GCC HR Tech Market Report by Application (Talent Management, Payroll Management, Performance Management, Workforce Management, Recruitment, and Others), Type (Inhouse, Outsourced), End Use Industry (TTH (Travel, Transportation, and Hospitality), Public Sector, Healthcare, Information Technology, BFSI (Banking, Financial Services, and Insurance), and Others), Company Size (Less than 1k Employees, 1k-5k Employees, Greater than 5k Employees), and Country 2026-2034

Market Overview:

The GCC HR tech market size reached USD 760.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,757.1 Million by 2034, exhibiting a growth rate (CAGR) of 9.45% during 2026-2034. The increasing use in small and medium-scale enterprises (SMEs) to streamline processes and enhance efficiency, rising focus on data driven insights for effective talent management, and the growing need for smooth and efficient onboarding processes represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 760.8 Million |

| Market Forecast in 2034 | USD 1,757.1 Million |

| Market Growth Rate 2026-2034 | 9.45% |

Access the full market insights report Request Sample

HR tech refers to the application of technology to streamline and optimize various aspects of human resource management within organizations. It encompasses a wide range of software, tools, and platforms designed to automate and enhance HR processes, which makes them more efficient, data-driven, and user-friendly. It covers a diverse set of functionalities, including recruitment and applicant tracking, employee onboarding, performance management, learning and development, payroll and benefits administration, and workforce analytics. It assists in increasing operational efficiency, reducing errors, better compliance with regulations, enhancing employee satisfaction, and improving strategic alignment of HR functions with overall business objectives. It also reduces administrative burdens, improves decision-making through data-driven insights, enhances employee engagement, and provides a more personalized employee experience. It can automate the screening and interview scheduling process and offer insights into employee performance trends, which helps organizations make informed talent management decisions. HR Tech empowers HR professionals with innovative tools to automate routine tasks and focus on strategic initiatives that drive organizational growth and employee success.

GCC HR Tech Market Trends:

Rise of freelance work models

The rise of freelance work models is fueling the market growth. As per industry reports, freelancing became a significant factor in Saudi Arabia’s economy, with more than 2.25 Million people registered on the freelance platform by September 2024. With an increase in businesses employing freelancers, gig workers, and consultants, conventional HR systems are inadequate in regulating their specific needs. HR technology platforms assist in freelance management by providing tools for contract monitoring, automated payments, project-specific performance tracking, and adherence to tax and labor regulations. These systems streamline onboarding, documentation, and interaction with remote, temporary workers. Businesses are utilizing HR technology to oversee varied teams, delegate tasks, and monitor results without increasing administrative workload. The high demand for on-demand talent is motivating companies to implement flexible HR solutions. In the GCC, as startups and digital platforms continue to grow, the freelance economy is gaining traction. This change is driving the demand for contemporary HR technologies that can respond to evolving workforce trends and foster a flexible and productive work setting.

Growing use of artificial intelligence (AI)

Increasing use of AI is positively influencing the market. According to the IMARC Group, the GCC AI market size reached USD 5.4 Billion in 2024. AI-oriented tools enhance recruitment by analyzing resumes, selecting candidates, and forecasting job suitability using data. In managing employees, AI assists in customizing learning journeys, tracking performance, and recommending career growth strategies. Chatbots handle standard HR inquiries, enhancing response speed and reducing manual effort. Predictive analytics support workforce planning, pinpointing attrition threats, and refining recruitment strategies. Businesses are employing AI to improve worker engagement by utilizing sentiment analysis and feedback mechanisms. AI aids in promoting diversity and inclusion by minimizing bias in hiring processes and assessments. With the digital transformation being adopted by businesses in the GCC, AI is becoming crucial for enhancing efficiency, refining decision-making, and fostering a data-based HR landscape.

Increasing adoption of cloud computing

Cloud-based HR solutions allow businesses to manage payroll, recruitment, attendance, and employee data from anywhere. These platforms reduce the need for physical infrastructure and enable real-time updates and collaboration. Cloud systems also ensure data security and automatic backups. Companies benefit from faster implementation, regular software updates, and the ability to scale services as workforce size changes. Cloud computing also enables integration with other digital tools like analytics and mobile apps, improving overall HR performance. As GCC businesses continue to focus on digital transformation and efficiency, cloud computing-based HR tech is becoming a key enabler, helping organizations streamline operations, reduce costs, and refine employee experiences. As per industry reports, the Saudi Arabia cloud computing market size is set to undergo a compound annual growth rate (CAGR) of 12.66% from 2025 through 2033.

GCC HR Tech Market Growth Drivers:

Innovations in technology

Technological advancements are stimulating the market growth. Innovations in machine learning (ML) and mobile applications allow companies to automate tasks like recruitment, payroll, performance tracking, and employee engagement. Advanced analytics help HR teams make data-oriented decisions, predict workforce trends, and improve talent management. Mobile-friendly platforms give employees access to HR services anytime, refining convenience and satisfaction. Integration of tools, such as chatbots, virtual onboarding, and e-learning solutions, is enhancing remote work capabilities and training. As businesses in the GCC region are prioritizing digital transformation and workforce optimization, the availability of cutting-edge HR technologies is leading to rapid adoption. These advancements not only streamline operations but also improve employee experiences, making them a major force behind the growth of the HR tech market in the region.

Rising HR outsourcing trends

The growing HR outsourcing trends are positively influencing the market in the GCC region. As businesses continue to delegate payroll, recruitment, compliance, and employee management to external providers, the need for integrated, cloud-based HR tech solutions is rising. These technologies help ensure smooth coordination between in-house teams and outsourcing partners, offering real-time access to employee data and automated reports. HR outsourcing also reduces operational burdens, motivating organizations to invest in smart tools that enhance transparency, accuracy, and speed. Providers of outsourced HR services rely on advanced tech platforms to deliver consistent, scalable, and secure services across multiple clients. This is catalyzing the demand for innovative and customizable HR tech solutions.

Compliance with evolving labor laws

Compliance with evolving labor laws is propelling the market growth. HR tech solutions help organizations stay updated with legal requirements related to wages, working hours, employee benefits, and nationalization policies. Automated compliance features reduce the risk of errors, penalties, and legal disputes by ensuring accurate payroll processing, timely documentation, and proper reporting. These systems also generate alerts and updates whenever laws change, helping HR teams act quickly and confidently. Multinational and regional companies benefit from centralized platforms that handle local variations in labor regulations. As labor laws in the GCC continue to evolve to support workforce development and economic diversification, businesses increasingly rely on digital HR tools to ensure consistent compliance. This growing need for accuracy, accountability, and transparency is significantly catalyzing the demand for advanced HR technologies in the region.

GCC HR Tech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC HR tech market report, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on application, type, end use industry, and company size.

Application Insights:

To get detailed segment analysis of this market Request Sample

- Talent Management

- Payroll Management

- Performance Management

- Workforce Management

- Recruitment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes talent management, payroll management, performance management, workforce management, recruitment, and others.

Type Insights:

- Inhouse

- Outsourced

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes inhouse and outsourced.

End Use Industry Insights:

- TTH (Travel, Transportation, and Hospitality)

- Public Sector

- Healthcare

- Information Technology

- BFSI (Banking, Financial Services, and Insurance)

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes TTH (travel, transportation, and hospitality), public sector, healthcare, information technology, BFSI (banking, financial services, and insurance), and others.

Company Size Insights:

- Less than 1k Employees

- 1k-5k Employees

- Greater than 5k Employees

A detailed breakup and analysis of the market based on the company size has also been provided in the report. This includes less than 1k employees, 1k-5k employees, and greater than 5k employees.

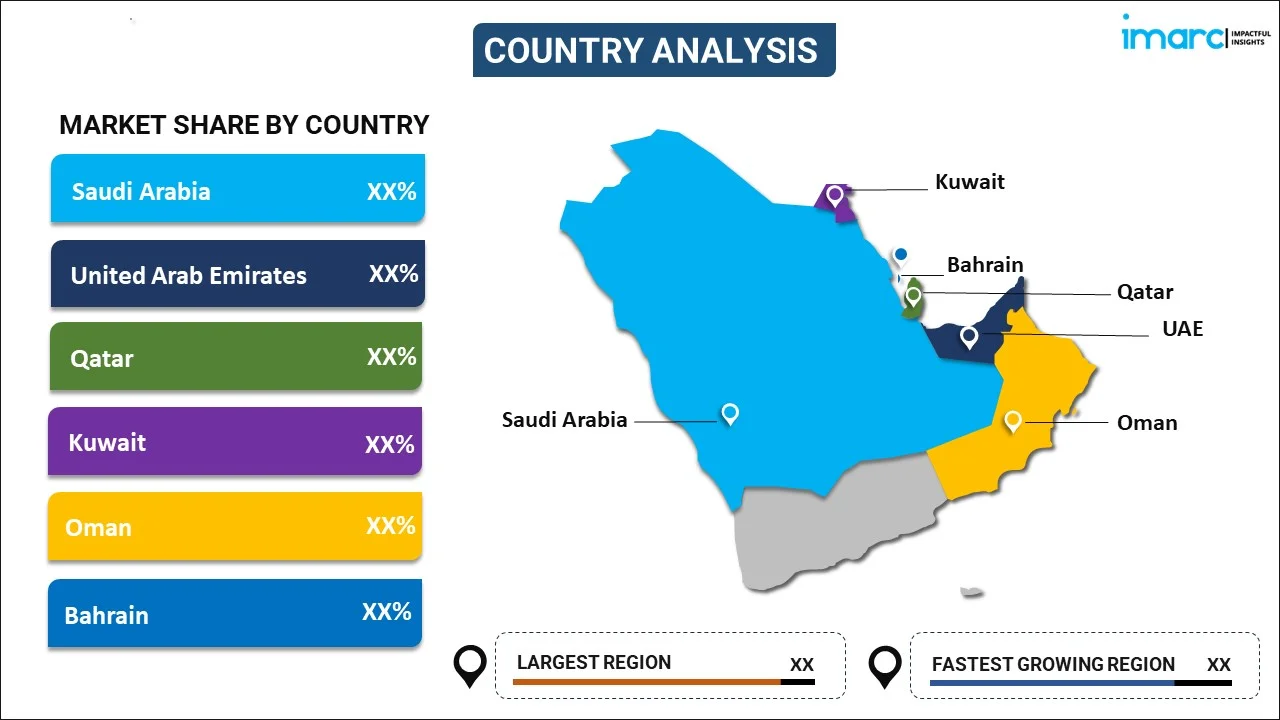

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC HR Tech Market News:

- June 2025: iSchool, a top K-12 AI platform in the MENA area, revealed the purchase of SEEDS, the educational technology branch of the Egyptian-Saudi software company Algoriza. This action signified a crucial advancement in iSchool’s strategy for regional growth, especially in Saudi Arabia’s fast-changing educational environment. It further strengthened iSchool’s developing approach of providing AI and coding instruction to the children of employees as a component of corporate HR programs. The platform was intended to establish a new type of education, where essential tech skills for the future served as a key advantage for families and a sustainable talent approach for employers.

- April 2025: Alareeb Holding of Saudi Arabia purchased an 80% share in Vision Talent, the prominent HR firm providing technology solutions. This collaboration sought to deliver innovative HR solutions that could improve the ability of businesses to attain sustainable operational efficiency.

- January 2025: Khalid Al Mengash was appointed as the Chief Human Resources Officer (CHRO) at Nesma Infrastructure & Technology (NIT), Saudi Arabia. He would lead HR initiatives to enhance the company's goal of providing innovative solutions in electrical, communication, IT, and energy services.

- January 2025: The 9th Annual HR Tech Saudi Summit was set to be held in Riyadh, KSA on November 3rd-4th, 2025. The 2024 summit's remarkable achievement stemmed from its extensive exploration of critical subjects, effectively merging advanced technology with human-focused strategies.

- October 2024: The Dubai Integrated Economic Zones Authority (DIEZ) unveiled its strategic HR plan for 2024-2026, focused on improving employee performance and talent management in its economic zones. This involved recognizing HR requirements, especially due to the increasing dependence on AI technologies, to prepare for upcoming job needs. The HR department prioritized the adoption of advanced technologies to improve the quality and efficiency of government services, allowing UAE talents to fully harness their potential through ongoing support and training.

- October 2024: The Ministry of Communications and Information Technology in Saudi Arabia initiated the Tech Talent Hub program in partnership with recruitment and HR firms to provide its services and advantages to national digital talent and technology startups. The project sought to assist the technology industry and enhance the expansion of the digital economy.

- September 2024: Lumofy, a top provider of AI-based skills development solutions, revealed a strategic alliance with Jisr, an all-inclusive HR tech firm based in Saudi Arabia. This collaboration was the first of its sort within Jisr, providing Jisr's partners with the benefit of accessing sophisticated training solutions that could assist in equipping their employees to stay updated with the fast-changing digital and technological environment in the employment market. These cutting-edge tools would enable organizations to boost their competitiveness both locally and globally and cultivate a workforce skilled in innovations and adaptability to continuous changes.

GCC HR Tech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Talent Management, Payroll Management, Performance Management, Workforce Management, Recruitment, Others |

| Types Covered | Inhouse, Outsourced |

| End Use Industries Covered | TTH (Travel, Transportation, and Hospitality), Public Sector, Healthcare, Information Technology, BFSI (Banking, Financial Services, and Insurance), Others |

| Company Sizes Covered | Less than 1k Employees, 1k-5k Employees, Greater than 5k Employees |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC HR tech market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC HR tech market?

- What is the breakup of the GCC HR tech market on the basis of application?

- What is the breakup of the GCC HR tech market on the basis of type?

- What is the breakup of the GCC HR tech market on the basis of end use industry?

- What is the breakup of the GCC HR tech market on the basis of company size?

- What are the various stages in the value chain of the GCC HR tech market?

- What are the key driving factors and challenges in the GCC HR tech market?

- What is the structure of the GCC HR tech market and who are the key players?

- What is the degree of competition in the GCC HR tech market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC HR tech market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC HR tech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC HR tech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)