France Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

France Gaming Market Overview:

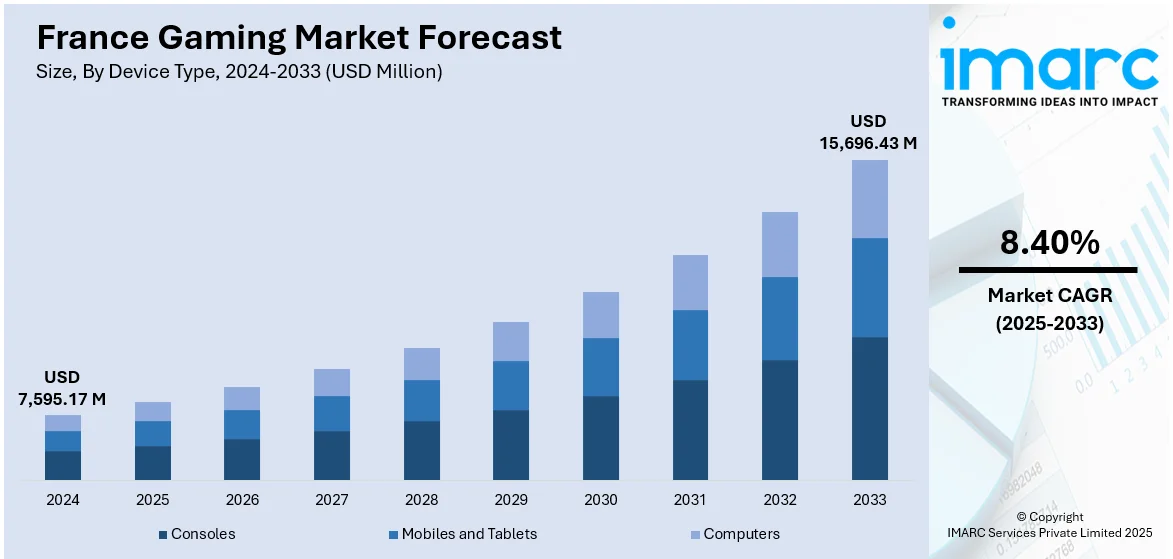

The France gaming market size reached USD 7,595.17 Million in 2024. Looking forward, the market is projected to reach USD 15,696.43 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The market is driven by strong government backing, tax credits, and a flourishing creative ecosystem that supports both indie and AAA game development. Esports professionalization, official recognition, and global tournament hosting have embedded competitive gaming in national culture. Additionally, the expanding mobile gaming sector, supported by localization, strong developer presence, and cloud gaming innovations, is further augmenting the France gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,595.17 Million |

| Market Forecast in 2033 | USD 15,696.43 Million |

| Market Growth Rate 2025-2033 | 8.40% |

France Gaming Market Trends:

Expansion of Esports and Competitive Gaming Ecosystem

Esports in France has transitioned from niche subculture to mainstream entertainment, with significant institutional and commercial support driving its growth. Paris serves as a central hub for esports events, regularly hosting major tournaments for titles such as Counter-Strike, League of Legends, and Rocket League. Government recognition of esports as an official sport has formalized player regulations and enhanced event organization standards. Dedicated esports venues, including Stade Pierre-Mauroy in Lille and Accor Arena in Paris, frequently host international competitions. Corporate sponsorships from telecom, automotive, and financial sectors fund team development, while media partnerships ensure broad event coverage. French players and teams have gained international recognition, further driving domestic interest in esports viewership and participation. Latest projections showed that the number of video game users in France is expected to increase by 2.7 million between 2025 and 2030, representing a 9.27% growth. By 2030, the total number of video gamers in the country is anticipated to reach 31.79 million, marking a new record high. Educational programs tailored to esports management, broadcasting, and professional training are emerging across universities and technical institutes. Additionally, collaborations between game publishers and French event organizers are elevating the profile of local esports on global circuits. This growing professionalization of esports infrastructure is embedding competitive gaming as a permanent fixture in France’s entertainment landscape, with increasing contributions to the economy and cultural visibility. According to latest industry reports, video gaming penetration in France reached its peak among younger age groups, with 94% of respondents aged 10–14 and 15–17 actively playing games. The survey also found that 92% of young adults aged 18–24 engaged in video gaming, followed by 87% for the 25–34 demographic.

To get more information on this market, Request Sample

Growing Market for Mobile and Casual Gaming

France’s mobile and casual gaming segments have expanded rapidly, driven by increased smartphone penetration, fast mobile internet, and the popularity of freemium game models. Latest survey data revealed that approximately 82.3% of internet users in France played video games across various devices as of Q3 2024. Smartphones led as the most used gaming device with a 57.2% share, followed by consoles at 36.6% and laptops/desktops at 27.4%. This highlights the dominance of mobile platforms in shaping consumption trends within the market. Casual games with mass appeal, such as puzzle games, simulation titles, and mobile adaptations of major franchises, dominate app store rankings. French consumers demonstrate a strong preference for mobile gaming as a leisure activity during commutes or breaks, creating consistent engagement levels across diverse demographic groups. Telecom operators in France offer gaming bundles, including cloud gaming access, to drive mobile data usage and subscriber retention, directly contributing to the France gaming market growth. Additionally, localization of international mobile games into French ensures cultural relevance and player retention. French mobile game developers, such as Voodoo and Gameloft, have achieved global success, showcasing local expertise in mobile-first design and monetization strategies. The increasing adoption of cloud gaming platforms further expands access to higher-quality games on mobile devices without requiring advanced hardware. Influencer-driven marketing and targeted advertising campaigns tailored for mobile platforms are enhancing user acquisition. These developments highlight mobile gaming’s growing role in France’s entertainment landscape, expanding access to gaming across both traditional and non-traditional audiences.

France Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

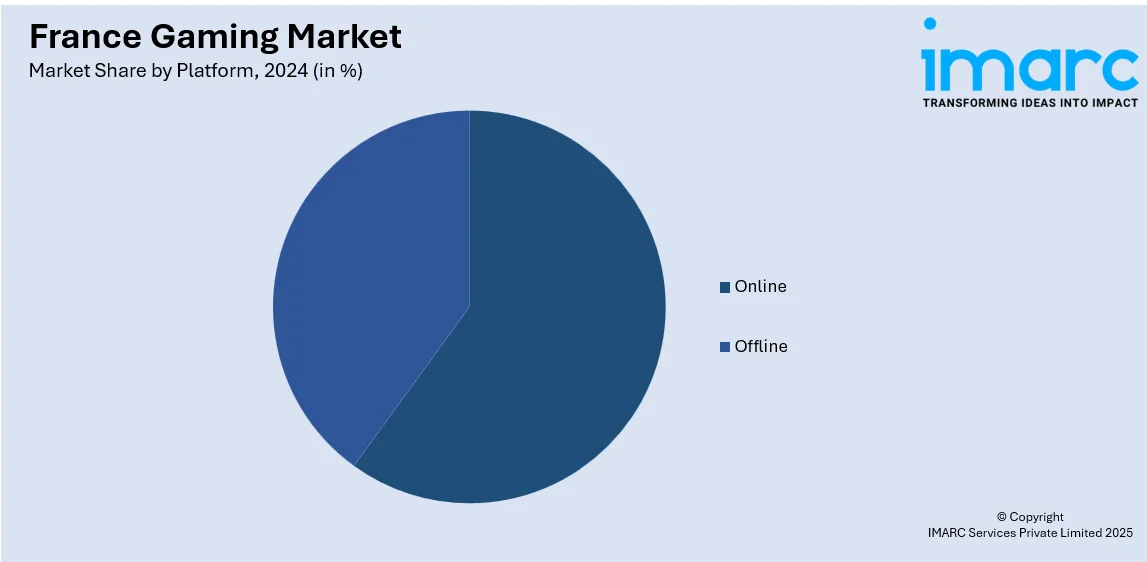

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Gaming Market News:

- On October 24, 2024, French entertainment technology company Netgem announced the acquisition of Gamestream's Cloud Gaming assets, including contracts, technology, and publisher agreements. The transaction positions Netgem to operate proprietary cloud gaming solutions across markets in Europe, Asia, and Africa, leveraging partnerships with major telecom operators like JIO (India), Telkom Indonesia, and ETISALAT (UAE). This acquisition will significantly expand Netgem’s role in the France gaming market by enhancing its immersive TV offerings and establishing stronger distribution channels for video games.

France Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the France gaming market on the basis of device type?

- What is the breakup of the France gaming market on the basis of platform?

- What is the breakup of the France gaming market on the basis of revenue type?

- What is the breakup of the France gaming market on the basis of type?

- What is the breakup of the France gaming market on the basis of age group?

- What is the breakup of the France gaming market on the basis of region?

- What are the various stages in the value chain of the France gaming market?

- What are the key driving factors and challenges in the France gaming market?

- What is the structure of the France gaming market and who are the key players?

- What is the degree of competition in the France gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)