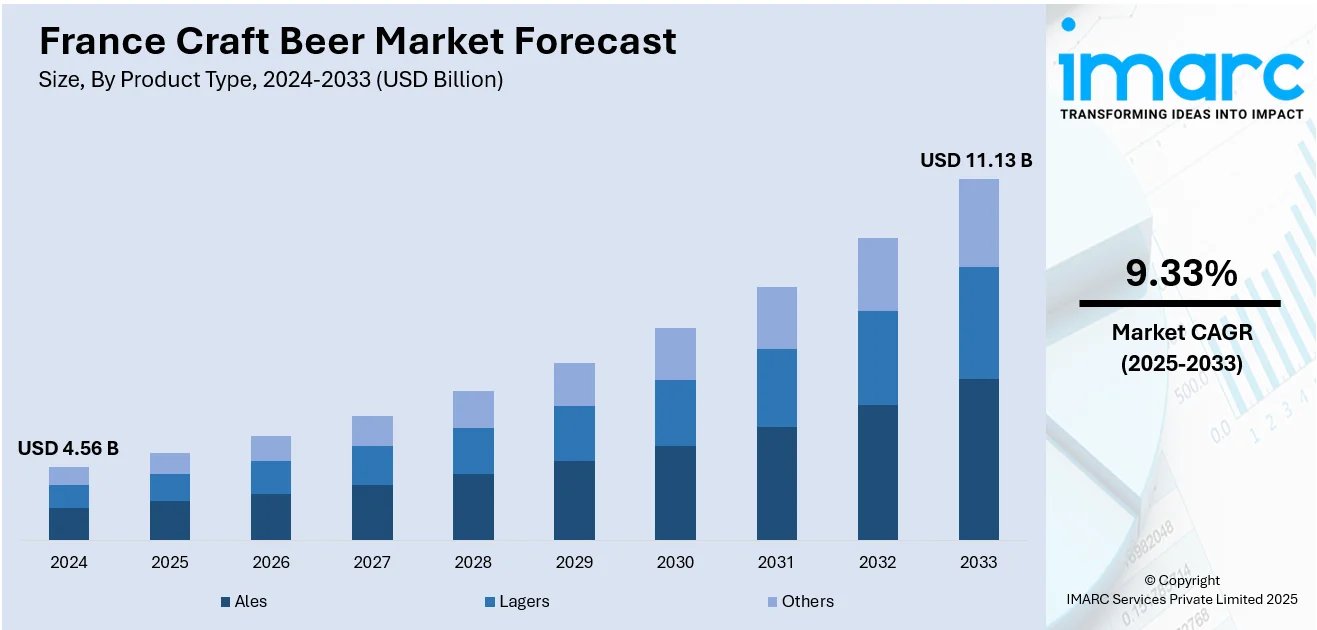

The France craft beer market size reached USD 4.56 Billion in 2024. The market is projected to reach USD 11.13 Billion by 2033, exhibiting a growth rate (CAGR) of 9.33% during 2025-2033. The market is witnessing consistent growth driven by rising consumer preference for locally brewed, artisanal products. Innovation in flavors and a surge in demand among younger demographics are reshaping consumption patterns across both urban and regional areas. Distribution through supermarkets, specialty stores, and online platforms has further expanded market accessibility. Producers are increasingly focusing on sustainable practices and unique branding to differentiate in a competitive landscape. These dynamics continue to influence the France craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.56 Billion |

| Market Forecast in 2033 | USD 11.13 Billion |

| Market Growth Rate 2025-2033 | 9.33% |

France Craft Beer Market Trends:

Regional Identity Fuels Innovation and Expansion

France's craft brewing industry keeps expanding as local microbreweries focus on local terroir and traditional methods. In 2024, the number of microbreweries in France reached more than 2,500, making the nation Europe's top craft brewing destination. Microbrewers highlight local tastes like buckwheat in Brittany or chestnut in Corsica evoking the richness of French culinary culture. Festivals and tasting events throughout regions such as Île-de-France, Grand Est, and Occitanie are gaining national recognition, providing consumers with experiential stimuli and greater connection to craft heritage. Artisanal renaissance is a defining characteristic of the France craft beer market trends, indicating movement towards authenticity and regional influence. With these events and collaborative efforts with local players, craft brewers are creating community, driving visibility, and cultivating brand loyalty. Furthermore, the French state has backed local production projects in various departments, creating a regulatory framework that promotes microbreweries' innovation. As the culture expands, so does its cultural impact, creating a unique presence in France's strong beverage culture, and driving tourism and regional economic development.

To get more information on this market, Request Sample

Export Push Elevates Global Recognition

Increasingly, French craft brewers are focusing on international markets to raise their profile and reach new audiences. Growth in exports during 2024 reflects expanding interest abroad, with select artisanal beers making their way into specialty bars and retailers in Europe, North America, and Asia. This global distribution helps raise awareness of France's evolving craft beer scene and supports the market growth beyond domestic sales. Export-focused brewers are also leveraging French branding craftsmanship, natural ingredients, and regional origin to differentiate their products internationally. Recognitions at international beer awards and participation in global craft exhibitions have further bolstered their reputation. These achievements have encouraged a steady increase in international collaborations and distribution partnerships. French beer is gaining traction in competitive markets where the "Made in France" label carries strong consumer appeal. The export trend not only enhances brand prestige but also injects fresh momentum into product innovation and quality standards, encouraging wider investment in the domestic brewing sector while strengthening France’s position in the global craft beverage market.

Strategic Innovation Fuels Consumer Engagement

France’s craft beer scene is embracing a wave of strategic innovation focused on enhancing consumer experience through creativity, experimentation, and digital outreach. These experimental batches are frequently released as limited-edition specials, encouraging consumer curiosity and repeat engagement through exclusivity. Alongside product innovation, breweries are leveraging digital channels, mobile apps, virtual tastings, and social media campaigns to create immersive community connections. Collaborations with local food artisans, wine producers, and cultural organizations are weaving craft beer into broader experiential narratives, from food pairing events to music festivals. These trends highlight evolving France craft beer market growth, showcasing agility in product development and engagement strategies that align with modern consumer expectations. A recent report from April 2025 found that 70% of beer brands are now experimenting with digital tastings and virtual brewery tours, while 54% have launched mobile apps to enhance consumer interaction, with 45% of drinkers preferring brands offering seamless digital experiences—highlighting the impact of digital-first strategies on engagement and loyalty. As breweries continue to blend creative brewing with digital storytelling, they are solidifying their position within France’s competitive and dynamic beverage landscape, attracting both local enthusiasts and international attention through experiential value.

France Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

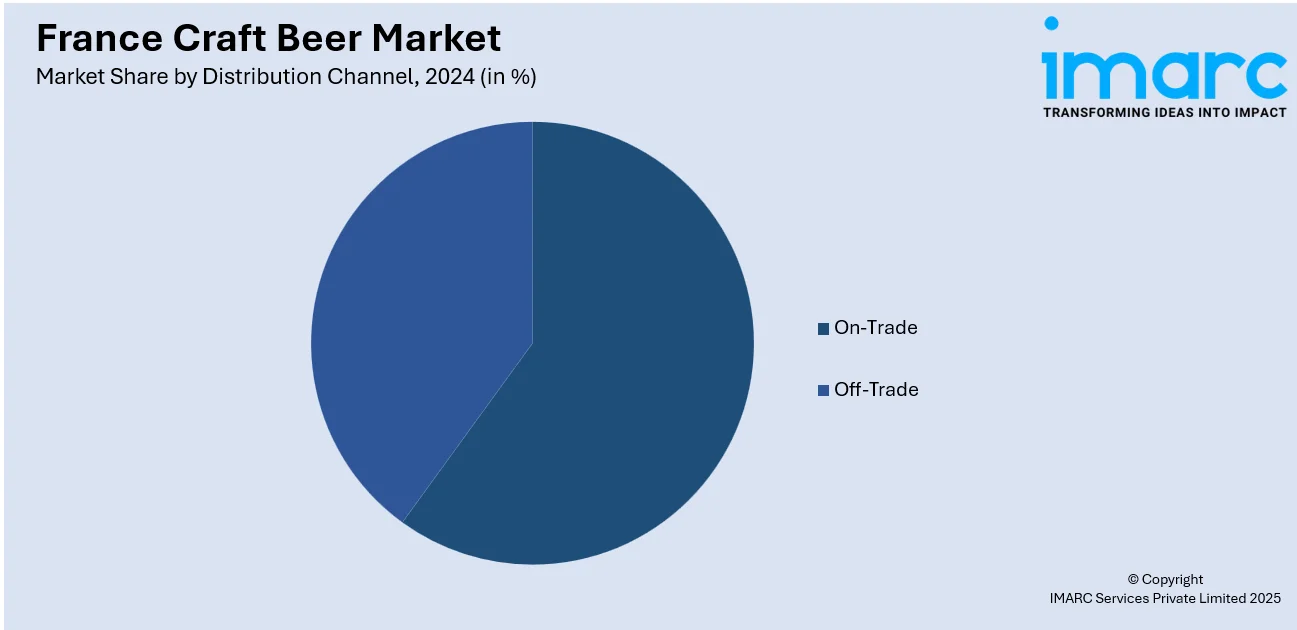

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Craft Beer Market News:

- In April 2025, Brasserie de Chambord opened near the iconic Château de Chambord. Built in late 2024, this sustainable brewery uses local low-carbon barley and French hops. With a 12,000-hl capacity, it features a taproom, visitor center, and offers both alcoholic and alcohol-free ranges. A partnership by Axéréal and the estate.

- July 2024: Carlsberg, through its French subsidiary Brasseries Kronenbourg, has acquired a minority stake in northern France’s Brasserie du Pays Flamand. The partnership strengthens the presence of the Anosteké brand across France, leveraging Brasseries Kronenbourg’s national distribution network and on-trade access. Both companies will collaborate on sustainability efforts, enhancing packaging, energy efficiency, logistics, water management, and biodiversity initiatives. This move marks a significant step in elevating Brasserie du Pays Flamand’s reach and reinforces Carlsberg’s commitment to the French craft beer sector.

France Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the France craft beer market on the basis of product type?

- What is the breakup of the France craft beer market on the basis of age group?

- What is the breakup of the France craft beer market on the basis of distribution channel?

- What is the breakup of the France craft beer market on the basis of region?

- What are the various stages in the value chain of the France craft beer market?

- What are the key driving factors and challenges in the France craft beer?

- What is the structure of the France craft beer market and who are the key players?

- What is the degree of competition in the France craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)