Frozen Food Packaging Market Size, Share, Trends and Forecast by Type, Product, Material, and Region, 2025-2033

Frozen Food Packaging Market Size and Share:

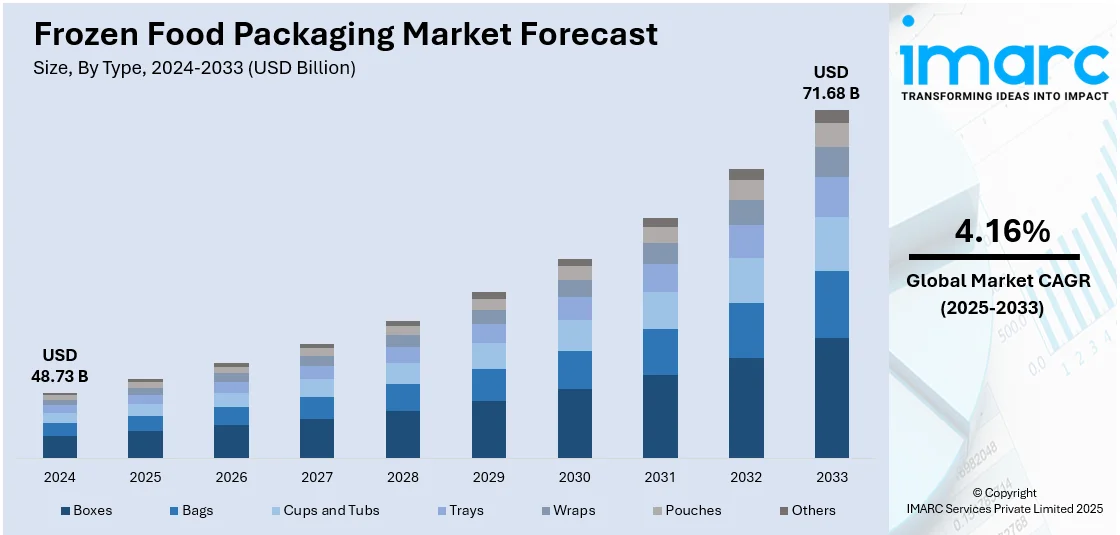

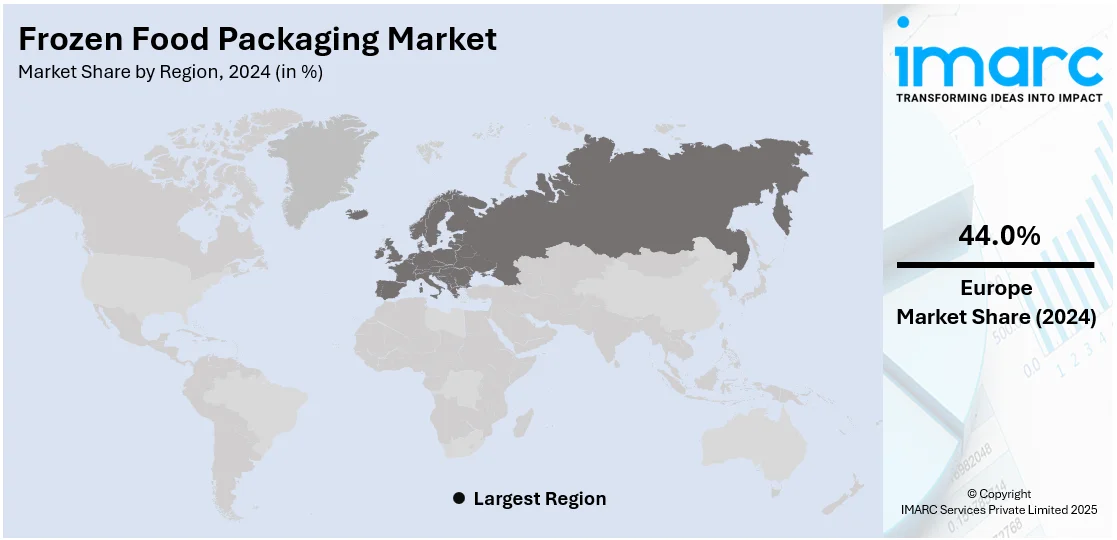

The global frozen food packaging market size was valued at USD 48.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 71.68 Billion by 2033, exhibiting a CAGR of 4.16% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 44.0% in 2024. The rapid product development and marketing efforts by frozen food companies, the increasing awareness of the nutritional value of frozen fruits and vegetables, and the customized packaging solutions for different frozen food product types and sizes are some of the factors propelling the frozen food packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.73 Billion |

|

Market Forecast in 2033

|

USD 71.68 Billion |

|

Market Growth Rate 2025-2033

|

4.16% |

Key drivers in the frozen food packaging market include the growing demand for convenient, ready-to-eat meals and the need for extended shelf life. Increasing consumer preference for frozen foods driven by busy lifestyles is fueling market growth. Additionally, advancements in packaging technology such as improved barrier properties, eco-friendly materials and innovative designs are enhancing product preservation and sustainability. For instance, in August 2023, Ahlstrom and The Paper People announced the launch of a sustainable fibre-based packaging solution for frozen food designed to replace fossil-based plastics. The recyclable packaging features FDA-approved Paperlock G technology and Ahlstrom's FluoroFree barrier for grease resistance compatible with existing equipment and available in various printing options. Stringent food safety regulations and rising awareness of maintaining product quality are also contributing to the positive frozen food packaging market outlook across the world.

Key trends in the United States frozen food packaging market include the rising demand for sustainable packaging solutions driven by consumer preference for eco-friendly materials. Innovations such as recyclable, biodegradable and compostable packaging are gaining traction. For instance, in January 2024, Accredo Packaging and Presto Products' Fresh-Lock announced their partnership to launch a sustainable stand-up pouch made with over 50% Post-Consumer Recycled (PCR) content suitable for food packaging. This innovative pouch features a child-resistant closure and highlights advancements in flexible packaging for various products including frozen foods. Additionally, advancements in smart packaging technologies such as temperature indicators and QR codes for traceability are enhancing convenience and safety. The shift towards single-serve and portion-controlled packaging to cater to busy lifestyles is also influencing the market along with the growing preference for premium frozen food products.

Frozen Food Packaging Market Trends:

Rapid packaging innovations

Rapid packaging innovations have significantly impacted the frozen food industry thereby enhancing consumer experiences. Manufacturers are constantly exploring new materials, technologies and designs to improve the quality, safety and convenience of frozen food packaging. Innovative packaging materials such as advanced films and laminates with enhanced barrier properties ensure optimal insulation and protection against moisture, air and odors preserving the integrity of frozen food products. Vacuum sealing and modified atmosphere packaging (MAP) techniques prolong shelf life and reduce food waste. Moreover, microwave-safe and oven-safe packaging options offer added convenience allowing consumers to cook frozen meals directly in the packaging saving time and effort. Portion-controlled and single-serving packaging meets the demands of busy individuals seeking quick and easy meal solutions.

Rising awareness of food waste reduction

The rising awareness of food waste reduction is creating a positive outlook for the market. For instance, as of the end of 2023, 2.5 Billion Tons of food is lost or wasted globally each year. Consumers are increasingly concerned about the environmental impact of excessive food wastage and are seeking ways to minimize it. As a result, frozen food packaging has evolved to address this concern. Packaging innovations, such as portion-controlled sizes, resealable bags, and microwave-safe containers, reduce food waste by enabling consumers to use only what they need and safely store the rest for later consumption. Additionally, manufacturers are implementing eco-friendly and sustainable packaging materials, aligning with consumers' values and reducing the environmental footprint of frozen food products. The awareness of food waste reduction has also led to increased emphasis on clear labeling and storage instructions, helping consumers make informed decisions about product shelf life and proper usage. The growing consciousness about food waste has prompted the market to embrace more sustainable practices, offering solutions that align with consumers' values and contribute to a more sustainable future.

Growing demand for sustainable and eco-friendly packaging materials

The growing demand for sustainable and eco-friendly packaging materials is offering lucrative opportunities for the market. According to a survey, 54% of consumers consider sustainable packaging when purchasing a product. As consumers become more environmentally conscious, they seek packaging options that align with their values and contribute to reducing the environmental impact. Sustainable packaging materials, such as biodegradable films, compostable trays, and recycled paperboard, are gaining popularity as they offer reduced carbon footprints and are less environmentally harmful. Consumers are increasingly choosing frozen food products packaged in eco-friendly materials to minimize their contribution to plastic waste and landfill pollution. In response to this demand, frozen food manufacturers are embracing sustainable packaging solutions to appeal to environmentally aware consumers. By adopting eco-friendly packaging materials, companies demonstrate their commitment to sustainability and environmental responsibility, building brand trust and loyalty. The shift towards sustainable packaging benefits the environment and enhances the overall image and reputation of frozen food brands, positioning them as responsible and forward-thinking industry players.

Frozen Food Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global frozen food packaging market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product, and material.

Analysis by Type:

- Boxes

- Bags

- Cups and Tubs

- Trays

- Wraps

- Pouches

- Others

Boxes stand as the largest type in 2024, holding around 34.3% of the market. Boxes dominate the Frozen Food Packaging Market because they offer better protection and storage for various frozen goods. Boxes have great insulation which keeps temperature changes from impacting food quality. Boxes are also flexible, able to fit different product sizes and shapes, from frozen meals to snacks. With their strong structure boxes provide safe handling when transported and stored. Furthermore, boxes are cost-effective and customizable allowing brands to enhance product visibility through printed designs while meeting sustainability demands with recyclable materials.

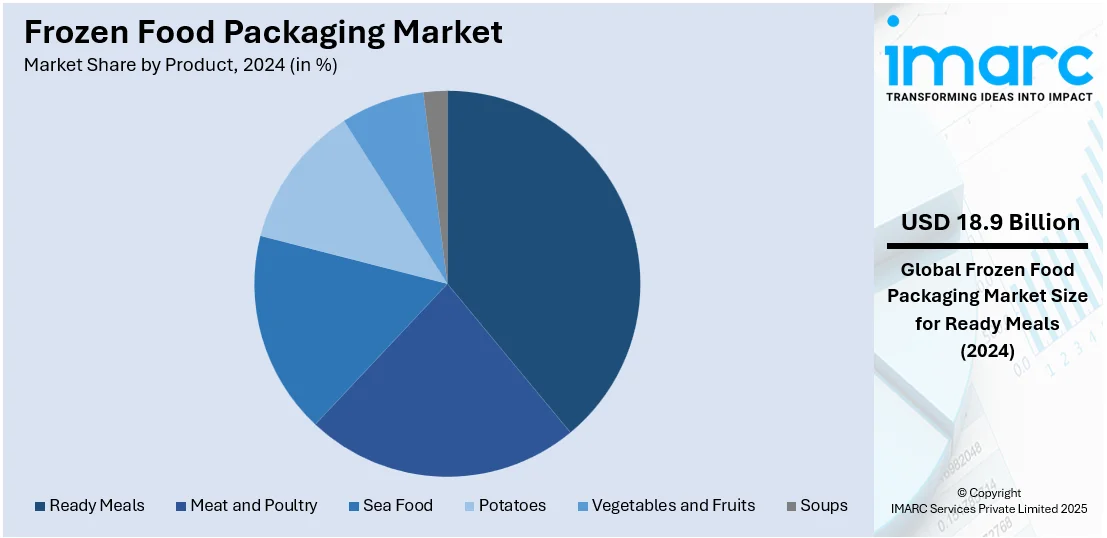

Analysis by Product:

- Ready Meals

- Meat and Poultry

- Sea Food

- Potatoes

- Vegetables and Fruits

- Soups

Ready meals lead the market with around 38.7% of market share in 2024. Ready meals lead the Frozen Food Packaging Market due to the increasing consumer demand for convenient, time-saving meal options. As busy lifestyles drive the preference for quick and easy meals, frozen ready meals offer a solution without compromising on taste or nutrition. Packaging innovations, such as portion-controlled and microwave-safe materials, enhance convenience and product appeal. Additionally, advancements in packaging technology ensure extended shelf life, freshness, and food safety, further fueling the growth of frozen ready meals in the market.

Analysis by Material:

- Plastics

- Paper and Paperboards

- Metals

- Others

Plastics lead the market with around 56.5% of market share in 2024. Plastics dominate the Frozen Food Packaging Market because they are versatile, durable, and inexpensive. They have very good moisture and air barrier characteristics, which protect the quality and freshness of frozen foods for long durations. Plastics, like polyethylene and polypropylene, are light in weight, convenient to handle, and can be shaped and sized into many forms, which make them well suited for packing frozen meals, snacks, and vegetables. In addition, innovations in recycled plastic materials resonate with increasing demand from consumers for environmentally friendly packaging solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 44.0%. Europe accounts for the largest share of the frozen food packaging market due to the region's strong demand for convenience foods and a well-established frozen food industry. The growing preference for ready-to-eat meals, along with busy lifestyles, drives the need for efficient and durable packaging solutions. Additionally, Europe is a leader in sustainable packaging initiatives, with increasing consumer demand for eco-friendly materials like recyclable plastics and biodegradable options. Stringent food safety regulations also contribute to the region's dominant market position.

Key Regional Takeaways:

North America Frozen Food Packaging Market Analysis

The North American frozen food packaging market is witnessing significant growth driven by increasing consumer demand for convenient, ready-to-eat meals and sustainable packaging solutions. As environmental concerns rise there is a shift toward eco-friendly materials such as biodegradable, recyclable and compostable options. Manufacturers are innovating with packaging technologies like plant-based coatings and water-based inks to maintain food safety while enhancing sustainability. Furthermore, advancements in packaging formats like fiber-based trays, recyclable films and biopolymer films are gaining traction meeting consumer demand for reduced plastic use. Government regulations and corporate sustainability commitments are fueling investments in advanced technologies while the focus on product preservation and reducing waste is pushing the market towards more sustainable and efficient packaging solutions. The trend towards sustainability is expected to drive long-term frozen food packaging market growth.

United States Frozen Food Packaging Market Analysis

In 2024, the United States accounted for over 87.90% of the frozen food packaging market in North America. United States is witnessing increasing frozen food packaging adoption due to growing demand for sustainable and eco-friendly packaging materials. According to a survey, about 50% of US consumers are willing to pay more for sustainable packaging. Consumers are actively seeking packaging solutions that reduce environmental impact, leading manufacturers to innovate with biodegradable, recyclable, and compostable materials. Companies are integrating plant-based coatings and water-based inks to enhance sustainability while maintaining food safety. Government regulations and corporate sustainability commitments are driving investments in advanced frozen food packaging technologies that minimize carbon footprints. Innovations such as recyclable films, fiber-based trays, and compostable pouches are gaining traction, ensuring product preservation while meeting consumer expectations. The shift toward minimal plastic usage is encouraging the adoption of paper-based packaging, moulded pulp containers, and biopolymer films. Increasing demand for sustainable and eco-friendly packaging materials is fostering collaborations between packaging firms and food manufacturers to develop next-generation frozen food packaging solutions. Rising consumer awareness and stringent environmental policies are pushing businesses to adopt frozen food packaging designs that align with sustainability goals, ensuring long-term market growth.

Asia Pacific Frozen Food Packaging Market Analysis

Asia-Pacific is experiencing rising frozen food packaging adoption due to growing food wastage, necessitating enhanced packaging solutions to extend shelf life and maintain product integrity. For instance, the amount of food wasted in Indian households every year could feed almost 377 Million people. With an average of 55 kg food waste generated per capita annually by households. The increasing preference for frozen food options among urban consumers is propelling advancements in vacuum-sealed, modified atmosphere, and moisture-resistant packaging. Growing concerns over food wastage are driving the development of antimicrobial packaging that prevents bacterial growth, ensuring extended usability. Innovations in portion-controlled and single-serve packaging formats are reducing wastage, catering to evolving consumer habits. The demand for robust frozen food packaging solutions is accelerating as businesses seek to enhance product visibility, maintain nutritional value, and prevent contamination. Technological advancements, such as temperature-sensitive indicators and active packaging solutions, are addressing food wastage concerns by providing real-time freshness tracking. As food wastage continues to be a significant challenge, companies are prioritizing frozen food packaging solutions that enhance efficiency and sustainability.

Latin America Frozen Food Packaging Market Analysis

Latin America is experiencing growing frozen food packaging adoption due to growing ready-to-eat meals demands due to growing disposable income. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Increasing consumer spending is fueling the demand for convenient meal solutions, propelling investments in advanced packaging technologies that enhance product longevity. Ready-to-eat frozen meals are becoming increasingly popular, necessitating packaging solutions that ensure easy storage, portion control, and freshness retention. Manufacturers are adopting lightweight, easy-to-open, and resealable packaging options that align with evolving consumer lifestyles. The demand for frozen food packaging is rising as disposable income growth supports the expansion of ready-to-eat meal options across different demographics. Companies are focusing on packaging innovations that enhance food safety, improve convenience, and minimize waste. As disposable income continues to increase, frozen food packaging manufacturers are prioritizing functional and sustainable materials that align with market expectations.

Middle East and Africa Frozen Food Packaging Market Analysis

Middle East and Africa is witnessing an increase in frozen food packaging adoption due to growing tourism. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. As tourism continues to grow, the frozen food packaging market demand for high-quality frozen food packaging solutions is also rising to meet the needs of hospitality businesses and travel-related food services. Growing frozen food packaging adoption is influenced by the necessity for durable and tamper-proof packaging that ensures food safety during transportation and storage. Hotels, airlines, and restaurants are relying on advanced frozen food packaging technologies to maintain food freshness while catering to diverse consumer preferences. The rise in tourism is encouraging businesses to invest in frozen food packaging that extends shelf life and reduces spoilage risks. Growing frozen food packaging adoption is further supported by innovations in leak-proof and temperature-controlled materials, which help in preserving food quality during travel.

Competitive Landscape:

The frozen food packaging market is highly competitive with numerous players striving to meet the increasing demand for convenience and sustainability. Companies are focusing on innovation developing packaging solutions that extend product shelf life while minimizing environmental impact. The adoption of ecofriendly materials such as recyclable films, biodegradable trays and compostable pouches is a key differentiator in the market. Manufacturers are also integrating advanced technologies like temperature-sensitive indicators, active packaging and moisture-resistant films to ensure food safety and maintain nutritional value. Businesses are collaborating with food manufacturers to create customized packaging solutions that align with changing consumer preferences and regulatory standards. The market is witnessing increased competition as companies seek to offer functional, sustainable and cost-effective packaging options to capture a larger share of the growing frozen food segment.

The report provides a comprehensive analysis of the competitive landscape in the frozen food packaging market with detailed profiles of all major companies, including:

- Amcor plc

- Berry Global Inc.

- Cascades Inc.

- Crown Holdings Inc.

- Huhtamäki Oyj

- ProAmpac

- Smurfit Kappa Group plc

- Sonoco Products Company

- WestRock Company

Latest News and Developments:

- January 2025: Royal Greenland has launched fully recyclable packaging for its frozen fish products, transitioning from PE-coated cardboard to a water-based coating. Developed in collaboration with Schur, this new packaging can endure plate freezing without adhering to the fish or freezers. Already in use on trawlers, it promotes easy recycling while adhering to industry standards. The company aims to improve sustainability while maintaining functionality.

- November 2024: Korozo Group is displaying its innovative flexible packaging solutions at Pack Expo 2024 in Chicago. Their range includes skin films, thermoforming films, and various pouches suitable for multiple food applications, including fresh and frozen products, dairy, and bakery items. Visitors are invited to check out Korozo’s offerings at Lakeside Upper, Stand 7960.

- October 2024: Lamb Weston has announced is partnership with SABIC and Oerlemans Plastics to launch sustainable, bio-based packaging for frozen potatoes. This packaging is made up of at least 60% bio-renewable polymers sourced from used cooking oil, which reduces its carbon footprint by 30%. The durable multilayer PE film is made using SABIC’s certified bio-HDPE and mLLDPE polymers and complies with European and U.S. food safety regulations.

- July 2024: Dole Packaged Foods has revamped its frozen Smoothie Bowls packaging by replacing plastic tubs with paper-based options. This change results in a 97% reduction in plastic use, eliminating 130 metric tons annually. This initiative supports Dole’s objective to eliminate petrochemical-based plastics by 2025, and the new packaging began reaching U.S. stores in July 2024.

- February 2024: American Packaging Corporation (APC) has introduced a new RE™ Design for Recycle technology for flexible packaging of frozen foods. This all-polyethylene (PE) packaging replaces non-recyclable laminates without compromising production efficiency or puncture resistance. It is designed for pillow bags with fin-seals and operates on VFFS equipment at speeds of up to 90 packages per minute. The design complies with APR guidelines and has received a pre-qualification letter from How2Recycle.

Frozen Food Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Boxes, Bags, Cups and Tubs, Trays, Wraps, Pouches, Others |

| Products Covered | Ready Meals, Meat and Poultry, Sea Food, Potatoes, Vegetables and Fruits, Soups |

| Materials Covered | Plastics, Paper and Paperboards, Metals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, Berry Global Inc., Cascades Inc., Crown Holdings Inc., Huhtamäki Oyj, ProAmpac, Smurfit Kappa Group plc, Sonoco Products Company, WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the frozen food packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global frozen food packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the frozen food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frozen food packaging market was valued at USD 48.73 Billion in 2024.

IMARC estimates the frozen food packaging market to reach USD 71.68 Billion by 2033, exhibiting a CAGR of 4.16% during 2025-2033.

Key factors driving the frozen food packaging market include growing consumer demand for convenient, ready-to-eat meals, increasing awareness of food safety and freshness preservation, rising preference for sustainable and eco-friendly packaging solutions, and innovations in packaging technologies that enhance product shelf life and reduce environmental impact.

Europe currently dominates the frozen food packaging market due to the strong demand for frozen food, advancements in packaging technologies, and a growing focus on sustainability and eco-friendly solutions in packaging.

Some of the major players in the frozen food packaging market include Amcor plc, Berry Global Inc., Cascades Inc., Crown Holdings Inc., Huhtamäki Oyj, ProAmpac, Smurfit Kappa Group plc, Sonoco Products Company, WestRock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)