France E-Commerce Market Size, Share, Trends and Forecast by Business Model, Mode of Payment, Service Type, Product Type, and Region, 2025-2033

France E-Commerce Market Overview:

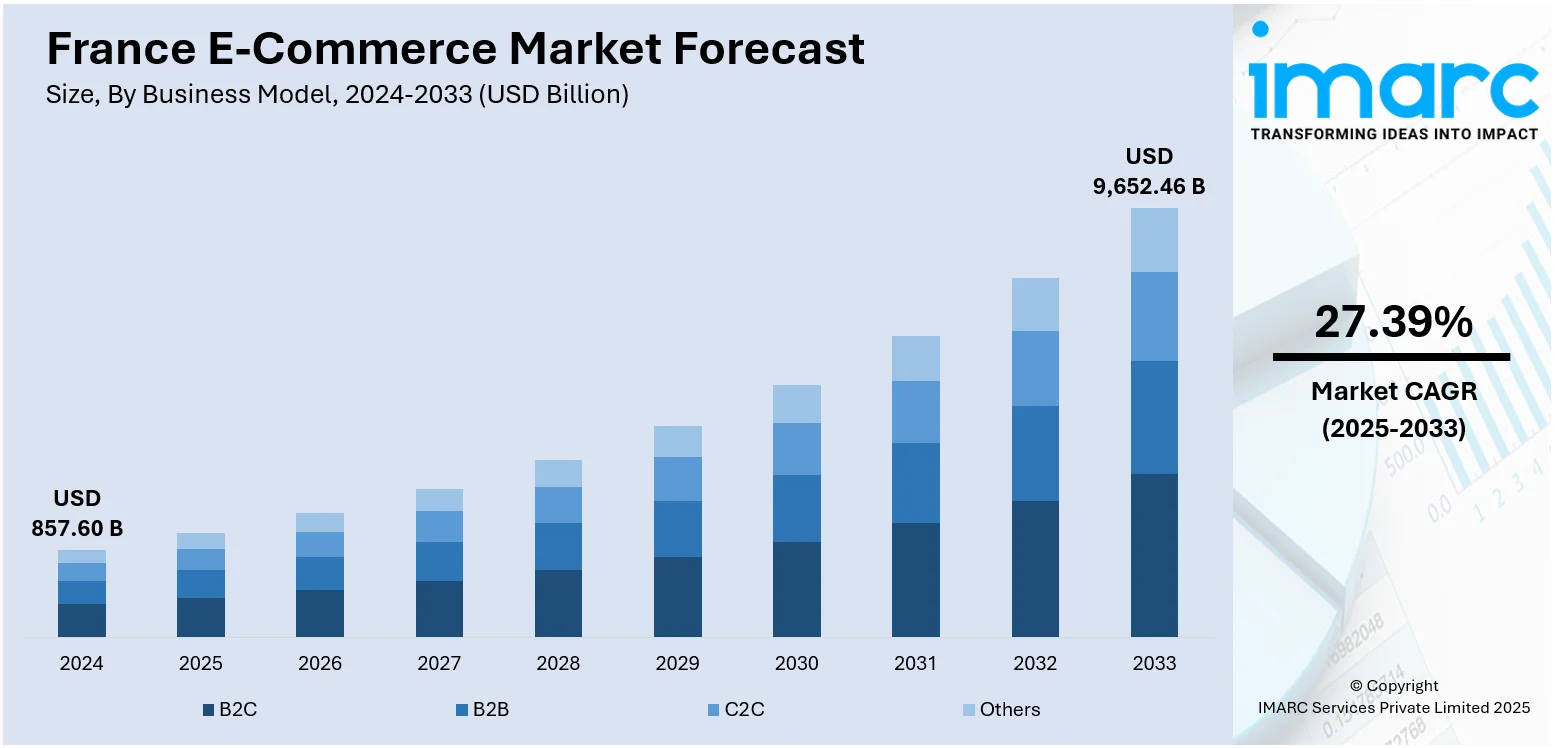

The France e-commerce market size reached USD 857.60 Billion in 2024. The market is projected to reach USD 9,652.46 Billion by 2033, exhibiting a growth rate (CAGR) of 27.39% during 2025-2033. The market is witnessing strong growth, led by mobile commerce uptake, AI-driven personalization, and boosting consumer pressure for environmentally friendly practices. High internet penetration and a technology-aware populace facilitate smooth online transactions, while changing consumer trends are refashioning the way retailers interact with customers. Investments in platform optimization and logistics remain key to improving competitiveness. These advances combined place France among the lead digital commerce centers of Europe, driving a sharp increase in France e-commerce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 857.60 Billion |

| Market Forecast in 2033 | USD 9,652.46 Billion |

| Market Growth Rate 2025-2033 | 27.39% |

France E-Commerce Market Trends:

Rise of Mobile-Optimized Commerce in France

Within France, the e-commerce market is experiencing a strong movement toward mobile-first shopper behavior, fueled by higher smartphone penetration and better internet access. Consumers are turning increasingly to mobile apps and mobile-optimized sites to shop, compare, and buy products, taking advantage of ease and efficiency. Facilities like retail biometric logins, rapid voice search, and direct payment integrations are strengthening the popularity of mobile commerce. Social commerce features via apps like TikTok and Instagram are also boosting this phenomenon, as consumers interact directly with products being promoted by creators and influencers. As per the sources, in April 2025, Kaufland announces the launch of its marketplace operation in France and Italy by summer, as a European competitor in two of the continent's leading four e-commerce markets. Moreover, for seamless app-like experience on any device, retailers are also investing in Progressive Web Apps (PWAs). As consumers prefer mobile interfaces for their ease of use and swiftness, companies are doing the same. This shift represents an important aspect of France e-commerce market trends, affirming the manner in which mobile-first approaches are becoming the key to digital commerce success and fueling market expansion.

To get more information on this market, Request Sample

Expansion of AI-Powered Personalization in Online Retail

The French e-commerce industry is progressively embracing artificial intelligence (AI) and machine learning (ML) as it delivers more bespoke customer experiences. Through the use of user behavior data, browsing history, and shopping patterns, websites are able to now provide targeted product recommendations, personalized pricing, and dynamic search results. This degree of personalization increases customer satisfaction and leads to greater conversion rates. AI-driven chatbots and virtual shopping assistants are also being used to aid in customer service, enhance navigation, and aid decision-making. These technologies not only rationalize processes but also foster customer loyalty by producing customized shopping experiences. According to the reports, in October 2024, seven large French banks introduced Wero, an electronic wallet that boosts instant mobile payments and reinforces the France e-commerce market with a local option for global payment facilities. Furthermore, personalized email, behavior-based retargeting, and real-time inventory optimization also make the experience richer. With more e-commerce businesses in France expanding AI use to larger parts of their platforms, consumer experience becomes ever more intuitive and predictive. These technologies are a central component of market trends, enabling retailers to gain competitive edge and make direct contributions to France e-commerce market growth.

Integration of Sustainability into E-Commerce Strategy

Sustainability has emerged as a value driver for France's e-commerce market, capturing changing consumer sentiment in favor of green brands and ethical consumption. Consumers increasingly exhibit a preference for companies that espouse green logistics, recyclable packaging, and transparent supply chains. Online shops are increasingly promoting sustainability credentials, including carbon label credentials and third-party certifications, in order to convey ecological responsibility. Many platforms are also introducing the option to include second-hand products, repair options, and carbon offsetting at the point of sale in line with France's wider circular economy goals. The initiatives are aligned with growing consumer values and national regulations that promote sustainable behaviors. Consequently, retailers are integrating sustainability into their brand and business models to appeal to responsible consumers. This trend represents one of the characterizing market trends, as sustainable and ethical practices not only satisfy regulatory requirements but also ignite consumer interest and loyalty, promoting market expansion in the long run.

France E-Commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on business model, mode of payment, service type, and product type.

Business Model Insights:

- B2C

- B2B

- C2C

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes B2C, B2B, C2C, and others.

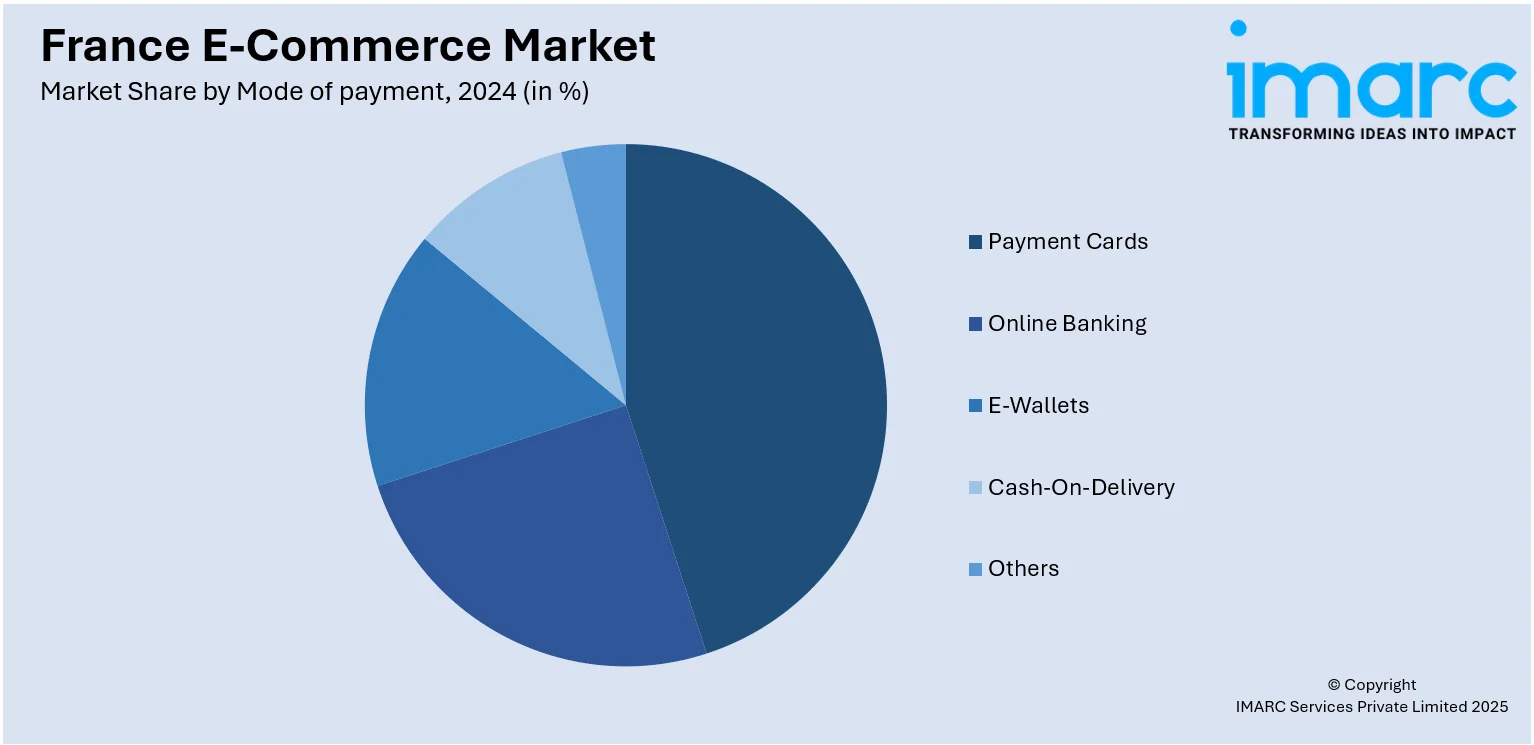

Mode of payment Insights:

- Payment Cards

- Online Banking

- E-Wallets

- Cash-On-Delivery

- Others

A detailed breakup and analysis of the market based on the mode of payment have also been provided in the report. This includes payment cards, online banking, e-wallets, cash-on-delivery, and others.

Service Type Insights:

- Financial

- Digital Content

- Travel and Leisure

- E-Tailing

- Others

The report has provided a detailed breakup and analysis of the market based on service type. This includes financial, digital content, travel and leisure, e-tailing, and others.

Product Type Insights:

- Groceries

- Clothing and Accessories

- Mobiles and Electronics

- Health and Personal Care

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes groceries, clothing and accessories, mobiles and electronics, health and personal care, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France E-Commerce Market News:

- In February 2025, TikTok Shop extended its presence into the French e-commerce market opening up membership to locally registered sellers. The strategic step strengthens France's emerging digital retail market, bringing social commerce onto mainstream consumer channels and supporting TikTok's presence in Europe's top online markets along with Germany, Italy, Spain, and Ireland.

France E-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Busines Models Covered | B2C, B2B, C2C, Others |

| Modes Of Payments Covered | Payment Cards, Online Banking, E-Wallets, Cash-On-Delivery, Others |

| Service Types Covered | Financial, Digital Content, Travel and Leisure, E-Tailing, Others |

| Product Types Covered | Groceries, Clothing and Accessories, Mobiles and Electronics, Health and Personal Care, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France e-commerce market performed so far and how will it perform in the coming years?

- What is the breakup of the France e-commerce market on the basis of business model?

- What is the breakup of the France e-commerce market on the basis of mode of payment?

- What is the breakup of the France e-commerce market on the basis of service type?

- What is the breakup of the France e-commerce market on the basis of product type?

- What is the breakup of the France e-commerce market on the basis of region?

- What are the various stages in the value chain of the France e-commerce market?

- What are the key driving factors and challenges in the France e-commerce?

- What is the structure of the France e-commerce market and who are the key players?

- What is the degree of competition in the France e-commerce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France e-commerce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)