GCC Foreign Exchange Market Report by Counterparty (Reporting Dealers, Other Financial Institutions, Non-financial Customers), Type (Currency Swap, Outright Forward and FX Swaps, FX Options), and Country 2026-2034

Market Overview:

The GCC foreign exchange market size reached USD 19.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.70% during 2026-2034. The increasing economic diversification efforts in the GCC region, fluctuating oil prices, extensive trade relations with other countries, and a rise in foreign direct investments (FDI) in various non-oil sectors represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 19.3 Billion |

| Market Forecast in 2034 | USD 37.7 Billion |

| Market Growth Rate (2026-2034) | 7.70% |

Access the full market insights report Request Sample

Foreign exchange, also known as forex or FX, refers to the marketplace where national currencies are traded against one another. It is the largest and most liquid financial market in the world. In the foreign exchange market, participants, including banks, corporations, and individuals, buy, sell, and speculate on currency pairs. These transactions can occur for various reasons, such as facilitating international trade, hedging against currency risk, or profiting from exchange rate fluctuations. Exchange rates, the value of one currency relative to another, are in constant flux in the forex market, influenced by many factors, including economic indicators (like GDP growth rates, inflation, and interest rates), political stability, market sentiment, and geopolitical events. Forex trading is decentralized, meaning it doesn't take place on a centralized exchange like stock trading. Instead, it occurs directly between two parties in an over-the-counter (OTC) market. The market operates 24 hours a day, five days a week, due to the nature of the economy and the different time zones in which participants operate. As a result, foreign exchange is an integral part of the economy, facilitating smooth financial interactions between countries and economies and providing opportunities for investors to profit from currency value changes.

GCC Foreign Exchange Market Trends:

As GCC countries continue to diversify their economies away from oil dependence, new sectors are emerging and attracting foreign investments, which increases forex activity. This, coupled with the improving trade relations with other countries, represents one of the key factors supporting the market growth. Moreover, fluctuations in oil prices can impact the GCC currencies, as higher prices generally boost revenue for these countries, potentially strengthening their currencies. Along with this, rapid growth in tourism in the GCC region, particularly in countries such as the UAE and Saudi Arabia, brings in a substantial amount of foreign exchange, thus positively influencing market growth. Additionally, the fiscal policy decisions made by GCC governments, including changes in tax rates, public expenditure, and government borrowing, can significantly impact their currencies. These decisions can influence inflation rates, public debt, and economic growth, affecting currency values. In line with this, GCC countries are attracting foreign direct investments (FDI) in various non-oil sectors, such as real estate, retail, and finance. Increased FDI often correlates with a stronger currency as it represents an inflow of foreign currency, thereby contributing to market growth. Furthermore, the rise of digital technologies and fintech has improved the accessibility of forex markets. Along with this, the growth of online forex trading platforms has led to a surge in retail participation in forex markets, including those in the GCC region, which in turn has fueled the market growth. Other factors, including economic diversification, favorable interest rate decisions made by central banks in the GCC countries, political stability, and technological advancements, are also creating a positive outlook for the market.

GCC Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC foreign exchange market report, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

To get detailed segment analysis of this market Request Sample

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

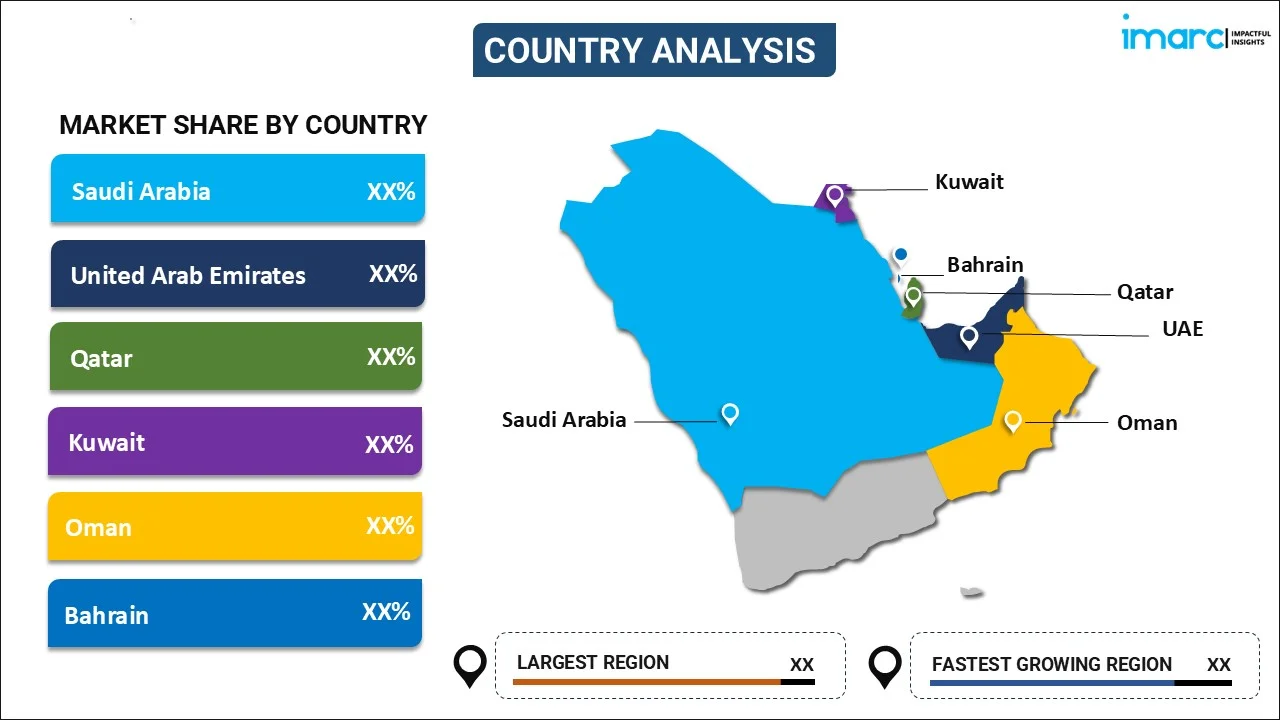

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, and Oman.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the GCC foreign exchange market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Countries Covered | Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC foreign exchange market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC foreign exchange market?

- What is the breakup of the GCC foreign exchange market on the basis of counterparty?

- What is the breakup of the GCC foreign exchange market on the basis of type?

- What are the various stages in the value chain of the GCC foreign exchange market?

- What are the key driving factors and challenges in the GCC foreign exchange market?

- What is the structure of the GCC foreign exchange market and who are the key players?

- What is the degree of competition in the GCC foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC foreign exchange market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)