France Ecotourism Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Sales Channel, and Region, 2025-2033

France Ecotourism Market Overview:

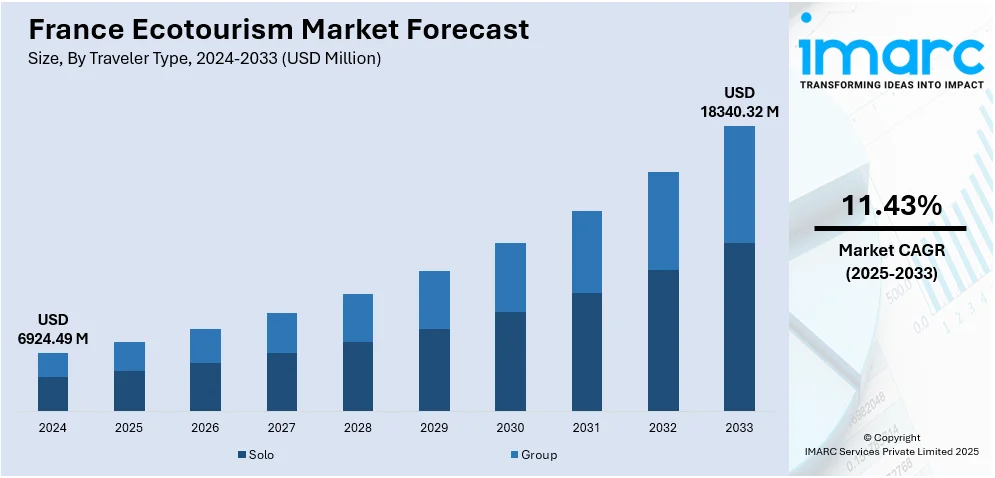

The France ecotourism market size was valued at USD 6924.49 Million in 2024 and is expected to reach USD 18340.32 Million by 2033, growing at a CAGR of 11.43% during 2025-2033. The market growth is mainly driven by the growing consumer awareness regarding environmental sustainability, expanding demand for sustainable travel experiences, increasing government policies, and high investments in sustainable infrastructure.

Key Market Trends & Insights

- Based on travel type, the market is divided into solo and group.

- On the basis of age group, the market is segmented as Generation X, Generation Y, and Generation Z.

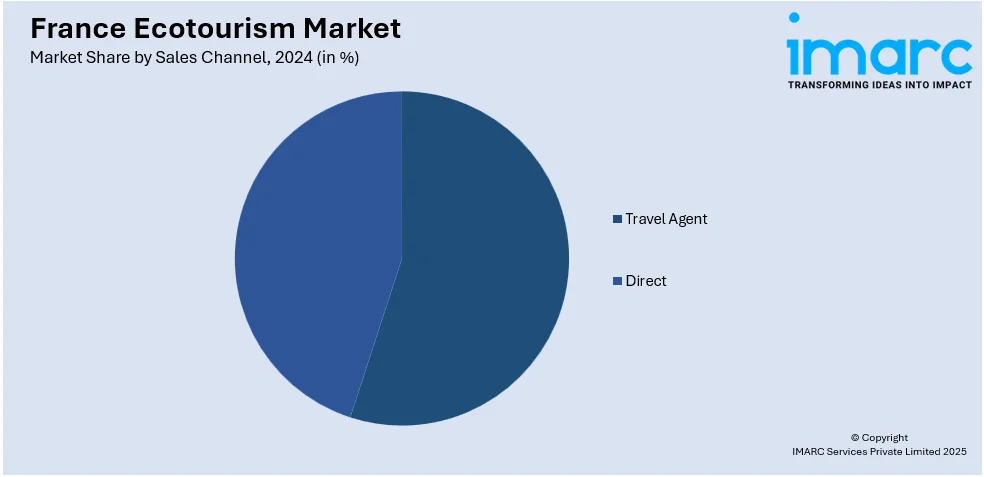

- Based on sales channel, the market is divided into travel agents and direct.

- On the basis of region, the market is segmented as Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Market Size & Forecast

- 2024 Market Size: USD 6924.49 Million

- 2033 Projected Market Size: USD 18340.32 Million

- CAGR (2025-2033): 11.43%

To get more information on this market, Request Sample

The increasing international tourist arrivals in France are significantly contributing to the market expansion. France remains one of the world's top tourism destinations, receiving nearly 100 Million visitors from abroad in 2024. The domestic tourism segment has also grown, with more French residents seeking nature-focused travel post-pandemic. This rising growth in the tourism segment is creating a stronger market for ecotourism, especially in rural and protected areas. Increased footfall supports community-based conservation initiatives, nature reserves, and park operators, while encouraging investments in sustainable infrastructure, education programs, and local craft and culinary experiences.

The growing demand for eco-friendly accommodations is a primary driver accelerating the France ecotourism market growth. Eco-accommodations, ranging from solar-powered lodges to zero-waste glamping sites, are increasingly preferred by domestic and international travelers. As per industry reports, France has introduced a new regulation mandating all hotels to comply with specific climate targets by 2026. This legislation is designed to curb the environmental footprint of the hospitality sector, which accounts for approximately 7% of emissions in France, the world's leading tourist destination. French hospitality operators are investing in renewable energy and eco-construction to align with evolving consumer expectations for sustainable travel experiences.

Regulatory support and government initiatives are vital components of a flourishing market economy. Notably, in June 2025, the French government called on tourism operators to reduce their water consumption amid growing environmental concerns. France tourism minister announced the creation of a water-management observatory and support tools, along with funding of up to EUR 50,000 (about USD 58946) for 25 selected tourism sites to implement initiatives such as smart monitoring systems, rainwater harvesting, and staff training on eco-responsible practices. Furthermore, regulatory measures around emissions, land use, and waste management are fostering an environment conducive to long-term ecotourism sustainability and innovation.

The ecotourism market in France is benefiting from the country's commitment to sustainable mobility. The country's expansive rail network, including high-speed TGV lines and regional TER services, and extensive use of electric vehicles are augmenting the France ecotourism market share. According to industry reports, as part of the France 2030 investment strategy, the French government has allocated EUR 2.5 Billion (about USD 2.9 Billion) to boost the manufacturing of approximately two Million electric and hybrid vehicles. In addition, EUR 1.2 Billion (about USD 1.4 Billion) will be directed toward research and development efforts focused on creating a next-generation low-carbon aircraft. These government-backed initiatives are encouraging the use of eco-friendly transportation modes, which directly support low-carbon tourism and enhance the accessibility of remote eco-destinations.

France Ecotourism Market Report Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on traveler type, age group, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

The solo segment is driven by increasing preferences for personalized, meaningful experiences. This segment often includes young adults seeking independence, self-discovery, or immersive cultural engagement. Industry reports indicate that 38% of solo travelers fall within the 18-24 age group, while 68% are aged 31 or younger. Many solo travelers opt for guided nature hikes, wellness retreats, or sustainable farm stays. They are generally more conscious of their environmental footprint and actively seek eco-certified accommodations and responsible tour operators. With the rise of digital platforms and social media, solo travelers are also influencing ecotourism trends by sharing sustainable travel narratives and destinations.

Group travelers represent a significant segment in the France ecotourism industry, especially among school trips, corporate retreats, and family tours. These groups often prioritize structured itineraries that include nature-based activities, such as forest education programs, national park excursions, or vineyard biodiversity tours. According to a 2024 industry survey, key preferences among American tourists visiting France include beautiful scenery (54%), relaxation (49%), and great wine (36%), all of which align closely with the experiences offered through group-focused ecotourism. Furthermore, group travel encourages resource-sharing, such as transportation and lodging, making it easier to implement sustainability measures.

Age Group Insights:

- Generation X

- Generation Y

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes generation X, generation Y, and generation Z.

Generation X segment, typically aged between 45 and 60, forms a stable and financially capable segment in the market. Often traveling with family or as couples, they prioritize comfort alongside environmental responsibility. This group is drawn to eco-lodges, slow travel experiences, and rural tourism that blends cultural heritage with nature. They value authenticity and are likely to support local artisans, organic farms, and conservation initiatives. Notably, France, Italy, Spain, and Portugal rank among the top travel destinations for British travelers aged 65 and above. Generation X travelers often seek deeper engagement through guided educational tours and heritage trails, making them instrumental in sustaining off-the-beaten-path destinations and fostering long-term support for ecotourism development in France.

Generation Y are a dominant segment shaping France ecotourism landscape due to their strong values around sustainability, adventure, and digital engagement. Typically aged between 27 and 44, Millennials tend to make the most of their time off, taking an average of 35 vacation days per year. This tech-savvy cohort often plans trips via social media and eco-travel platforms, amplifying the visibility of green destinations. Their preference for experiences over material goods aligns well with ecotourism’s values. As advocates for climate action, Millennials are pushing tour operators and regional planners in France to innovate and adopt more sustainable, transparent practices.

Generation Z, comprising travelers under 27, is emerging as a key demographic in France’s ecotourism market. Raised in a climate-aware era, they show strong interest in biodiversity, climate justice, and sustainable consumption. Gen Z tourists prefer budget-friendly, flexible travel options such as eco-hostels, digital nomad retreats, and community-based tourism. Social media influences the international travel choices of 90% of Generation Z, and they often seek "green" experiences that are both shareable and impactful. Although younger and with less spending power, their preferences are reshaping the future of tourism in France by emphasizing inclusivity, ethical practices, and low-impact travel solutions.

Sales Channel Insights:

- Travel Agent

- Direct

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes travel agent and direct.

Travel agents continue to hold relevance in the ecotourism market in France, particularly among international tourists and older age groups who prefer structured planning and expert guidance. Eco-certified travel agencies curate sustainable tour packages that combine environmental awareness with cultural immersion, offering access to protected natural areas, responsible accommodations, and local guides. These agents often collaborate with regional eco-operators to design itineraries aligned with France’s conservation goals. Their role is crucial in educating travelers about eco-practices and ensuring compliance with sustainability standards. By leveraging established networks, travel agents help boost rural ecotourism and channel tourism flows toward lesser known, environmentally sensitive destinations.

Direct sales channels segment, such as official websites, mobile apps, and social media, are becoming increasingly dominant in France’s ecotourism sector. As per industry reports, over 66% of the global population now uses the internet. This widespread digital access allows travelers to discover, compare, and book sustainable experiences directly, enhancing transparency and fostering stronger engagement between providers and environmentally conscious tourists. Many eco-lodges, community tourism initiatives, and nature-focused tours now rely on direct bookings to reduce intermediaries, retain higher margins, and foster trust. The growth of this channel supports localized economic development, as it empowers small-scale operators and allows for real-time adjustments in capacity, promoting more sustainable visitor management.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

The Paris Region, widely known for its urban tourism appeal, is emerging as a key region in green travel through its commitment to sustainability and green innovations. With Paris 2024 pledging carbon neutrality and investing EUR 1.4 Billion (about USD 1.6 Billion) in restoring the Seine River, the region is reinforcing its environmental leadership on the global stage. Efforts such as bicycle-sharing networks, eco-certified accommodations, and the promotion of green spaces like the Regional Natural Park of the French Vexin further highlight this shift. As a primary gateway for international visitors, Paris not only attracts eco-conscious urban travelers but also sets sustainability benchmarks that influence ecotourism standards across the country.

Auvergne-Rhône-Alpes plays a pivotal role in the market due to its diverse geography. Known for outdoor sports, thermal tourism, and rural charm, the region attracts eco-conscious travelers seeking hiking, cycling, and wildlife observation. Local authorities actively promote sustainable tourism through eco-labelling and carbon-neutral infrastructure. The presence of 9 major UNESCO-listed sites and rich biodiversity strengthens its appeal. The region is also a leader in eco-accommodation and local agritourism, helping small communities benefit economically from conservation-focused tourism. Its strong environmental governance makes it a benchmark for regional sustainability practices in France.

Nouvelle-Aquitaine is a major contributor to the France ecotourism sector, boasting a 970 km coastline and four islands. The region is renowned for its stunning landscapes and exceptional quality of life. The region offers diverse ecotourism experiences such as oyster farming tours, bird watching in the Marais Poitevin, and surfing in eco-sensitive zones. Strong regional policies support biodiversity conservation and green travel infrastructure. Nouvelle-Aquitaine also leads in promoting responsible coastal tourism, with eco-certifications for campsites and beaches. Its emphasis on sustainable rural development helps empower local communities while preserving natural heritage. With its blend of cultural richness and ecological variety, the region serves as a model for integrated, responsible tourism in France.

Hauts-de-France is an emerging region in the country’s ecotourism landscape, known for its unspoiled coastlines, marshlands, and historic villages. The region offers unique eco-experiences such as seal watching in the Bay of Somme, nature reserves, and green cycling routes. Its proximity to Belgium and the UK also makes it accessible for cross-border eco-travel. Regional efforts to revitalize post-industrial landscapes into eco-friendly spaces, such as rewilded mining sites, demonstrate a commitment to environmental regeneration. By focusing on both heritage and habitat, Hauts-de-France is developing a sustainable tourism identity that contributes to local economic revival and biodiversity protection.

Occitanie is a standout ecotourism destination in southern France, offering a rich mix of Mediterranean coastlines, mountains, and historic villages. The region boasts multiple regional natural parks, eco-trails, and agritourism sites promoting organic and biodynamic farming. It is also home to strong climate initiatives, such as carbon-neutral tourism zones and renewable energy investments in rural areas. Tourists are drawn to eco-adventures like canyoning in the Pyrenees or exploring the Camargue wetlands. Occitanie’s proactive support for community-based tourism and local biodiversity makes it a critical area for sustainable travel and an important contributor to France’s green tourism strategy.

Provence-Alpes-Côte d’Azur (PACA) blends natural beauty with ecological preservation, making it a leading ecotourism hub in France. Attracting over 3 Million visitors annually, Calanques National Park highlights the region’s rich offering of eco-focused experiences. PACA authorities actively promote sustainable coastal and inland tourism, encouraging eco-certification for hotels and implementing visitor caps in sensitive areas. The area’s strong Mediterranean identity, biodiversity, and emphasis on wellness tourism enhance its appeal to environmentally conscious travelers. Through initiatives in water conservation, local product promotion, and sustainable mobility, PACA reinforces its status as a top-tier destination for green tourism.

Grand Est is gaining recognition in the market with its cross-border appeal, wine tourism, and forested landscapes. Regions like Alsace and the Vosges mountains offer eco-travelers immersive experiences in nature, including organic vineyards, thermal spas, and heritage cycling paths. For instance, the Alsace Wine Fair Festival, Colmar, planned from 25 July to 3 August, offers a refined celebration of regional viticulture, complemented by a diverse cultural program. The region supports sustainable development through eco-labeling, green lodging, and conservation partnerships with local communities. Grand Est’s commitment to balancing cultural heritage with environmental stewardship makes it a major region in promoting cross-regional sustainability and enriching the diversity of France’s ecotourism offerings.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Ecotourism Market News:

- On May 22, 2025, MooVert, a French platform promoting sustainable tourism, was selected to represent France at French Tourism Days USA 2025, an event held across Washington, D.C., Los Angeles, and San Francisco. This recognition highlights France’s growing emphasis on eco-responsible travel, with MooVert showcasing a portfolio of over 500 eco-lodgings and 120 curated itineraries rooted in local culture and environmental stewardship. The platform incorporates advanced digital features such as real-time availability, multi-currency support, and a proprietary algorithm. to identify and promote certified sustainable tourism providers.

France Ecotourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Generation X, Generation Y, Generation Z |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France ecotourism market performed so far and how will it perform in the coming years?

- What is the breakup of the France ecotourism market on the basis of traveler type?

- What is the breakup of the France ecotourism market on the basis of age group?

- What is the breakup of the France ecotourism market on the basis of sales channel?

- What is the breakup of the France ecotourism market on the basis of region?

- What are the various stages in the value chain of the France ecotourism market?

- What are the key driving factors and challenges in the France ecotourism market?

- What is the structure of the France ecotourism market and who are the key players?

- What is the degree of competition in the France ecotourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France ecotourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France ecotourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France ecotourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)