Fumaric Acid Market Report by Application (Food Additives, Rosin-Sized Sheathing Paper, Unsaturated Polyester Resins, Alkyd Resins, and Others), End-Use Industry (Food and Beverages Industry, Cosmetics Industry, Pharmaceutical Industry, Chemical Industry, and Others), and Region 2025-2033

Fumaric Acid Market Size:

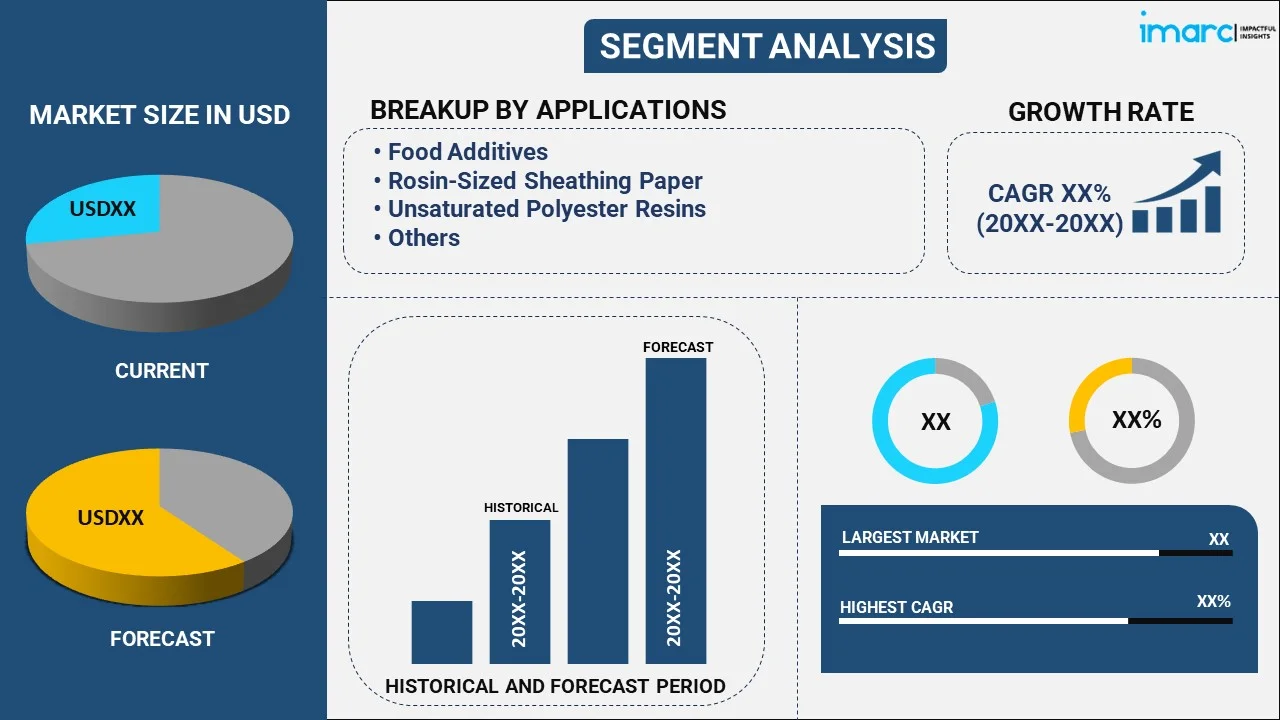

The global fumaric acid market size reached USD 808.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,168.8 Million by 2033, exhibiting a growth rate (CAGR) of 3.85% during 2025-2033. Increasing demand for processed food and beverages, the rising population, and the expanding pharmaceutical industry represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 808.4 Million |

|

Market Forecast in 2033

|

USD 1,168.8 Million |

| Market Growth Rate 2025-2033 | 3.85% |

Fumaric acid is a naturally occurring organic acid found in various fruits and vegetables. It is made through the fermentation of glucose or sucrose by certain strains of fungi, such as Rhizopus oryzae. The resulting product is a white crystalline powder that is soluble in water and alcohol. It is also used in the food and beverage (F&B) and pharmaceutical industries as a food additive and acidity regulator. It is also used in producing synthetic resins and plastics, as well as to manufacture pharmaceuticals. One of its key advantages is its ability to improve the stability and shelf life of products. It also enhances the flavor of certain foods and helps balance the sweetness of sugary products. When compared to other food additives, such as citric acid, fumaric acid has a sourer taste and is less hygroscopic, meaning it absorbs less moisture from the air. Currently, there are two types of product variants: trans- and cis-fumaric acid.

Global Fumaric Acid Market Trends:

Increasing demand for processed foods

Rising demand for processed foods in the world is consequently driving the growth of the expanding fumaric acid market. Fumaric acid is increasingly applied as an acidulant in processed foods since it can flavor, extend shelf-life, and produce a desirable texture in food. Increased demand for convenience and ready-to-eat foods is urging the food and beverage industry to consume more and more fumaric acid in beverages, bakery products, and frozen foods. This trend has been particularly more prevalent in the emerging markets where there exists a more propensity of urbanization and busy lifestyles which leads to the consumption of packaged food. With that, growing popularity of the food processing industry along with the requirement for additives that provide functionality as well as cost-effectiveness are crucially adding to the increasing fumaric acid market demand.

Growing application in unsaturated polyester resin

The construction and automotive industries are seeing a rise in the use of unsaturated polyester resins (UPRs), which is boosting the demand for fumaric acid. Fumaric acid acts as a key intermediate in the production of UPRs, which are used in fiberglass-reinforced plastics, coatings, and composite materials. With increasing infrastructure projects and the automotive sector’s growth, particularly in emerging economies, the need for UPRs is expanding. These resins offer durability and resistance to chemicals and heat, making them highly suitable for use in construction materials, vehicle parts, and industrial applications. As the demand for lightweight, durable materials grows, the role of fumaric acid in producing UPRs becomes more prominent.

Rising popularity of sustainable additives

As industries shift toward sustainability and environmentally friendly solutions, fumaric acid is gaining attention as a biodegradable and non-toxic alternative in various applications. The growing consumer awareness regarding the environmental impact of chemicals used in food, construction, and other industries is pushing manufacturers to adopt more sustainable additives. Fumaric acid, being naturally derived and biodegradable, aligns with this shift. Its application in eco-friendly cleaning products, biodegradable plastics, and food additives is expanding as businesses strive to meet regulatory standards and consumer expectations for sustainability. This trend is driving increased production and use of fumaric acid across multiple industries.

Fumaric Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the application and end use industry.

Application Insights:

- Food Additives

- Rosin-Sized Sheathing Paper

- Unsaturated Polyester Resins

- Alkyd Resins

- Others

The report has provided a detailed breakup and analysis of the fumaric acid market based on the application. This includes food additives, rosin-sized sheathing paper, unsaturated polyester resins, alkyd resins, and others. According to the report, the food additives accounted for the largest market share.

End-Use Industry Insights:

- Food and Beverages Industry

- Cosmetics Industry

- Pharmaceutical Industry

- Chemical Industry

- Others

The report has provided a detailed breakup and analysis of the fumaric acid market based on the end-use industry. This includes food and beverages industry, cosmetics industry, pharmaceutical industry, chemical industry, and others. As per the report, food and beverages industry accounted for the largest market share.

Regional Insights:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, and Latin America. According to the report, Asia Pacific holds the largest fumaric acid market share. Some of the factors driving the Asia Pacific fumaric acid market included the rapid growth of the F&B industry, the increasing population, rising disposable incomes, and shifting consumer preferences towards convenience foods and beverages.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global fumaric acid market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Bartek Ingredients Inc.

- Dastech International

- Fuso Chemical Co., Ltd.

- Polynt

- Prinova Group

- Changzhou Yabang Chemical Co. Ltd.

- Nippon Shokubai

- The Chemical Company

- Thirumalai Chemicals

- U.S. Chemicals

- Wego Chemical Group

- Huntsman Corporation

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Fumaric Acid Market News:

- In September 2023, Bartek Ingredients has offered an update on the progress of the world's largest malic and fumaric acid production facilities. The project, which began in January 2023, is on track to deliver products to clients by the end of September 2024. Bartek expects the new facility to set a new global benchmark for plant safety, efficiency, and environmental performance.

Fumaric Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Application, End-Use Industry, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Bartek Ingredients Inc., Dastech International, Fuso Chemical Co., Ltd., Polynt, Prinova Group, Changzhou Yabang Chemical Co. Ltd., Nippon Shokubai, The Chemical Company, Thirumalai Chemicals, U.S. Chemicals, Wego Chemical Group, Huntsman Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fumaric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global fumaric acid market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fumaric acid industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global fumaric acid market was valued at USD 808.4 Million in 2024.

We expect the global fumaric acid market to exhibit a CAGR of 3.85% during 2025-2033.

The rising adoption of nutrient-rich food products among health-conscious individuals, along with the increasing demand for fumaric acid to stabilize and enhance the flavor and aroma of these products, is primarily driving the global fumaric acid market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for fumaric acid.

Based on the application, the global fumaric acid market has been segmented into food additives, rosin-sized sheathing paper, unsaturated polyester resins, alkyd resins, and others. Among these, food additives currently hold the majority of the total market share.

Based on the end-use industry, the global fumaric acid market can be divided into food and beverages industry, cosmetics industry, pharmaceutical industry, chemical industry, and others. Currently, the food and beverage industry exhibits a clear dominance in the market.

On a regional level, the market has been classified into Asia Pacific, North America, Europe, Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global fumaric acid market include Bartek Ingredients Inc., Dastech International, Fuso Chemical Co., Ltd., Polynt, Prinova Group, Changzhou Yabang Chemical Co. Ltd., Nippon Shokubai, The Chemical Company, Thirumalai Chemicals, U.S. Chemicals, Wego Chemical Group, and Huntsman Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)