Gas Chromatography Market Report by Product (Accessories and Consumables, Instruments, Reagents), End Use Industry (Pharmaceutical, Oil and Gas, Food and Beverage, Agriculture, Environmental Biotechnology, and Others), and Region 2025-2033

Gas Chromatography Market Size:

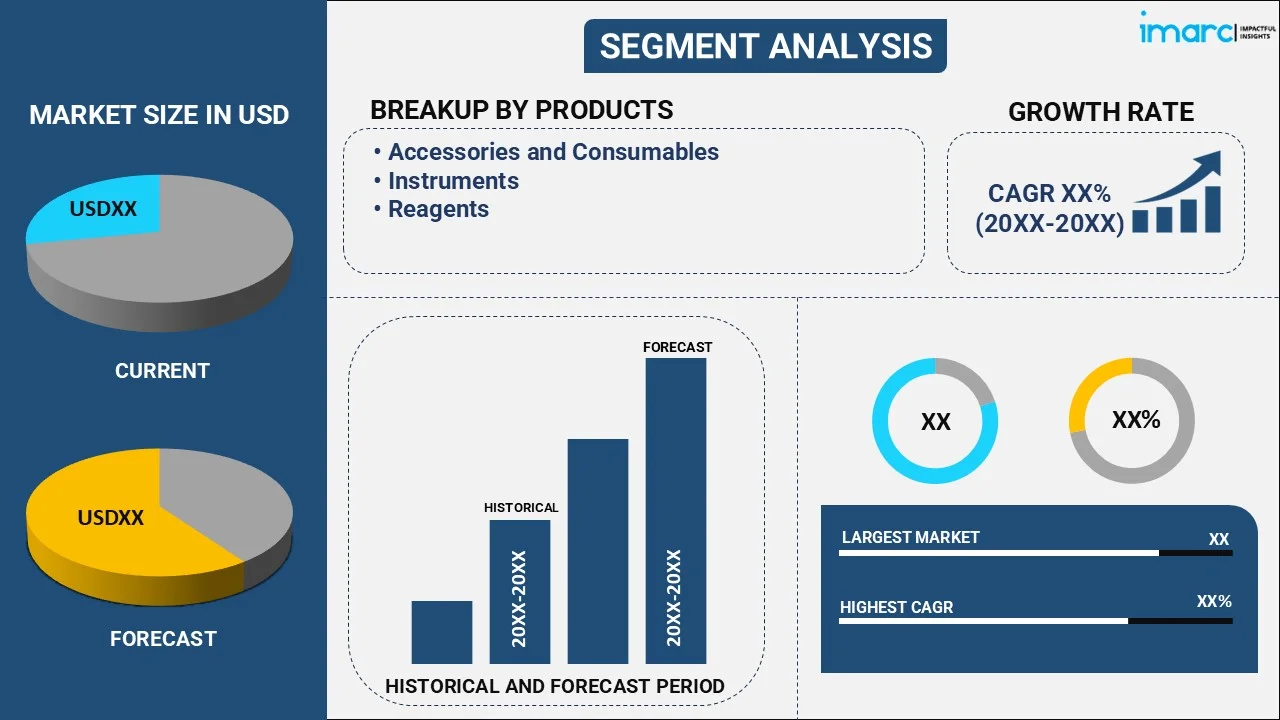

The global gas chromatography market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033. At present, North America holds the largest market share due to advanced research facilities, high demand in industries like pharmaceuticals and environmental testing, and strong regulatory frameworks supporting innovation. Additionally, significant investments in technology development and a growing focus on quality control contribute to market leadership. The ongoing advancements in technology, increasing demand for analytical testing in pharmaceuticals, environmental monitoring, forensic science, food safety, and biotechnology, and rising investments in research and development (R&D) and regulatory compliance are some of the major factors strengthening the market growth.

Market Size & Forecasts:

- Gas chromatography market was valued at USD 3.2 Billion in 2024.

- The market is projected to reach USD 4.7 Billion by 2033, at a CAGR of 4.06% from 2025-2033.

Dominant Segments:

- Product: Accessories and consumables (columns and accessories, fittings and tubing, auto-sampler accessories, flow management and pressure regulator accessories, and others) represent the largest segment owing to their essential role in ensuring the proper functioning and performance of gas chromatography systems. Frequent usage, regular replacements, and the need for ongoing optimization in laboratory processes drive their high demand and market share dominance.

- End Use Industry: Food and beverage accounts for the largest market share due to the need for precise quality control, safety testing, and compliance with stringent regulations. Gas chromatography ensures accurate detection of contaminants, additives, and flavor profiles in products.

- Region: North America leads the gas chromatography market, accredited to advanced research infrastructure, strong regulatory frameworks, and high demand across sectors like pharmaceuticals, environmental testing, and food safety. Significant investments in technology and innovation further support the market growth in the region.

Key Players:

- The leading companies in gas chromatography market include Agilent Technologies Inc., Bio-Rad Laboratories Inc., Chromatotec, Merck KgaA, PerkinElmer Inc., Phenomenex Inc. (Danaher Corporation), Restek Corporation, Shimadzu Corporation, Thermo Fisher Scientific Inc., W. R. Grace and Company, and Waters Corporation.

Key Drivers of Market Growth:

- Technological Advancements: Continuous improvements in gas chromatography design are supporting the market growth by delivering smarter, compact systems that boost accuracy and reduce energy use. Modern instruments help labs cut costs, save space, and meet strict standards without losing productivity, supporting higher efficiency and sustainability goals.

- Improved Environmental Monitoring: Stricter environmental standards and rising concern for water quality are catalyzing the demand for gas chromatography. Industries and regulators rely on its precision to detect pollutants at trace levels, ensuring effective monitoring of harmful substances in wastewater and protecting ecosystems through accurate, reliable analysis.

- Non-Invasive Diagnostics Growth: Growing demand for non-invasive diagnostics is encouraging the use of advanced gas chromatography systems. By analyzing breath, blood, or urine with high precision, these systems help detect diseases early and safely. Combined with smart data tools, they support modern preventive and personalized healthcare.

- Strengthened Pharma Compliance: Strict global regulations make gas chromatography essential for checking impurities and consistency. Biotech and contract research firms rely on modern systems to deliver accurate data and meet growing drug development needs.

- Stringent Food Safety Laws: Implementation of strict food safety rules and rising consumer awareness encourage producers and labs to adopt precise testing methods. Gas chromatography helps detect hidden contaminants and verify product claims, ensuring compliance with strict global standards.

- Integrated GC-MS Solutions: Combining gas chromatography with mass spectrometry allows labs to handle complex analyses that basic systems cannot. This integrated approach delivers precise results for fields like metabolomics and proteomics. Reliable trace detection, faster processing, and high accuracy is driving the demand for advanced GC-MS technology.

Future Outlook:

- Strong Growth Outlook: The gas chromatography market is experiencing strong growth driven by increasing demand across industries like pharmaceuticals, environmental monitoring, and food safety. Technological advancements, stricter regulatory standards, and a growing need for precision in analytical testing further contribute to the market expansion, ensuring long-term growth potential.

- Market Evolution: The gas chromatography market is evolving with advancements in technology, such as automation, improved resolution, and faster analysis times. Innovations in detectors, integration with other analytical techniques, and the expansion of applications across industries like environmental, pharmaceutical, and food testing are driving significant changes and market growth.

With industries encountering tighter regulations regarding product quality and safety, gas chromatography is becoming crucial for maintaining compliance. In industries such as pharmaceuticals, food and beverage (F&B), and environmental monitoring, accurate and dependable analytical outcomes are necessary to comply with these regulations. The need for uniform quality control is catalyzing the demand for gas chromatography. In addition, the rising trend of automating lab processes is driving the need for automated gas chromatography systems. Automation enhances testing processes, minimizes human mistakes, and boosts efficiency in high-demand settings. This enables ongoing and dependable testing, resulting in broader acceptance of gas chromatography technologies across various sectors. Apart from this, continuous investments in research and development (R&D) are resulting in advancements in gas chromatography technology. R&D across multiple fields, such as pharmaceuticals, chemicals, and environmental sciences, is extending the limits of what can be examined with gas chromatography. These investments aim to enhance the usability, integration, and precision of gas chromatography instruments, broadening their relevance in various areas.

To get more information on this market, Request Sample

Gas Chromatography Market Trends:

Technological Innovation and Sustainable Design

Ongoing technological progress is bolstering the gas chromatography market growth by providing systems that fulfill contemporary laboratory requirements for efficiency, accuracy, and sustainability. Instrument makers are creating more intelligent, smaller devices with capabilities that enhance efficiency while lowering operating expenses. in 2024, Agilent launched the 8850 Gas Chromatograph, a compact single-channel system blending the 6850's simplicity with the 8890's intelligence. It offered faster analysis, remote connectivity, and up to 30% reduced energy usage, optimizing both space and sustainability for modern labs. These advancements assist laboratories in maximizing space, minimizing energy utilization, and upholding high analytical standards while ensuring productivity is not affected. Incorporating intelligent controls and energy-efficient features, these next-gen systems represent the sector's movement towards more accountable, high-efficiency devices that comply with tougher regulatory requirements and rising operational demands globally.

Expanding Environmental Monitoring Requirements

Increased worldwide emphasis on environmental safeguarding is catalyzing the demand for gas chromatography, as a growing number of industries and governments emphasize precise pollutant monitoring. Rising industrial effluents, city runoff, and more stringent wastewater regulations require sophisticated analytical methods that can identify toxic substances at very low concentrations. In 2025, scientists created a sensitive gas chromatography-ion trap mass spectrometry (GC-ITQ-MS) technique to identify hydroxy derivatives of polycyclic aromatic hydrocarbons (OH-PAHs) in wastewater. Utilized on Krakow samples, this technique uncovered differing OH-PAH levels, offering an effective means for assessing pollutants that endanger aquatic ecosystems. These innovations demonstrate that gas chromatography, when paired with sophisticated detectors, allows environmental agencies and research organizations to monitor new contaminants more efficiently. As awareness about water quality and ecosystem health increases, strong analytical methods like GC-ITQ-MS will continue to be critical, guaranteeing adherence to tougher environmental standards and protecting public health.

Advancements in Non-Invasive Diagnostics

The growing emphasis on non-invasive diagnostic methods is driving the need for sophisticated gas chromatography systems, especially when paired with mass spectrometry and smart data analysis. Healthcare professionals are compelled to identify illnesses sooner and with greater precision while reducing patient discomfort and hazards. Gas chromatography allows for accurate examination of intricate biological specimens, assisting in the detection of minor chemical indicators that reveal the existence of illness. As healthcare advances to personalized medicine and preventive care, laboratories require strong systems that provide dependable results from non-invasive samples such as breath, blood, or urine. In line with this trend, in July 2025, The FDA granted Breakthrough Device Designation to TOBY’s AI-powered GC–MS urine test for early bladder cancer detection. The non-invasive test analyzes volatile organic compounds (VOCs) and showed excellent accuracy with an AUC above 0.9. This advancement aims to reduce reliance on invasive tools like cystoscopy.

Gas Chromatography Market Growth Factors:

Regulatory Pressure and Expanding Drug Pipelines

According to the World Health Organization (WHO), by 2030, one in six people globally will be aged 60 years or older, with this figure projected to double to 2.1 billion by 2050. This demographic shift is driving a rise in the demand for new drugs, generics, and biosimilars, placing greater pressure on laboratories to maintain rigorous quality control throughout the drug development cycle. Strict international regulations for impurity profiling, batch consistency, and pharmacokinetic studies leave no margin for error, making gas chromatography indispensable for ensuring compliance. Biotech companies advancing novel therapies require versatile systems capable of analyzing diverse and complex compounds. Contract research organizations depend on accurate and timely data to meet sponsor expectations worldwide. As personalized medicine expands, laboratories must conduct more targeted, smaller-scale analyses, further reinforcing the need for reliable, modern gas chromatography systems to uphold quality standards and support an expanding pharmaceutical pipeline.

Stricter Food Standards and Consumer Vigilance

Stringent regulations and increasing consumer expectations for safe, reliable food continue to drive producers and laboratories to invest in accurate testing techniques. Gas chromatography is crucial for its role in effectively identifying pesticide residues, concealed additives, and potential adulterants that standard inspections may overlook. Exporters rely on gas chromatography data to meet stringent global standards for contaminants, ensuring market entry and safeguarding trade agreements. Brands promoting organic or natural products utilize these tests to validate claims and attract discerning consumers seeking evidence on labels. In 2025, Zimbabwe, aided by the FAO, launched a USD 139,000 initiative to implement a comprehensive Food Safety Policy aimed at enhancing public health, coordinating regulations, and creating trade prospects. Actions like this continue to elevate standards globally, establishing gas chromatography as a reliable resource for identifying issues early, preventing expensive recalls, and protecting a brand’s image from production to retail.

Demand for Advanced Hyphenated Systems

Combining gas chromatography with mass spectrometry enables laboratories to analyze intricate samples in ways that fundamental systems cannot manage independently. Whether it is detecting trace substances in environmental assessments or charting metabolic pathways, GC-MS is emerging as the preferred instrument for laboratories requiring dependable outcomes at minute levels. Disciplines, such as metabolomics and proteomics, depend on this integrated configuration to analyze large datasets in one go, enhancing advancements in medical and life sciences research. In 2025, scientists at Hannover Medical School evaluated a quality control system for GC-MS to examine amino acids in urine and plasma, employing deuterated methyl ester internal standards to demonstrate the method’s precision for targeted metabolomics. Forensic specialists, chemical producers, and food safety laboratories also gain advantages, driving the demand for enhanced GC-MS systems featuring quicker software, improved detection capabilities, and precise, justifiable data.

Gas Chromatography Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with gas chromatography market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product and end use industry.

Breakup by Product:

- Accessories and Consumables

- Columns and Accessories

- Fittings and Tubing

- Auto-sampler Accessories

- Flow Management and Pressure Regulator Accessories

- Others

- Instruments

- Systems

- Auto-samplers

- Fraction Collectors

- Detectors

- Flame Ionization Detectors (FID)

- Thermal Conductivity Detectors (TCD)

- Mass Spectrometry Detectors

- Others

- Reagents

- Analytical Gas Chromatography Reagents

- Bioprocess Gas Chromatography Reagents

Accessories and Consumables account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes accessories and consumables (columns and accessories, fittings and tubing, auto-sampler accessories, flow management and pressure regulator accessories, and others), instruments (systems, auto-samplers, fraction collectors, and detectors (flame ionization detectors (FID), thermal conductivity detectors (TCD), mass spectrometry detectors, and others)), and reagents (analytical gas chromatography reagents and bioprocess gas chromatography reagents). According to the report, accessories and consumables represented the largest segment.

Accessories and consumables account for the majority of the share in the gas chromatography market segmentation due to their essential role in the operation and maintenance of GC systems. These items include columns, syringes, vials, filters, and detectors, which are critical for ensuring accurate and efficient chromatographic analysis. Columns need regular replacement to maintain performance and accuracy. Also, consumables such as carrier gases, septa, and liners are frequently used and need periodic replenishment. The recurring nature of these purchases creates a steady and significant revenue stream for suppliers. As the demand for high-precision analytical testing in various industries grows, so does the need for these consumables and accessories, further creating a positive gas chromatography market outlook.

Breakup by End Use Industry:

- Pharmaceutical

- Oil and Gas

- Food and Beverage

- Agriculture

- Environmental Biotechnology

- Others

Food and beverage hold the largest share of the industry

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes pharmaceutical, oil and gas, food and beverage, agriculture, environmental biotechnology, and others. According to the report, food and beverage accounted for the largest market share.

The food and beverage industry holds the largest gas chromatography market share due to the critical need for accurate and comprehensive testing of food products for safety, quality, and compliance with regulatory standards. GC is widely used to detect and quantify contaminants, pesticides, additives, and flavor compounds in F&B, ensuring they are safe for consumption and meet quality specifications. The increasing complexity of food supply chains and the heightened focus on food safety regulations globally drive the demand for advanced GC techniques. Along with this, the growing consumer awareness and demand for transparency in food labeling and ingredients further propel the use of gas chromatography market value, making it a pivotal tool for ensuring product integrity and safety.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest gas chromatography market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for gas chromatography.

Gas chromatography market analysis revealed North America as the leading region owing to its advanced technological infrastructure, extensive R&D activities, and stringent regulatory standards across various industries. The region is home to numerous pharmaceutical, biotechnology, F&B, and petrochemical companies that rely heavily on GC for analytical testing and quality control. Additionally, the presence of leading GC manufacturers fosters continuous innovation and availability of advanced GC systems and consumables. Strong governmental regulations related to environmental monitoring and food safety further drive the adoption of GC technologies. The robust academic and research institutions in North America also contribute to the high demand for sophisticated GC systems, solidifying the region's gas chromatography market size.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the gas chromatography industry include:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Chromatotec

- Merck KgaA

- PerkinElmer Inc.

- Phenomenex Inc. (Danaher Corporation)

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- W. R. Grace and Company

- Waters Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The competitive landscape of the GC market is characterized by the presence of several key players who are continually innovating to maintain and enhance their market positions. Gas chromatography companies focus on technological advancements, such as integrating mass spectrometry with GC systems and developing high-resolution columns and automated sample preparation systems to improve analytical accuracy and efficiency. Additionally, strategic collaborations, mergers and acquisitions, and expansions into emerging markets are common strategies employed to capture larger market shares. Smaller and regional players also contribute to the competitive dynamics by offering specialized and cost-effective solutions. The market is driven by ongoing demand in pharmaceuticals, environmental testing, F&B, and petrochemicals, ensuring sustained competition and innovation.

Gas Chromatography Market News:

- In July 2025, At ASMS 2025 in Baltimore, Peak Scientific launched Intura, a new line of hydrogen, nitrogen, and zero air generators for gas chromatography (GC). Designed for compactness and efficiency, Intura features reduced power usage, an improved PSA dryer, and Peak’s patented AirMax filter.

- In June 2025, Researchers from the University of Pretoria developed a non-invasive malaria detection method using wearable samplers and thermal desorption-comprehensive two-dimensional gas chromatography-time-of-flight mass spectrometry (TD-GC×GC–TOF-MS). This technique analyzes skin-emitted volatile organic compounds (VOCs) to identify potential malaria markers.

- In June 2025, Researchers from CSIC in Madrid developed a multi-analytical GC–MS and LC–MS workflow to assess raspberry ketone supplement authenticity. The method detected fraud through mislabeling, low bioactive content, and synthetic additives in 60% of tested products. It offers a valuable tool for quality control in the nutraceutical industry.

- In September 2023, Shimadzu unveils the Brevis GC-2050, a compact gas chromatography system designed to maximize lab space without sacrificing performance. This versatile system supports additional headspace samplers, mass spectrometers, and other accessories. With a large GC oven accommodating two capillary columns, the Brevis GC-2050 enhances flexibility and efficiency for diverse analytical needs.

Gas Chromatography Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Use Industries Covered | Pharmaceutical, Oil and Gas, Food and Beverage, Agriculture, Environmental Biotechnology, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Bio-Rad Laboratories Inc., Chromatotec, Merck KgaA, PerkinElmer Inc., Phenomenex Inc. (Danaher Corporation), Restek Corporation, Shimadzu Corporation, Thermo Fisher Scientific Inc., W. R. Grace and Company, Waters Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gas chromatography market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global gas chromatography market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gas chromatography industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global gas chromatography market was valued at USD 3.2 Billion in 2024.

We expect the global gas chromatography market to exhibit a CAGR of 4.06% during 2025-2033.

The rising consumer preference towards gas chromatography, as it is cost-effective, reliable, and offers various benefits, such as accurate and quick separation and reproducibility over conventional micro-extraction and electrophoresis separation techniques, is primarily driving the global gas chromatography market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for gas chromatography..

Based on the product, the global gas chromatography market has been segmented into accessories and consumables, instruments, and reagents. Among these, accessories and consumables currently hold the majority of the total market share.

Based on the end use industry, the global gas chromatography market can be divided into pharmaceutical, oil and gas, food and beverage, agriculture, environmental biotechnology, and others. Currently, food and beverage exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global gas chromatography market include Agilent Technologies Inc., Bio-Rad Laboratories Inc., Chromatotec, Merck KgaA, PerkinElmer Inc., Phenomenex Inc. (Danaher Corporation), Restek Corporation, Shimadzu Corporation, Thermo Fisher Scientific Inc., W. R. Grace and Company, Waters Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)