France Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

France Diaper Market Overview:

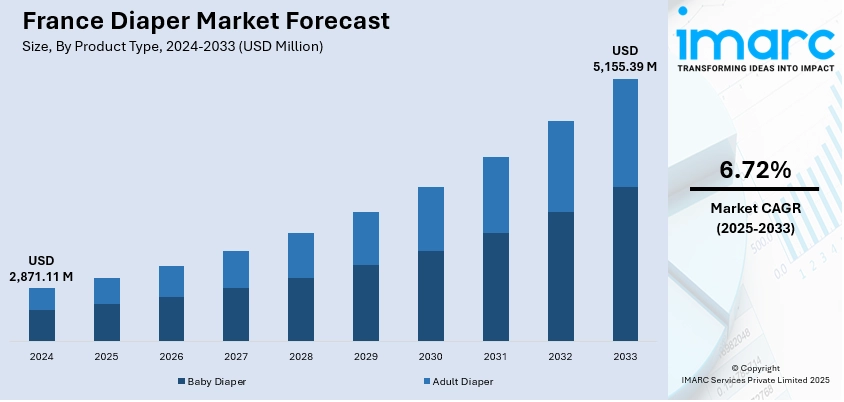

The France diaper market size reached USD 2,871.11 Million in 2024. The market is projected to reach USD 5,155.39 Million by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033. The market is experiencing growth driven by increasing demand for sustainable, eco-friendly products. Consumer preferences are shifting towards greener options, with a focus on biodegradability and performance. Innovations in leak protection and material quality also continue to influence the France diaper market share, fostering strong competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,871.11 Million |

| Market Forecast in 2033 | USD 5,155.39 Million |

| Market Growth Rate 2025-2033 | 6.72% |

France Diaper Market Trends:

Sustainability Drives Consumer Preferences in France

The increase in demand for sustainable products in the diaper industry is an indication of a major consumer trend shift, with environmental concerns now at the centre of buying decisions. Parents in France are increasingly turning away from conventional plastic-based diapers towards more sustainable options that match their environmental philosophies. This is fueled by increased concern for the environmental footprint of disposable goods, along with a greater focus on cutting carbon prints. In July 2024, Soft N Dry Diapers responded to this need through the release of its tree-free disposable baby diapers in France. These green diapers, made to be environmentally friendlier and in accordance with the EU Deforestation-Free Regulation, gave consumers a feasible solution that redefines performance while being responsible to the environment. Through such offerings, the market felt a boost of demand from environmentally responsible families looking for greener options. This market trend reinforces a firm consumer demand for biodegradable products, and this leaves the diaper brands with a competitive scenario to improve their sustainability as well as performance. French retailers are now under the pressure to adhere to these demands, making the eco-friendly diapers available with greater frequency and ease to accommodate the increasing market size of environmentally responsible parents.

To get more information on this market, Request Sample

Technological Innovation Shapes Diaper Offerings

In the highly competitive French diaper sector, technological advancements continue to drive significant changes in product offerings as consumers demand better performance, convenience, and affordability. Technological innovation enables manufacturers to enhance the functionality of diapers, offering improved leak protection, comfort, and fit. Parents now prioritize diapers that deliver superior absorbency and softness while minimizing the environmental impact. In April 2025, GreenCore Solutions introduced the TreeFree Diaper Private Label Program in Europe, showcasing its commitment to leveraging cutting-edge technology to meet evolving consumer demands. This innovation enabled retailers in France to offer high-performance, sustainable store brands with faster time-to-market, creating a new competitive landscape for diaper companies. GreenCore’s launch pushed market players to focus on improving product quality while maintaining sustainability, offering a compelling proposition to parents seeking both value and performance. The rapid adoption of advanced materials, such as eco-friendly fibers, and innovations like leak protection systems and adjustable fits is now a major differentiator for brands. This trend suggests that technological advancements will continue to shape the future of the France diaper market growth, making it crucial for manufacturers to invest in ongoing product innovation to meet consumer expectations.

France Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diaper (pad type, flat type, and pant type).

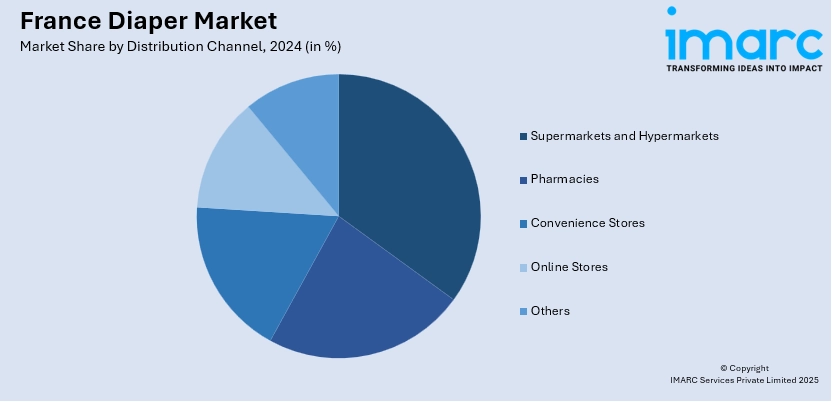

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Diaper Market News:

- May 2025: Cottonsie launched the world’s first disposable cotton diaper, offering an eco-friendly alternative with 82% biodegradability. Combining sustainability with performance, it addressed the needs of parents seeking the convenience of disposable diapers and the benefits of natural materials, boosting demand for greener baby care products.

- April 2025: GreenCore Solutions launched the TreeFree Diaper Private Label Program in Europe, offering eco-friendly, high-performance diapers. This innovation enabled retailers to provide premium, sustainable store brands with improved speed to market. The launch boosted market competition and attracted eco-conscious consumers, enhancing brand loyalty.

France Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the France diaper market on the basis of product type?

- What is the breakup of the France diaper market on the basis of distribution channel?

- What is the breakup of the France diaper market on the basis of region?

- What are the various stages in the value chain of the France diaper market?

- What are the key driving factors and challenges in the France diaper market?

- What is the structure of the France diaper market and who are the key players?

- What is the degree of competition in the France diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France diaper market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)