France Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

France Luxury Fashion Market Overview:

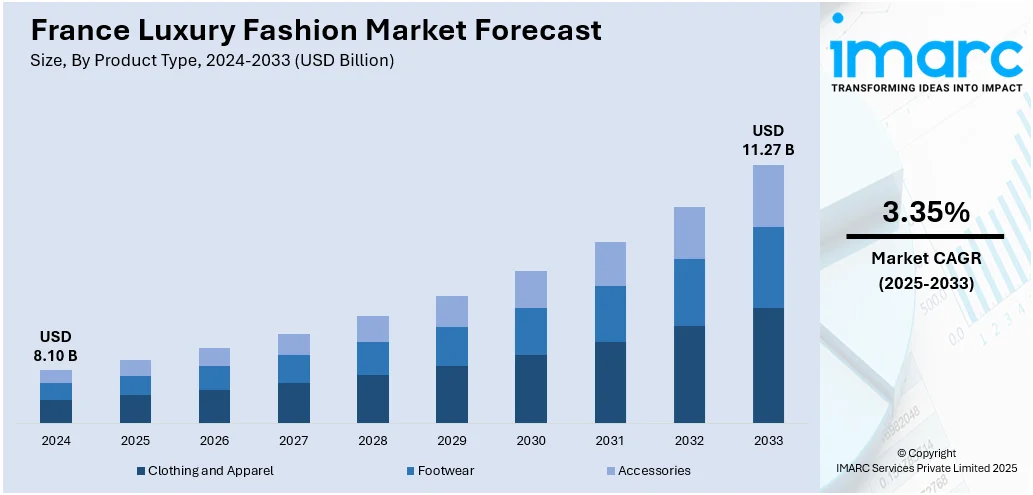

The France luxury fashion market size was valued at USD 8.10 Billion in 2024 and is expected to reach USD 11.27 Billion by 2033, growing at a CAGR of 3.35% during 2025-2033. The market growth is mainly driven by the inflating disposable incomes, increasing demand from affluent tourists, growing digital engagement, sustainability-driven innovations, and expanding global brand collaborations.

Key Market Trends and Insights

- Based on product type, the market is divided into clothing and apparel, footwear, and accessories.

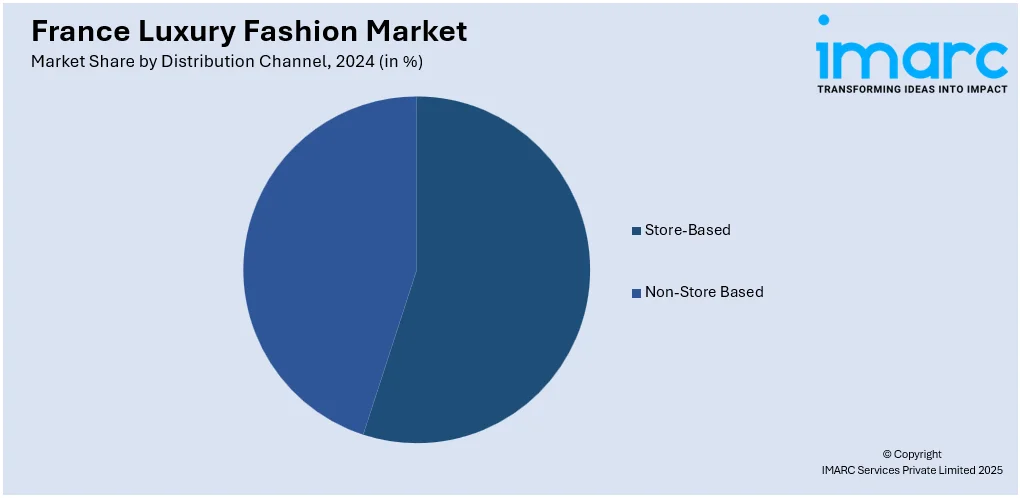

- On the basis of distribution channel, the market is segmented as store-based and non-store based.

- Based on end user, the market is divided into men, women, and unisex.

- On the basis of region, the market is segmented as Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Market Size and Forecast

- 2024 Market Size: USD 8.10 Billion

- 2033 Projected Market Size: USD 11.27 Billion

- CAGR (2025-2033): 3.35%

The growing economy of the country has led to an increase in individual disposable income, particularly among urban households. As per industry reports, the spending power in France grew by an average of 3.4% each year between 2014 and 2024. In 2024, this growth accelerated to 4.8%. With rising income levels, consumers are more inclined to invest in premium and high-quality fashion products that express their social status and individual sense of style. As consumers prioritize experience-driven purchases and self-expression, luxury brands benefit from strong demand across apparel, leather goods, and accessories. The willingness to spend on exclusivity and quality fuels the expansion of flagship stores and high-end retail outlets nationwide.

To get more information on this market, Request Sample

The increasing international tourist arrivals in France are significantly contributing to the France luxury fashion market growth. In 2024, France welcomed more than 100 Million international tourists. France remains one of the world’s most visited luxury destinations, attracting affluent tourists from Asia, the Middle East, and North America. These high-spending travelers are key contributors to the market development. Tourists view French luxury fashion as symbolic of cultural prestige and exclusivity, often purchasing items as part of a curated shopping experience. As global tourism rebounds, the luxury segment sees consistent footfall from international visitors, reinforcing France’s reputation as a global hub for high-end fashion retail.

The rapid digitalization of the French retail sector is a vital component flourishing market economy. Leading fashion houses are embracing omnichannel strategies that blend in-store experiences with advanced digital interfaces. Technologies like augmented reality (AR), 3D scanning technology, AI-driven personalization, and virtual try-ons are enriching the consumer journey. For instance, CLX Europe, an eClerx company, launched a new creative content studio in Paris. The facility, operational since February 2025, leverages advanced 3D scanning technology from ALLSIDES Media along with generative AI to produce photorealistic digital assets tailored for luxury fashion and e‑commerce brand. This Paris studio enables scalable, omnichannel content creation, ranging from e‑commerce imagery to AR/VR applications. Moreover, social media plays a crucial role in shaping brand identity and engaging younger audiences.

The luxury fashion market in France is benefiting from the rising environmental consciousness among consumers. Notably, on June 18, 2025, France’s Senate approved pioneering legislation targeting ultra‑fast fashion brands, introducing a phased eco‑tax of EUR 5 (about USD 5.8) per item in 2025, rising to EUR 10 (about USD 11.7) by 2030, to fund sustainable local fashion initiatives. The law also bans advertising and influencer promotion of ultra‑fast fashion, compels mandatory eco‑score disclosures (covering carbon emissions, resource usage, recyclability) at the point of sale, and imposes penalties of up to 50 % of the product price for non‑compliance. In addition, certifications, traceability tools, and transparent supply chains are gaining prominence. This transition not only mitigates reputational risks but also reinforces the competitive advantage of French luxury brands in a global market increasingly focused on ethical fashion.

France Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

The clothing and apparel segment forms the core of the market, representing the largest product segment in terms of both revenue and brand heritage. Paris, widely regarded as the fashion capital of the world, with the presence to iconic brands, whose haute couture and ready-to-wear collections define global luxury standards. French luxury clothing is synonymous with craftsmanship, exclusivity, and innovation, often showcased in high-profile fashion weeks that set global trends. For example, on March 12, 2025, Paris Fashion Week Fall-Winter 2025 concluded after a nine-day run marked by high-profile designer debuts and dynamic presentations. The collections embraced themes of escapism, empowerment, and nostalgia, showcasing retro-inspired aesthetics, bold reinterpretations of office wear, and subtle homages to late filmmaker David Lynch.

Footwear plays a significant role in the market, with brands exemplifying the blend of design, artistry, and comfort. The segment thrives on the appeal of statement pieces, such as red-soled heels or artisanaly crafted leather boots, that symbolize personal style and social status. For instance, Christian Louboutin unveiled the “Miss Z” pump silhouette on January 15, 2025, showcasing it during an immersive Paris Fashion Week presentation at the Piscine Molitor. The design features an innovative sculptural heel with an illusion of greater height than its actual 60–120 mm measurement, an expanded toe box with padded insoles for enhanced comfort, and the brand’s durable “Everlasting Red” sole. With a focus on heritage craftsmanship and limited-edition collections, luxury footwear from France remains a high-margin product that reinforces brand identity and global influence.

The accessories segment in the market is propelled by a wide array of products that blend practicality with sophistication. Signature items like the Hermès Birkin and Louis Vuitton monogram tote continue to uphold strong brand equity and foster deep consumer loyalty. In 2024, leading brands such as Christian Dior, Chanel, and Hermès reported impressive value retention, with the Lady Dior bag topping the list at an average retention rate of 96%. These figures reflect the impact of brand legacy, classic design, and product exclusivity. Accessories also generate higher margins due to scalable production and year-round demand. Their universal appeal, amplified by celebrity endorsements, reinforces the global presence and supports sustained market growth.

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

Store-based distribution remains the cornerstone of the market, offering immersive brand experiences that are central to luxury retail. Flagship stores in Paris serve as architectural showcases and reinforce brand prestige. A recent industry survey reveals that 84% of French consumers continue to favor in-store shopping. The physical stores play a pivotal role in maintaining brand integrity, enabling direct consumer engagement, personalized fittings, and experiential marketing that strengthen customer loyalty and premium positioning. Moreover, high-end boutiques and department stores create exclusive environments that highlight craftsmanship, heritage, and personal service elements crucial to luxury consumer expectations.

Non-store-based distribution, particularly through e-commerce and brand-owned digital platforms, is augmenting the France luxury fashion market share. With internet penetration reaching 95.2% of the population by early 2025, online shopping has gained dominance due to its convenience and accessibility. Luxury brands are leveraging digital channels to adapt to shifting consumer preferences, particularly among younger demographics and international buyers. These platforms enable brands to extend their reach beyond traditional retail locations, removing geographic barriers to sales. Moreover, advancements in augmented reality and AI-powered personalization are elevating the online shopping experience, making it an essential complement to physical retail.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Women represents one of the dominant end-user segments in the market, driving demand across clothing, footwear, and accessories. According to a 2024 industry report, French consumers purchased an average of 42 items spanning apparel, home linens, and footwear. On average, women accounted for 32 clothing items within that total. French luxury houses have historically tailored their flagship collections toward female consumers, with an emphasis on haute couture, elegant silhouettes, and refined craftsmanship. The segment benefits from high brand loyalty and consistent demand for seasonal collections, exclusive accessories, and signature fragrances. Women's luxury fashion continues to evolve with trends that balance tradition and innovation, offering both timeless classics and contemporary pieces. This strong consumer base sustains the segment's position as the most influential within the market.

The men's segment is witnessing steady growth in the market, reflecting changing consumer attitudes and rising interest in premium grooming, tailored fashion, and designer footwear. According to an industry report, the average French male shopper purchased 19 clothing items in 2024, contributing to an overall individual average of 42 fashion-related purchases, including garments and footwear. Brands are expanding their men's collections, with a focus on combining craftsmanship with modern style. Moreover, increased disposable income, evolving fashion consciousness, and a broader acceptance of personal styling have contributed to the segment's expansion.

The unisex segment holds growing importance in the market as gender-fluid fashion gains momentum, especially among younger consumers. Luxury brands are progressively developing collections that challenge traditional gender norms, offering versatile pieces in neutral tones and adaptable silhouettes. This shift reflects broader societal changes favoring inclusivity, individuality, and sustainability. The rise of unisex fashion allows brands to streamline production, reduce inventory complexity, and appeal to a wider audience, enhancing market flexibility and aligning with modern consumer values.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

The Paris Region serves as the global epicenter for high-end design, innovation, and branding. As the headquarters for iconic fashion houses, Paris hosts prestigious events such as Paris Fashion Week, drawing global attention and elite clientele. The region's luxury retail infrastructure, including flagship boutiques, ateliers, and department stores, offers immersive brand experiences and drives high-value sales. In 2024, there were seven luxury store openings in Paris on the city's four key luxury streets. Also, Paris accounted for nearly 75% of all retail signings, indicating strong future momentum with several flagship launches expected soon. Besides, its international appeal, cultural prestige, and influence on global fashion trends make the Paris Region the most significant contributor to both domestic market strength and export performance.

The Auvergne-Rhône-Alpes region holds strategic importance in the market, particularly through its contributions to textile manufacturing and artisanal craftsmanship. Known for its silk heritage in cities like Lyon, the region supports the production of high-quality fabrics and accessories used by leading fashion houses. It also benefits from a concentration of skilled labor and design schools that feed into the national fashion ecosystem. While not a primary retail hub like Paris, Auvergne-Rhône-Alpes plays a vital role in the supply chain, blending traditional know-how with innovation to uphold the high standards associated with French luxury fashion.

Nouvelle-Aquitaine contributes to the market through its niche artisanal industries and a growing presence of high-end boutiques in cities. For instance, Hermès is set to open its sixth leather goods workshop in Nouvelle-Aquitaine by 2026, reinforcing the region's growing importance in France's luxury manufacturing landscape. The region is home to several workshops producing leather goods, jewelry, and textiles that are integral to luxury collections. Additionally, Nouvelle-Aquitaine offers a favorable environment for sustainable fashion initiatives, with a focus on eco-conscious production and locally sourced materials. Its expanding role supports the decentralization of luxury retail and manufacturing beyond Paris, enhancing regional diversity in the market.

Hauts-de-France plays a supportive yet growing role in the market, particularly through textile production and industrial know-how. Historically a textile manufacturing hub, the region has adapted to modern demands by embracing high-end fabric innovation and sustainable practices. Luxury brands increasingly source materials from this region due to its combination of quality, efficiency, and heritage. Cities like Lille are witnessing a rise in fashion-focused events and concept stores that showcase local designers and artisanal labels. While retail demand may be moderate, Hauts-de-France remains a valuable contributor to the fashion supply chain and regional development.

Occitanie has emerged as a region of growing importance in France's market due to its blend of traditional craftsmanship, design innovation, and tourism-driven retail. Cities like Toulouse and Montpellier host boutique stores and pop-up experiences catering to affluent travelers. The region is recognized for its leather goods production, artisanal workshops, and support for fashion start-ups, often aligning with sustainability and circular economy principles. Occitanie also attracts designers looking for inspiration and slower-paced, quality-driven production. Its evolving ecosystem contributes to the diversification of the luxury market, reinforcing France's image as a country of both tradition and creativity.

The Provence-Alpes-Côte d'Azur (PACA) region represents a vital lifestyle region of the France luxury fashion market, combining fashion, tourism, and elite leisure culture. Cities like Nice, Cannes, and Saint-Tropez are hotspots for luxury consumption, especially during seasonal influxes of high-net-worth visitors. The region boasts numerous high-end boutiques, resort wear collections, and exclusive pop-up stores by major fashion houses. Notably, Louis Vuitton staged its Cruise 2026 show on May 22, 2025, at the historic Palais des Papes in Avignon, marking the first ever runway at this UNESCO site in southeastern France. With a focus on Mediterranean elegance, PACA supports a unique luxury identity that emphasizes relaxed sophistication and coastal allure.

Grand Est contributes to the market primarily through high-end manufacturing and cross-border trade dynamics. Known for its legacy in the textile and leather industries, particularly in regions like Alsace and Lorraine, Grand Est supplies premium materials and finished goods to national and international brands. Its proximity to Germany, Switzerland, and Luxembourg supports a strong export orientation and cross-cultural fashion influence. Additionally, the region is investing in innovation and sustainable practices, reinforcing its role in the evolving fashion supply chain. While retail activity is moderate, Grand Est remains integral to the foundational structure of French luxury production.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Luxury Fashion Market News:

- On May 15, 2025, Coats Footwear launched its first "Bag-in-a-Box" kit under the new Lifestyle Solutions line, aimed at simplifying luxury handbag production. The kit consolidates all essential components, sustainable reinforcements, threads, and fillers, into a single package to streamline sourcing, improve inventory transparency, and support eco-conscious manufacturing. Designed for premium bag makers, the solution features customizable, high-performance materials, including recycled thermoplastics and leather waste reinforcements.

- On April 9, 2024, Hermès began construction on a new leather goods workshop in L’Isle-d’Espagnac, just east of Angoulême in Charente, France, with operations slated to commence in 2025 and the facility employing approximately 260 skilled artisans. Designed by Bordeaux firm Guiraud‑Manenc, the 5,500 m² building emphasizes sustainability. This expansion strengthens Hermès’ South‑West France manufacturing hub, complementing existing workshops in Montbron, Nontron, and Saint‑Junien.

France Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the France luxury fashion market on the basis of product type?

- What is the breakup of the France luxury fashion market on the basis of distribution channel?

- What is the breakup of the France luxury fashion market on the basis of end user?

- What is the breakup of the France luxury fashion market on the basis of region?

- What are the various stages in the value chain of the France luxury fashion market?

- What are the key driving factors and challenges in the France luxury fashion market?

- What is the structure of the France luxury fashion market and who are the key players?

- What is the degree of competition in the France luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)