GCC Cold Storage Construction Market Report by Storage Type (Bulk Stores, Ports, Production Stores, and Others), Warehouse Type (Private and Semi Private Warehouse, Public Warehouses), End User (Food and Beverages, Pharmaceuticals, Chemicals, and Others), and Country 2026-2034

Market Overview:

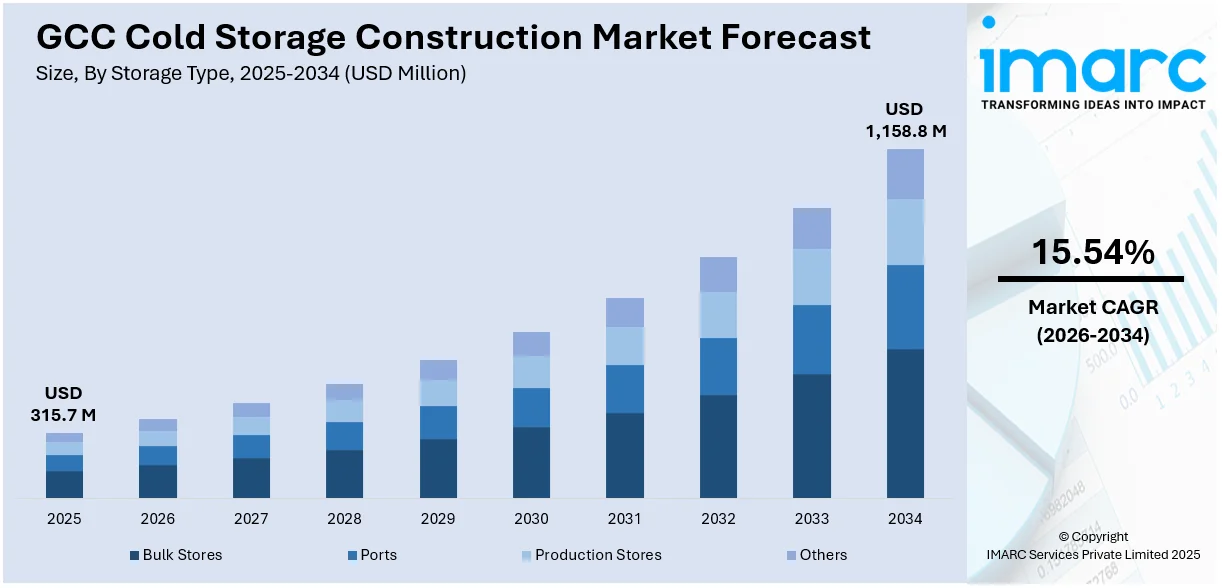

GCC cold storage construction market size reached USD 315.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,158.8 Million by 2034, exhibiting a growth rate (CAGR) of 15.54% during 2026-2034. The increasing demand for improved insulation materials, energy-efficient designs, and automation technologies that help in creating more sustainable and cost-effective cold storage facilities, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 315.7 Million |

| Market Forecast in 2034 | USD 1,158.8 Million |

| Market Growth Rate (2026-2034) | 15.54% |

Cold storage construction involves the design and development of facilities specifically engineered to maintain low temperatures for the preservation of perishable goods such as food, pharmaceuticals, and chemicals. These structures are equipped with advanced insulation, refrigeration, and climate control systems to create and sustain the required low temperatures. The construction materials and techniques prioritize thermal efficiency to minimize heat transfer and energy consumption. Cold storage facilities play a crucial role in the supply chain, ensuring the safe storage and transportation of temperature-sensitive products. The design must consider factors like insulation, ventilation, and refrigeration technology to maintain optimal conditions for the stored items. Cold storage construction contributes significantly to industries reliant on temperature-controlled environments, promoting the longevity and quality of stored goods throughout the entire logistics process.

To get more information on this market Request Sample

GCC Cold Storage Construction Market Trends:

Growing Food & Beverage (F&B) Industry

Food and beverage (F&B) industry in the GCC region is growing swiftly due to growing populations, shifting consumer tastes, and heightened demand for perishable imports. Food security has become a priority for governments, resulting in greater demand for controlled storage facilities. Hypermarkets, supermarkets, and online grocery stores are expanding their cold chain capabilities, and this is driving new cold storage facility construction. Dairy, seafood, frozen food, and fresh food imports are on the rise, requiring temperature-controlled logistics. Tourism and hospitality industries are also adding to it, with resorts and hotels requiring continuous cold storage of food stocks. Food manufacturing is going in volumes locally, and manufacturers need dependable cold storage facilities to minimize wastage and maintain quality. Developers are thus investing in constructing state-of-the-art, energy-saving cold warehouses with sophisticated temperature controls. Logistical complexity of the food industry is feeding into the region's cold storage construction growth directly. In 2024, Saudi Arabia officially inaugurated the Jeddah Food Cluster, a significant initiative designed to convert the city into an international business center with an investment goal of SR20 billion ($5.3 billion). Covering 11 million square meters, the cluster was acknowledged by Guinness World Records as the largest food park globally by size. The project is anticipated to generate more than 43,000 jobs, stimulating economic growth at both local and national levels.

Growing Pharmaceutical and Vaccine Storage Requirements

The GCC pharmaceutical sector is experiencing robust growth, thereby driving the need for pharmaceutical grade cold storage. Ultra-reliable cold storage solutions are needed by vaccine distribution, biologics, and other temperature-sensitive medication. Governments are boosting immunization programs and pandemic preparedness initiatives, which demand large-scale vaccine storage facilities. In addition, the development of medical tourism and specialty procedures is necessitating that hospitals and clinics carry sensitive medications that require cold chain integrity. Local health authorities are establishing more stringent requirements for storage and transport of pharmaceuticals, which is leading to the development of bespoke cold storage facilities that meet international standards such as GDP and WHO guidelines. Additionally, pharmaceutical firms are setting up regional distribution centers in the GCC to cater to the Middle East and North Africa (MENA), which is further increasing demand. Construction firms are constructing high-tech, insulated buildings with backup power and automated temperature control to accommodate the changing pharmaceutical storage needs. IMARC group predicts that the Saudi Arabia healthcare cold chain logistics market is projected to attain USD 204.50 Million by 2033.

Expansion of E-commerce and Online Grocery Delivery

E-commerce is revolutionizing the way GCC consumers buy groceries, particularly perishable products such as dairy, meat, and ready-to-eat foods. Grocery online platforms are expanding operations and need to have a strong cold storage network to manage last-mile delivery effectively. Accelerated delivery guarantees spontaneous grocery fulfillment are pressurizing cold storage systems to be located near urban areas. This is propelling the development of micro cold storage clusters and dark stores in city boundaries. Fulfillment centers are incorporating cold storage rooms that accommodate a multi-temperature environment for a large number of stock keeping units (SKUs). Developers are including automation and artificial intelligence (AI)-powered inventory systems in order to minimize handling time and avoid spoilage. As buying habits irreversibly incline toward convenience and urgency, the need for cold storage development linked with e-commerce keeps growing. In 2025, Keeta, the global branch of Meituan - China's top on-demand delivery company - has officially introduced Keemart, a fresh grocery delivery service aimed at delivering daily necessities to customers' doorsteps within 15 minutes. The service has launched in the Al Yasmin and Granada areas of Riyadh, with intentions to grow throughout the city and other parts of Saudi Arabia.

GCC Cold Storage Construction Market Growth Drivers:

Government Driven Food Security Plans

GCC governments are investing aggressively in food security initiatives to minimize dependence on imports and provide sustainable access to food. Construction of cold storage is being given priority as a central component of national food strategy. Saudi Arabia and the UAE, for instance, are constructing enormous storage facilities to store strategic stocks of key perishable items. Agro-zones and food processing parks are coming up with cold storage options built into them to lengthen shelf life and enhance export facility. Public-private collaborations are being promoted, with developers who construct cold chain facilities being incentivized and made to align their efforts with national objectives. Governments are also investing in research for energy-efficient and solar-powered cold storage solutions appropriate for the GCC's extreme climate. These measures are actually promoting demand for specialized construction companies that can construct mass-scale, hygienic, and temperature-controlled storage facilities. With food security emerging as a long-term strategic imperative, the market for cold storage construction is witnessing steady and sustained growth.

Halal Meat and Seafood Export Industry Boom

The GCC is emerging as an international center for halal meat and seafood exports, which demand high-end cold storage facilities to ensure quality and regulatory compliance. Exporters are increasing their processing and packaging activities, particularly in nations such as Saudi Arabia and the UAE, and constructing cold storage facilities to preserve freshness along the supply chain. Halal certification requirements for compliance require complete temperature and sanitation control during storage and distribution. As these exports move into new markets overseas, such as Europe and Southeast Asia, manufacturers are investing in cold storage to fulfill international health and safety regulations. Ports of the sea and air are developing their cold chain facilities to be able to export high volumes. Cold storage facility construction close to logistic centers, free zones, and industrial parks is on the rise to ensure this expansion. The halal boom in exports is not only generating demand but also transforming cold storage design with dedicated sections for meat, fish, and frozen processed foods.

Advances in Technology in Cold Storage Design

Technology is changing cold storage building technology in the GCC, with developers consistently incorporating new advances to enhance energy efficiency, automation, and management control. Construction companies are incorporating high-performance insulation materials and adopting modular construction practices to accelerate construction schedules. Intelligent monitoring systems are being placed to monitor temperature, humidity, and CO2 levels in real time. These technologies minimize spoilage risk and energy use, making buildings more economical and environment-friendly. Renewable energy sources, particularly solar energy, are increasingly becoming popular, particularly in arid or desert locations. Robotics and automated storage and retrieval systems (AS/RS) are enhancing space usage and reducing human error. Cold storage is also being constructed to have multiple temperature zones within a single building, allowing operators to ship a range of products from pharmaceuticals to frozen foods. These technologies are not only stimulating construction demand but also remodeling the standards and expectations in the cold storage industry.

GCC Cold Storage Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on storage type, warehouse type, and end user.

Storage Type Insights:

- Bulk Stores

- Ports

- Production Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the storage type. This includes bulk stores, ports, production stores, and others.

Warehouse Type Insights:

- Private and Semi Private Warehouse

- Public Warehouses

A detailed breakup and analysis of the market based on the warehouse type have also been provided in the report. This includes private and semi private warehouse and public warehouses.

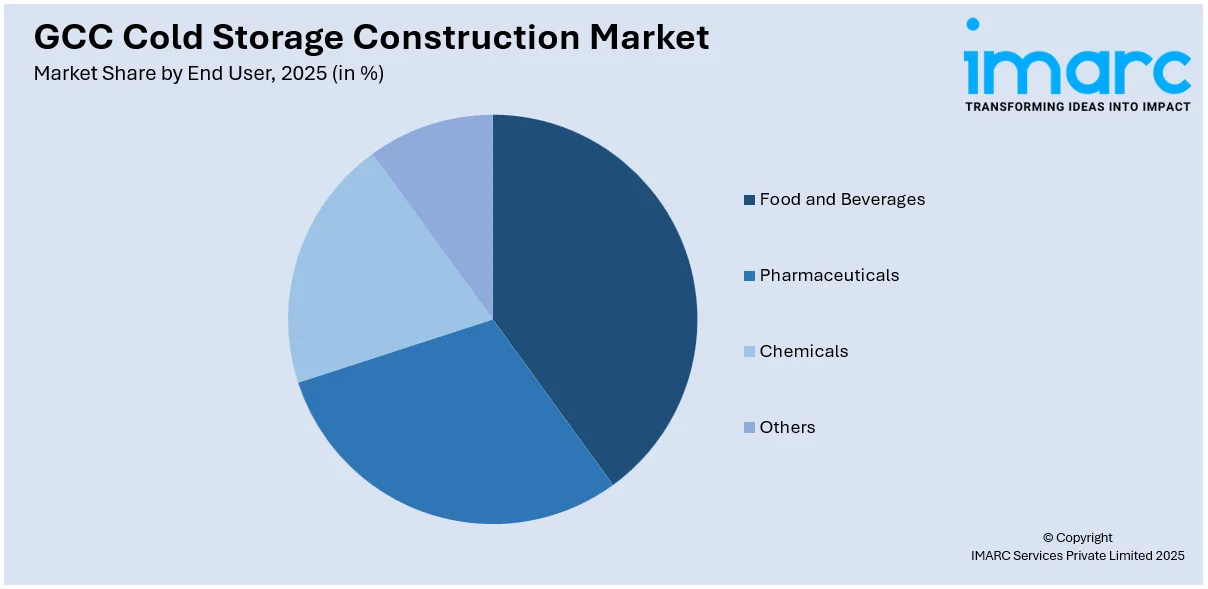

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food and beverages, pharmaceuticals, chemicals, and others.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Cold Storage Construction Market News:

- September 2025: Reitar Logtech Holdings Limited, the leading integrated Property-Logistics Technology (PLT) solutions platform in Asia, announced a comprehensive strategic partnership with Solowin Holdings. Solomon Capital Fund SPC-Solomon Capital SP9, a USD-denominated fund from Solowin, aims to invest strategically up to US$150 million in Reitar's logistics automation systems, automated cold storage, and associated automated equipment. This partnership will seamlessly combine Reitar's technological capabilities in smart logistics with Solowin's knowledge in fintech and digital assets, collectively promoting the digital evolution of the logistics sector, especially in expanding markets throughout Southeast Asia and the Middle East. Reitar has set up its global second headquarters in Qatar and has teamed up with strategic partner NEXX Global, which previously entered into a MOU with Qatar Navigation Q.P.S.C. (“Milaha”) and KEC to collaboratively advance smart logistics and e-commerce in Qatar, fully dedicated to developing markets in the Middle East and North Africa.

- August 2025: Thomsun Mercantile & Marine LLC, a reliable name in logistics for more than 30 years, has revealed the opening of its state-of-the-art cold and temperature-controlled storage facility in the Jebel Ali Free Zone (JAFZA). This tactical growth enhances the firm's capacity to support regional and international supply chains with unparalleled speed, accuracy, and dependability.

- May 2025: Aldar revealed today that it has commenced construction on a tailor-made cold storage and distribution center for Emirates Snack Foods (ESF), a leading distributor of fast-moving consumer goods (FMCG) in the UAE. To commemorate the collaboration, Jassem Saleh Busaibe, CEO of Aldar Investment, and Feda Saimua, Managing Partner of Emirates Snack Foods, met at Make It In The Emirates, an annual event focused on the UAE’s swiftly growing industrial and manufacturing sectors.

GCC Cold Storage Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storage Types Covered | Bulk Stores, Ports, Production Stores, Others |

| Warehouse Types Covered | Private and Semi Private Warehouse, Public Warehouses |

| End Users Covered | Food and Beverages, Pharmaceuticals, Chemicals, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC cold storage construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC cold storage construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC cold storage construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold storage construction market in the GCC was valued at USD 315.7 Million in 2025.

The GCC cold storage construction market is projected to exhibit a CAGR of 15.54% during 2026-2034, reaching a value of USD 1,158.8 Million by 2034.

Key factors driving the GCC cold storage construction market include expanding food and beverage demand, rising pharmaceutical and vaccine storage needs, growth of e-commerce and online grocery delivery, government-led food security initiatives, booming halal meat and seafood exports, and adoption of advanced, energy-efficient cold storage technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)