France Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Province, 2025-2033

France Vegetable Oil Market Overview:

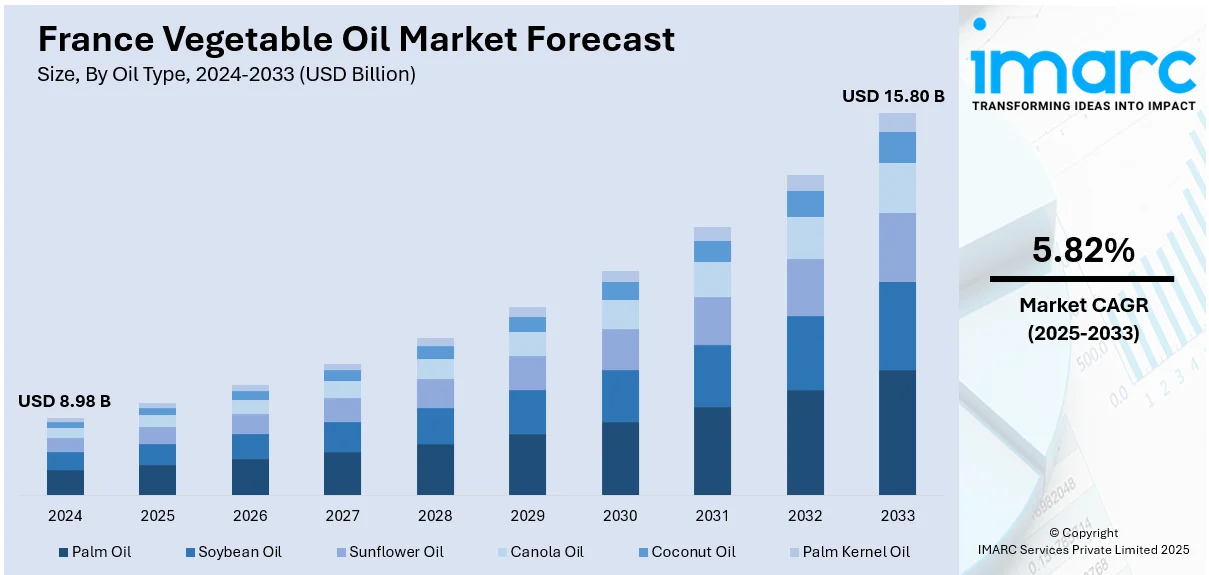

The France vegetable oil market size reached USD 8.98 Billion in 2024. Looking forward, the market is projected to reach USD 15.80 Billion by 2033, exhibiting a growth rate (CAGR) of 5.82% during 2025-2033. The market is fueled by France's high culinary embedding of sunflower, olive, and rapeseed oils in gourmet and health-oriented uses. Regulatory stress about sustainability, trans fat removal, and environmentally friendly sourcing is reforming industry practice. Increased adoption of vegetable oil in food processing and bio-based manufacturing industries is also increasing the France vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.98 Billion |

| Market Forecast in 2033 | USD 15.80 Billion |

| Market Growth Rate 2025-2033 | 5.82% |

France Vegetable Oil Market Trends:

Culinary Integration and High-End Oil Preferences

Vegetable oils are a crucial part of French cooking, not only as cooking media but as flavorings and nutritional sources. The most widely consumed vegetable oils are sunflower, rapeseed (canola), and olive oil, which are included in basic dishes, salad dressings, and gourmet foods. French consumers, especially in urban and high-income areas, have strong affinities for cold-pressed, organic, and extra virgin forms, in line with the nation's food culture that places high value on artisanal food and ingredient quality. Provençal or Mediterranean regional cuisines depend greatly on olive oil, whereas rapeseed oil is used in the cuisine of northern France and in bakery uses. Health awareness compels consumers to prefer oils that are seen as low in saturated fat and high in omega-3 or antioxidants. Labeling regulations and certifications such as “AB” (Agriculture Biologique) influence purchase decisions and promote trust. French supermarkets and specialty grocers offer diverse oils from local cooperatives and EU-sourced suppliers, often with PDO or PGI labels ensuring origin and quality. While imported oils such as coconut and avocado are gaining niche traction, domestic oils remain dominant. This gastronomic alignment and premium consumption culture are major forces behind France vegetable oil market growth in both retail and foodservice sectors.

To get more information on this market, Request Sample

Regulatory Pressure and Sustainable Sourcing Mandates

France has implemented stringent regulations on food labeling, ingredient traceability, and environmental impact, which strongly influence vegetable oil production and marketing. The country’s ban on partially hydrogenated oils and trans fats has led manufacturers to reformulate food products using healthier vegetable oil alternatives. Additionally, regulations related to palm oil—particularly concerning deforestation and greenhouse gas emissions, have triggered a notable shift toward certified sustainable palm oil (CSPO) or palm oil-free products. French food brands now promote sustainable sourcing as a competitive advantage, particularly for oils used in baked goods, ready meals, and processed snacks. Government-led nutritional labeling systems, such as Nutri-Score, indirectly pressure producers to use oils that improve a product's health rating. Moreover, France’s commitment to the EU Green Deal and climate-neutral targets influences agro-industrial policies that favor low-carbon, domestically grown oilseed crops. Investment in rapeseed, sunflower, and linseed cultivation has received national support, reinforced internal supply chains and reducing reliance on imports. As sustainability moves from niche concern to market requirement, compliance with environmental norms becomes integral to market participation, shaping how vegetable oil is sourced, refined, and marketed across France.

Industrial Demand from Food Manufacturing and Bioeconomy

France’s food manufacturing sector is among the most advanced in Europe, with major players in bakery, dairy, snacks, and ready-to-eat meals requiring large volumes of refined vegetable oils. Sunflower, rapeseed, and palm oil derivatives are widely used for frying, texture enhancement, emulsification, and flavor carrying. These oils must meet precise technical specifications, including heat stability, oxidative resistance, and neutral sensory profiles. French companies are also increasingly incorporating vegetable oils into functional food products, such as fortified spreads and high-protein bars, targeting health and wellness consumers. Outside of food, vegetable oil derivatives are integral to France’s expanding bioeconomy, supporting biolubricants, bio-based packaging, and personal care formulations. Innovations in green chemistry have opened new pathways for rapeseed and linseed oil to be processed into industrial-grade esters and polymers. With the government promoting circular economy principles, industries are adopting biodegradable and plant-based alternatives across sectors, from agriculture to cosmetics. Public procurement policies, EU funding, and carbon reduction incentives further support these transitions. As vegetable oil moves beyond culinary applications into industrial innovation, its market relevance continues to expand across a broad spectrum of sectors.

France Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

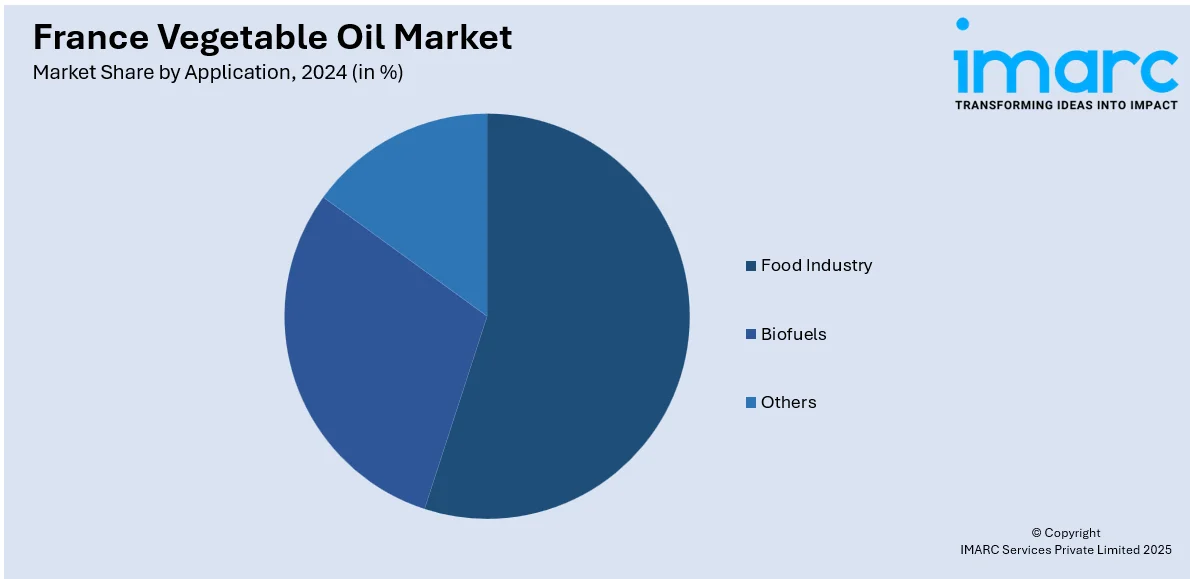

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Province Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Vegetable Oil Market News:

- On July 4, 2025, French agri-food group Avril announced the signing of an exclusivity agreement to acquire a rapeseed processing facility in Baleycourt, Grand Est, which processes approximately 400,000 tonnes of seeds annually. This acquisition aligns with Avril's strategic objective to strengthen its position in vegetable oil refining and biodiesel production, especially within one of France’s key rapeseed-growing regions. Avril aims to reinforce domestic oilseed capacity amid intensifying European competition in the vegetable oil sector.

France Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Provinces Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the France vegetable oil market on the basis of oil type?

- What is the breakup of the France vegetable oil market on the basis of application?

- What is the breakup of the France vegetable oil market on the basis of province?

- What are the various stages in the value chain of the France vegetable oil market?

- What are the key driving factors and challenges in the France vegetable oil market?

- What is the structure of the France vegetable oil market and who are the key players?

- What is the degree of competition in the France vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)