GCC Outbound Travel and Tourism Market Size, Share, Trends and Forecast by Tourism Type, Spending Type, Age Group, Booking Method, and Country, 2025-2033

GCC Outbound Travel and Tourism Market Size and Share:

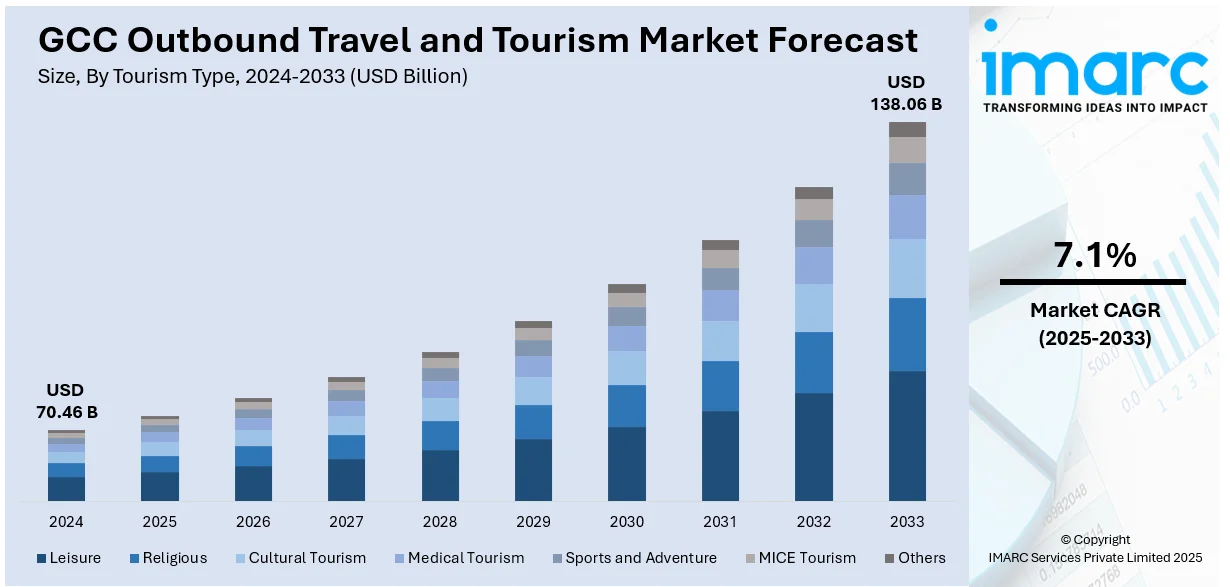

The GCC outbound travel and tourism market size was valued at USD 70.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 138.06 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033. The GCC outbound travel and tourism market share is growing due to the increasing preferences for green accommodations and low-environmental impact activities, a growing inclination for students to study overseas, and the rising popularity of events and food-based media.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 70.46 Billion |

| Market Forecast in 2033 | USD 138.06 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The GCC outbound travel and tourism market growth is attributed to the steadily rising disposable income levels, as citizens of the nation are traveling luxuriously. The United States Department of Agriculture states that the per capita income of Saudi Arabia is $27,680, which indicates the purchasing power of its citizens to afford luxury travel. Moreover, international destinations have become increasingly popular with the help of robust diplomatic relations and visa-on-arrival arrangements with many countries, which has increased outbound tourism. The cultural propensity of the region to shop and dine out also adds to the appeal of destinations that offer high-end retail and fine dining.

In addition, the rapid expansion of airline connectivity, such as the growth of GCC-based carriers like Emirates, Qatar Airways, and Etihad Airways, has made travel easier and more convenient, thus making it more likely to travel abroad often. Demographic factors, including a young and tech-savvy population, also drive outbound travel. Awareness and interest in traveling to global destinations are increased by social media platforms and OTAs, while seasonal factors such as the extreme summer temperatures in the GCC push residents to travel abroad to seek cooler climates. The growing investment in travel technologies, such as mobile apps and AI-driven travel planning, coupled with the increasing availability of flexible travel packages, is further fueling demand for international travel experiences among GCC residents.

GCC Outbound Travel and Tourism Market Analysis:

As per the GCC outbound travel and tourism market analysis, challenges in the market include changing economic conditions, high travel costs, and shifts in consumer preference. Political instability in some areas, limited flight connectivity, and a need for stronger sustainability practices are also a challenge. Travel restrictions and issues of safety and health also limit the growth of outbound tourism.

GCC Outbound Travel and Tourism Market Trends:

Rising demand for experiential travel

Experiential travel is another significant factor boosting the GCC outbound travel and tourism demand. With millennial and Gen Z consumers forming a more prominent share of travelers, experiential travels, such as immersion in cultural heritage, adventure sports, eco-tourism, and food explorations, are also taking center stage as part of a tour. Tours are now customized around authentic experiences like vineyard tours in Europe, wildlife safaris in Africa, and wellness retreats in Southeast Asia. During the first six months of 2024, it was reported by the UAE Ministry of Economy that around 15.3 million guests stayed at UAE's seven emirates' hotels, which reflects 10.5 percent growth. People seek and desire meaningful, personalized travel experiences connecting tourists with destinations' heritage and culture. Social media also plays a significant role, as travelers look for shareable moments that resonate with authenticity and exclusivity. Travel providers are capitalizing on this trend by curating bespoke packages and promoting off-the-beaten-path destinations to meet the demand for experiential travel.

Growth of digital travel platforms

The adoption of digital technologies is reshaping the GCC outbound travel and tourism market trend. Online travel agencies, mobile apps, and AI-driven platforms are becoming a part of the booking process. More travelers are using digital platforms for research, price comparison, and easy bookings, with a focus on convenience and cost-effectiveness. Personalization, powered by AI and big data analytics, is improving user experience through tailored recommendations based on travel history, preferences, and real-time trends. Virtual tours, AR features, and interactive itineraries also attract tech-savvy travelers, allowing them to see the trip before traveling. Further, e-visas and digital payment platforms have also simplified international travel processes. With this scenario, GCC airlines and hospitality brands are using digital channels to offer dynamic pricing, loyalty programs, and app-exclusive deals to cater to consumer behavior that is dominated by technology. This trend has gained even more momentum post-pandemic, with travelers placing greater emphasis on contactless transactions and seamless digital experiences.

Sustainability on the rise in GCC outbound travel

As travelers become more conscious of the environment, sustainability is a growing concern in the GCC outbound travel market. Travelers are looking for green accommodations, carbon offset flights, and destinations that practice sustainability. Initiatives that involve reducing plastic use, using renewable energy, and engaging local communities are on the rise. This is what appeals to younger generations, as it presents a mode of travel to influence the world positively. The Green City Times states that Green Riyadh in Saudi Arabia aims at turning Riyadh into a greener, healthier, and more sustainable city through the planting of over 10 million trees. It is in line with regional responsibility to the environment. Travel operators are responding by including eco-tourism options in packages, partnering with green-certified hotels, and offering carbon offset programs. Sustainable destinations such as those in Scandinavia and New Zealand are also becoming increasingly popular among GCC travelers. Governments in the GCC region continue to promote sustainable tourism with public awareness campaigns and partnerships with international environmental organizations. The emphasis on responsible tourism is reshaping the market, encouraging industry stakeholders to prioritize eco-conscious practices to attract environmentally mindful travelers.

GCC Outbound Travel and Tourism Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC outbound travel and tourism market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on tourism type, spending type, age group, and booking method.

Analysis by Tourism Type:

- Leisure

- Religious

- Cultural Tourism

- Medical Tourism

- Sports and Adventure

- MICE Tourism

- Others

Leisure tourism is opted by people looking to take time out to enjoy relaxation, entertainment, and an escape from reality. They find their favorite spots usually on beaches, resorts, or shopping hubs. The Ministry of Tourism states that 17.5 million international tourists entered the Kingdom of Saudi Arabia from January up to July 2024. That marked a 10% increase, mostly for leisure and holiday activities. Religious tourism, including the pilgrimage to Mecca and Medina, accounts for a lot of outbound travel, with millions of Muslims making the Hajj and Umrah pilgrimages every year. Cultural tourism encompasses soaking up local customs, history, and art as travelers visit museums, UNESCO heritage sites, and cultural festivals. Medical tourism, which involves traveling for medical treatments, has been growing due to the GCC's high demand for specialized health services abroad, especially in destinations known for advanced healthcare systems. Sports and adventure tourism appeals to travelers seeking active experiences like skiing, diving, and safaris, with international destinations offering these experiences gaining popularity. MICE tourism constitutes international corporate business travel by persons attending meetings, incentives, conferences, and exhibitions and increases international travel volume with business meetings.

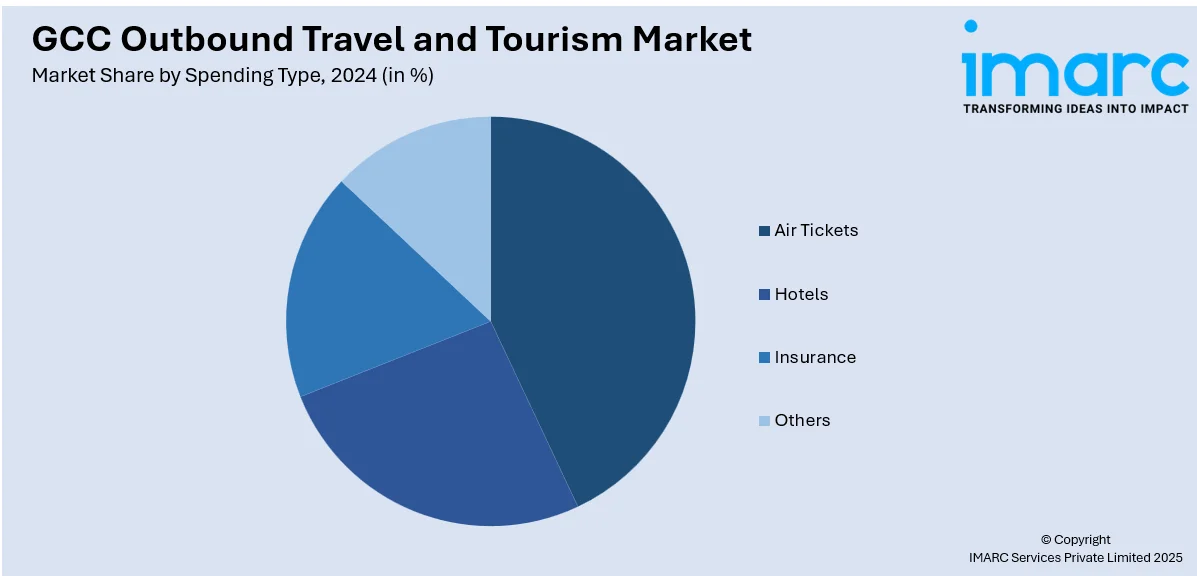

Analysis by Spending Type:

- Air Tickets

- Hotels

- Insurance

- Others

Airlines, especially regional giants like Emirates, Qatar Airways, and Etihad, offer competitive pricing, loyalty programs, and premium services, making air travel a major expenditure for GCC residents. The main source of cost for air tickets is, in fact, a part of high spending on outgoing travel due to the increasing number of international flights taking off from the GCC region due to its ideal strategic position. Hotels are another crucial spending category, with travelers opting for a variety of accommodations ranging from luxury resorts to boutique hotels, reflecting the growing demand for high-quality lodging across the globe. According to the Ministry of Economy, the UAE's tourism sector is growing steadily, the revenue generated by hotel establishments increased by 7% to AED 24.6 billion in H1 2024. This segment's growth in premium hotel services benefits popular tourist destinations. Travel insurance is crucial due to increasing awareness about the need for protection against travel risks. Key offerings to make the traveler feel secure in an increasingly unpredictable global environment include medical, trip cancellation, and baggage loss insurance.

Analysis by Age Group:

- Generation Z

- Millennials

- Generation X

- Baby Boomers

Generation Z, born between late 1990 and early 2010, constitutes a generation of enthusiastic users of technology, significantly influenced by social media and digital platforms when traveling. As cited by the Central Intelligence Agency, the population growth rate in Saudi Arabia is 1.68%, which depicts a growing and dynamic population whose travel preferences evolve with these generations. Generation Z seeks unique, adventurous experiences in ecotourism, cultural immersion, and budget-friendly options, and many of them even book their trips through mobile applications. Millennials range from 25 to 40 years old. They tend to be more attracted to experiential travel. They spend a lot on luxury, customized travel experiences. Millennials require destinations with great social scenes, strong cultural attractions, and offbeat adventure activities. Gen X (ages 41 to 56), in their high-earning phase, wants to feel comfortable and convenient, which means they're looking for more family trips or business travel to luxurious resorts. They are more likely to book a longer stay and focus on high-end accommodations and family destinations. Baby Boomers aged 57 and above, prefer traveling for relaxation, cultural heritage tours, and medical tourism. They majorly seek comfort, guided tours, and fewer miles covered when traveling, however, most prefer areas with healthcare and senior-friendly facilities.

Analysis by Booking Method:

- Online

- Offline

Online booking travel has become a popular method due to the modern convenience of digital platforms and mobile apps that allow travelers to compare prices, read reviews, and book services online at any time. This method appeals to all age groups, especially those tech-savvy Millennials and Generation Z who are accustomed to booking flights, hotels, and activities via OTAs, airline websites, or dedicated apps. According to Travel and Tour World, Saudi Arabia's booking preference is also changing, with 76% of total bookings made directly through the apps and an increase of 7% from the web. Mobile is now the fastest-growing platform for distribution in travel. Online booking also benefits from the growing trend of personalization and tailored experiences enabled through big data and AI algorithms. Offline bookings are mostly among the older generations, like Generation X and Baby Boomers, who prefer the traditional way of booking through travel agents. Such travelers appreciate face-to-face contact, expert advice, and guidance when planning their trips, especially when it comes to complex itineraries or high-budget travels. In the wake of rising online booking, travel agencies remain profitable, thanks to personal service and particular requirements that are harder to satisfy in an online system.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The Saudi Arabia market is driven by a large population, high disposable income, and strong religious travel demand, particularly for Hajj and Umrah. Saudi travelers are now looking more and more for luxury, leisure, and adventure tourism abroad. A country with a huge population of high-income earners and lots of expatriates, the UAE sees vast outbound travel demand, particularly luxury vacations, shopping, and business trips. Dubai and Abu Dhabi serve as entry points to international destinations, promoting both leisure and business tourism. Qatar's high-income population is increasingly looking for luxury and cultural tourism and is now more interested in medical tourism outside the country. Popular destinations include Europe, the US, and Southeast Asia. Bahrain's small high-income population prefers regional short breaks, mainly to Dubai and Doha, for family and cultural tourism. The wealthy Kuwaitis travel a long distance to enjoy luxury holidays, and the destinations are usually in Europe and the US. Medical tourism abroad is also on the rise. Oman's tourism sector is growing, with leisure travel to nature, adventure, and cultural destinations, and ecotourism. According to the World Travel and Tourism Council, the sector is expected to contribute 9.8% of Oman's economy by 2034, employing over 265,600 people and employing one in 13 residents.

Competitive Landscape:

Market players in the GCC outbound travel and tourism sector are constantly responding to changing consumer preferences through customized travel experiences and better digital engagement. For example, airlines, including Emirates, Qatar Airways, and Etihad, are extending their networks and providing services through customized cabin structures and exclusive packages to cater to the growing affluent tourist segment. According to the Ministry of Economy, the country has undertaken various investment and development projects in aviation infrastructure, enhancing airports' capabilities to serve more than 160 million passengers. Online travel agencies have begun to utilize AI as well as big data to offer specific recommendations on travel and dynamic pricing. The big hotel chains are targeting the increased demand for luxury and experiential stays by offering customized packages and various forms of loyalty programs. The drift toward promoting sustainable tourism with emphasis placed by the players on environment-friendly practices and promotion of green initiatives is notable. Travel brands' partnerships with tech companies will accelerate innovation toward seamless booking processes and improvement of customer experiences. These efforts are creating a positive GCC outbound travel and tourism market outlook.

Latest News and Developments:

- August 2024: ITA Airways opens a new Rome-Jeddah nonstop with three weekly departures, marking the carrier's further expansion within Saudi Arabia, which is rising as a growing tourism market, and increasing direct connectivity for people traveling from Italy, Europe, and the Americas to further build cultural and trade exchanges. Recently, ITA opened in Riyadh.

- November 2024: Emirates NBD and Mastercard launched the Emirates NBD Wholesale Travel Solution, a virtual card-based B2B payment product for travel agencies. It aimed to optimize payment flows, and enhance cash flow, security, and efficiency, thereby helping travel agencies to digitize payments and improve business operations in the travel sector.

- November 2024: Visit Qatar collaborated with Es'hailSat to introduce a dedicated satellite TV channel to market Qatar as the world's best tourist destination. This channel is aired on Es'hail-2, highlighting the country's culture, attractions, and events. The move is to support Qatar's growth in attracting millions of visitors annually.

- September: The Bahrain Tourism and Exhibition Authority (BTEA) has collaborated with EaseMyTrip to attract more Indian tourists to Bahrain. They will work on promoting Bahrain's rich culture, history, and modern attractions through EaseMyTrip's vast network. Tailor-made travel packages and digital campaigns will be undertaken to increase tourism from India.

GCC Outbound Travel and Tourism Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tourism Types Covered | Leisure, Religious, Cultural Tourism, Medical Tourism, Sports and Adventure, MICE Tourism, Others |

| Spending Types Covered | Air Tickets, Hotels, Insurance, Others |

| Age Groups Covered | Generation Z, Millennials, Generation X, Baby Boomers |

| Booking Methods Covered | Online, Offline |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC outbound travel and tourism market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC outbound travel and tourism market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC outbound travel and tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC outbound travel and tourism market was valued at USD 70.46 Billion in 2024.

The GCC outbound travel and tourism market growth is attributed to the rising adoption of sustainable travel options, such as green accommodations and low-impact activities, increasing inclination to study overseas, and growing popularity of shows and food-based media.

IMARC estimates the GCC outbound travel and tourism market to exhibit a CAGR of 7.1% during 2025-2033.

The growth opportunity in the outbound travel and tourism market in GCC countries is in increasing demand for eco-conscious travel, luxury experiences, and wellness tourism. As the younger generation continues to seek more sustainable options, travel operators can capitalize on this trend by offering destinations that are friendly to the environment, green accommodations, and tailored packages.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)