France Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

France Insurtech Market Overview:

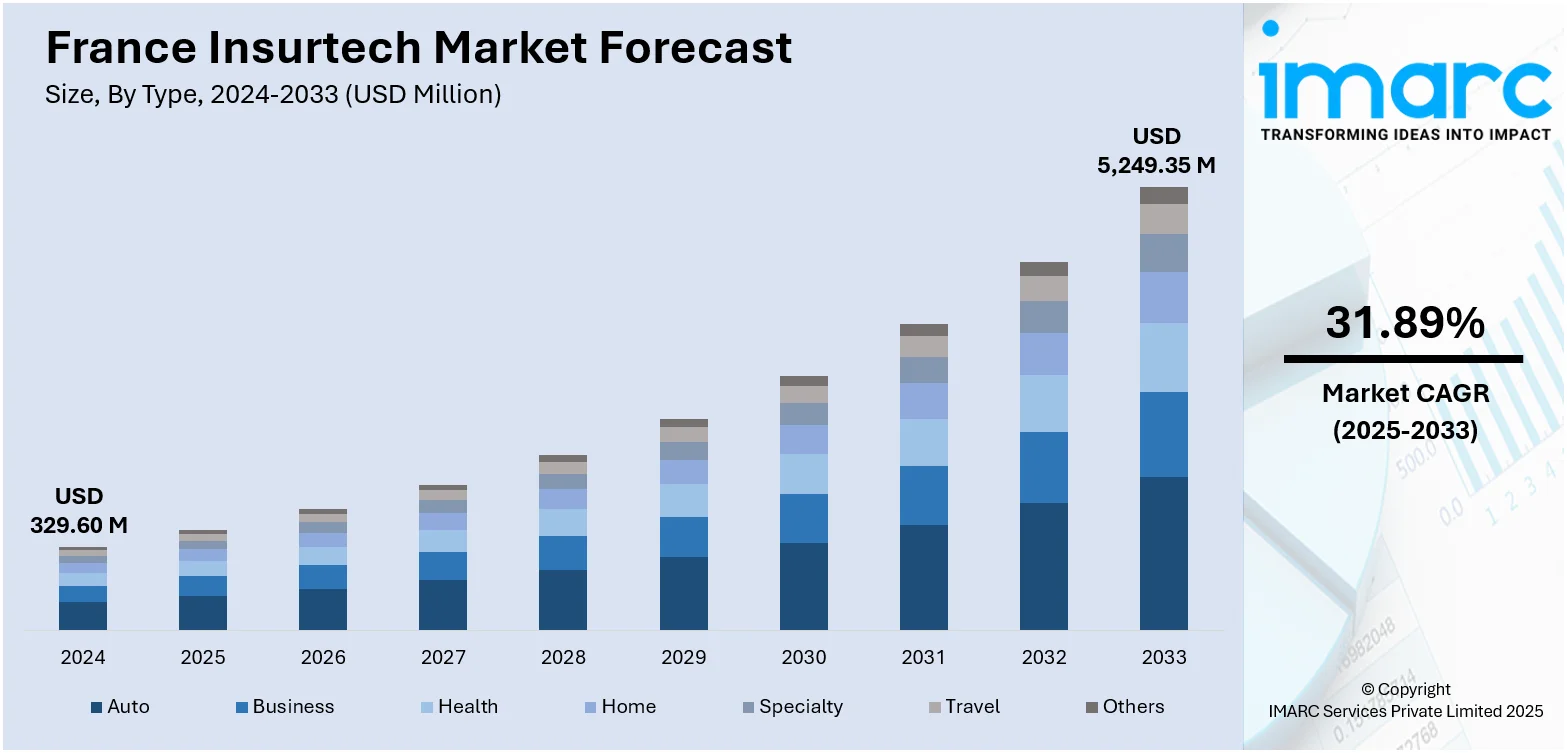

The France Insurtech market size reached USD 329.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,249.35 Million by 2033, exhibiting a growth rate (CAGR) of 31.89% during 2025-2033. Technological innovation and rising investor interest are positively influencing the Insurtech market in France, with artificial intelligence (AI), automation, and data-driven platforms reshaping operations. Furthermore, the increasing demand for tailored, fast-response solutions to emerging risks like cyber threats, which requires flexible, tech-enabled insurance models, is contributing to the expansion of the France Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 329.60 Million |

| Market Forecast in 2033 | USD 5,249.35 Million |

| Market Growth Rate 2025-2033 | 31.89% |

France Insurtech Market Trends:

Technological Advancements and Investment Momentum

The swift progress of transformative technologies like artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and blockchain is altering the operational and strategic capacities of the insurance industry in France. These technologies facilitate improved precision in risk modeling, automate underwriting tasks, analyze claims predictively, and strengthen fraud detection, which results in major gains in efficiency, scalability, and client satisfaction. As a result, Insurtech startups that successfully incorporate these technologies are becoming more appealing to venture capital investors and established insurance companies aiming to update and stay competitive. A significant instance is the 2024 Series F funding round by French digital health insurer Alan, which secured $193 million and raised its valuation to €4 billion. The round was spearheaded by Belgium’s Belfius Bank, which also chose Alan to offer health insurance for its 7,000 workers and pledged to advocate for Alan’s services among its clientele in Belgium. This strategic investment not only highlights confidence in Alan’s technology-focused model but also mirrors the wider trend of funding supporting tech-driven insurance innovation. Alan's intentions to grow regionally, improve its AI features, and focus on group profitability by 2026 illustrate how the synergy of technological advancement and financial support is speeding up product innovation and market growth, fostering a more vibrant and progressive Insurtech landscape in France.

To get more information on this market, Request Sample

Addressing Emerging Risks with Innovative Insurance Models

The increasing complexity and occurrence of emerging threats, such as cyberattacks, failures in digital infrastructure, and widespread operational disruptions, are generating new needs within the France insurance sector, especially for small and medium-sized enterprises (SMEs). Conventional insurance offerings frequently find it challenging to adapt to these changing risks, particularly regarding prompt payouts and straightforward coverage conditions. In reply, Insurtech companies are creating tailored, tech-based insurance solutions that effectively and accurately tackle these gaps. For instance, parametric insurance is becoming more popular because it provides set payouts activated by certain events, which minimizes uncertainty and speeds up claims processing. This advancement improves clarity and provides swift financial assistance, which is especially vital for companies with restricted operational reserves. The transition towards addressing non-traditional risks also signifies the wider trend in the Insurtech industry to create flexible, data-driven frameworks that capture the realities of a digital economy. As the risk environment develops, the capacity to foresee and address new vulnerabilities with focused, technology-driven solutions is emerging as a crucial factor influencing the France Insurtech market growth. In 2024, Insurtech Descartes launched Cyber Shutdown Cover in France, a parametric insurance solution designed to protect SMEs from business interruptions caused by cyberattacks. The policy offered predefined compensation per day of shutdown, enabling faster payouts. This marked Descartes’ expansion into emerging risks beyond natural catastrophes.

France Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

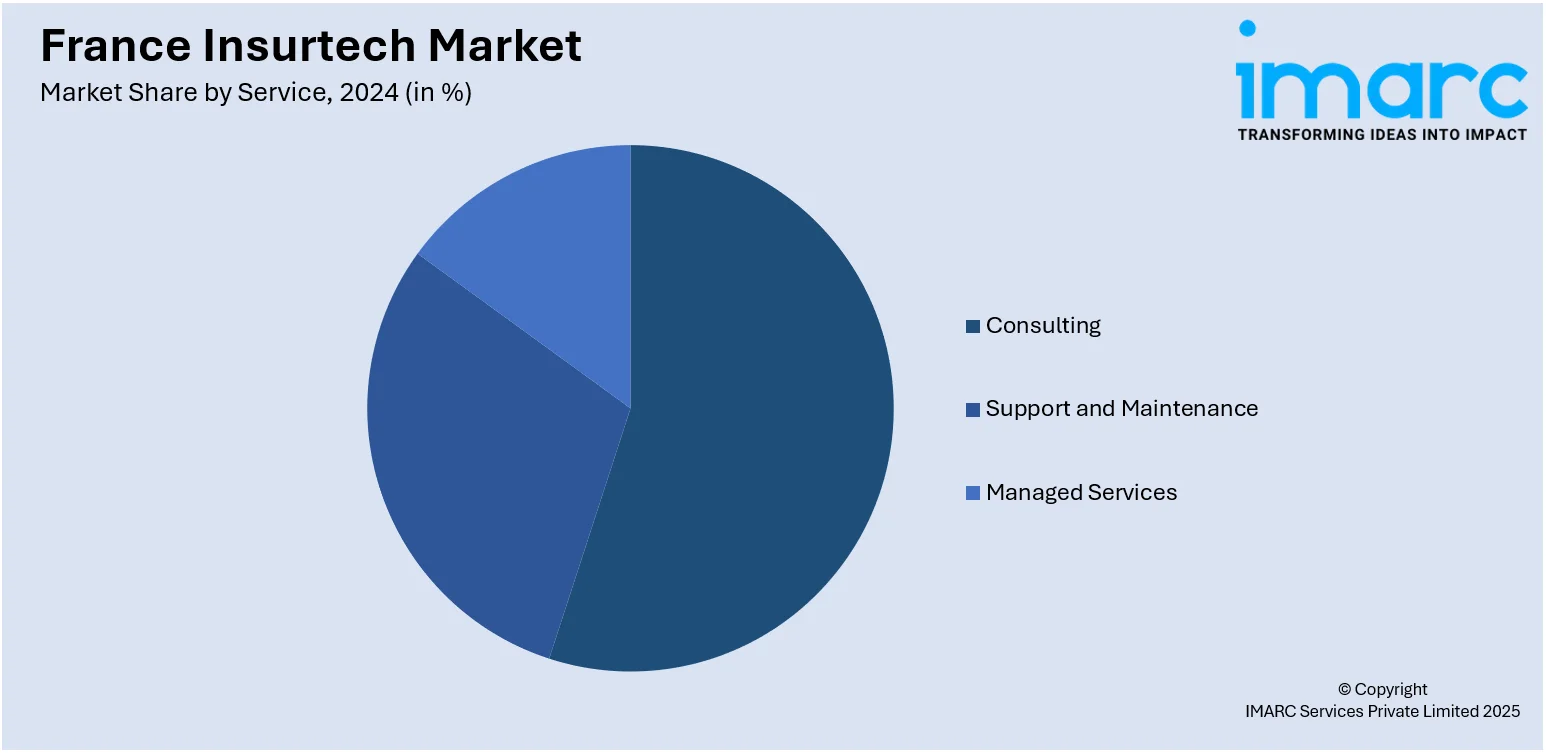

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Insurtech Market News:

- In April 2024, Insurtech Lemonade partnered with BNP Paribas Cardif to launch AI-powered homeowners insurance in France. Starting at €10/month, the policy included core protections and optional add-ons like school insurance and legal protection. This marked Lemonade’s transition to a multi-line Insurtech provider in Europe.

- January 2024, Allianz Partners launched the allyz mobile app in France, Germany, and the Netherlands, offering travelers a digital companion with insurance services, trip updates, and cyber protection. Users with Allianz travel insurance gained access to features like lounge access, Doctor Chat, and six months of free cyber care. The app enhanced user experience through integrated AI and digital tools.

France Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the France Insurtech market on the basis of type?

- What is the breakup of the France Insurtech market on the basis of service?

- What is the breakup of the France Insurtech market on the basis of technology?

- What is the breakup of the France Insurtech market on the basis of region?

- What are the various stages in the value chain of the France Insurtech market?

- What are the key driving factors and challenges in the France Insurtech market?

- What is the structure of the France Insurtech market and who are the key players?

- What is the degree of competition in the France Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)