Freight Management System Market Size, Share, Trends and Forecast by Component, Transportation Mode, End User, and Region, 2025-2033

Freight Management System Market Size and Share:

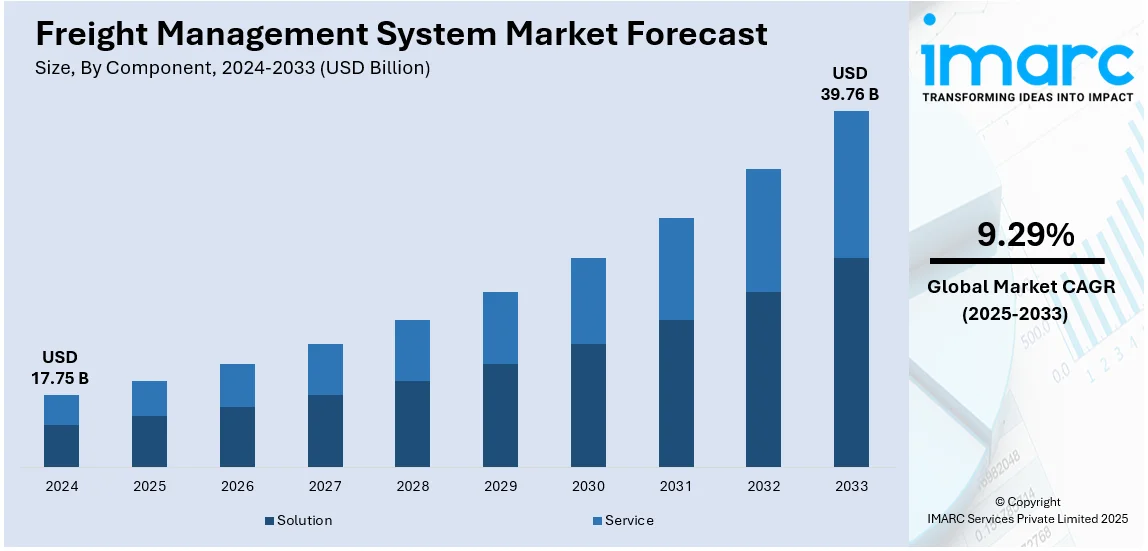

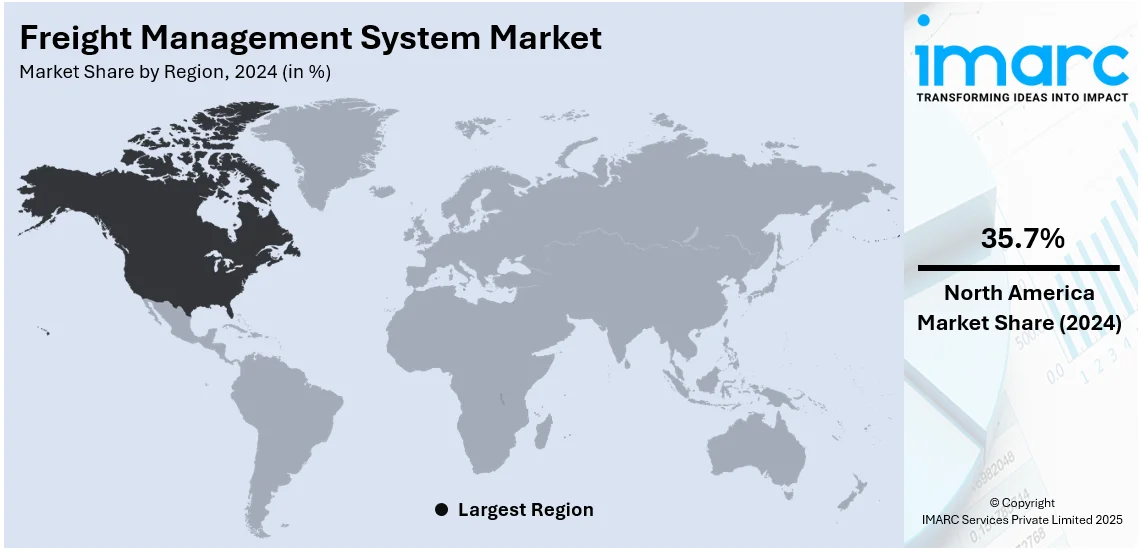

The global freight management system market size was valued at USD 17.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 39.76 Billion by 2033, exhibiting a CAGR of 9.29% from 2025-2033. North America currently dominates the market, holding a market share of over 35.7% in 2024. The growth of the North American region is driven by advanced logistics infrastructure, high e-commerce demand, widespread adoption of innovative technologies, and strong regulatory focus on sustainability and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.75 Billion |

| Market Forecast in 2033 | USD 39.76 Billion |

| Market Growth Rate 2025-2033 | 9.29% |

At present, the rising popularity of e-commerce, which requires efficient and reliable freight solutions to handle high shipping volumes and ensure timely deliveries, represent one of the key factors impelling the market growth. Besides this, the integration of technologies like artificial intelligence (AI), Internet of Things (IoT), and blockchain is improving supply chain visibility, enabling real-time tracking, and enhancing decision-making processes. Advanced freight management systems provide predictive analytics and performance metrics, enabling businesses to identify inefficiencies and improve decision-making. Furthermore, many businesses are adopting freight management systems to reduce operational costs by optimizing routes, automating processes, and minimizing fuel usage. Additionally, strategic alliances between logistics providers and technology companies are accelerating the development and deployment of innovative freight management solutions.

The United States is a key region in the market, driven by the rising number of online shopping platforms that require efficient logistics and freight management solutions to handle high shipping volumes and last-mile deliveries. Moreover, the extensive road, rail, and air freight infrastructure supports seamless logistics, creating a favorable environment for advanced freight management systems. Apart from this, the increasing adoption of specialized software tailored to meet the unique needs of specific industries is contributing to the market growth. These platforms centralize logistics operations, improve efficiency, and enhance decision-making through analytics and secure data management. These targeted solutions enable businesses to streamline complex supply chain processes and meet industry-specific challenges effectively. In 2024, Manitoba Corp. launched Freight130, a web-based freight management software designed to optimize logistics for recyclers, manufacturers, and traders. The platform centralizes shipments, bids, and vendor details while offering analytics and data security. It will be showcased at Scrap Expo from September 17-18 in Louisville, Kentucky.

Freight Management System Market Trends:

Rising Volume of Freight Being Transported

As the volume of freight grows, logistics and transportation operations become more intricate. For instance, according to an industrial report, the global volume of air freight has expanded steadily in recent years, reaching 65.6 Million metric tons in 2021. This figure was expected to reach 57.7 Million metric tons by 2023. Again, in May and June 2024, container imports increased 11.9% and 10.4%, respectively, as compared to 2023, according to supply chain software vendor Descartes. The volume was marginally lower than in previous months. The June Logistics Managers Index (LMI) reading for freight capacity was neutral rather than increasing, which is the first time the LMI has shown capacity growth since March 2022. Managing large quantities of goods across various regions and modes of transportation requires sophisticated solutions. FMS systems are equipped to handle this complexity by providing tools for efficient planning, tracking, and optimization of freight movements. These factors are expected to propel the freight management system market in the coming years.

Expansion of E-Commerce Industry

The rapid growth of e-commerce globally is leading to a rise in demand for efficient logistics and supply chain solutions. According to IMARC, the global e-commerce market size reached USD 21.1 trillion in 2023 and is projected to grow significantly, reaching USD 183.8 trillion by 2032, with a CAGR of 27.16% from 2024 to 2032. This remarkable growth is intensifying the need for advanced freight management systems, which play a crucial role in streamlining freight operations, optimizing inventory, and ensuring timely deliveries. These systems leverage cutting-edge technologies such as AI, IoT, and automation to provide real-time tracking, predictive analytics, and cost-efficient solutions. As businesses strive to meet user expectations for speed and reliability, freight management systems adoption is becoming essential. Additionally, sustainability-focused features in freight management systems are aligning with efforts to create eco-friendly and efficient supply chain practices.

Integration of Advanced Technologies

These technological advancements are transforming the way freight and cargo logistics are managed, offering greater efficiency, accuracy, and visibility throughout the supply chain. IoT technology involves the use of sensors and connected devices to gather real-time data from assets, vehicles, and cargo. Integration of IoT in FMS enables continuous monitoring of freight conditions, including temperature, humidity, and location. For instance, in March 2024, Irving-based OnAsset Intelligence deployed its Sentry 600 FlightSafe device as a dedicated aircraft-installed gateway. It can transform an airplane into a virtual connected warehouse and allows real-time visibility for shippers. These factors further positively influence the freight management system market forecast. Automation has emerged as a key component of contemporary FMS, drastically cutting down on manual data processing, which generates 20% of the logistics industry's yearly revenue. Order processing, shipment tracking, and billing are just a few of the operations that businesses can automate to improve operational efficiency and lower human error.

Freight Management System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global freight management system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, transportation mode, and end user.

Analysis by Component:

- Solution

- Planning

- Execution and Operations

- Control and Monitoring

- Service

- Consulting

- System Integration and Deployment

- Support and Maintenance

Solution planning, execution and operations, and control and monitoring) leads the market with 65.2% of market share in 2024. Solution dominates the market due to its ability to address critical operational challenges in logistics. It provided businesses with tools to optimize end-to-end freight processes. Advanced planning features enable effective route optimization, load balancing, and resource allocation, ensuring cost and time efficiency. Execution and operations solutions enhance real-time shipment tracking, carrier management, and seamless communication across stakeholders. Control and monitoring tools allow for early problem-solving and ensure timely delivery and high service standards. These solutions include advanced technologies such as AI, IoT, and data analytics, offering predictive insights and real-time visibility of supply chain operations. Increasing demand for automated systems to handle complex freight operations and the trend of efficiency, precision, and user experience is driving widespread acceptance of the solution segment.

Analysis by Transportation Mode:

- Rail Freight

- Road Freight

- Ocean Freight

- Air Freight

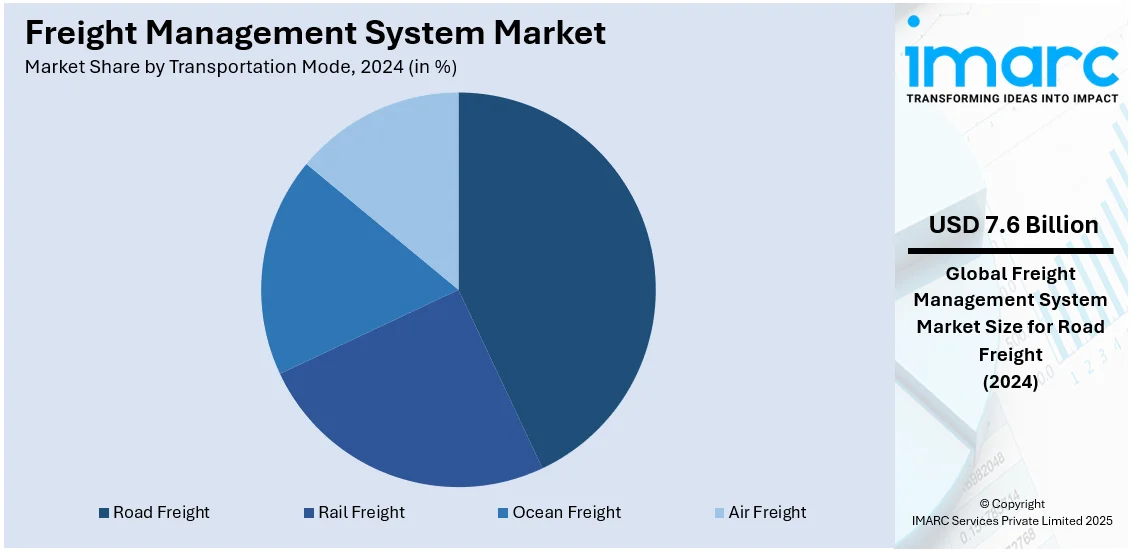

Road freight dominates the market with 42.6% of market share in 2024. Road freight is the largest segment attributed to its flexibility and ability to accommodate diverse transportation needs. It offers extensive connectivity across regions, making it ideal for short and medium distances as well as last-mile delivery. Road freight provides the advantage of door-to-door service, ensuring goods reach their destinations without the need for additional transfers. Its adaptability to different cargo types, including perishable goods, heavy machinery, and small parcels, adds to its appeal. Advanced freight management systems are further enhancing road freight by offering real-time tracking, optimized route planning, and efficient fuel management, reducing costs and improving delivery times. The segment’s reliance on modern technologies such as global positioning systems (GPS) and fleet management software is helping carriers streamline operations and meet the growing individual and business demands for reliable and timely logistics services.

Analysis by End User:

- Third-party Logistics

- Forwarders

- Brokers

- Shippers

- Carriers

Third-party logistics (3PL) is the largest segment, driven by its role in offering specialized and cost-efficient logistics services to businesses. 3PL providers manage a wide range of supply chain activities, including transportation, warehousing, and distribution, allowing companies to focus on core operations. The adoption of advanced freight management systems by 3PLs enhances their ability to optimize routes, improve inventory management, and provide real-time tracking for clients. These systems enable seamless coordination between carriers, shippers, and warehouses, ensuring timely deliveries and reducing operational inefficiencies. The growing complexity of global supply chains and the increasing demand for customized logistics solutions are making 3PL providers essential partners for businesses across industries. Their expertise in leveraging technology and economies of scale positions them as a crucial segment, supporting the market growth by meeting the diverse needs of enterprises and ensuring high levels of user satisfaction.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounted for the largest market share of 35.7% in 2024. North America leads the market, driven by its highly developed logistics infrastructure and the widespread adoption of advanced technologies. The region’s strong focus on enhancing supply chain efficiency is leading to investments in freight management solutions that optimize operations and improve transparency. The extensive e-commerce activity in North America generates notable demand for real-time tracking, route optimization, and streamlined freight operations. Additionally, the presence of leading freight management system providers and their partnerships with logistics companies contribute to the segment's growth. Regulations emphasizing sustainable practices and reducing emissions further push companies to adopt advanced systems for better fuel efficiency and route planning. In 2024, Hangar A launched Version 2.0 of its Express Cargo Management System (eCMS), introducing an advanced dock-to-door air shipping platform with real-time tracking through its Command Center Console. This innovation enables businesses to streamline logistics, expand market reach, and offer next-day and two-day delivery across North America. The platform reduces the need for multiple distribution centers, saving costs and enhancing operational efficiency.

Key Regional Takeaways:

United States Freight Management System Market Analysis

United States accounted for 77.50% of the total North American market share. The increasing demand for operational efficiency in logistics and the uptake of digital technologies are driving the freight management system (FMS) market in the United States. Digital Commerce 360's analysis of U.S. Department of Commerce data shows that e-commerce in the United States accounted for 22.0% of total retail sales. E-commerce sales in

the United States increased by 7.6% from USD 1.040 Trillion in 2022 to around USD 1.119 Trillion in 2023. In the meantime, overall retail sales increased 3.8% from roughly USD 4.904 Trillion in 2022 to almost USD 5.088 Trillion in 2023. Moreover, the demand for efficient freight solutions has increased due to the industry's rapid growth. Companies are spending money on FMS to guarantee on-time delivery, lower transportation costs, and increase supply chain visibility.

Freight modernization is supported by government programs, including as infrastructure upgrades made possible by the Infrastructure Investment and Jobs Act. Furthermore, real-time tracking and predictive analytics are made possible by the growing usage of IoT and AI, which improves supply chain efficiency. Owing to their affordability and scalability, cloud-based FMS solutions are becoming more and more popular, especially among small and medium-sized businesses (SMEs).

Additionally, by optimizing routes and fuel consumption, FMS is being adopted to lower carbon footprints because of the sustainability movement. Further propelling market expansion is the incorporation of blockchain technology, which enhances security and transparency in freight operations. The need for electric and driverless trucks in freight transportation is also driving FMS innovation to keep up with these developments.

Europe Freight Management System Market Analysis

The European market for goods management systems benefits from the region's advanced transportation infrastructure and strong emphasis on sustainability. Companies are being compelled by laws like the European Green Deal to implement eco-friendly logistics techniques, which is why FMS is being used to reduce emissions and boost fuel economy.

The necessity for advanced FMS to manage intricate supply chain operations is increased by the growth of cross-border trade inside the European Union. Blockchain, IoT, and AI are examples of technologies that are being widely used to increase efficiency and transparency. The expansion of e-commerce, particularly in nations like Germany, the UK, and France, increases the need for FMS to satisfy client demands for precise and timely delivery. Europe accounts for over 24% of Amazon's worldwide sales, and the company dominates the global e-commerce market, as per an industrial report. Amazon is a major contributor to jobs in European e-commerce as a contractor for over 275,000 vendors. Furthermore, market expansion is supported by investments in intelligent logistics hubs and developments in multimodal transportation networks.

Asia Pacific Freight Management System Market Analysis

The goods management system market in Asia-Pacific is expanding quickly because of the region's substantial trade volumes and thriving e-commerce industry. According to the data by Asian Development Bank, the retail and business-to-consumer (B2C) e-commerce markets are dominated by Asia and the Pacific, which is predicted to account for 61% of the global industry by 2025. China, India, Japan, and other nations are making significant investments in cutting-edge logistics technologies to optimize supply chains. Strong FMS solutions are becoming more important because of the growth of cross-border trade accords like the Regional Comprehensive Economic Partnership (RCEP).

The region’s vast geography necessitates efficient freight solutions to manage diverse transportation networks. Additionally, SMEs' increasing use of cloud-based and AI-driven FMS to enhance logistics operations contributes to market growth. Government programs to improve logistical infrastructure, particularly in developing nations, help to accelerate economic growth.

Latin America Freight Management System Market Analysis

The market for freight management systems in Latin America is expanding because of rising e-commerce and logistics infrastructure investments. According to an industrial report, pandemic drove a lot of e-commerce growth, before the pandemic, e-commerce made up about 5% of all Latin American sales; now, it accounts for an astounding 13%. Advanced FMS is being adopted by nations like Brazil and Mexico to lower costs and increase supply chain efficiency. The region's emphasis on incorporating sustainable logistics techniques complements FMS's capacity to optimize routes and cut emissions. Opportunities for the implementation of FMS are being created by trade agreements like Mercosur and the Pacific Alliance, which promote cross-border freight activities. Furthermore, the emergence of cloud-based solutions meets the demands of SMEs and propels regional market penetration.

Middle East and Africa Freight Management System Market Analysis

The market for goods management systems is growing across the Middle East and Africa because of increased commerce and logistical activity, particularly in the Gulf Cooperation Council (GCC) nations. The demand for FMS is increased by the growth of trade hubs like Dubai and investments in infrastructure like rail networks. The expansion of e-commerce and government-sponsored initiatives to diversify the economy promote the use of contemporary logistics technologies. Adoption in the local logistics sector is also supported by the requirement for effective route optimization and real-time tracking, which complements FMS capabilities. The UAE now has the most developed e-commerce market in the Middle East and North Africa, with an estimated 23% annual growth between 2018 and 2022, according to a joint study by Dubai Economy and Visa.

Competitive Landscape:

Key players in the market are focusing on developing advanced solutions to streamline logistics and enhance supply chain visibility. They are integrating technologies like AI, ML, and IoT to offer predictive analytics and real-time tracking. Collaboration with logistics providers and businesses is enabling the customization of solutions to meet specific industry needs. Cloud-based platforms and automation tools are being prioritized to improve operational efficiency and reduce costs. Investments in research operations are helping introduce innovative features, while strategic partnerships and acquisitions are expanding market reach and service portfolios. In March 2024, Irving-based OnAsset Intelligence deployed its Sentry 600 FlightSafe device as a dedicated aircraft-installed gateway. It can transform an airplane into a virtual connected warehouse and allows real-time visibility for shippers.

The report provides a comprehensive analysis of the competitive landscape in the freight management system market with detailed profiles of all major companies, including:

- Blue Yonder Group Inc. (Panasonic Holdings Corporation)

- C.H. Robinson Worldwide Inc.

- Ceva Logistics (CMA CGM Group)

- DB Schenker (Deutsche Bahn AG)

- e2open LLC (E2open Parent Holdings Inc.)

- Kuehne + Nagel International AG

- McLeod Software

- MercuryGate International Inc.

- Oracle Corporation

- SAP SE

- The Descartes Systems Group Inc.

- United Parcel Service of America Inc.

- Werner Enterprises Inc.

Latest News and Developments:

- September 2024: CEVA Logistics announced taking over CMA CGM’s freight management as part of a new agreement to strengthen their partnership. This move will help CEVA grow its business, while allowing CMA CGM to concentrate on its main shipping services.

- September 2024: A new service called Connect Europe was introduced by XPO Logistics with the goal of making managing international shipments across 25 European nations easier. By giving businesses of all sizes a single point of contact for all of their shipping requirements, the service seeks to simplify shipping. This makes it easier to navigate the difficulties of international transit and manage several middlemen.

- June 2024: DP World Logistics launched its international air freight forwarding service. With the addition of air freight services, DP World logistical aims to provide a full set of logistical choices.

Freight Management System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Transportation Modes Covered | Rail Freight, Road Freight, Ocean Freight, Air Freight |

| End Users Covered | Third-party Logistics, Forwarders, Brokers, Shippers, Carriers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Yonder Group Inc. (Panasonic Holdings Corporation), C.H. Robinson Worldwide Inc., Ceva Logistics (CMA CGM Group), DB Schenker (Deutsche Bahn AG), e2open LLC (E2open Parent Holdings Inc.), Kuehne + Nagel International AG, McLeod Software, MercuryGate International Inc., Oracle Corporation, SAP SE, The Descartes Systems Group Inc., United Parcel Service of America Inc., Werner Enterprises Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the freight management system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global freight management system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the freight management system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight management system market was valued at USD 17.75 Billion in 2024.

The freight management system market is projected to exhibit a CAGR of 9.29% during 2025-2033, reaching a value of USD 39.76 Billion by 2033.

Key factors driving the market include the rise of e-commerce, the rapid integration of advanced technologies such as artificial intelligence (AI) and Internet of Things (IoT), increased demand for efficient logistics, heightened route optimization, and cost reduction in freight operations.

North America currently dominates the freight management system market, accounting for a share exceeding 35.7%. This dominance is fueled by advanced logistics infrastructure, high e-commerce demand, and widespread technology adoption.

Some of the major players in the freight management system market include Blue Yonder Group Inc. (Panasonic Holdings Corporation), C.H. Robinson Worldwide Inc., Ceva Logistics (CMA CGM Group), DB Schenker (Deutsche Bahn AG), e2open LLC (E2open Parent Holdings Inc.), Kuehne + Nagel International AG, McLeod Software, MercuryGate International Inc., Oracle Corporation, SAP SE, The Descartes Systems Group Inc., United Parcel Service of America Inc., and Werner Enterprises Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)