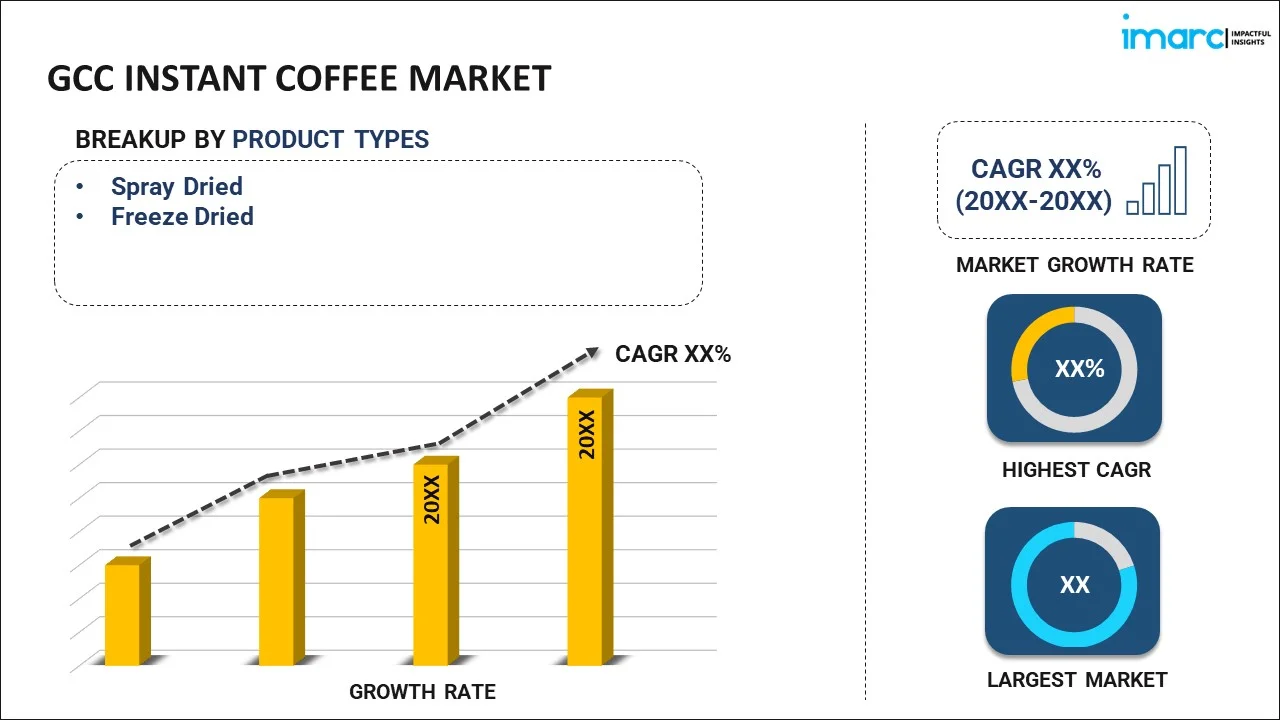

GCC Instant Coffee Market Report by Product Type (Spray Dried, Freeze Dried), Packaging (Pouch, Jar, Sachet, and Others), Flavored/Unflavored (Flavored, Unflavored), Distribution Channel (Supermarkets and Hypermarkets, Business to Business, Independent Retailers, Departmental Stores, Online, and Others), End-User (Institutional Users, Home Users), and Country 2025-2033

Market Overview:

The GCC instant coffee market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.56% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.4 Billion |

|

Market Forecast in 2033

|

USD 5.7 Billion |

| Market Growth Rate 2025-2033 | 5.56% |

Instant coffee is made from brewed coffee beans that can be instantly prepared by adding milk or water. Driven by factors such as its convenience, ease of use, rising number of retail coffee shops, premiumization, and format innovation; the demand of instant coffee has been increasing in the GCC region.

A key factor driving the demand of instant coffee is its convenience as it can be made easily by anyone. To make instant coffee a consumer only requires hot water. Another key factor driving the demand of instant coffee is that it is relatively cheaper than fresh ground coffee and quite affordable to the mass population. Furthermore, driven by increasing incomes, westernization, and changing food habits, the consumption of instant coffee is increasing robustly in both the retail and institutional segments. Apart from this, single-serve packs, which are more convenient to carry and consume have witnessed a strong growth in both at-home and out-of-home segments. Such format innovations are also driving value growth across the GCC markets. Catalyzed by rising exposure to premium coffee via social media platforms, foreign travel and on-trade outlets, the demand for value-added and premium products that contain richer ingredients and flavors is also on the rise in Saudi Arabia. The competitive landscape of the instant coffee market in Saudi Arabia is quite concentrated with Nestlé currently representing the market leader.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the GCC instant coffee market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product type, packaging, flavored/unflavored, distribution channel and end-user.

Breakup by Product Type:

- Spray Dried

- Freeze Dried

Breakup by Packaging:

- Pouch

- Jar

- Sachet

- Others

Breakup by Flavored/Unflavored:

- Flavored

- Unflavored

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Business to Business

- Independent Retailers

- Departmental Stores

- Online

- Others

Breakup by End-User:

- Institutional Users

- Home Users

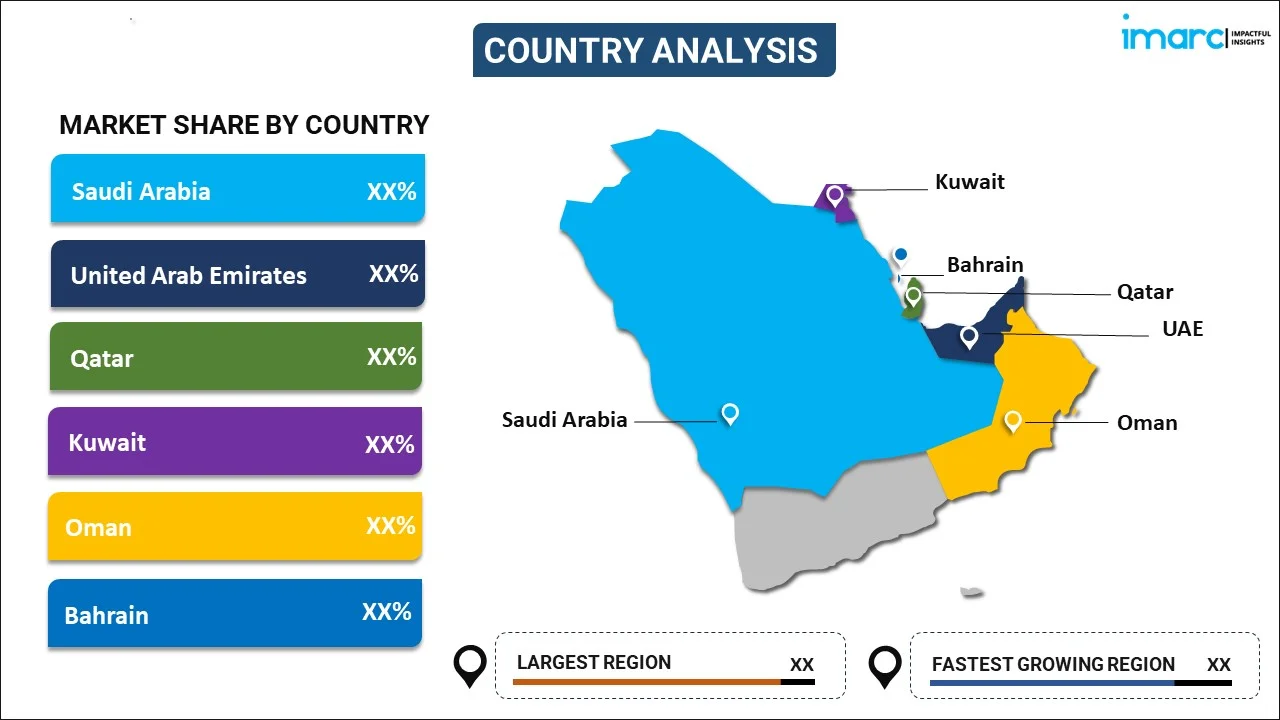

Breakup by Country:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Bahrain

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Jacobs Douwe Egberts, Luigi Lavazza S.P.A., Nestle S.A., Starbucks Corporation, Strauss Group Ltd, Tata Global Beverages Limited, Tchibo Coffee International Ltd., The Kraft Heinz Company, etc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Packaging, Flavored/Unflavored, Distribution Channel, End-User, Country |

| Countries Covered | United Arab Emirates, Saudi Arabia, Qatar, Oman, Kuwait, Bahrain |

| Companies Covered | Jacobs Douwe Egberts, Luigi Lavazza S.P.A., Nestle S.A., Starbucks Corporation, Strauss Group Ltd, Tata Global Beverages Limited, Tchibo Coffee International Ltd., The Kraft Heinz Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC instant coffee market performed so far and how will it perform in the coming years?

- What is the regional breakup of the GCC instant coffee market?

- What is the impact of COVID-19 on the GCC instant coffee market?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the packaging?

- What is the breakup of the market based on flavored/unflavored instant coffee?

- What is the breakup of the market based on the distribution channel?

- What is the breakup of the market based on the end-user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the market?

- What is the structure of the GCC instant coffee market and who are the key players?

- What is the degree of competition in the market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)