Fusion Splicer Market Report by Offering (Hardware, Software and Services), Product (Single Fiber Fusion Splicer, Ribbon Fiber Fusion Splicer, Special Fiber Fusion Splicer), Alignment Type (Core Alignment, Cladding Alignment), Application (Telecommunication, Cable TV, Enterprises, Aerospace & Defense, and Others), and Region 2025-2033

Global Fusion Splicer Market:

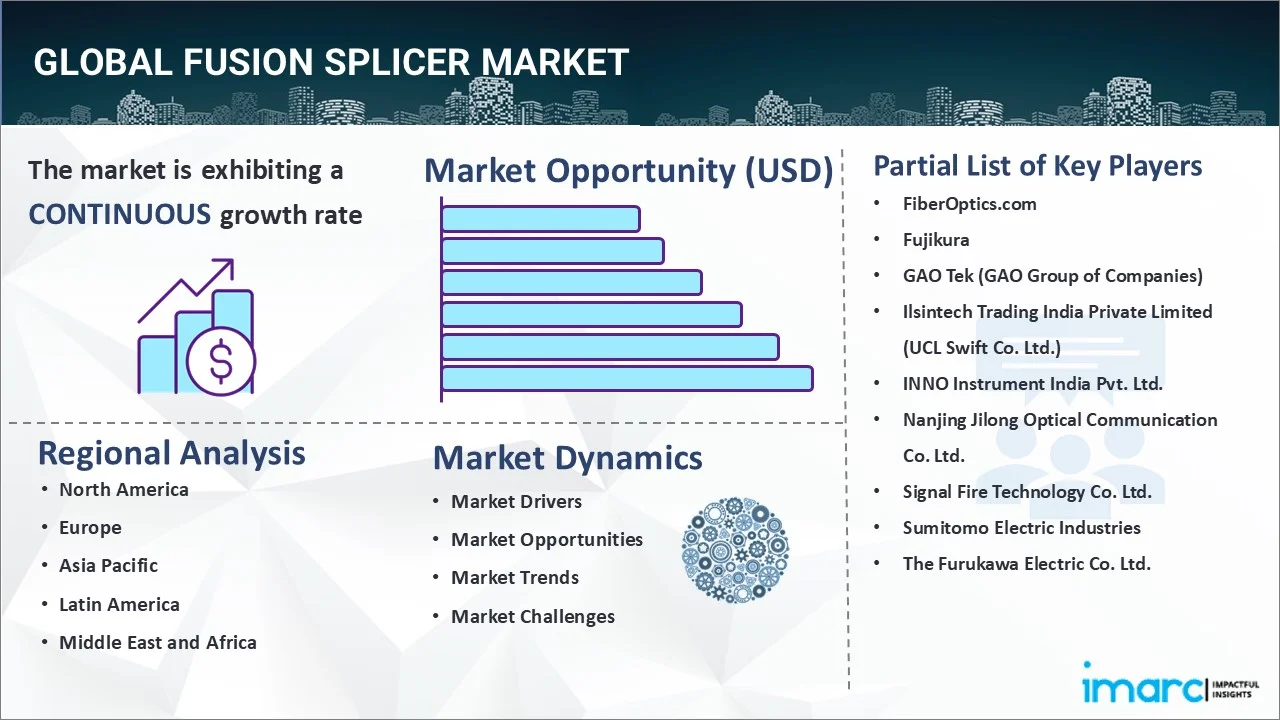

The global fusion splicer market size reached USD 830.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,300.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. The increasing demand for voice, data, and video services, along with the growing technical support from government bodies, is primarily bolstering the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 830.0 Million |

|

Market Forecast in 2033

|

USD 1,300.0 Million |

| Market Growth Rate 2025-2033 | 4.9% |

Fusion Splicer Market Analysis:

- Major Market Drivers: The rising trend of cloud-based solutions, coupled with the inflating requirement for networks with high data-carrying capacity, represent key drivers stimulating the market across the globe.

- Key Market Trends: The widespread integration of fiber-optic technology with telemedicine and advanced medical equipment is bolstering the market. Besides this, the continuous development of novel splicers that can find extensive applications in research projects is also acting as a significant growth-inducing factor.

- Competitive Landscape: Some of the prominent companies in the market include FiberOptics.com, Fujikura, GAO Tek (GAO Group of Companies), Ilsintech Trading India Private Limited (UCL Swift Co. Ltd.), INNO Instrument India Pvt. Ltd., Nanjing Jilong Optical Communication Co. Ltd., Signal Fire Technology Co. Ltd., Sumitomo Electric Industries, and the Furukawa Electric Co. Ltd., among many others.

- Geographical Trends: Asia Pacific exhibits a clear dominance in the market, owing to the expanding telecommunication infrastructure. Furthermore, key players across the region are sourcing components locally to capitalize on cost benefits, which is positively impacting the market.

- Challenges and Opportunities: The complexity and initial price of the equipment can pose a challenge to the market growth. However, comprehensive training programs to improve operator skills and continuous technological advancements to minimize costs and enhance user-friendliness are expected to catalyze the market in the coming years.

To get more information on this market, Request Sample

Fusion Splicer Market Trends:

High-Speed Internet Connections

There is an escalating demand for optimal internet connectivity among businesses and consumers across the globe. Consequently, fiber optics cables are gaining widespread adoption, which usually relies on fusion splicers to ensure maximum efficiency and ensure low signal loss. For example, in March 2023, AFL enhanced fiber preparation and protection for fusion splicing with Fujikura's new lineup of specialty fusion splicing accessories, namely the FSR-116, FSR-115, and FSR-117 optical fiber recoaters, as well as the CT-115, CT-114, and CT-116 fiber cleavers. Moreover, engineered with high capability and performance, these tools aimed to increase reliability. Apart from this, by creating a seamless junction between fibers, splicers enable the efficient transmission of large volumes of data over long distances, which is crucial for high-speed internet services. In September 2023, HFCL Limited (HFCL), one of the integrated next-gen communications product and solution providers, developed intermittently bonded ribbon (IBR) Cables in the UK that allow installation of higher fiber counts in small diameter ducts, especially useful in congested areas with constraint space. Additionally, its high productivity mass fusion splicing feature helps in quick restoration in case of an accidental outage. Besides this, government bodies and private corporations are providing comprehensive training programs to expand fiber optics networks, thereby creating a positive fusion splicer market outlook. For instance, in July 2023, during the Alberta Investment Forum at the Calgary Stampede, Amazon Web Services (AWS) collaborated with Momentum, a community organization committed to offering relevant skills-based training programs to bring a free fiber optic fusion splicing training course to Calgary, Canada. Furthermore, in March 2024, AFL, one of the fiber optic cables, connectivity, and equipment providers, announced an investment of over US$ 50 Million to expand its fiber optic cable manufacturing operations in South Carolina, U.S.

Expanding Telecom Infrastructures

The rising deployment of 5G is escalating the need for ultra-reliable and low-latency communication services, which are generally facilitated by fiber optics networks. Unlike previous generation networks that could rely on copper cables to some extent, 5G demands the high bandwidth and minimal latency that only fiber-optic cables can provide. In May 2024, the Fiber Broadband Association (FBA) published a new white paper on "The Benefits of Retiring Copper Today" that explores the cost benefits and reasons why operators should accelerate the removal of copper completely and adopt advanced fiber optics. Moreover, the rising investments in 5G infrastructures are also elevating the market. In February 2024, Kyndryl entered into a global strategic alliance with Hewlett Packard Enterprise (HPE) to jointly develop and deliver LTE and 5G private wireless services to customers worldwide. Furthermore, in May 2024, Ericsson and Telcaria partnered to introduce new ways of improving the energy efficiency of 5G networks for delivering traffic speeds of one gigabit per second over the mid-band spectrum. In June 2024, four ministries in Malaysia reportedly held talks to introduce an action plan to implement the country's second 5G network. These advancements not only drive the demand for novel product variants but also encourage manufacturers to innovate, leading to devices that are more reliable, efficient, and easier to use. This represents one of the fusion splicer market's recent opportunities.

Rising Data Center Construction

The increasing number of data centers that are connected via a complex web of fiber-optic cables is growing the utilization of optimal quality splicing to ensure enhanced performance. For instance, in June 2023, AFL Hyperscale, one of the connectivity solutions providers, developed data center interconnect (DCI) splice solutions that offer a fast and effective way to provide connections. Additionally, they are produced by adopting state-of-the-art technology, including AFL's innovative wrapping tube cable (WTC) with SpiderWeb Ribbon (SWR) technology. Besides this, fusion splicers are integral for setting up and maintaining the intricate cabling systems within data centers. For example, in May 2024, FiberLight expanded its services through the use of a Point of Presence (POP), where connections come together at the Globalinx data center in Virginia Beach, enabling network connectivity on a global scale. Moreover, in June 2024, Telin signed a memorandum of understanding (MoU) with Singtel to launch a novel subsea cable system connecting Indonesia and Singapore to support the expanding data centers in both countries. Apart from this, the widespread focus among key players on data security is increasing the importance of high-quality splicing equipment, which, in turn, is elevating the fusion splicer market revenue. For example, in March 2024, Space World subsidiary Constl, one of the fiber-based digital infrastructure providers, rolled out the largest network of point-to-point and neutral optical fiber connections to the data centers in seven major cities across India.

Fusion Splicer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the fusion splicer market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the offering, product, alignment type, and application.

Breakup by Offering:

- Hardware

- Software and Services

Software and services accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the offering. This includes hardware and software and services. According to the report, software and services represented the largest market segmentation.

Software and services are gaining traction due to the increasing need for advanced solutions that enhance the functionality and efficiency of fusion splicing equipment. Modern fusion splicers are integrated with sophisticated software that facilitates precise alignment, automated splicing processes, and comprehensive diagnostics, which significantly improve performance and reduce error rates. For example, software updates can introduce new features such as enhanced splice loss estimation and real-time data analytics, providing operators with critical insights and ensuring optimal network performance. Additionally, services, including training, maintenance, and technical support, are essential for ensuring the longevity and reliability of fusion splicing equipment. Recent launches, such as the Fujikura 90S+ Fusion Splicer and the INNO View 12R, come with advanced software capabilities that offer user-friendly interfaces, cloud connectivity for data management, and remote diagnostics, underscoring the importance of software and services in this market segment. These advancements not only streamline the splicing process but also support the growing requirement for high-speed internet and other fiber optic applications, which is escalating the fusion splicer market demand.

Breakup by Product:

- Single Fiber Fusion Splicer

- Ribbon Fiber Fusion Splicer

- Special Fiber Fusion Splicer

Single fiber fusion splicer holds the largest share in the industry

The report has provided a detailed breakup and analysis of the market based on the product. This includes a single fiber fusion splicer, ribbon fiber fusion splicer, and special fiber fusion splicer. According to the report, single fiber fusion splicer represented the largest market segmentation.

Extensive applications of single fiber fusion splicers in telecommunication networks, data centers, and fiber-to-the-home (FTTH) deployments are bolstering the segment's growth. These splicers are designed to splice individual optical fibers with high precision, which is essential for maintaining the integrity and performance of fiber optic networks. Their versatility and reliability make them the preferred choice for various installations and maintenance tasks. For example, the Fujikura 70S+ and the Sumitomo T-400S are popular single-fiber fusion splicers known for their durability, ease of use, and advanced features such as real-time arc control and automated splicing. Other launches, such as the INNO View 8+ and the AFL Fujikura 90S+, highlight the continuous innovation in this segment. These models offer improved splicing speed, enhanced battery life, and advanced software capabilities, catering to the growing demand for efficient and reliable fiber optic connections. This, in turn, is increasing the fusion splicer market share.

Breakup by Alignment Type:

- Core Alignment

- Cladding Alignment

Core alignment represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the alignment type. This includes core alignment and cladding alignment. According to the report, core alignment represented the largest market segmentation.

Core alignment splicers use advanced imaging systems to align the fiber cores based on their core positions rather than their cladding. This method significantly reduces optical loss and is essential for high-performance fiber optic networks. In March 2022, Sumitomo Electric Industries introduced the Z2C, a core alignment fusion splicer that enables any user to power through with ease. It is equipped with exclusive AI-driven NanoTune technology that assists in ensuring consistent, high-quality fusion splicing, irrespective of user experience or setting. It also offers built-in video tutorials for skill development. According to the fusion splicer market statistics, the rising demand for reliable fiber optic connections in data centers, telecommunications, and other high-speed internet infrastructures will continue to fuel the segment's growth in the coming years.

Breakup by Application:

- Telecommunication

- Cable TV

- Enterprises

- Aerospace & Defense

- Others

Telecommunication exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes telecommunication, cable TV, enterprises, aerospace & defense, and others. According to the report, telecommunication represented the largest market segmentation.

The growing number of voice and data services is primarily augmenting the market in this segmentation. As demand for reliable and fast communication continues to grow, the need for efficient and precise fiber optic splicing becomes paramount. Fusion splicers are essential in building and maintaining these networks, ensuring low signal loss and high-strength connections. Moreover, the rising investments by telecom companies and government bodies in expanding and upgrading their telecommunications infrastructures are also propelling the fusion splicer market's recent price. In June 2023, the U.S. National Science Foundation revealed 35 research collaborations with India's Department of Science and Technology, along with a cooperative agreement with the Indian Ministry of Electronics and Information Technology to focus on areas, including advanced telecommunications.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the fusion splicer market overview, Asia Pacific currently dominates the global market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The expanding telecommunications industry is augmenting the market across Asia Pacific. In countries, including India, the rising digital economy is inflating the requirement for high-speed internet access, which is acting as a significant growth-inducing factor. In February 2024, HFCL secured a purchase order worth Rs 141 Crore from Bharat Sanchar Nigam Limited (BSNL) for Indigenous 4G and 5G backhauling solutions. Apart from this, continuous improvements in fiber optics technologies are also positively influencing the regional market. For example, in March 2024, NEC and NTT, multinational corporations in Japan, introduced submarine cable technology to enhance internet speeds under the sea. Moreover, numerous product innovations will continue to propel the market across the Asia Pacific over the forecasted period. For instance, in July 2022, Sumitomo Electric Industries, Ltd., released the video in collaboration with TSUKEN Co. Ltd., who field-tested our cold-resistant fusion splicer.

Competitive Landscape:

Companies are actively pursuing strategic mergers and acquisitions to broaden their product portfolio and gain access to new customer bases. Acquiring smaller companies with specialized technologies can quickly bolster a company's offerings without the long R&D cycle. Moreover, leading players are also offering extensive training programs and customer support. This ensures users can maximize the capabilities of their fusion splicers, which in turn increases customer loyalty and long-term contracts. Numerous companies are becoming vertically integrated by producing not just fusion splicers, but also fiber-optic cables and other accessories required for splicing. This provides a complete solution to customers and can be a strong, unique selling proposition. Furthermore, collaboration with telecom service providers, data center operators, and other end-user industries is another strategy being employed.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major fusion splicer market companies have also been provided. Some of the key players in the market include:

- FiberOptics.com

- Fujikura

- GAO Tek (GAO Group of Companies)

- Ilsintech Trading India Private Limited (UCL Swift Co. Ltd.)

- INNO Instrument India Pvt. Ltd.

- Nanjing Jilong Optical Communication Co. Ltd.

- Signal Fire Technology Co. Ltd.

- Sumitomo Electric Industries

- The Furukawa Electric Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Fusion Splicer Market Recent Developments:

- June 2024: Telin signed a memorandum of understanding (MoU) with Singtel to launch a novel subsea cable system connecting Indonesia and Singapore to support the expanding data centers in both countries.

- May 2024: Ericsson and Telcaria partnered to introduce new ways, including using enhanced fusion splicers, to deliver traffic speeds over the mid-band spectrum.

- March 2024: Space World subsidiary Constl, one of the fiber-based digital infrastructure providers, developed the largest network of point-to-point and neutral optical fiber connections to the data centers in seven major cities across India.

Fusion Splicer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Hardware, Software and Services |

| Products Covered | Single Fiber Fusion Splicer, Ribbon Fiber Fusion Splicer, Special Fiber Fusion Splicer |

| Alignment Types Covered | Core Alignment, Cladding Alignment |

| Applications Covered | Telecommunication, Cable TV, Enterprises, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | FiberOptics.com, Fujikura, GAO Tek (GAO Group of Companies), Ilsintech Trading India Private Limited (UCL Swift Co. Ltd.), INNO Instrument India Pvt. Ltd., Nanjing Jilong Optical Communication Co. Ltd., Signal Fire Technology Co. Ltd., Sumitomo Electric Industries, The Furukawa Electric Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fusion splicer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global fusion splicer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fusion splicer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fusion splicer market was valued at USD 830.0 Million in 2024.

The fusion splicer market is projected to exhibit a (CAGR) of 4.9% during 2025-2033, reaching a value of USD 1,300.0 Million by 2033.

The market is fueled by the speedy growth in fiber optic networks and heightened needs for telecommunication and high-speed internet services. Installation in telecom, broadband infrastructure, and data center applications, combined with splicing technology advancements and heightened global interconnectivity needs, are major drivers that power the market globally.

Asia Pacific currently dominates the fusion splicer market, accounting for the largest share globally. Rapid expansion of fiber optic networks, increasing demand for high-speed internet, and extensive deployment in telecommunications and broadband infrastructure drive growth. Technological advancements, rising investments in connectivity projects, and growing adoption of advanced splicing solutions further strengthen the region’s leading position in the market.

Some of the major players in the fusion splicer market include FiberOptics.com, Fujikura, GAO Tek (GAO Group of Companies), Ilsintech Trading India Private Limited (UCL Swift Co. Ltd.), INNO Instrument India Pvt. Ltd., Nanjing Jilong Optical Communication Co. Ltd., Signal Fire Technology Co. Ltd., Sumitomo Electric Industries, The Furukawa Electric Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)