France Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2025-2033

France Office Furniture Market Overview:

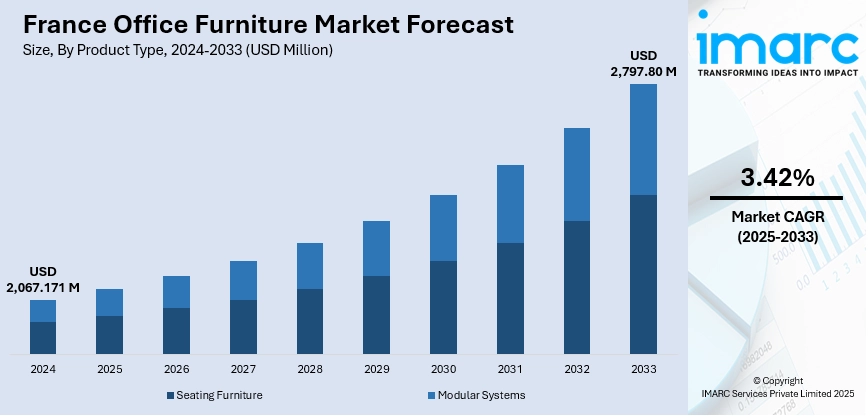

The France office furniture market size reached USD 2,067.171 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,797.80 Million by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033. At present, more businesses are embracing hybrid and remote work, which is encouraging firms to redesign their office spaces. Moreover, companies and individuals are highly prioritizing environmental responsibility, thereby driving the need for sustainable furniture. This trend, along with the heightened focus on employee well-being and ergonomics, is expanding the France office furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,067.171 Million |

| Market Forecast in 2033 | USD 2,797.80 Million |

| Market Growth Rate 2025-2033 | 3.42% |

France Office Furniture Market Trends:

Sustainability and green materials

Sustainability is emerging as an important driver in the market, with companies and individuals increasingly prioritizing environmental responsibility. Businesses are looking more and more for office furniture products that are made from green materials, including recycled wood, sustainable metals, and non-toxic coatings. These changes are being spurred by both corporate social responsibility efforts and the increasing number of employees who wish to work in environmentally-friendly buildings. Businesses are creating products that are not only long-lasting but also recyclable and energy-efficient in response. Sustainable furniture is being increasingly added to new office designs as part of overall sustainability objectives for many industries. Companies are also seeking furniture that supports a circular economy by making products easily recyclable and disassembled at the point of their demise. The growth in demand for sustainable office furniture is driving the growth in the French market overall. In 2024, Enky, a Belgian start-up, ventured into the UK market, introducing its distinctive zero-waste furniture subscription service to new territories. Belgian start-up Enky, primarily focused on office furnishings, is gaining attention throughout mainland Europe by tackling increasing worries about furniture waste and the demand for more sustainable business practices. The company has installed furniture valued at over US$5.4m across Belgium, Switzerland, Spain, and France, all without any advertising.

To get more information on this market, Request Sample

Employee well-being and ergonomics focus

The increased focus on employee well-being and ergonomics is supporting the France office furniture market growth. Organizations are realizing the ill effects of poor ergonomics on the health of employees, and thus, they are making investments in furniture that promotes physical well-being. Height-adjustable desks, ergonomic chairs, and tilt-adjustable monitor stands are becoming the norm in offices as companies seek to alleviate the risks of extended sitting, including back pain and musculoskeletal disorders. This is also contributing to increased productivity, as employees are more comfortable and able to work efficiently in ergonomic settings. Manufacturers are continuing to innovate, developing furniture that integrates with technology and encourages movement throughout the day. In addition, increased awareness about mental health in the workplace is also beginning to impact the design of office furniture, as a focus on comfort and minimizing stress levels drives sustained growth in the market. France has designated mental health as its “Grande cause” for 2025, emphasizing it as a national priority and urging collective action from all sectors.

Growing need for flexible offices

The France market is witnessing strong growth based on the rising need for flexible offices. As more businesses embrace hybrid and remote working, firms are redesigning their office spaces to create dynamic, flexible environments. These offices are intended to facilitate multiple activities, such as collaborative meetings, individual work, and relaxation. Office furniture producers are moving towards creating flexible and modular solutions that can be quickly reconfigured. The emphasis is on ergonomic furniture designs that ensure comfort and health among employees, as well as flexible furniture systems that can smoothly adapt to evolving workspace demands. Businesses are increasingly focusing on multi-purpose furniture pieces, like height-adjustable desks, movable walls, and modular chairs. This is all trending with the overall move towards flexible office layouts that support a wide variety of work styles and activities, contributing further to the demand for French office furniture. This is also encouraging more companies to open their stores in France. For instance, in 2025, Zuiver Interior Group opened its own sales office in France. Zuiver Interior Group is also concentrating on a successful Maison et Objet, during which it intends to showcase its newest collections for Zuiver, Dutchbone, and the white-label collection.

France Office Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and price range.

Product Type Insights:

- Seating Furniture

- Modular Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seating furniture and modular systems.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wood, metal, plastic and fiber, glass, and others.

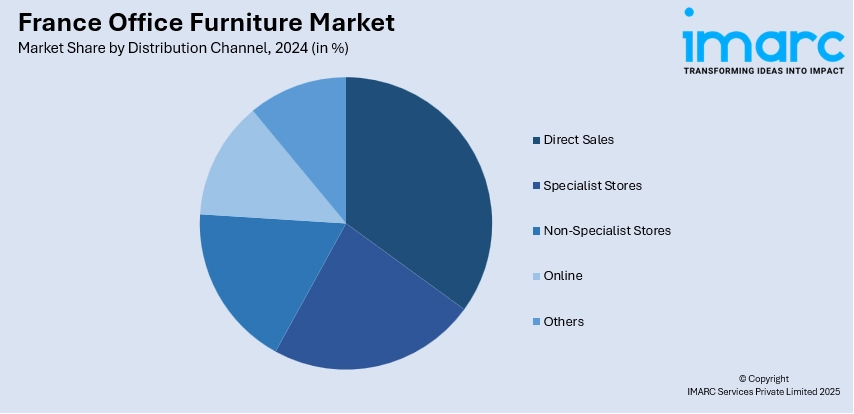

Distribution Channel Insights:

- Direct Sales

- Specialist Stores

- Non-Specialist Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, specialist stores, non-specialist stores, online, and others.

Price Range Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low, medium, and high.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Store, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France office furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the France office furniture market on the basis of product type?

- What is the breakup of the France office furniture market on the basis of material type?

- What is the breakup of the France office furniture market on the basis of distribution channel?

- What is the breakup of the France office furniture market on the basis of price range?

- What is the breakup of the France office furniture market on the basis of region?

- What are the various stages in the value chain of the France office furniture market?

- What are the key driving factors and challenges in the France office furniture market?

- What is the structure of the France office furniture market and who are the key players?

- What is the degree of competition in the France office furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France office furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)