France Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

France Steel Market Overview:

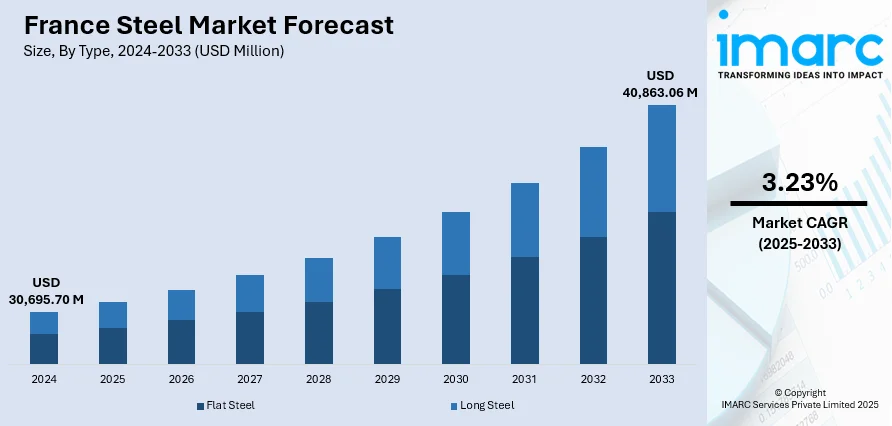

The France steel market size reached USD 30,695.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 40,863.06 Million by 2033, exhibiting a growth rate (CAGR) of 3.23% during 2025-2033. Growing demand from construction, automotive, and manufacturing industries, infrastructure projects, and increased focus on sustainable steel production are some of the factors contributing to France steel market share. Government policies, technological advancements, and rising investments in green initiatives further support the market’s growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30,695.70 Million |

| Market Forecast in 2033 | USD 40,863.06 Million |

| Market Growth Rate 2025-2033 | 3.23% |

France Steel Market Trends:

Shift to Electric Arc Furnace Technology in Steel Production

The steel industry is seeing a significant transition toward electric arc furnace (EAF) technology, which reflects increased attempts to modernize manufacturing processes. EAF mills, which employ scrap metal and direct reduced iron (DRI) as raw materials, are gradually replacing traditional blast furnaces. This change supports global environmental goals by lowering carbon emissions and increasing energy efficiency. Governments have an important role in promoting investments in this new technology. The switch to EAF mills is not merely a response to environmental concerns, but also a larger effort to innovate within the sector. As corporations embrace this approach, the future of steel manufacturing appears to be more environmentally friendly and resource efficient. These factors are intensifying the France steel market growth. For example, in May 2025, ArcelorMittal announced its plans to invest EUR 1.2 Billion in Dunkirk, France, to install an electric arc furnace (EAF) production line. This move reflects the company's collaboration with the French government, which has played a significant role in supporting France's steel industry. The investment follows a previous decision to pause some European investments to convert blast furnaces to EAF mills fed by scrap and direct-reduced iron (DRI).

To get more information on this market, Request Sample

Steel Production Witnessing Strong Recovery

The steel sector is expanding rapidly, with large year-over-year increases in output. This jump demonstrates a favorable market change, fueled by recovery efforts and increased demand. Steel production has consistently increased, indicating resilience and a return to pre-pandemic levels. The sector is benefiting from improved manufacturing processes and stronger market circumstances, resulting in larger monthly outputs than in prior years. This development demonstrates the steel sector's continuous recovery, with businesses adjusting to changing market requirements and difficulties. As production levels climb, the sector is poised for long-term expansion, aided by stronger economic circumstances and continuous investments in advanced technology. The rebound points to a bright future for steel production going ahead. For instance, in March 2025, French steelmakers increased steel production by 10.4% year-on-year, reaching 921 Thousand Tons, securing 18th place globally in steel production rankings by the WorldSteel Association. Between January and March, steel production totaled 2.59 million tons, up 2.1% from the previous year. In 2024, French steel production grew by 7.6%, showing a strong recovery. The average monthly production in 2024 was 896.25 Thousand Tons, higher than in 2023 and 2022.

France Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

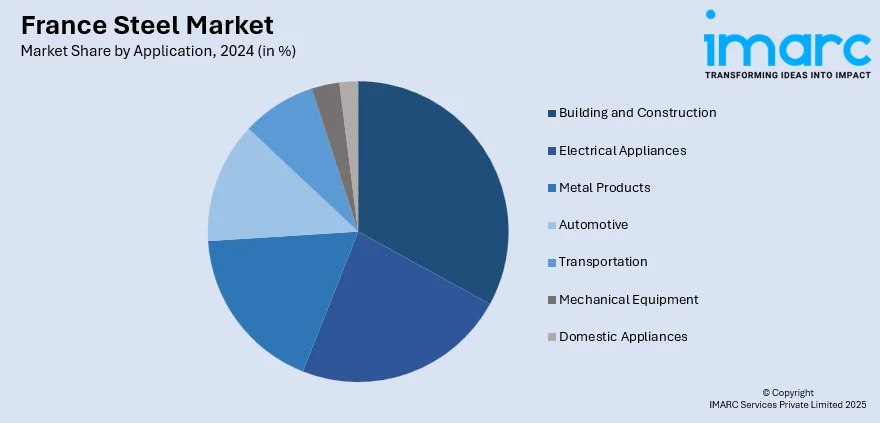

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Steel Market News:

- In June 2025, ArcelorMittal ramped up its efforts to enhance scrap processing across Europe, aiming to reduce CO2 emissions and move toward a circular steel production model. The company is investing in advanced equipment, including a ladle furnace at Fos-sur-Mer to increase scrap utilization fivefold by 2025, cutting CO2 emissions by 10%. It has expanded its processing capacity in Dunkirk and acquired four scrap recycling firms to secure raw materials.

France Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France steel market performed so far and how will it perform in the coming years?

- What is the breakup of the France steel market on the basis of type?

- What is the breakup of the France steel market on the basis of product?

- What is the breakup of the France steel market on the basis of application?

- What is the breakup of the France steel market on the basis of region?

- What are the various stages in the value chain of the France steel market?

- What are the key driving factors and challenges in the France steel market?

- What is the structure of the France steel market and who are the key players?

- What is the degree of competition in the France steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)