Fruit Beer Market Size, Share, Trends and Forecast by Fruit-Flavor, Sales Channel, and Region, 2025-2033

Fruit Beer Market Size, Share, Growth and Report:

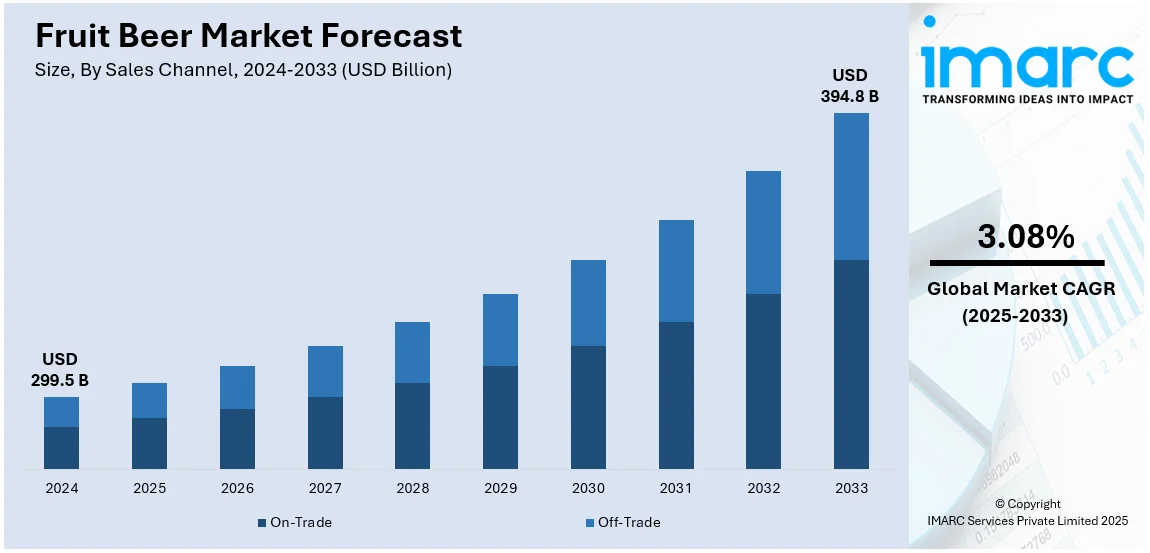

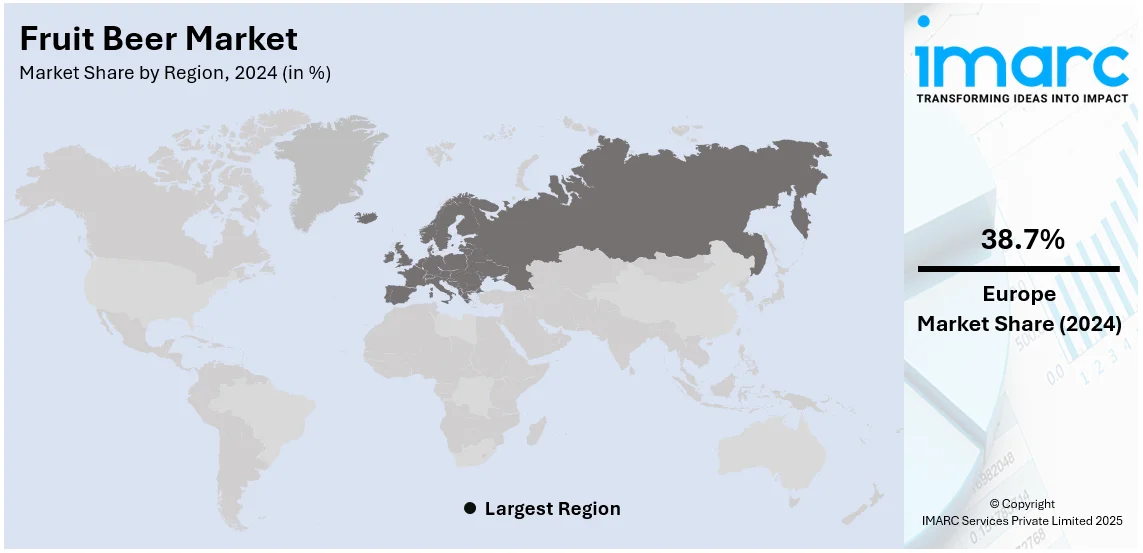

The global fruit beer market size was valued at USD 299.5 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 394.8 billion by 2033, exhibiting a CAGR of 3.08% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 38.7% in 2024. The fruit beer market share is primarily driven by the changing palate of consumers, the increasing demand for unique and flavorful beverages, the rise of the craft beer movement, the widespread availability of fruit beers, and the growing marketing and branding strategies adopted by major market players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 299.5 Billion |

|

Market Forecast in 2033

|

USD 394.8 Billion |

| Market Growth Rate (2025-2033) | 3.08% |

The global fruit beer market growth is being increasingly driven by the rising consumer preference for flavored and innovative alcoholic drinks. As individuals seek unique drinking experiences, fruit beers, which combine the refreshing taste of fruit with traditional beer, are gaining popularity. Additionally, the rising demand for craft beers, known for their variety and creativity, is contributing substantially to industry expansion. According to the IMARC Group, the global craft beer market is projected to exhibit a CAGR of 8.74% during 2025-2033. Besides this, health-conscious consumers are also supporting market growth, as fruit beers often contain fewer calories compared to other alcoholic drinks, contributing to their widespread popularity.

The United States has emerged as a key regional market for craft beers, driven by the growing interest in diverse, refreshing alcoholic beverages among younger consumers. Fruit beers are catering to these preferences by blending traditional brewing techniques with fruity flavors. The rise of the craft beer movement has further popularized this trend, as local breweries experiment with diverse fruit flavors to create distinctive brews. As per a report by the IMARC Group, the United States craft beer market is forecasted to grow at a CAGR of 3.42% during 2025-2033. In addition, the rise of social media and influencer culture has also helped promote fruit beers through lifestyle trends, creating greater awareness and interest.

Fruit Beer Market Trends

Increasing product demand among consumers

The fruit beer market trends indicate that currently, numerous individuals worldwide favor fruit beer, which is both palatable and beneficial for health, as it contains fruit extracts that are rich in minerals, vitamins, folic acid, and fiber. As a result, consumers are increasingly seeking innovative and flavorful non-alcoholic beverages, driven by an eagerness to explore new flavors. The non-alcoholic beverage market reached USD 971.7 Billion in 2024 and is expected to exhibit a growth rate of 4.31% during 2025-2033, according to industry reports. In addition, as consumer awareness grows, consumer preferences are shifting toward non-alcoholic or low-alcohol beers. As a result, fruit beer industry suppliers are developing new flavors of non-alcoholic or low-alcohol beverages to fulfill the growing demand for fruit beer in these segments, thereby broadening the overall fruit beer market scope.

Growth and expansion of online channels

The global expansion of online platforms and e-commerce is enabling fruit beer retailers to expand their distribution channels and provide their products through online retail, which is contributing to a positive fruit beer market outlook. As per the IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024 and is forecasted to exhibit a CAGR of 25.83% during 2025-2033. Unlike traditional retail establishments, e-commerce retailers offer faster delivery, additional deals, payment options, and enhanced brand visibility. Furthermore, online retailers enable buyers to quickly purchase fruit beers from various brew series on a single platform. Retailing fruit beer through these platforms also allows retailers to bypass the significant investment required for physical storefronts, which, in turn, is providing an impetus to the market.

Growing health-conscious consumer base

The fruit beer market demand is also driven by a heightened sense of awareness about health and wellness. For the most part, fruit beers are regarded as lighter options as compared to heavy, high-calorie regular beers and tend to attract healthier consumers seeking to indulge their cravings. The perceived natural ingredients found in fruit beers, such as real fruit juice or natural fruit extracts, are also attractive to consumers seeking products with clean-label ingredients that meet their health-conscious lifestyle choices. According to industry reports, the global clean label ingredients market reached USD 52.9 Billion in 2024 and is projected to grow at a CAGR of 5.3% during 2025-2033. This general trend toward healthier, lower-calorie alcoholic drinks is helping in the wider acceptance of fruit beers across the markets of the world, thus propelling their sales.

Fruit Beer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fruit beer market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on fruit-flavor and sales channel.

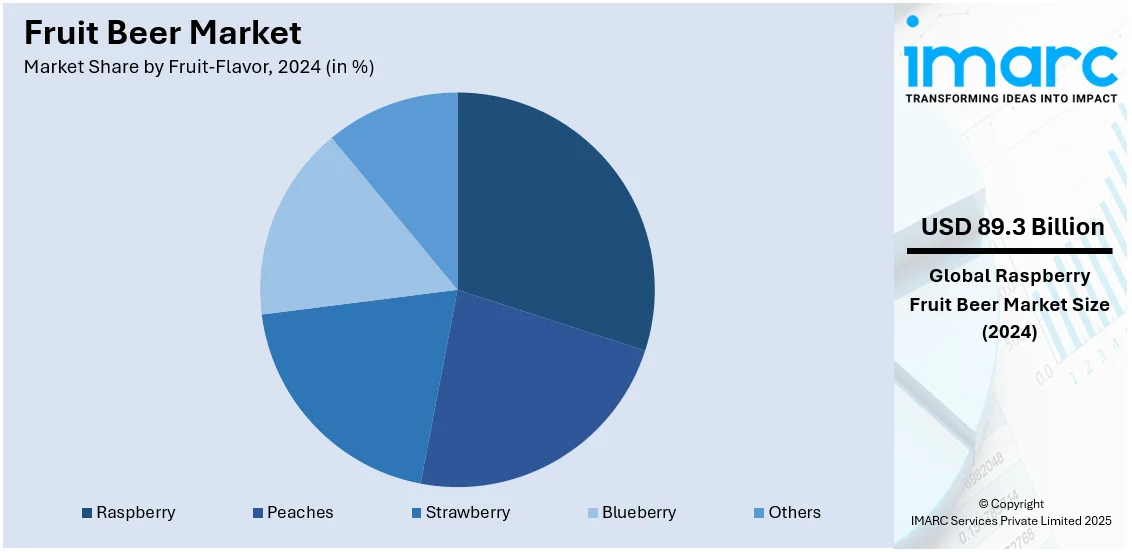

Analysis by Fruit-Flavor:

- Raspberry

- Peaches

- Strawberry

- Blueberry

- Others

Raspberry stands as the largest component in 2024, holding around 29.8% of the market share. Raspberry fruit beer is projected to be the most popular flavor due to its great nutritional benefits, such as low-calorie content and high concentrations of fiber, vitamins, and minerals. Furthermore, individuals are encouraged to buy such products as raspberries have remarkable flavor attributes. Moreover, raspberries contain a high concentration of vital elements, particularly potassium. Potassium is required for normal cardiac function and has been shown to modulate blood pressure. Raspberries also contain omega-3 fatty acids, which can help prevent strokes and heart disease. These factors are driving the popularity of raspberries in the market, which, in turn, is creating a positive fruit beer industry outlook.

Analysis by Sales Channel:

- On-Trade

- Pubs

- Bars

- Restaurants

- Others (Cafes, Institutions)

- Off-Trade

- Supermarkets and Hypermarkets

- Specialty Stores

On-trade represents the leading market segment in 2024. The global fruit beer industry overview shows that the on-trade segment is leading the market. The ease and accessibility offered to consumers through this distribution channel have significantly contributed to its growth. Furthermore, the prominence of on-trade channels allows breweries to reach a broader consumer base, contributing to its dominance in the market. Various on-trade channels, such as pubs, bars, and restaurants, offer premium product brands that are not readily available via off-trade channels. The increasing socialization and the rising popularity among the millennial population are expected to bolster the dominance of on-trade.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 38.7%. Europe dominates the fruit beer industry production due to the vast number of microbreweries in the region. Furthermore, the rising demand for alcohol-free beverages among consumers in countries such as the United Kingdom and France is also propelling industry expansion. Additionally, Europe is predicted to be the fastest-growing region over the forecast period, owing to the increasing popularity of beer in its member countries. Besides this, increased consumer awareness about the detrimental effects of alcohol on the human body is also contributing substantially to market growth as consumers opt for safer, non-alcoholic alternatives such as fruit beer.

Fruit Beer Industry Regional Takeaways:

Fruit Beer Market Analysis in the United States

In 2024, the United States accounts for over 80.00% of the fruit beer market in North America. The fruit beer industry in the United States is witnessing a significant rise, driven by shifting consumer preferences toward innovative alcoholic beverages with unique flavors and lower alcohol content. The growing trend of health-conscious consumers is driving demand for fruit-flavored beers that offer a lighter and more refreshing alternative to traditional beer options. Industry data indicates that the percentage of U.S. adults who consume non-alcoholic beer on a weekly basis increased from 0.6% in 2020 to 5.2% in 2023, indicating a general trend toward lighter, lower-alcohol beverages. This trend is benefiting fruit beers, which are viewed as a popular alternative to heavier alcoholic beverages. Additionally, the craft beer revolution has paved the way for smaller, independent breweries to experiment with various fruit infusions, further expanding the market with diverse product offerings. The increasing popularity of outdoor and social activities, such as barbecues, picnics, and festivals, also supports the demand for fruit beers due to their refreshing nature and appeal to casual drinkers. Furthermore, as the millennial and Gen Z consumer bases prioritize sustainability and organic ingredients, fruit beers made with natural fruit extracts and eco-friendly packaging are gaining favor. The rise of e-commerce platforms also enables consumers to access a broader range of craft and fruit-infused beers, thus expanding market reach.

Fruit Beer Industry Analysis in Asia Pacific

The Asia Pacific fruit beer market is growing rapidly with changing consumer tastes and rising disposable incomes. Since the region houses the world's most rapidly urbanizing areas, with East Asia and the Pacific having an average annual urbanization rate of 3% (World Bank), the urban population is increasingly in search of new alcoholic drinks. Demand is rising for lighter, fruit-flavored drinks because of the urban shift in places such as Japan, South Korea, and China, particularly among young and health-conscious consumers. Craft beer is also becoming popular in this region, with local producers experimenting with fruits and coming up with products that are suited to the preferences of their consumers. Fruit beer also enjoys high consumption by millennials and the Gen Z demographics. Besides this, the health-conscious trend is encouraging demand for low-calorie, fruit-based beers. E-commerce and modern retail channels have also improved access to diverse beer options, propelling market growth in the region.

Fruit Beer Industry Analysis in Europe

Fruit beer sales in Europe are growing strongly, driven by changes in consumer preferences, as well as rising craft brewing culture. There is a rise in demand for beer with fruits among younger consumers who prefer such varied drinking. The growing interest in health drinks is further strengthening this shift. Consumers are nowadays opting for light and low-calorie drinks. According to industry reports, 29% of European consumers have bought low and no-alcohol drinks in the last year, compared to 37% who have bought alcoholic drinks, thus indicating a growing preference for alternative options. This trend is benefiting fruit-flavored beers, which are perceived as a lighter and more refreshing choice. In addition, a rapidly growing culture of craft beers has been further propelling the popularity of fruit beers as local breweries experiment with new fruits and spices to make more interesting brews. Sustainability concerns are also driving the preference for fruit beer as they are a byproduct of sustainable processes and also present flavors that have unique characterizations. Increasing demand for premium and artisanal beverages is another notable growth-inducing trend. Festivals and seasonal demand also increase the market share, mainly in breweries-led countries, such as Germany, the United Kingdom, Belgium, and their associated territories.

Fruit Beer Industry Analysis in Latin America

Market prospects for fruit beers in Latin America are growing rapidly as urbanization drives the consumption of innovative alcoholic beverages, particularly beer with fruit flavors. According to research reports, the region accounts for about 80% of levels of urbanization, higher compared with most other places, which indicates the growing requirement. Younger consumers in markets such as Brazil and Mexico also seem to embrace fruit-flavored local craft beers lately. Rising disposable incomes and a preference for lighter, refreshing drinks further fuel the market. Social drinking occasions such as festivals and gatherings also contribute to the increasing popularity of fruit beers across the region.

Fruit Beer Industry Analysis in the Middle East and Africa

The market for fruit beer in the Middle East and Africa is expanding steadily. Increasing preference for lighter and refreshing alcoholic beverages, including fruit beers, is driving demand and, hence, industry expansion. The World Bank states that the MENA region is already 64% urbanized and will continue this trend. In countries that prohibit traditional alcohol, fruit-based drinks, usually low-alcohol or non-alcohol, are becoming popular. Tourism and social drinking are further contributors to increases in consumption, while new fruit beer flavors continue to attract new consumers. As the market offerings widen, fruit beers are emerging as a preferred drink for public gatherings in the region.

Top Fruit Beer Brands, Companies, & Manufacturers:

Leading fruit beer market participants are driving growth through new innovations and diversified portfolios. Major brewery companies are launching innovative fruit beers with a variety of flavors to satisfy broad consumer preferences. Some brands are also incorporating exotic fruit and other sour and tart profiles to cater to adventurous beer connoisseurs. The fruit beer industry is also benefitting from increased promotional activities undertaken by leading players that are branding fruit beers as refreshing seasonal beverages and capitalizing on their popularity during warm weather and festive seasons. Besides this, strategic alliances with craft breweries and online and offline distribution channels are also expanding accessibility and making these products available to more consumers in the market.

The report provides a comprehensive analysis of the top brands, companies, & manufacturers in the fruit beer market with detailed profiles of all major companies, including:

- All Saints Brewing Company

- Bell’s Brewery Inc. (Lion)

- Brewery Ommegang

- Founders Brewing Co. (Mahou San Miguel)

- Golden Road Brewing (Anheuser-Busch Companies LLC)

- Lindemans Brewery

- Lost Coast Brewery

- New Belgium Brewing Company

- New Glarus Brewing Company

- Pyramid Breweries Inc. (FIFCO USA)

- Shipyard Brewing Company

- Unibroue

Latest News and Developments:

- July 2024: Belgium-based family-run brewery Haacht has recently started using PoS ingredients in their Super 8 fruit beers. This includes Super 8 Peach (3.7% ABV) and Super 8 Cherry (3.4% ABV). These beers are mixed with 25% fruit juice content and are available in bottles and kegs in the market.

- April 2024: The Boston Beer Co. has launched General Admission, an alcohol-free ready-to-drink (RTD) fruit beer, in the United States. The beverage is available in four distinct flavors and has an alcohol content of less than 0.5%, blending low-alcohol beer with fruit-infused seltzer water. It is the newest addition to the other non-alcoholic products of the company.

- March 2024: Tokyo-based Masuki Corporation has launched a limited edition ‘Melon Ale’ as part of its ‘Gohobia’ product line. The ‘Melon Ale’ is the newest product in the seasonal fruit beer collection of Masuki. The beer has the rich, sweet aroma of Hokkaido melons and is crafted to provide individuals with a sophisticated and soothing experience.

- October 2023: Founders Brewing Co. has revealed an innovative new technique to stay competitive in an oversaturated industry with shifting consumer preferences. With this method, the company is utilizing sales and consumer data to create innovative beer formulations, such as hoppy and fruity varieties.

- June 2023: Innis & Gunn has introduced Kriek 2023, a new 5.1% cherry beer that combines Scottish fruits and Belgian-style beer to create a modern twist. The beverage is made with fresh Perthshire cherries and premium lager, which is blended together and then kettle-sourced and aged. This new product aims to highlight the innovation of Innis & Gunn in the fruit beer market in Scotland.

Fruit Beer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fruit-Flavors Covered | Raspberry, Peaches, Strawberry, Blueberry, Others |

| Sales Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | All Saints Brewing Company, Bell's Brewery Inc. (Lion), Brewery Ommegang, Founders Brewing Co. (Mahou San Miguel), Golden Road Brewing (Anheuser-Busch Companies LLC), Lindemans Brewery, Lost Coast Brewery, New Belgium Brewing Company, New Glarus Brewing Company, Pyramid Breweries Inc. (FIFCO USA), Shipyard Brewing Company, Unibroue, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fruit beer industry from 2019-2033.

- The fruit beer market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fruit beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fruit beer market was valued at USD 299.5 Billion in 2024.

The fruit beer market is projected to exhibit a CAGR of 3.08% during 2025-2033, reaching a value of USD 394.8 billion by 2033.

The increasing consumer demand for unique and flavored alcoholic beverages, growing popularity of craft beer culture, rising health consciousness and preference for lighter, lower-calorie options, expanding availability of fruit beers through online and retail channels, and seasonal and festive appeal, particularly during warmer months and holidays, are the primary factors driving the fruit beer market.

Europe currently dominates the market due to its strong craft beer culture and long-standing tradition of innovative brewing.

Some of the major players in the fruit beer market include All Saints Brewing Company, Bell's Brewery Inc. (Lion), Brewery Ommegang, Founders Brewing Co. (Mahou San Miguel), Golden Road Brewing (Anheuser-Busch Companies LLC), Lindemans Brewery, Lost Coast Brewery, New Belgium Brewing Company, New Glarus Brewing Company, Pyramid Breweries Inc. (FIFCO USA), Shipyard Brewing Company, Unibroue, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)