France Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

France Duty-Free and Travel Retail Market Overview:

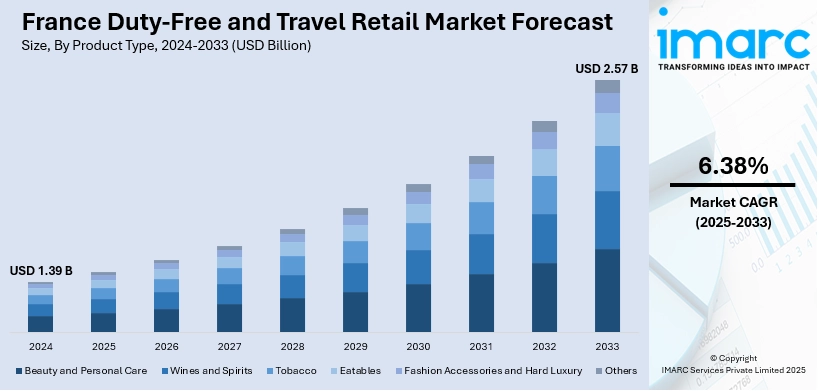

The France duty-free and travel retail market size reached USD 1.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.57 Billion by 2033, exhibiting a growth rate (CAGR) of 6.38% during 2025-2033. A wide range of luxury goods, cosmetics, alcohol, and fashion products, catering to international travelers, is one of the factors contributing to France duty-free and travel retail market share. It benefits from France's status as a key global travel hub, with high sales at airports, cruise ports, and train stations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.39 Billion |

| Market Forecast in 2033 | USD 2.57 Billion |

| Market Growth Rate 2025-2033 | 6.38% |

France Duty-Free and Travel Retail Market Trends:

Fresh Moves in French Airport Shopping

More international retailers are eyeing France’s duty-free shelves, setting up new stores in airports and border points to tap into rising passenger traffic. This reflects a wider push by non-European operators expanding beyond their home countries and adding new choices for travelers. France’s airports are seeing new partnerships form between local and foreign groups, promising extra shopping options before boarding. With experience running outlets at home, these newcomers bring new ideas and deals, hoping to win over tourists and frequent flyers alike. Competition is set to get sharper as more players test Europe’s busy travel spots, giving shoppers fresh products and brands to browse while they wait to board flights or cross borders. These factors are intensifying the France duty-free and travel retail market growth. For example, in November 2024, Adani Enterprises, via its arm Mumbai Travel Retail, announced its plans to enter France’s duty-free market. A new joint venture with Eurotunnel JV INC (Falic Group–Duty Free Americas) would set up duty-free stores in France. Adani already runs 17 duty-free outlets in India, and this move marks its first step into Europe, expanding its international retail footprint and adding fresh competition in France’s travel retail space.

To get more information on this market, Request Sample

Premium Spirits Luring High-Spending Travelers

Ultra-premium launches are adding fresh sparkle to France’s airport shelves, especially at major hubs like Charles de Gaulle. More heritage labels are choosing airports to reveal exclusive editions and rare collections, hoping to capture the attention of global travelers with a taste for fine spirits. Limited releases and anniversary editions bring luxury closer to passengers who want memorable purchases before takeoff. Airports are also doubling down on immersive tasting corners and branded showcases that elevate the shopping experience beyond simple transactions. These efforts help position France’s duty-free spots as gateways to the country’s celebrated craftsmanship. More brands in wine and spirits are expected to follow this playbook, using airport foot traffic to connect with collectors and curious buyers in search of something special. For instance, in July 2024, Cognac maker Delamain launched its ultra-premium L’Oiseau Rare at Paris Charles de Gaulle Airport through Extime Duty Free, the Lagardère Travel Retail and Groupe ADP joint venture. Marking Delamain’s 200th anniversary, the Grande Champagne Cognac debut includes an immersive experience at CDG, with more airport activations planned. L’Oiseau Rare joined Delamain’s permanent collection, highlighting France’s luxury duty-free offerings.

France Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

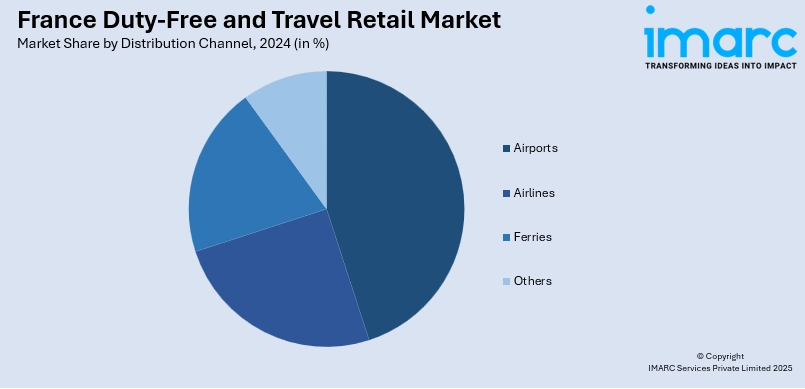

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Region Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Duty-Free and Travel Retail Market News:

- In July 2025, Lagardère Travel Retail joined eight major French retailers to launch LESS (Low Emission Sustainable Sourcing), a joint effort to cut CO₂ emissions across the supply chain. Coordinated by Perifem and FCD, the initiative uses the OpenClimat platform to unify carbon data reporting by suppliers. This move supports greener sourcing and operations within France’s duty-free and travel retail sector, improving transparency and sustainability performance.

France Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the France duty-free and travel retail market on the basis of product type?

- What is the breakup of the France duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the France duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the France duty-free and travel retail market?

- What are the key driving factors and challenges in the France duty-free and travel retail market?

- What is the structure of the France duty-free and travel retail market and who are the key players?

- What is the degree of competition in the France duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)